Don’t let history—read 2022—repeat itself. While a stroke of luck is always welcome, our actions matter in financial investments. As always, portfolio diversification into new asset classes and regions appears a safe bet as the new year unfolds. Help is at hand, thankfully!

Yes, now you can invest in US stocks sitting in India with CoinSwitch making US stocks available to its users! All one needs is a regular bank account. More on that later.

Yes, US stock indices underperformed last year, but so did most asset classes. But dismissing US stocks based on a single year’s performance would be missing the woods for the trees. Over the last decade, the world’s largest equity market has relatively outperformed other global markets, including India. And mind you, there is more to US equity markets than Tesla and the famed FAANG stocks, as we will find out in a bit. Read on as we offer you a personal, guided tour of Wall Street.

1. US stock markets are the world’s largest

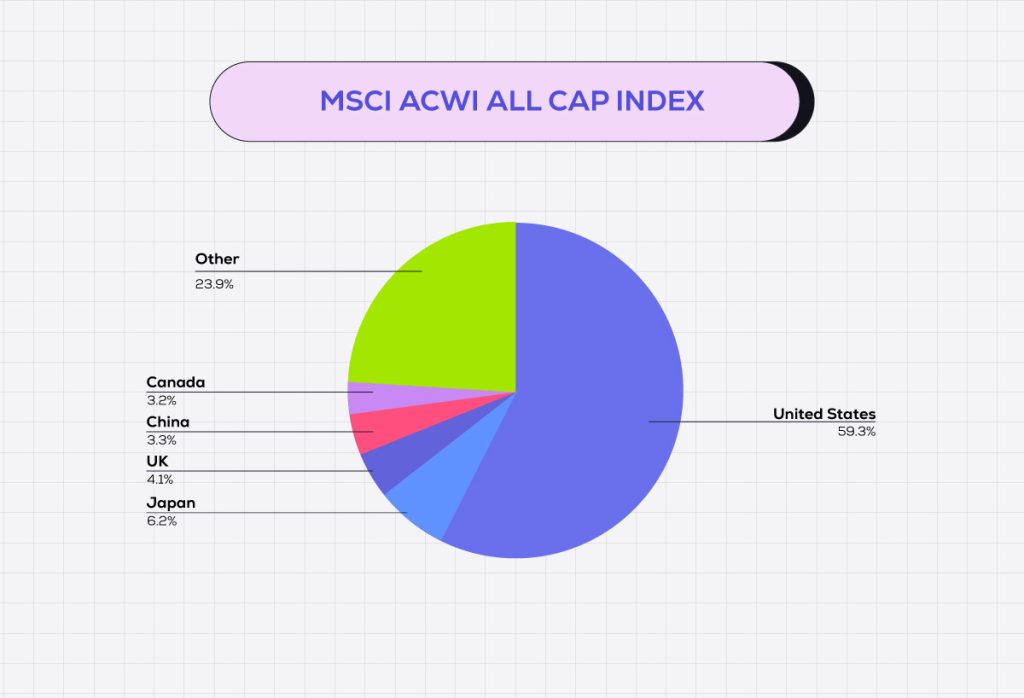

Did you know that the United States makes up about 60% of the MSCI ACWI All Cap Index? The index is widely regarded as representative of the global equity markets. Leading American exchanges such as the New York Stock Exchange and the Nasdaq are also known for their depth and liquidity. And American companies such as Apple Inc., Microsoft Corp, Tesla Inc., and Amazon.com Inc. are some of the world’s largest in terms of market capitalization.

* The MSCI ACWI Index (All-Country World Index) measures the performance of large- and mid-cap stocks across 23 developed and 24 emerging markets. It is often seen as representative of global equity markets.

2. They are great for portfolio diversification

Investing in the US stock markets will help diversify your portfolio. You can gain exposure to truly global, technology-driven companies such as Google parent Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), iPhone maker Apple Inc. (AAPL), Facebook’s new avatar Meta Platforms, Inc. (META), and electric-vehicle manufacturer Tesla Inc. (TSLA).

Rising oil prices have put the spotlight back on major oil producers like ExxonMobil (XOM) and ConocoPhillips (COP). And the pharmaceuticals sector boasts of multinationals such as Pfizer Inc. (PFE) and Eli Lilly & Co. (LLY). Most of these companies have global operations, which will protect your investments even if the US economy slows down.

