In 2020, when the world was reeling under the impact of a pandemic and the global economy was slowing down, Bitcoin and other cryptos outshined every other traditional asset. Crypto proved to be a great non-correlated asset and the perfect hedge against inflation and economic uncertainty.

Come 2022, things have changed entirely. The crypto market is closely following the global stock market. And for several weeks now, Bitcoin prices have continued to correspond with Nasdaq and S&P 500.

How did we get here? What changed between 2020 and 2022? And why is the crypto market resilience showcased in 2020 and 2021 missing now?

Two market scenarios

It’s true that crypto is very different and has no direct relationship with other traditional assets. But, the crypto market is directly connected with global liquidity conditions. There are two ways in which this connection usually plays out.

A super loose monetary policy

In 2020, to sustain growth and reduce the economic hardship of the pandemic, central banks around the world opted for a pretty loose monetary policy. They flooded the market with additional liquidity (money) and reduced interest rates on credit so that both businesses and individuals could help spur growth.

The additional liquidity got channeled into the stock and crypto markets, generating superior returns from both in a shorter duration than usual.

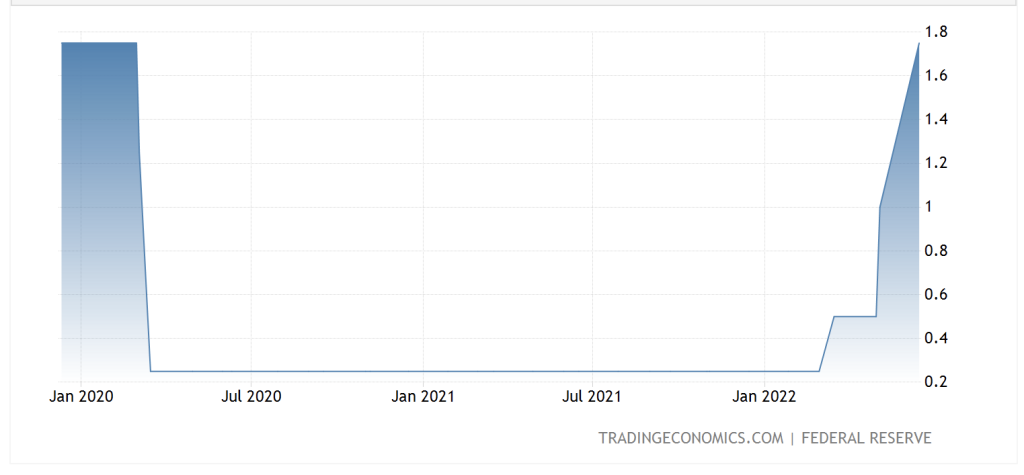

Federal Reserve Funds Rate Chart

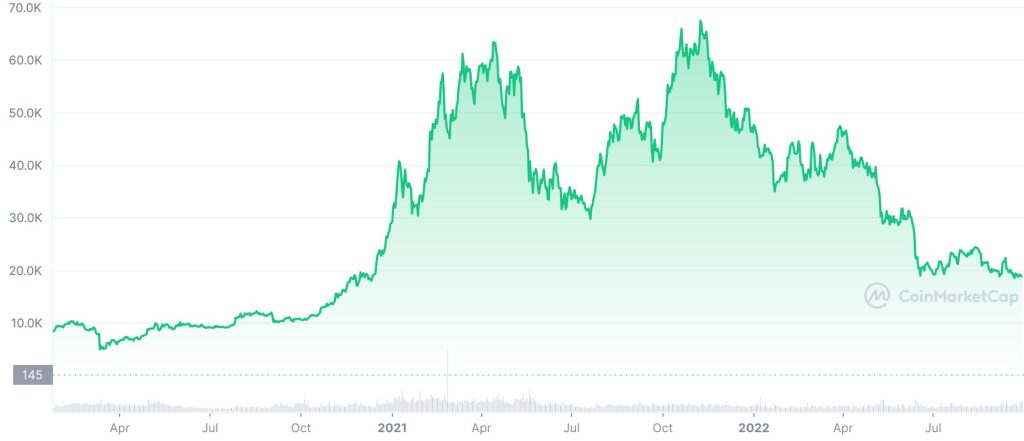

Bitcoin Price Chart (Source: Coinmarketcap.com)

If you look at both the charts above and connect the dots, you will see that during the period of loose monetary policy by the Fed, from March 2020 to February 2022, the price of Bitcoin skyrocketed. It reached an all-time high level of $68,789 in November 2021. However, it started to decline once the Fed started with the rate hike cycle in March 2022 to tame inflation.

