In the last 7 months, Bitcoin fell by 61%. From a peak of more than $69,000 in November 2021, it dropped all the way to $26,700 by the end of May 2022.

A $42,000 drop.

The math tells us that a ₹1,00,000 investment in Bitcoin in November 2021 would be valued, going by those numbers, at just over ₹34,000 today (28 July 2022). That’s a lot of red tickers in a very short time.

A lot of money is tied to crypto. Pocket money, life savings, and VC money. All of it.

Such price falls could spell bad news for everybody.

But do they?

Source: TradingView

We know it seems like the price of Bitcoin is the only thing that matters when you’ve got skin in the game. But that’s not true.

Bitcoin is not just about mind-bogglingly large returns.

It’s about something else entirely.

What really matters

Bitcoin blew up really fast. Everyone knows that.

When it first started out, it promised to create a decentralized method to transfer money without involving banks.

Samiksha, for example, would be able to send her friend lakhs of rupees in under 10 minutes from the remotest corner of the Earth without ever knowing what a SWIFT code is, or paying a single penny in charges. All she would have to arrange for was a computer and some Bitcoin.

That’s pretty cool, right?

This is the original utility of Bitcoin—the ability to transfer value without intermediaries.

But sometime during the last couple of years, we’ve forgotten that.

Bitcoin, Ethereum, and thousands of other cryptos have become mere trading horses. People care if prices go up. People care a LOT if they’re going down. And they seem to stop caring when neither of that happens (which is most of the time).

There’s a problem with that.

Because Bitcoin is not about making money.

Bitcoin could be the new money.

Anyone could smear crypto over prices. It’s convenient and easy, and people don’t have to think twice about it. But like I said, it’s not about the price.

It’s about…

The metrics

Bitcoin has been doing exactly what it’s supposed to, one step at a time.

Here’s how we know that.

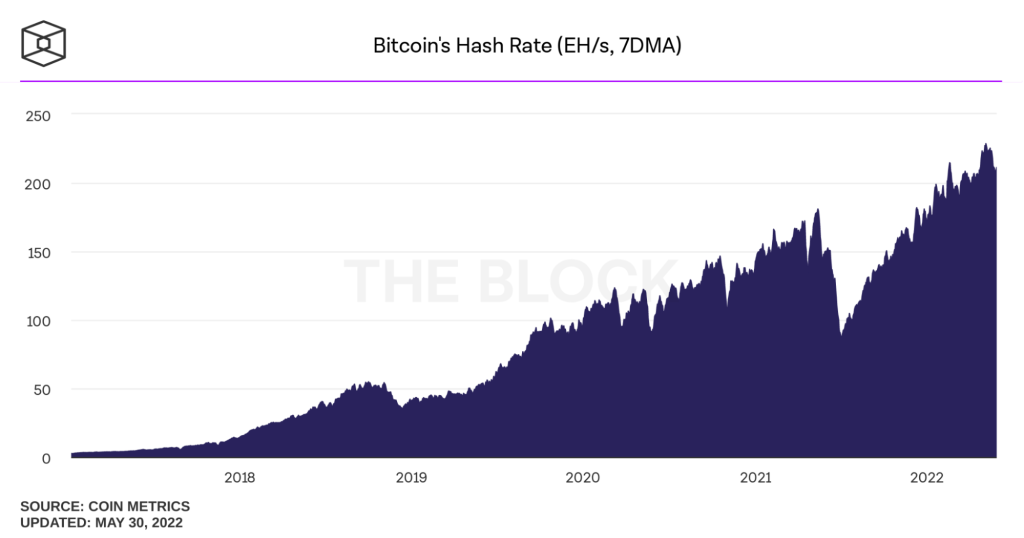

Hash rates are at an all-time high

Higher hash rates mean that verifying transactions is getting harder. Miners need more power to crack hashes and add more transactions to the chain.

Mining is getting more difficult every single month. Even when the price slumps.

And hackers need to work that much harder to manipulate anything.

Look at the Glassnode-sourced graph below. You’ll see that the hash rate increased from 50 Trillion Hashes (TH) per second in May 2019 to over 225 TH per second in January 2022. That’s more than a four-fold rise there.

