All investments come with some risks—some more, some less. Sometimes, though, the fund’s Net Asset Value (NAV) may be hit, despite the fund manager’s best efforts. In such a scenario does unfold, the practice of side pocketing comes into play.

In this article, we will discuss side pocketing in mutual funds in detail. We will explore the concept, purpose, and mechanics of side pocketing. We will also look at why mutual funds use side pocketing and the advantages and disadvantages of this practice.

Introduction to side pocketing

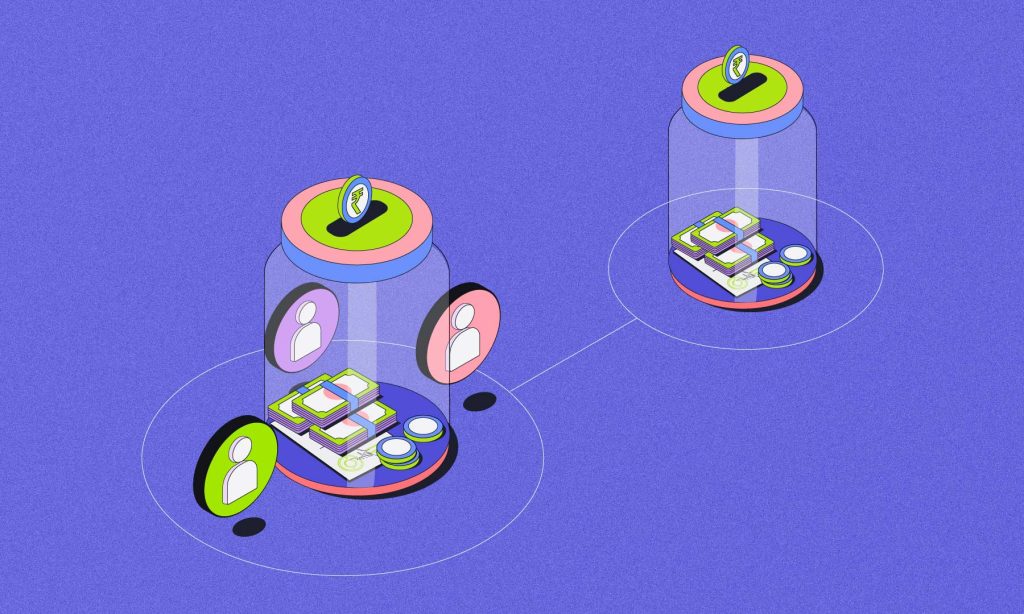

Side pocketing is a mechanism that mutual funds use to separate bad or illiquid assets from good ones. It is a way of preventing bad assets from impacting the performance of the entire portfolio. The practice helps the mutual fund manager to protect the interests of investors.

Mutual funds resort to this measure when a credit event occurs or there is a default by one of the portfolio’s holdings. It helps prevent the panic sell-off that might otherwise occur in the fund. In this way, it ensures that the interests of all investors are protected.

Understanding the basics and purpose of side pocketing in mutual funds

Mutual funds pool money from a group of investors and invest it in a diversified portfolio of assets. The Net Asset Value (NAV) per share represents the price at which investors can buy or sell shares in the fund.

However, in certain situations, a mutual fund may experience a significant event that affects its NAV. For example, a company in which the mutual fund has invested may declare bankruptcy. As a result, there may be in a sharp decline in the value of the investment.

In such scenarios, the mutual fund may face the risk of a significant number of investors redeeming their shares. Should this happen, it will cause a liquidity crunch. This is known as a run on the fund. If the fund does not have enough cash to meet the redemption requests, it may be forced to sell its assets at fire-sale prices, causing losses. This is where side pocketing comes in handy.

What is side pocketing?

Side pocketing is a practice in which a mutual fund separates illiquid or hard-to-value assets from the rest of the portfolio. These assets are segregated into a separate portfolio, known as a side pocket. The side pocket is not subject to redemption requests. This allows the fund manager to manage the liquid portion of the portfolio effectively. At the same time, they can now provide liquidity to investors who wish to redeem their shares.

The assets in the side pocket are marked to market regularly to determine their fair value. The NAV of the side pocket is calculated separately from the main portfolio. Investors who wish to redeem their shares can only do so in the liquid portion of the portfolio.

An explanation of the definition and concept

The goal is to protect the liquidity of the mutual fund’s remaining assets. Without it, the rest, too, would likewise be affected by the illiquid asset.

For example, to protect the fund’s other investors, the manager may choose to isolate illiquid security in a side pocket. The illiquid security is then subject to its own redemption terms. Meanwhile, the rest of the assets remain available for investors to buy or sell.