Things get tighter

A loose monetary system may look like an excellent option for economies seeking to spur growth, but in the long run, it can come with the pain of high inflation. Everyday lives of the lower and middle classes can be adversely affected by it. That’s why economies around the world at present are struggling.

Therefore, central banks feel the need to control the inflationary pressure in the economy. That’s how we arrive at the second scenario. Central banks start withdrawing the ultra-loose monetary policy and going aggressive with rate hikes. Rate hikes suck out the liquidity from the system, leaving people and businesses with less money in hand while making credit dearer.

Additionally, higher bond yields are a bit negative for risk-on assets like stocks and crypto assets. As longer-term bond yields are considered the risk-free rate, an increase in bond yields results in a flight of capital from risk-on assets to risk-off assets. Simply put, investors begin to naturally choose risk-off assets because with them one can earn higher returns by taking absolutely no or few risks.

This is exactly what is happening with the crypto market currently.

Furthermore, high inflation spooks investor sentiments. As the inflation rate increases, the price of daily essential goods and services rises, and the purchasing power of consumers drops. It directly impacts investors’ investment and risk appetite, and in turn, causes a fall in the price of assets.

So, to sum it up, what changed between 2020 and 2022 is this: the market evolved from the first to the second scenario. And that meant lesser resilience. That’s why we are here.

What does this mean for the future of crypto?

With all of these developments, there is a growing fear of recession making the rounds. (And that is also impacting the crypto market currently.) But is the fear valid? Is there really a recession looming, and what does that mean for crypto? The answers may be found in an Inverted Yield Curve.

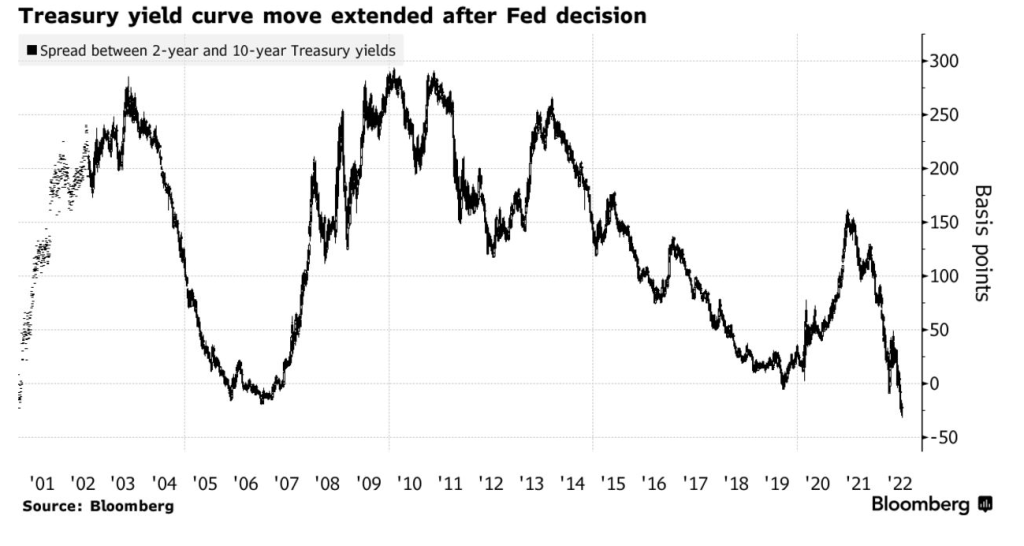

An inverted yield curve occurs when short-term debt instruments have a higher yield than long-term ones. It indicates that the long-term economic outlook of the country is poor.

Then, the difference (the spread) between the 10-year US treasury and the 2-year US treasury turned negative.

That means things have not been so bad in a while. The last time it was this bad was during the global financial crisis of 2008.

So yes, a recession may come, and if it does, people are likely to favor investing in debt assets in the short term for higher risk-free returns instead of highly volatile asset classes. And there will be a real impact on risk-on assets like cryptocurrencies.

But investors who are here for the long haul need not panic yet. Because it’s likely that these developments will only impact the market in the short term. Remember, Bitcoin was launched soon after the global financial crisis of 2008 when the inverted yield curve was also negative. And it still managed to become one of the best-performing assets.

And, as the crypto ecosystem evolves and grows, the crypto market will become uncorrelated from global financial markets and chart its own course. It just isn’t there yet.