Bitcoin halving is a defining feature of the pioneering crypto. It plays a key role in ensuring that Bitcoin remains valuable over a long period of time. This article will examine Bitcoin halving, how it works, and why it matters.

Bitcoin halving is a defining feature of the pioneering crypto. It plays a key role in ensuring that Bitcoin remains valuable over a long period of time. This article will examine Bitcoin halving, how it works, and why it matters.

Bitcoin halving is an event that occurs every four years or precisely after every 210,000 blocks mined on the Bitcoin network. The event gets its name from the fact that it is meant to halve the rewards given to miners. It is designed to keep the supply of Bitcoin tokens (BTC) in check.

The Bitcoin network is the first decentralized blockchain conceptualized by Satoshi Nakamoto in 2008. To understand the functioning of the Bitcoin network, we need to understand the blockchain.

The network comprises computers called nodes that work together using special software. These nodes keep track of all the transactions that happen on the Bitcoin network, forming a digital record called the blockchain. Put simply, it’s like a digital ledger that keeps track of all the transactions made with Bitcoin.

To approve a transaction on the Bitcoin network, a node must ensure it’s valid. This means checking if it meets certain requirements and is of the right length. Each transaction is checked individually.

Once a group of transactions, called a block, is approved, it gets added to the existing blockchain. This means that the transaction is permanently recorded and shared with other nodes in the network.

The network’s security relies on the consensus mechanism called Proof-of-Work (PoW). PoW makes it computationally expensive to alter the blockchain’s history, ensuring transaction integrity. And on top of everything is the decentralized system that ensures the integrity and transparency of the Bitcoin network.

When miners verify a block of Bitcoin transactions, they receive a certain amount of BTC as a reward. Bitcoin halving, an event occurring every four years, cuts this reward in half. The event is designed to limit the supply of BTC. The blockchain protocol implements this by reducing the amount of BTC created each time a block is mined.

