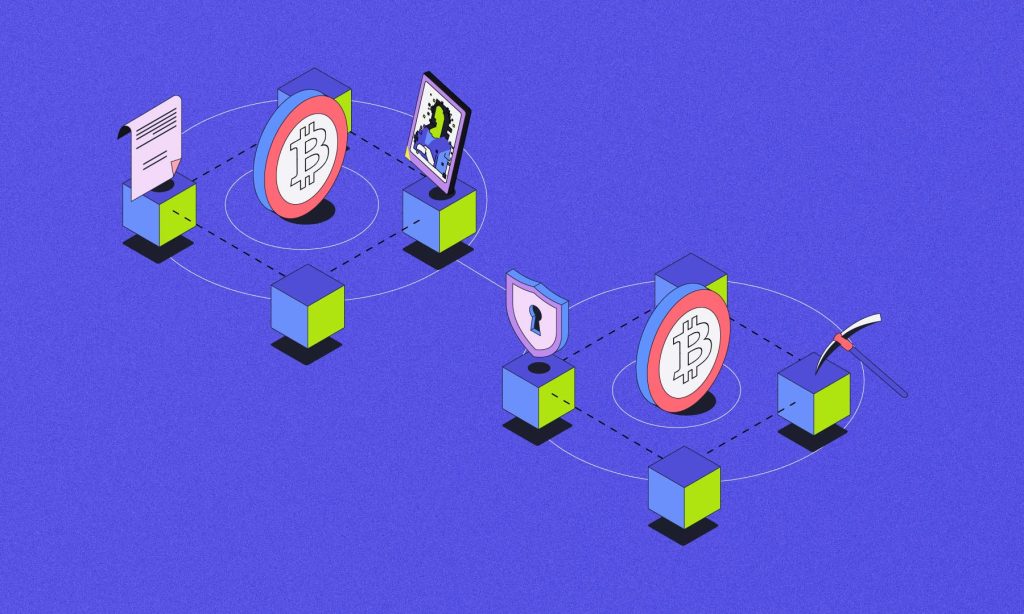

Crypto is an innovative and revolutionary technology that has taken the world by storm. It has transformed how people conduct transactions, transfer money, and invest in digital assets. Crypto minting and crypto mining are two of the most common activities in the world of crypto. While both are critical to the functioning of the blockchain, they differ in many ways. In this article, we will explore the differences between the two and assess the pros and cons of each.

Introduction to crypto minting and crypto mining

Crypto minting and crypto mining are both ways of creating new coins on the blockchain. One can use these coins for transactions or investments. However, the process of making coins differs in each method.

Crypto minting is the process of creating new coins or tokens using a smart contract or protocol. Creating the tokens through minting does not involve the use of a significant amount of energy or computational work.

Crypto mining, on the other hand, is the process of creating new coins on the blockchain by solving complex mathematical problems using powerful computer systems. The process involves verifying transactions on the network and adding them to the blockchain. The process of crypto mining is also known as Proof of Work (PoW), where miners compete to solve complex algorithms to create new blocks.

Exploring the definition, purpose, and mechanics of crypto minting

Crypto minting aims to provide a more energy-efficient and environmentally friendly alternative to the energy-intensive process of crypto mining. Crypto minting allows users to participate in the creation of new coins without the need for expensive and powerful computer systems. The mechanics of crypto minting involve users holding a certain amount of crypto in a wallet for a specified period. During this period, they validate transactions on the network and create new blocks in the blockchain.

Crypto minting provides a more accessible and inclusive process compared to crypto mining. It allows users with lower computing power to participate in creating new coins and earn rewards. It also allows users to support the blockchain network by validating transactions and adding security.

Understanding the definition, purpose, and mechanics of crypto mining

Crypto mining aims to create new coins on the blockchain and maintain the network’s security. Crypto mining involves solving complex mathematical problems using powerful computer systems. The mechanics of crypto mining involve miners competing to solve complex algorithms to create new blocks in the blockchain.

Crypto mining is a highly energy-intensive process that requires a significant amount of computing power. Miners use specialized hardware and software to solve complex algorithms and create new blocks. The process of crypto mining requires a significant amount of energy, which can result in high electricity bills and harm the environment.

Differences in energy consumption

Crypto minting and mining differ in energy consumption. Mining is notorious for consuming large amounts of energy due to the computational power required to solve complex mathematical equations. In contrast, minting requires significantly less energy than mining.

Comparing the energy requirements of crypto minting and crypto mining

Crypto mining requires considerable energy due to solve complex mathematical equations. The equations require high-end hardware that consumes a lot of energy to function. The energy consumption of mining is a major concern for many people as it contributes to climate change. On the other hand, minting typically requires less energy than mining. Minting involves staking coins or tokens and earning rewards for holding them rather than validating transactions. This means minting consumes less energy than mining, making it a more eco-friendly alternative.