3. The US market has given superior returns for more than a decade

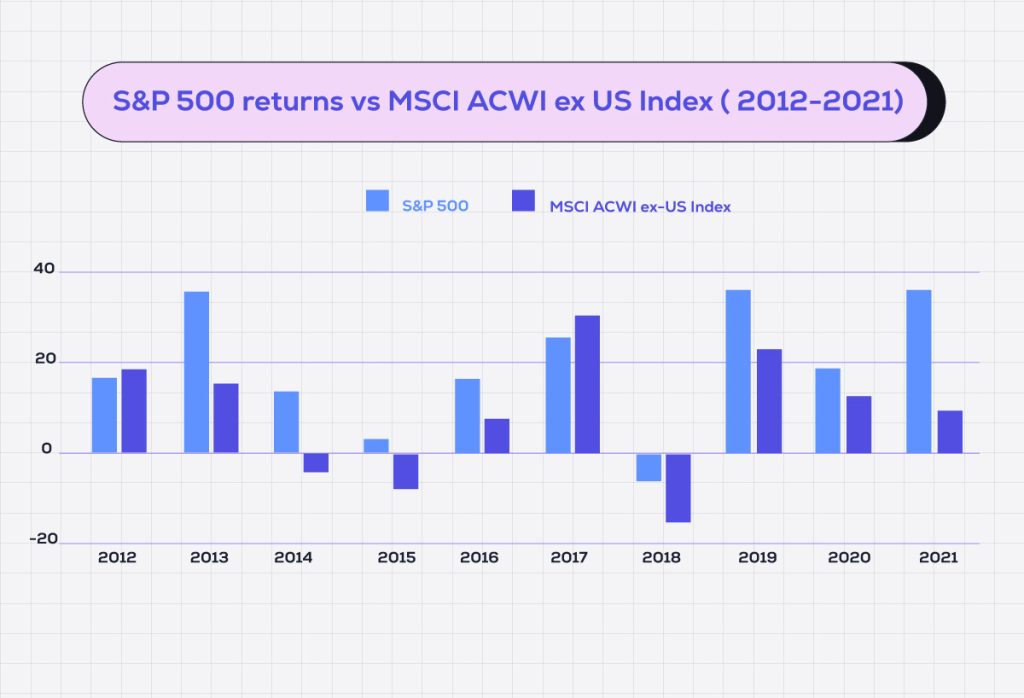

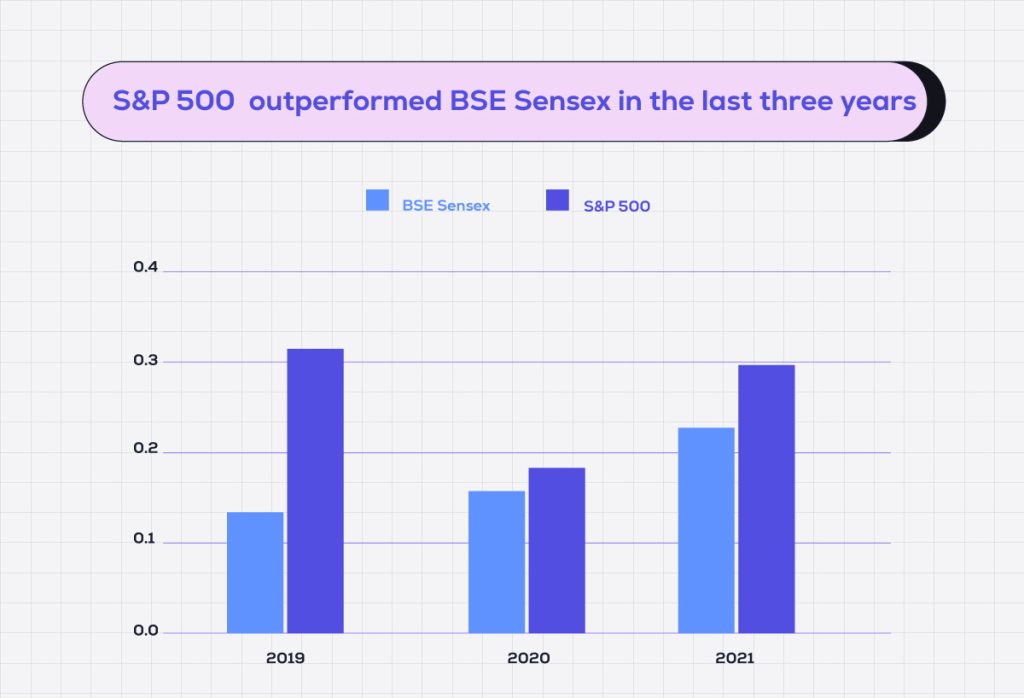

The only thing that matters in stock market investments is consistent outperformance over a long period of time. The US stock market has surpassed other global markets, including India’s BSE Sensex. And the S&P 500 index’s returns are superior to the returns of the MSCI All Country World ex-US Index.

Annual performance returns in percentage

Annual performance returns in percentage

Data sources: MSCI* and www.spglobal.com

*The MSCI ACWI ex US Index is a stock market index designed to measure equity market performance of both developed and emerging markets, excluding the US. The S&P 500 Index measures the performance of 500 of the biggest companies in leading industries of the US economy. It captures 75% coverage of US equities.

Total returns, in percentage

Data Source: BSE, Industry Reports

4. Rupee depreciation in relation to USD will boost your returns

Investing in US stocks would help you reduce currency risks. Put simply, the Indian rupee loses value when oil prices rise (oil is traded in US dollars) as India imports most of its oil and also when foreign portfolio investors pull out money from the Indian market. US stock investments will protect you against the depreciation of the rupee against the USD. To top it all, the US dollar is likely to strengthen further as Federal Reserve, the US central bank, continues to raise interest rates to control rising inflation.

Let us see how the rupee–US dollar exchange rate could help you when you invest in US stocks.

As an Indian investor, you buy US stocks by converting Indian rupees to dollars. The reverse process of converting dollars to INR happens at the time of redemption. The stocks purchased are denominated in USD, so any appreciation in the greenback against INR will boost your investment returns on top of the increase in the price of the stock you hold.

Confused? This example will make it absolutely clear to you. Suppose you invested ₹3,500 in a US stock when the INR/USD rate was at ₹70. Converted to USD, you bought stocks worth $50.

After six months, the rupee depreciates further and the INR/USD rate is at ₹80.

When you convert your $50 into Indian rupees, you will get ₹4,000, which is a 14.3% increase just by investing in the US market even if the value of your stock investment remains the same at $50.

