Blockchain is a digital database or ledger shared among a computer network’s nodes. Blockchains can be used in any industry to secure data, but they are best known for maintaining a record of transactions in the crypto industry. Though blockchain technology was first conceived in 1991, its first real-world application came with the launch of Bitcoin in January 2009. For instance, Bitcoin transactions are recorded on the Bitcoin blockchain.

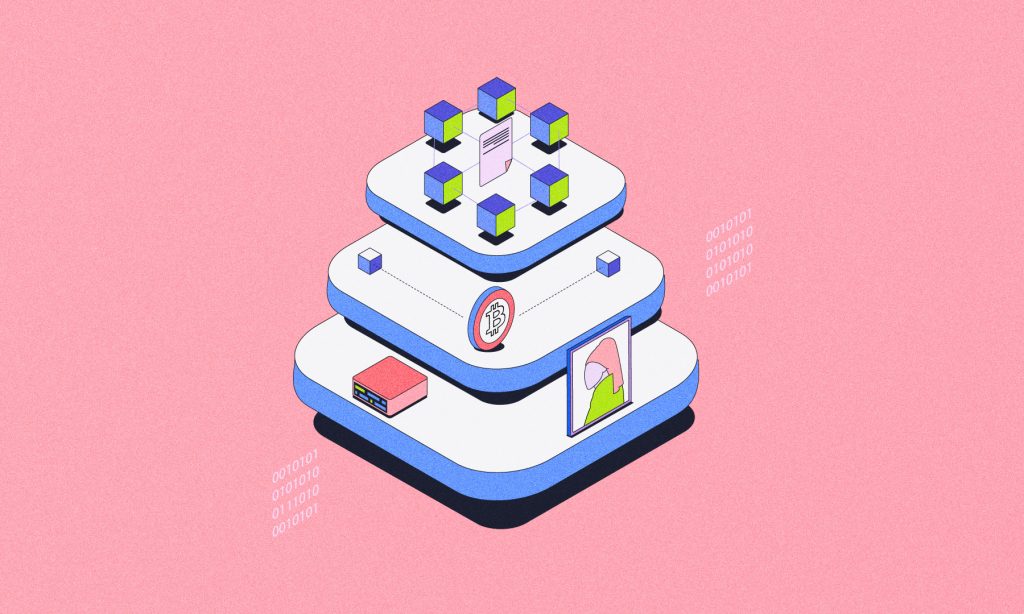

Blockchain networks are segmented into different layers like Layer, Layer 2, and Layer 3 which handle various functions like data storage and user-facing applications. Bitcoin and Ethereum, for example, are layer 1 or L1 protocols. The more advanced Layer 3 protocols, with use cases like DeFi applications and blockchain gaming, also endow blockchain networks with cross-chain capabilities.

As the blockchain evolves rapidly, let’s understand the different architectural structures of blockchain technology.

The three layers of blockchain: Layer 1, Layer 2, and Layer 3

Layer 1, Layer 2, and Layer 3 represent the different architectural layers in blockchain technology. The three layers of blockchain signify the evolution and improvement of each layer, offering specific purposes and functionalities. The ultimate aim of all layers is to make the blockchain technology better. Let’s understand them in detail.

Layer 1

Layer 1 represents the underlying infrastructure for blockchain. This layer includes networks like Bitcoin, Ethereum, and Cardano. Layer 1 handles major functionalities in the blockchain like block creation, consensus mechanisms, transaction validation, and smart contract execution. Any changes in the layer 1 protocol require voting or consensus among participants. The blockchain often splits if the network participants cannot reach a common agreement, leading to a hard fork.

Layer 2

The Layer 2 protocol is built on top of Layer 1. They are also called Layer 2 solutions or scaling solutions as the scalability issues with Layer 1 protocol led to the creation of Layer 2. They offload a lot of steam from Layer 1 and solve Layer 1’s scaling issues often associated with Bitcoin and Ethereum networks. L2s solve the scalability issue by making transaction fees cheaper and taking the transaction from the main blockchain to something called off-chain. Examples of Layer 2 include Bitcoins’s Lightning Network (LN) and the Ronin Network, a sidechain of the Ethereum network. Now, we’ll discuss the Layer 3 protocol in detail.

What is a Layer 3 Protocol?

