A tax evasion-related lawsuit has been filed against Michael Saylor and the company he founded, MicroStrategy. The lawsuit was filed by Karl Racine, Attorney General for the District of Columbia in the United States. Racine alleges that the company assisted Saylor in evading tax and is thus extending the lawsuit to the company as well.

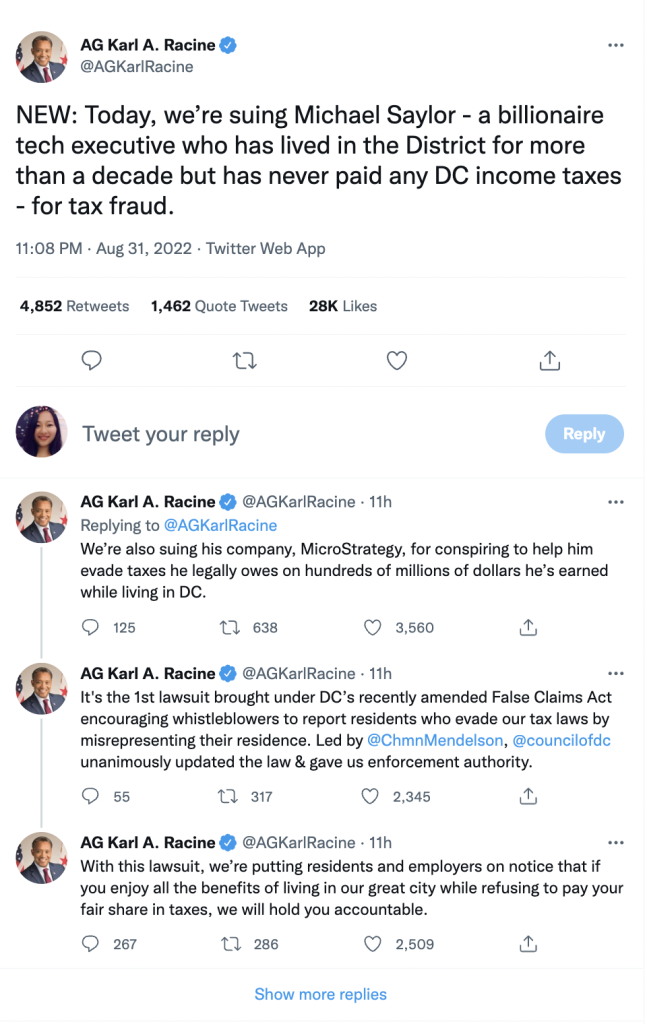

News of the lawsuit broke via a series of tweets by Racine on 31 August.

Saylor’s resignation: A quick recap

Under Michael Saylor’s leadership, MicroStrategy became one of the first institutional adopters of Bitcoin. Unfortunately, MicroStrategy lost over $1 billion of its funds in the second quarter of 2022. As a result, Saylor stepped down as CEO last month. He was later appointed as the Executive Chair of the company.

Additional charges

The attorney general’s office also claims that Saylor falsified his residency with the help of MicroStrategy. Saylor has been living at his house in Georgetown, Columbia, since 2005 and has even docked at least two of his luxury yachts on the property.

According to the DC laws, individuals who reside in the District for a minimum of 183 days a year are required to pay local taxes. Saylor failed to pay the local tax and has breached the law, according to the claim from the DC office. He could now face penalties to the tune of $100 million.

This is the first lawsuit brought under the District of Columbia’s recently amended False Claims Act, Racine’s tweet revealed. The law encourages whistleblowers to report residents who evade tax despite enjoying the benefits of being a resident.

FAQs

Did MicroStrategy founder Michael Saylor once lose $6 billion in a day?

Yes, Michael Saylor, the founder of MicroStrategy, did experience a significant loss of $6 billion in a single day during the dot-com bubble burst. The stock price of MicroStrategy plummeted by 62% in a day after the company announced accounting mistakes, leading to a substantial decrease in Saylor’s wealth.

Is Michael Saylor still with MicroStrategy?

As of the information available, Michael J. Saylor is still associated with MicroStrategy. He currently serves as the Executive Chairman and Co-founder of the company.

How much Bitcoin does Michael Saylor have personally?

The search results do not provide specific information regarding the exact amount of Bitcoin that Michael Saylor personally holds. For the most accurate and up-to-date information on Michael Saylor’s Bitcoin holdings, it is recommended to refer to official statements from MicroStrategy or Michael Saylor himself.

Did MicroStrategy CEO step down after Bitcoin losses?

The search results do not provide information indicating that the MicroStrategy CEO stepped down specifically due to Bitcoin losses. It is recommended to verify the latest news or official statements from MicroStrategy for the most accurate and up-to-date information regarding the CEO’s status and any potential reasons for any changes.