The higher the hash rate, the more resistant the network is to attacks, and the safer Bitcoin is.

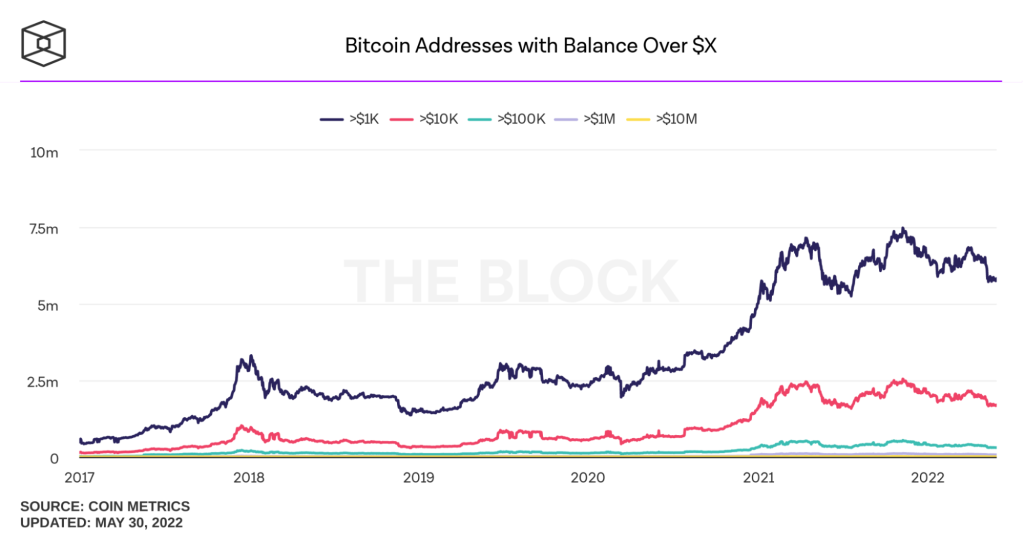

Bitcoin balances are rising

The number of Bitcoin addresses with balances has also increased over time. Even the number of small investors (those with less than $1,000 worth of BTC in their wallets) has steadily increased—from roughly 2.5 million in 2020 to more than 7.5 million at the start of 2022.

Here’s the graph:

More people are buying Bitcoin and increasing their aggregate balances. Note that the number of addresses with some balance hasn’t gone down, even though prices have.

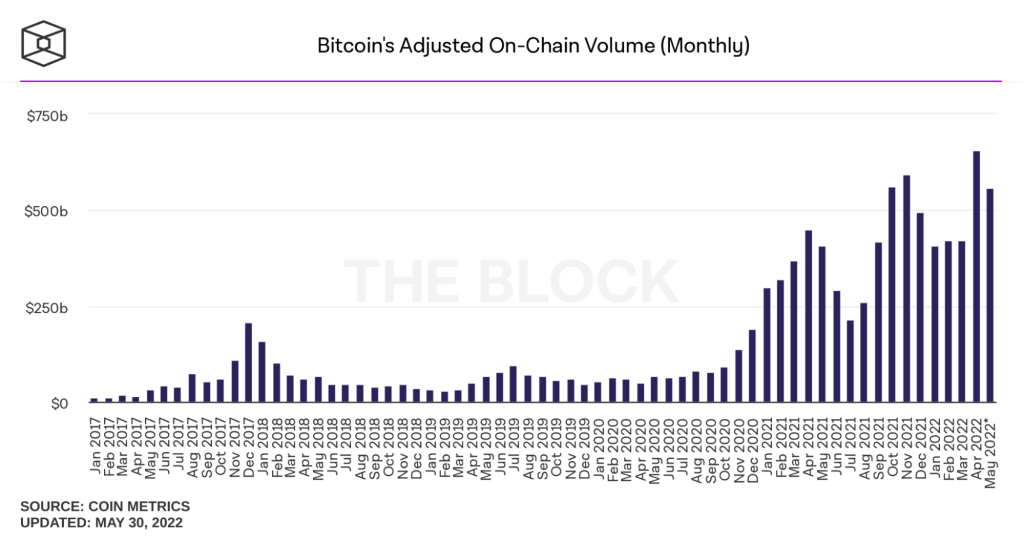

On-chain volumes are consistent

The on-chain volume records the number of valid transactions on Bitcoin. If the volume is high, it means a large number of users are using the network at once.