Why do mutual funds use side pocketing?

Mutual funds use side pocketing for several reasons. First, side pocketing helps fund managers manage liquidity risk effectively. By segregating illiquid assets, they ensure that they have the cash to meet any redemption requests.

Second, side pocketing helps prevent a run on the fund. In the event of a significant event that affects the NAV, side pocketing prevents a run on the fund. This has to do with the fact that it allows the fund manager to manage the affected assets effectively.

Finally, side pocketing can provide greater transparency and clarity for investors. With it, fund managers can give investors a clearer picture of the liquidity and valuation risks.

An overview of the reasons

The primary reason mutual funds use this technique is to protect the interests of investors. When a significant adverse event, such as a bankruptcy filing, affects the value of a security, it can drag down the performance of any fund that holds it. When this happens, it hurts all of its investors. Side pocking prevents this.

How side pocketing works in mutual funds

Side pocketing is a technique that mutual funds sometimes use to create a separate account or sub-portfolio. This is usually a step they take when an adverse event affects the securities they hold.

The manager implements the technique by separating the impacted securities from the rest of the portfolio. They then calculate the value of the side pocket separately from the main portfolio.

A step-by-step explanation of the mechanics and implementation of the idea

Here’s a broad overview of how side pocketing works.

- The mutual fund’s board of directors or investment manager decides to use side pocketing for a particular security or securities.

- They identify and transfer the impacted securities to a separate account or sub-portfolio.

- Then, they record the value of the securities separately from the main portfolio.

- The side pocket is typically not open to new investments or redemptions, meaning investors cannot buy or sell shares in the side pocket.

- The mutual fund continues to manage the side pocket. The manager may sell the impacted securities or wait for their value to recover.

- When the impacted securities are sold or otherwise resolved, the proceeds go to the side pocket investors on a pro-rata basis.

Advantages and disadvantages of side pocketing in mutual funds

Side pocketing has both advantages and disadvantages for all parties on the scene. Here is an analysis of the pros and cons of side pocketing in mutual funds.

Advantages for investors

- Protection of investor interest: Side pocketing helps protect the interest of existing investors by preventing the risk of the illiquid assets from spreading to the rest of the portfolio.

- Transparency: The technique provides transparency to investors as it segregates distressed assets. This enables them to track the performance of the two funds separately.

- Flexibility: It gives investors the option of either redeeming their shares in the original fund before the side pocketing or holding them and receiving a share of the new fund after. In that sense, it is pretty flexible.

Disadvantages for investors

- Reduced liquidity: Side pocketing reduces the liquidity of the original fund as it creates a new fund with illiquid assets. As the new fund is only available to the investors who held the fund before the side pocket, it means reduced liquidity for investors.

- Valuation risk: The fair value estimate used to price the side-pocketed assets may not reflect their true value.

An analysis of the pros and cons of side pocketing for fund managers

Now that we know what the pros and cons are for investors let’s look at what it means for fund managers.

Pros for fund managers

Side pocketing can have several advantages for fund managers. In safeguarding the interests of existing investors in the fund, it protects the reputation of the fund manager. That also, of course, also means it protects their profits in the long run.

Fund managers can also do their job better because they provide investors with a more accurate picture of the overall health of the fund with this practice. This can, again, lead to greater investor confidence and trust in the fund.

Cons for fund managers

While side pocketing can have several benefits, it is not without its drawbacks. One of the primary disadvantages is that it can create confusion and complexity for investors. Side pocketing can make it difficult for investors to understand the true value of their investment. This is understandable because they now have to track the performance of multiple pockets in the same fund.

Another potential disadvantage is that it can create a conflict of interest for fund managers. In some cases, fund managers may overstate the value of the main portfolio while understating the value of the side pocket. This can lead to a misalignment of interests between fund managers and investors. This ultimately results in poorer investment outcomes for all.

FAQs

What is side pocketing in mutual funds example?

Side pocketing in mutual funds involves segregating illiquid or risky assets from the main scheme. For instance, bad debt assets are isolated until resolved, safeguarding investors.

What is the side pocket of a fund?

A side pocket in a fund is an accounting technique that separates illiquid or risky assets, safeguarding investors by isolating these assets until resolved.

What is a side pocket in business terms?

In business, a side pocket typically refers to an emergency fund or segregated account used to manage and isolate specific assets, especially illiquid or distressed ones.

Is it OK to invest all money in one mutual fund?

It’s generally not recommended. Diversifying across multiple funds reduces risk. Investing solely in one mutual fund exposes you to specific market risks associated with that fund.