Layer 3 protocol is built on top of layer 2, with the solutions provided by layer 2. The aim is to provide specialized functionalities on the blockchain ecosystem by leveraging the solutions provided by Layer 2. Layer 3 protocol focuses on specific use cases like decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized exchanges (DEXs). Put simply, Layer 3 leverages the Layer 2 solutions such as scalability, and speed, and allows the building of more complex applications like decentralized applications (dApps).

More importantly, Layer 3 brings interoperability to blockchain technology. Layer 2 solutions like Lightning Network are limited to the Bitcoin network, but Layer 3 made interoperability between different blockchain networks and Layer 2 solutions possible.

Advantages of Layer 3 Protocols

Layer 3 protocols have several functionalities that benefit developers and the blockchain concerned.

Improves scalability

Leveraging on the solutions provided by Layer 2, Layer 3 protocols can handle more transactions without congesting the network or increasing the transaction fees. It specializes in hosting a single application which ensures that the app’s specific requirements are met without posing problems for the main blockchain.

Specialized applications

The Layer 3 protocol enables special applications or complex applications like decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized exchanges (DEXs), and decentralized applications (dApps).

Enhanced interoperability

Before Layer 3, blockchains could not interact with one another. Layer 3 solved this problem. The cross-chain functionality enables smooth interaction and data exchange across multiple platforms, something Layer 1 and Layer 2 protocols could not provide.

Customization and flexibility

Layer 3 confers autonomy to developers to design and implement applications with specific features and requirements. For example, Uniswap (UNI), a DEX built on Ethereum, enables users to trade with one another without an intermediary like a bank or broker.

Innovation

Looked at one way, Layer 3 protocols are a playground for developers as they can experiment without blockers. Developers can launch new ideas and develop new concepts and functionality, all of which contribute to the betterment of blockchain technology.

Layer 3 use cases

Layer 3 protocols have several use cases in the blockchain ecosystem which include:

- Gaming: Projects like Axie Infinity, Decentraland, and The Sandbox have built an industry, leveraging Layer 3 technology to provide immersive gaming experiences.

- DeFi apps: Layer 3 protocols are extensively used in DeFi apps like Uniswap, Compound, Aave, and MakerDAO, providing customized privacy and other functionalities.

- Creation of NFTs: Layer 3 protocols enable the creation of NFTs with NFT platforms like OpenSea and Rarible redefining the ownership of digital assets like collectibles and in-game items.

- Creation of DAOs: Decentralized Autonomous Organizations (DAOs) are possible as Layer 3 protocols enable network participants to govern and make decisions sans centralized control.

- Allows enhanced privacy: Layer 3 protocol supports confidential transactions and contracts. This has prompted the launch of a new category of cryptocurrencies called privacy coins. Monero and Zcash are examples.

Challenges of Layer 3 Protocols

Despite its benefits, Layer 3 protocols come with their set of challenges. Some of them are:

Security vulnerabilities: Layer 3 protocols are more prone to security vulnerabilities than Layer 1s. Vulnerabilities common in Layer 3 protocols include IP spoofing, denial-of-service (DoS) attacks, and other information privacy-related problems.

Centralization risks: The main focus of a Layer 3 protocol is to make the blockchain more scalable and improve its performance. However, with the growing popularity of Layer 3 projects, the level of management and implementation can vary from project to project. Hence, some networks tend to lean toward centralization despite the inherently decentralized nature of the blockchain and Layer 3 protocols. So, developers and network participants need to keep tabs on this aspect of Layer 3.

Governance challenges: To make decisions in Layer 3 protocols, coordination is required among stakeholders such as developers, miners/stakers, and network operators. However, as history shows, the failure to reach a consensus results in a blockchain split or hard fork which could impact the networks’s stability and reputation. Therefore, governance structures in Layer 3 projects need well-balanced transparency and security.

Could Layer 3 protocols shape the future?

Clearly, Layer 3 protocols can potentially shape the future of blockchain networks. Layer 3 protocols have emerged as a formidable technology, redefining modern networking infrastructure, communication, innovation, and connectivity. The rising popularity also enabled the development of Web 3.0 crypto coins such as Internet Computer (ICP) and Chainlink (LINK).

In the DeFi and dApps sector, Layer 3 protocols drove massive technological progress, fostering the development of new applications and services. To conclude, Layer 3 protocols are poised to play a vital role in shaping the future of blockchain technology and allied industries.