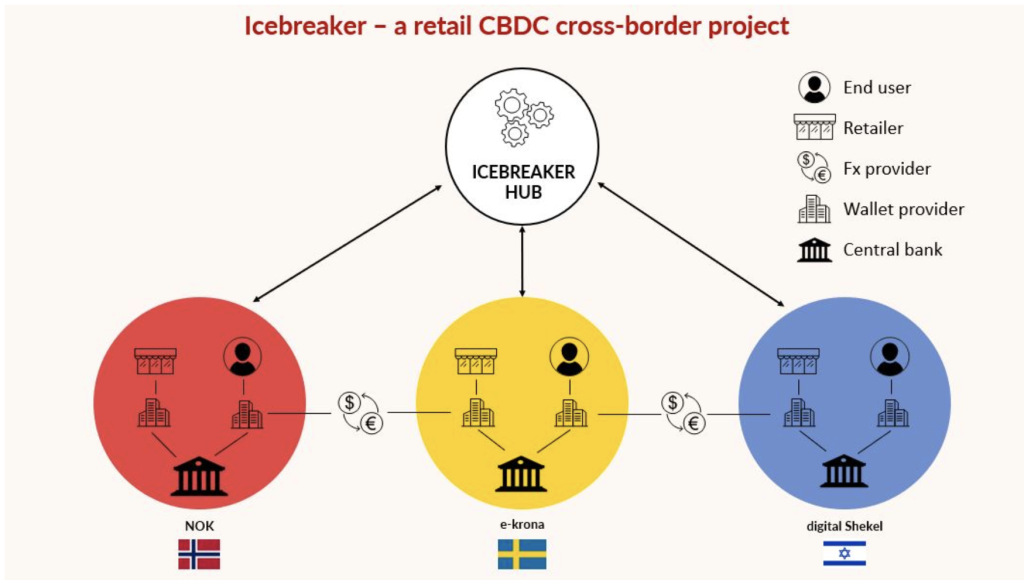

The Bank of International Settlements (BIS), situated in Basel, Switzerland, has partnered with the central banks of Israel, Norway, and Sweden to explore the possibility of using Central Bank Digital Currencies (CBDCs) for retail and international remittance payments. The partnerships are being made under Project Icebreaker, according to a recent press release.

The bank’s Innovation Hub Nordic Centre will test key functions and technological feasibility of interlinking domestic CBDC systems. The central banks of respective countries will develop a new hub that can connect their proof-of-concept CBDC systems.

The partnership will explore different use cases related to CBDC design and architecture, as well as the policy matters related to the use of CBDCs, according to the press release. The primary purpose of the project is to explore CBDC use cases and reduce cross-border remittance costs, increasing speed and efficiency.

The final report of the project is expected to be presented at the end of the first quarter of 2023.

This isn’t the first time BIS has made pro-CBDC moves. On 27 September 2022, the financial institution reported the success of a similar partnership with the central banks of Hong Kong, Thailand, China, and the United Arab Emirates. Testing and facilitating cross-border transactions worth over $22 million had been going on for a month before that.

“This first-of-a-kind experiment will dig deeper into the technology, architecture, and design choices and trade-offs, and explore related policy questions. These learnings will be invaluable for central banks thinking about implementing CBDCs for cross-border payments,” Beju Shah, head of the BIS Innovation Hub Nordic Center, said this time around, according to a press note.