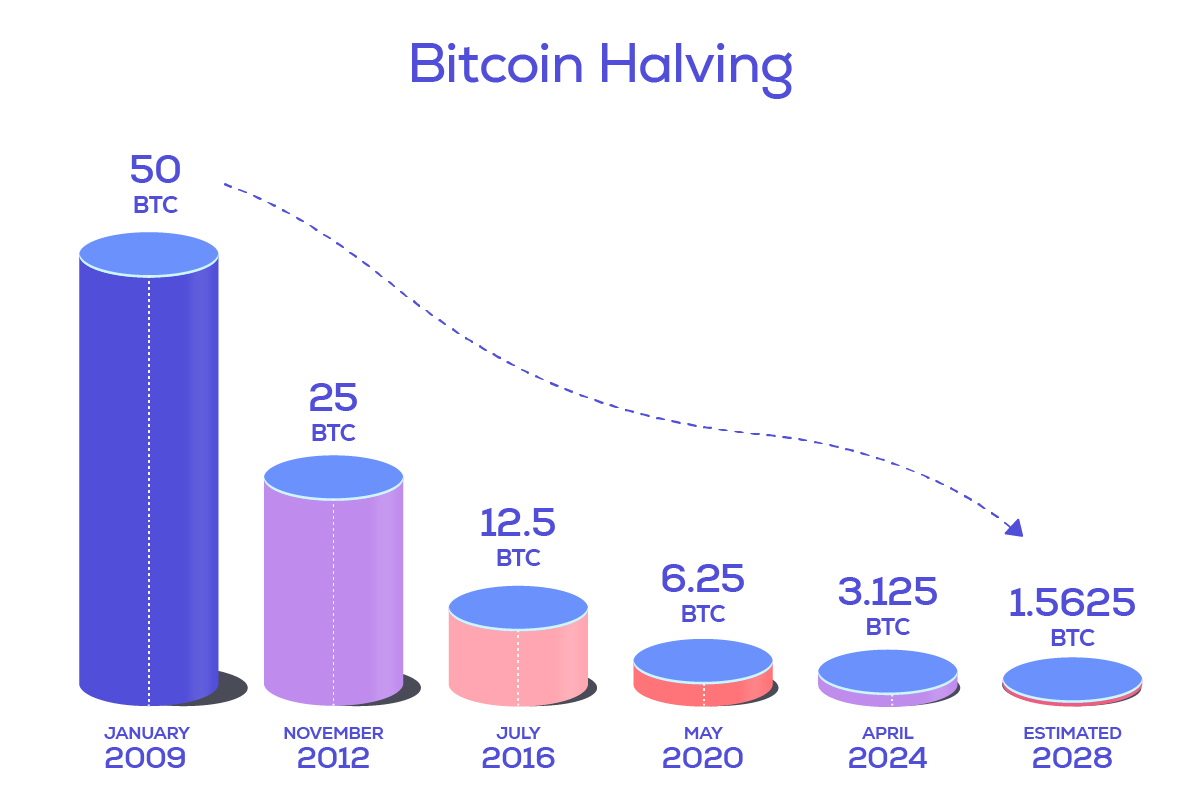

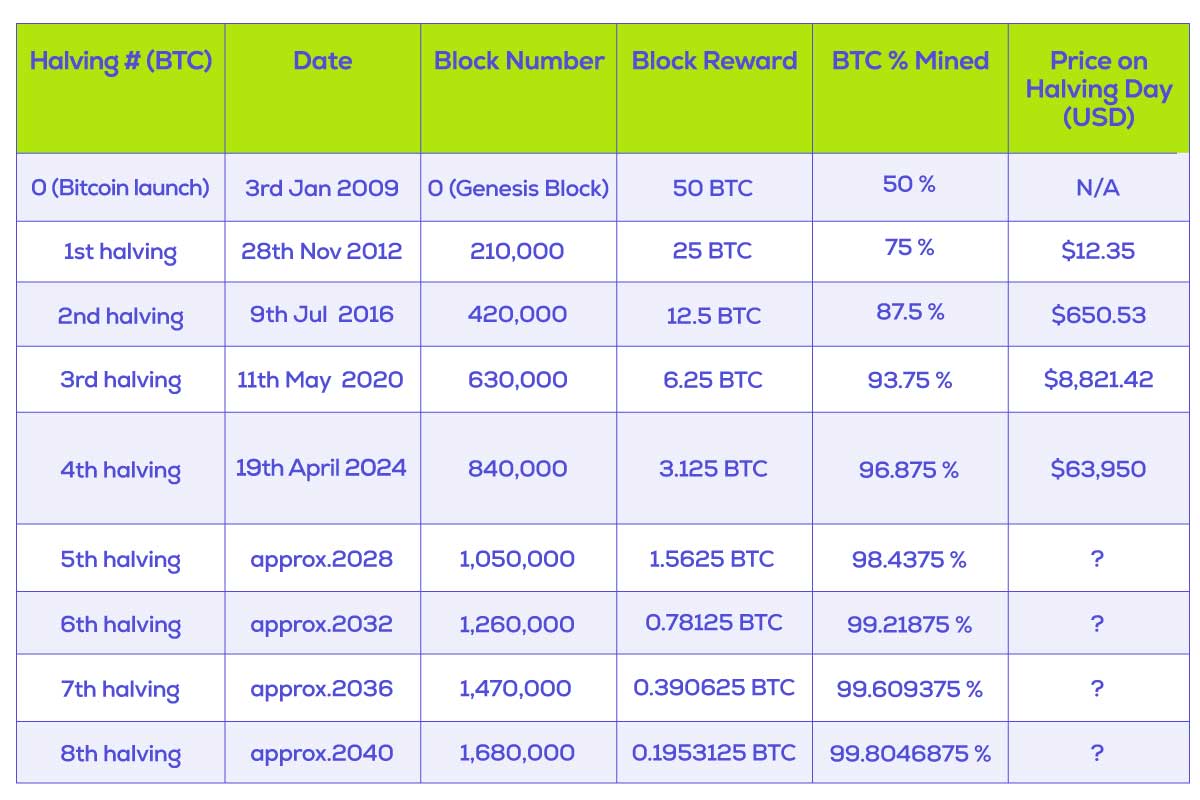

The first Bitcoin halving occurred in November 2012. The block reward was cut from 50 BTC to 25 BTC at the time. The second halving occurred in July 2016. The rewards for miners were slashed to half again—from 25 to 12.5 BTC. The most recent halving occurred in May 2020. This time, the rewards fell from 12.5 to 6.25 BTC. Investors kept a close watch on these events, significantly impacting the price of BTC.

The next Bitcoin halving event is scheduled to occur in April 2024.

The maximum supply of BTC is 21 million. That means the network’s protocol caps the total number of BTC that can ever exist at 21 million. So, all coins will have been mined by 2140, and that’s the last time we will see a Bitcoin halving.

The halving of block rewards is one of the reasons Bitcoin still has value. Every halving event reduces the number of BTCs created by the network. This limits the supply of new coins and the price increases so long as demand remains strong. Halving also counteracts inflation by maintaining scarcity. Additionally, it ensures that the total number of BTC in circulation remains consistent and predictable.

