In what could be seen as a sign of slow recovery in the crypto market, the circulating supply of Tether (USDT) has expanded after three months of steady decline.

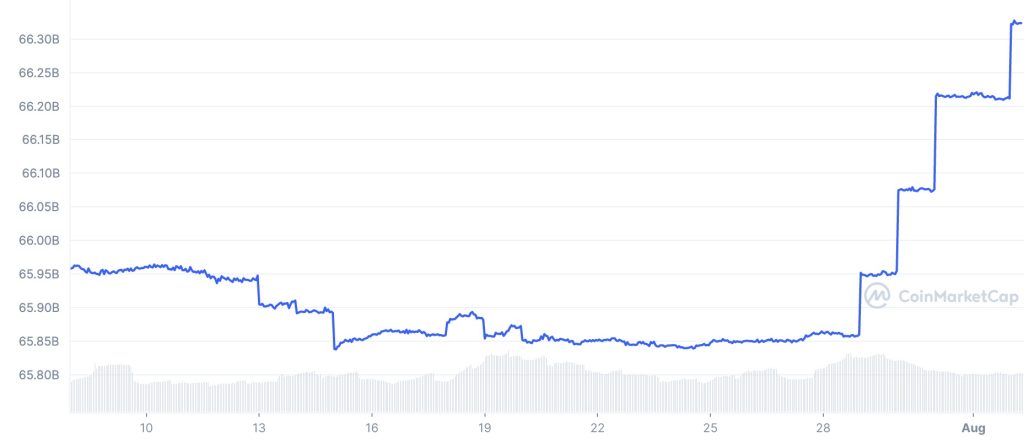

According to coinmarketcap.com, the first mint happened on July 29, 2022, followed by three more on July 30, 31, and August 2. The fresh new injections are small compared to the decline in the last three months, lifting the total market cap from $65.8 billion to $66.3 billion, giving it a total market share of 43% among stablecoins.

Before the start of the Terra-UST collapse, the market cap of Tether had touched a high of $83.2 billion. Redemption pressure and market uncertainty led to the large-scale withdrawal of USDT, resulting in a 21% decline to a low of $65.8 billion.

During the period, Circle increased the market share of USDC stablecoin by taking its total circulating supply from $48.5 billion to $55.8 billion. It now commands a market share of 36% among stablecoins.

The market share of stablecoins in the crypto market has reached an all-time high level of 13.6%. Recently, Aave’s plan to launch an algorithmic stablecoin has received decentralized autonomous organization (DAO) approval.

According to Aave’s founder Stani Kulechov, the stablecoin will be named GHO. It will be yield-generating, can be used to solve payment issues, and can be deployed as collateral for on-ground and online assets.