What is Bitcoin Dominance?

Bitcoin (BTC) Dominance is a metric that measures the relative market share or dominance of Bitcoin in the overall crypto sector. In other words, Bitcoin Dominance refers to the percentage share of Bitcoin’s market capitalization compared to the total market capitalization of all other cryptos combined.

It indicates the extent of Bitcoin’s influence over the entire crypto ecosystem and helps traders understand whether Bitcoin is leading or lagging behind relative to altcoins.

Origin of Bitcoin Dominance: A Glance at the Past

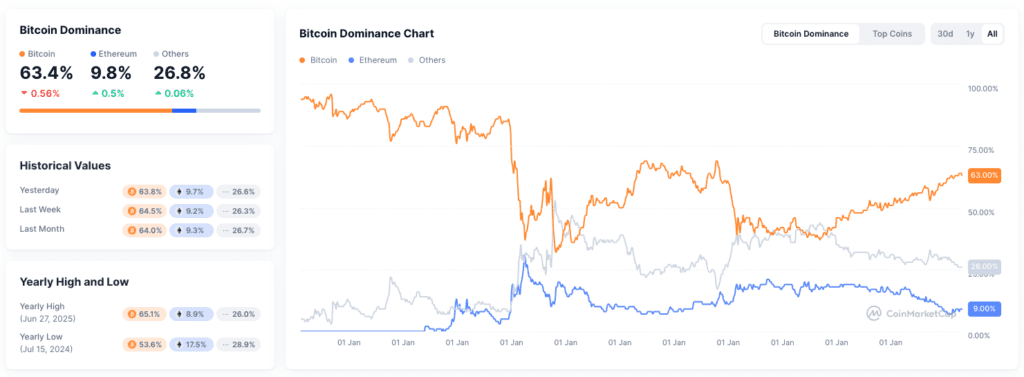

In the early days of crypto, Bitcoin represented nearly 100% of the total crypto market cap. As new altcoins emerged—such as Ethereum, Litecoin, and Ripple—Bitcoin’s share started to decline. Yet, BTC dominance has remained a key metric since 2013, reflecting shifts in market sentiment between Bitcoin and altcoins.

Read More: What is Bitcoin, and how does it work?

Understanding the Bitcoin Dominance Chart

The BTC dominance chart tracks the relative strength of Bitcoin compared to the broader crypto market. A rising dominance indicates capital flow into Bitcoin, often suggesting market caution or uncertainty. A declining dominance typically signals increased interest in altcoins, heralding a potential bull market or high-risk, high-reward appetite among investors.

BTC Dominance vs. Other Technical Analysis Metrics

Unlike indicators like RSI or MACD that measure price momentum or trading volume, BTC dominance reflects capital allocation behavior. It is not price-dependent and offers a macro view of market trends. Traders often combine BTC dominance with chart patterns or altcoin performance to refine their strategies.

Read More: Bitcoin CME Gaps: What They Are, and How to Trade Them

Other Factors Affecting Bitcoin Dominance

- New Altcoin Projects: The launch of new, hyped up tokens can dilute Bitcoin’s dominance.

- Market Sentiment: Bitcoin is widely perceived as a safe-haven asset during market downturns, thereby increasing Bitcoin’s dominance.

- Ethereum and Layer 2 Adoption: In bull markets, capital often flows to DeFi and NFT platforms.

- Regulatory Events: Government regulations may drive investors toward or away from Bitcoin.

Tips on Trading Using BTC Dominance

- High BTC Dominance: Consider focusing on Bitcoin or stable trading pairs.

- Declining BTC Dominance: Altcoins might outperform—ideal for exploring promising altcoin projects.

- Sideways Dominance: Use other technical indicators to confirm market direction.

- Combine with BTC Price: Rising BTC price + Rising Dominance often signal a Bitcoin-led bull market.

How to Take Advantage of Bitcoin Dominance

- Portfolio Allocation: Allocate more capital into BTC during high dominance phases.

- Identify Altcoin Seasons: When dominance drops sharply, it may be the start of an altcoin run.

- Hedging Strategy: Use BTC dominance as a macro filter for long vs. short bias on altcoins.

Conclusion

Bitcoin Dominance is more than a number—it’s a powerful sentiment gauge for crypto markets. Whether you’re allocating assets, identifying trends, or managing risk, monitoring BTC dominance can provide key insights. For both beginners and seasoned traders, it remains a critical tool in navigating crypto’s fast-paced environment.

FAQs

1. What happens when BTC dominance increases?

An increase in BTC dominance means more capital is flowing into Bitcoin compared to altcoins. This usually indicates market caution or a bearish sentiment for altcoins, with investors preferring the relative safety of Bitcoin.

2. What is the rule of BTC dominance?

The general rule is:

Rising BTC dominance → Bitcoin is outperforming altcoins.

Falling BTC dominance → Altcoins are gaining more market share and may offer higher returns.

3. What is the equation for BTC dominance?

BTC Dominance (%) = (Market Cap of Bitcoin / Total Crypto Market Cap) × 100

4. How do you analyze BTC dominance?

To analyze BTC dominance, traders:

Compare dominance trends with BTC and altcoin price movements.

Use dominance levels as a signal for rotating your portfolio between BTC and altcoins.