And that’s exactly what’s happening since 2022 began.

The graph below shows that the on-chain volume has stayed fairly consistent. Although the first three months started off low at below $500 billion per month, April 2022 logged the highest volume ever recorded at close to $600 billion.

Interestingly, this was in April, when BTC prices supposedly “had no bottom.”

The number of new Bitcoin addresses is on the rise

This is perhaps the strongest metric of them all.

Around the world, the number of new addresses created every month on Bitcoin has remained the same for a long time, which means that Bitcoin has consistently been attracting new private or institutional users to its network.

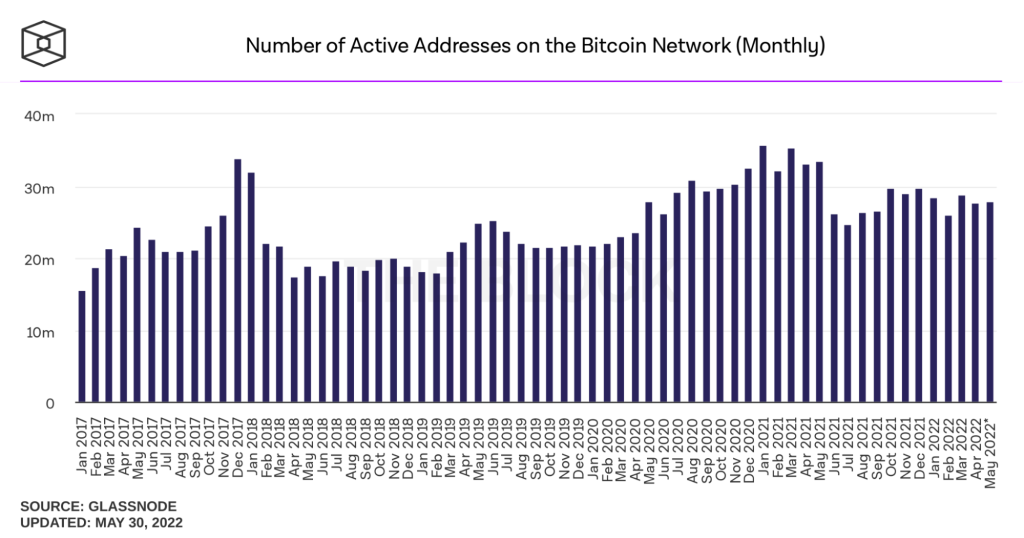

The graph below indicates that roughly 60 million new addresses were added since January 2022 alone.

The number of active addresses has also been largely stable for the last two years, standing firm at roughly 28 million.

These numbers indicate that the community that actually drives Bitcoin does so irrespective of price fluctuations.

So why are we telling you this?

Because we want to remind you that on-chain metrics are more important than price movements. Bitcoin isn’t trying to be the catch-all asset that makes everyone rich.

What Bitcoin is, is the future of how we interact with money.

And that future has nothing to do with Bitcoin’s price movements every day.

These metrics…

- Hash rates

- Addresses with balances

- On-chain volumes

- New addresses

- Monthly active addresses

…are the true indicators of Bitcoin’s real objective. They measure how institutions, banks, and companies see the technology moving forward.

And the fact that these metrics have stayed largely unchanged while the market went bonkers says something.

This wasn’t just a one-time affair either. History bears testament to the fact that Bitcoin has consistently shown on-chain success. And that’s what matters the most.

Falling Bitcoin prices are not an indication of bad things happening behind the scenes. There is no behind-the-scenes with Bitcoin. Everything’s crystal clear.

And the crystal says that this isn’t the end. It’s only the beginning.

Irrespective of how Bitcoin prices move, the people who make it all happen at the back end—the miners, developers, and large investors—are still at it. Without pause and without complaint.

Because they see the big picture. And the next time you’re about to panic-sell your BTC, we hope you do too.