Differences in complexity

Crypto minting and mining differ in terms of complexity. Mining is a highly complex process that requires specialized hardware and software. It involves solving complex mathematical equations to validate transactions and create new coins. In contrast, minting is a relatively simple process involving holding coins or tokens in a wallet and earning rewards.

Evaluating the complexity of crypto minting and crypto mining

Crypto mining requires high technical expertise, specialized hardware, and software. The process involves solving complex mathematical equations to validate transactions and create new coins. This requires significant computational power, which can be costly and difficult to maintain. On the other hand, minting is a relatively simple process that involves holding coins or tokens in a wallet and earning rewards for doing so. This process requires significantly less technical expertise than mining.

Differences in rewards

The primary difference between crypto minting and crypto mining lies in each process’s rewards. When you mine crypto, you are rewarded with a certain number of coins for solving complex mathematical problems. The amount of crypto you can earn through mining depends on the problem’s difficulty and your computer’s processing power.

On the other hand, crypto minting rewards users for holding a certain amount of crypto in a digital wallet. When you mint crypto, you use your coins as collateral to help secure the network. In return for your contribution, you receive additional coins as a reward.

Understanding the rewards and incentives for crypto minting and crypto mining

Crypto mining and crypto minting offer different rewards and incentives for users. In the case of crypto mining, the reward is directly tied to the amount of computational power you can contribute to the network. The more powerful your computer, the more coins you can mine.

Mining also incentivizes users to continuously upgrade their hardware, which can be costly. However, the potential rewards for mining can be significant, especially for early adopters of new cryptos.

Crypto minting, on the other hand, is a more passive way of generating crypto. By staking your coins in a digital wallet, you are helping to secure the network and contributing to its overall stability. The reward for minting is typically a smaller amount of coins, but it requires less effort than mining.

In addition, some cryptos offer a higher reward for minting than mining, making it a more attractive option for some users. For example, the crypto Cardano offers a higher reward for minting than mining, which has led to a surge in interest in minting among its users.

Differences in security

The level of security is another key difference. Mining is a highly secure process that helps validate transactions on the blockchain network. By solving complex mathematical problems, miners verify transactions and prevent double-spending.

However, mining can also be vulnerable to attacks by malicious actors who may attempt to take over the network or steal coins from miners. In some cases, attackers may employ a 51% attack to gain control of over 51% of the network’s processing power, allowing them to manipulate the blockchain and potentially steal coins.

On the other hand, crypto minting is a more secure process that helps maintain the integrity of the network. By staking your coins as collateral, you are helping to secure the network and prevent malicious actors from taking control.

However, minting can also be vulnerable to attacks by hackers who may attempt to steal coins from users’ digital wallets. In addition, minting requires users to keep their coins in a digital wallet, which can be vulnerable to hacking attempts.

Assessing the security implications of crypto minting and crypto mining

The security implications of crypto minting and mining must be assessed when deciding which process to participate in. In the case of minting, users should be cautious of vulnerabilities in the smart contract code, as they can result in significant financial losses. Users should also be careful when selecting the blockchain they want to participate in, as some may have a higher risk of security breaches than others.

For mining, users should be aware of the risks of a 51% attack and take steps to mitigate these risks. This could involve joining a mining pool, which distributes computational power among multiple users, reducing the risk of a single user controlling the network.

Conclusion: The pros and cons of crypto minting and crypto mining

In conclusion, while both crypto minting and crypto mining offer the potential for significant financial rewards, they also come with their unique set of security risks. Many consider crypto minting more secure than crypto mining, but it is crucial to take appropriate security measures to minimize the risk of hacking or other security breaches.

The decision to pursue crypto minting or mining will depend on various factors, including the level of technical expertise, the availability of resources, and the overall risk tolerance of the investor. By carefully assessing these factors and taking appropriate security precautions, individuals can minimize the risk of loss and maximize the potential for financial gain when investing in cryptos.

FAQs

What is the difference between crypto minting and crypto mining?

Crypto minting refers to the creation of new tokens or assets on a blockchain, often through smart contracts, while crypto mining involves validating transactions and adding them to the blockchain to earn rewards.

How does crypto minting work?

Smart contracts define rules. Users meet conditions and interact, blockchain executes, generating new tokens or assets transparently and immutably.

What is crypto mining, and how does it differ from minting?

Crypto mining involves validating transactions and adding them to the blockchain to earn rewards. Minting creates new tokens through smart contracts.

How does minting or mining impact the blockchain network?

Minting creates new tokens/assets, impacting token supply and usage. Mining secures the network, validates transactions, and adds blocks, ensuring consensus.