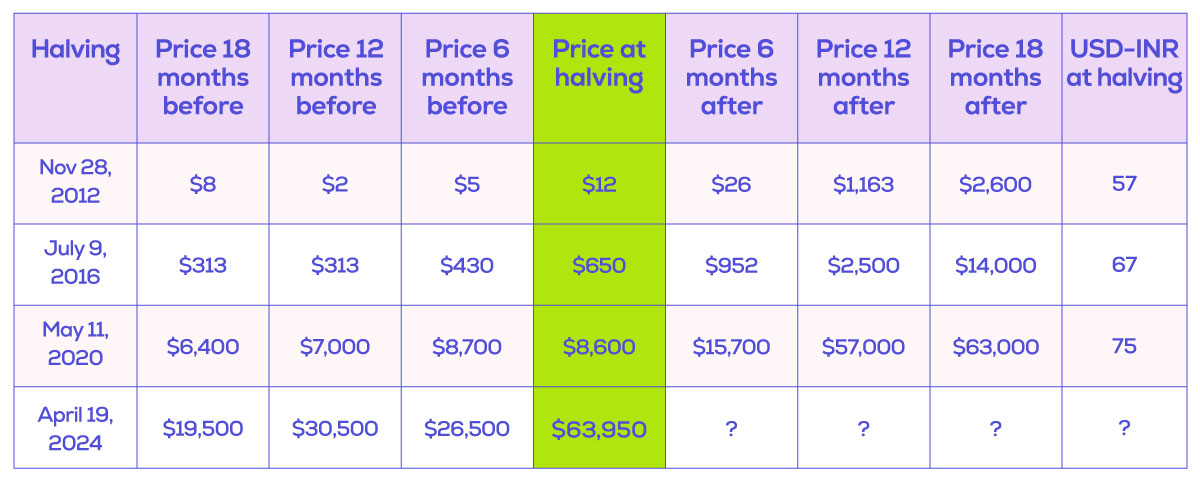

Historically, Bitcoin had a bull run after every halving. However, the correlation between Bitcoin halving and the crypto’s price is not always immediate as seen in the last three halvings. Though the event itself is a big positive for Bitcoin, it takes time—typically three to six months—to reflect in the price. For instance, before the first halving in November 2012, BTC’s price was $12. In less than a year, the price jumped to $1,207. Likewise, the price was around $647 during the second halving in 2016. After climbing steadily over the next few months, Bitcoin reached $20,000 by December 2017. Similarly, during the third and the most recent Bitcoin halving in May 2020, BTC’s price was close to $8,500. The price touched $11,950 about 100 days later and hit an all-time high of over $65,000 only by November 2021.

That said, it is important to understand that halving does not guarantee a price surge. Sometimes, reduced mining activity due to halving could cause the price to level off. To sum up, several factors can impact bitcoin price, and halving is just one of them.

Bitcoin halving is just about two months away, and quite naturally, investors are curious to know its possible effect on the price. For those who are new to this once-in-four-year event, it is important to understand what halving is and how it could potentially impact the price of BTC.

Halving is an event specific to Bitcoin mining that cuts miner rewards by half. To be specific, BTC miners are rewarded with 6.25 BTC for adding a new block to the chain—-approximately every 10 minutes—-to keep the world’s biggest decentralized network secure and running. This will be reduced to 3.125 BTC post-halving.

As halving cuts miner rewards, it would also reduce the issuance of new bitcoins. For instance, if 900 BTC are created daily at the current mining rewards, it will be reduced to 450 BTC after the expected halving in April 2024. Halving would surely create a supply shock in the market, given the rapid pace at which big assets managers have accumulated BTC through their regulated product offerings. To put things in context, within a month of the Bitcoin ETF launch, BlackRock alone has amassed more than 75,000 BTC, which is close to 2,500 BTC a day.

It would be informative to observe the price action of BTC during the previous halving events.

The table clearly shows that the price of Bitcoin rose exponentially—-as high as 9,500%—-within 12 months of halving. While the price appreciated within six months as well, it is minimal compared to one-year returns post-halving.

An analysis of the given data shows that BTC could very well be trading between $28,000 to $55,000 at the time of halving. Looking ahead, the world’s largest crypto might reach the $100k mark by 2025.

Bitcoin halving is an important event for investors and miners alike, as it helps maintain the crypto’s value. If you’re an investor or miner looking to take advantage of the upcoming halving event, be prepared. Do your research, ensure that you have a secure wallet, diversify your investments, and stay informed about related developments.

Bitcoin halving decreases the rate at which new coins are generated. The event limits the number of Bitcoins in the market, ensuring that the price will stay higher as long as demand remains strong. Thus, it makes Bitcoin more valuable.

Historically, Bitcoin price has increased within a year of every halving event. However, past performance is no indicator of future returns, as one cannot discount the possibility of reduced mining causing the price to level off. So, do your research before making any investment decision.

The mining rewards reduce after each halving, but the value of BTC increases. There could also be a decrease in competition and a resulting increase in mining opportunities. If a miner remains competitive by investing in the right tools or by joining a mining pool, mining can be profitable even after halving. However, it is important to note that in addition to Bitcoin halving, many other factors also make mining on the network more profitable.

The next Bitcoin halving event is scheduled to be held in April 2024. It would be the fourth halving event, which follows events that occurred in 2012, 2016, and 2020.

During the next halving in April 2024, the Bitcoin network is estimated to have 8,40,000 blocks. The reward for mining BTC will decrease from 6.25 to 3. 125 BTC per block

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. The information provided in this post is not to be considered investment/financial advice from CoinSwitch. Any action taken upon the information shall be at the user’s risk

Weekly crypto updates and insights delivered to your inbox.

Browse our Newsletter Archive for past editions.