In a telltale sign of waning interest in NFTs, GameStop’s NFT marketplace has recorded its daily fee revenue from the sale of NFT plummeting below $4,000.

According to dappradar.com, the NFT marketplace has generated roughly $177k in sales volume in the last 24 hours, and with the platform charging 2.25% as a commission fee, the platform earned close to $3,980 worth of revenue.

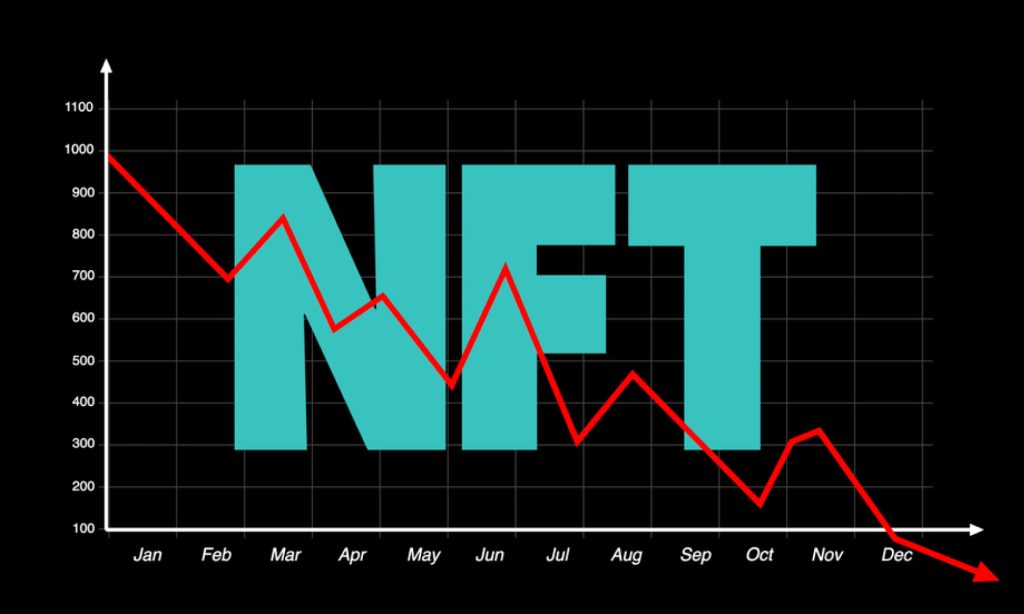

At the time of writing, OpenSea remains the top NFT marketplace with $14.92 million in volume, which is also witnessing a steady downward trend. At its peak, OpenSea witnessed a consistent sales volume of over $150 million.

Other popular NFT projects are too witnessing soured investor sentiment on the backdrop of a drop in the prices of leading crypto assets. Fears of liquidation have resulted in a drop in the value of BAYC NFTs. Several BAYC holders who have borrowed against the NFTs on BendDAO are up for liquidation auction resulting in pressure on the price of BAYC NFTs.

As per estimates, NFTs used as collateral on BendDAO protocol are worth over $59 million, and close to 272 BAYC NFTs or 2.72% of the collections are kept as collateral in the platform.

Many NFT analysts have warned that the NFTs kept as collateral in BendDAO is at higher risk of liquidation. BendDAO allows users to borrow up to 30-40% of the value of NFTs as loans keeping them as collateral. If the price of NFT drops so much that the loan equates to 90% of the value of NFT, the depositor either needs to provide additional collateral or the protocol will auction the NFTs to recover dues.

At present, 10 BAYC NFTs are in danger of getting liquidated, while the count for MAYC NFTs stands at 14. In the last 30 days, the floor price of BAYC NFTs has fallen by close to 30%.

FAQs

How much does GameStop charge for NFT marketplace?

GameStop had not announced any specific plans to launch its own NFT marketplace, and therefore, there were no details available about any charges or fees associated with such a platform.

It’s important to note that the information landscape, especially in the cryptocurrency and blockchain space, can change rapidly. New developments, announcements, and initiatives may have occurred since my last update. If GameStop has introduced an NFT marketplace or made any related announcements, it would be advisable to check the official GameStop website, official statements, or credible news sources for the most up-to-date information on fees and charges associated with their NFT marketplace.

What is GameStop NFT marketplace?

If GameStop has launched an NFT marketplace or made related announcements, I recommend checking the official GameStop website, official statements from the company, or reputable news sources for the most up-to-date information. Companies may enter the NFT space to offer digital assets, collectibles, or other forms of content using blockchain technology, and announcements about such endeavors are typically made through official channels.

What is the NFT platform fee?

It’s important to check the fee structure of each NFT platform, as fees can vary significantly. Additionally, the blockchain network on which the NFTs are issued (e.g., Ethereum, Binance Smart Chain, Flow) can impact transaction fees, as each network has its own associated costs and speed.

How much is the NFT marketplace worth?

The overall value of the NFT (Non-Fungible Token) marketplace is dynamic and subject to change over time. The NFT market has experienced significant growth and attention in recent years, with high-profile sales, celebrity endorsements, and a surge in interest from both artists and collectors. However, the value of the NFT market can be influenced by various factors, including market trends, user adoption, the popularity of specific platforms, and broader economic conditions.