If the price of your stock appreciates to say, $60 from $50, then your investment gains will be even more, the cherry on the cake!

5. It is possible to buy small chunks of top US stocks (Fractional investing)

Have you ever wished you could buy a small chunk of a share of a leading Indian company? For example, if you want to buy a share of Reliance Industries (RIL), you would normally have to buy one full share of the blue-chip stock at its trading price of ₹2,649 (at the time of publication). Put simply, you can’t buy a portion of Reliance share, say, for ₹100.

All that has changed now with the option to invest in the US market. It offers you the golden chance to buy tiny portions of shares in US-listed companies. For instance, the shares of Google are trading at $94.50 at the time of writing. But thanks to fractional trading, one can buy a tiny portion of Google’s stock for as little as $1 (about ₹82 currently).

6. You can also buy shares of non-US companies in the US

Now, Indian investors can own shares of some of the renowned foreign companies trading on the New York Stock Exchange. Some of the prominent foreign firms that are also listed on the US stock exchanges are:

Taiwan Semiconductor (TSM), the world’s leading chipmaker

The UK alcoholic beverage firm Diageo plc (DEO)

Consumer goods conglomerate Unilever plc (UL)

7. US markets are safer to invest in than emerging markets

Investing in the US stock markets is far safer than trading in emerging markets. The latter can be shaky because of geopolitical and other disturbances. The US, on the other hand, has strict corporate governance norms, which protect investors against fraud.

The US market regulators Securities and Exchange Commission (SEC) and FINRA (Financial Industry Regulatory Authority) supervise all stock market and corporate activities in the country.

US firms are more shareholder-friendly compared to companies based elsewhere. Returns to shareholders are a top priority for companies, and they help generate investor wealth and keep the stock market humming.

Conclusion

Many of the world’s leading companies in prominent sectors such as technology are based out of the US. Driven by innovation, they have delivered superior earnings consistently. To sum it up, investing in the US markets will help diversify your portfolio and reduce currency risk—all within the confines of a safe regulatory environment.