Crypto is no longer in the top 10 financial risks for the US, according to a central bank survey conducted by the Federal Reserve Bank of New York. The report stated 14 factors that pose a financial risk, and crypto stands only at the 11th position.

While crypto may have missed being included in the top 10 risks list, the survey reiterates the US central’s anti-crypto position while evaluating the risks with this digital asset. Most of the top crypto by market valuation, including Bitcoin (BTC), Ethereum (ETH), Binance coin (BNB), Cardano (ADA), and Ripple (XRP) are down about 69% in value, the survey said, compared to the last November bull market 2021 peak.

The infamous implosion of the Terra ecosystem, which has caused collateral damage to the entire crypto market, is also mentioned in the survey. The entities that had direct exposure to TerraUSD ended up landing themselves in financial troubles.

Proponents of traditional finance often dismiss crypto for the associated financial risks. So the news about this virtual digital asset taking the backseat on the top 10 list could help take some of the heat off the crypto ecosystem.

The continued efforts of major stakeholders in the crypto space to educate the masses seem to have contributed to removing some of the “risky asset” stigma. The change is also reflected in the rise in the number of companies and individuals migrating to the Web 3.0 space.

The latest report from one of US’s 12 federal reserve banks also reveals a change in investor mindset.

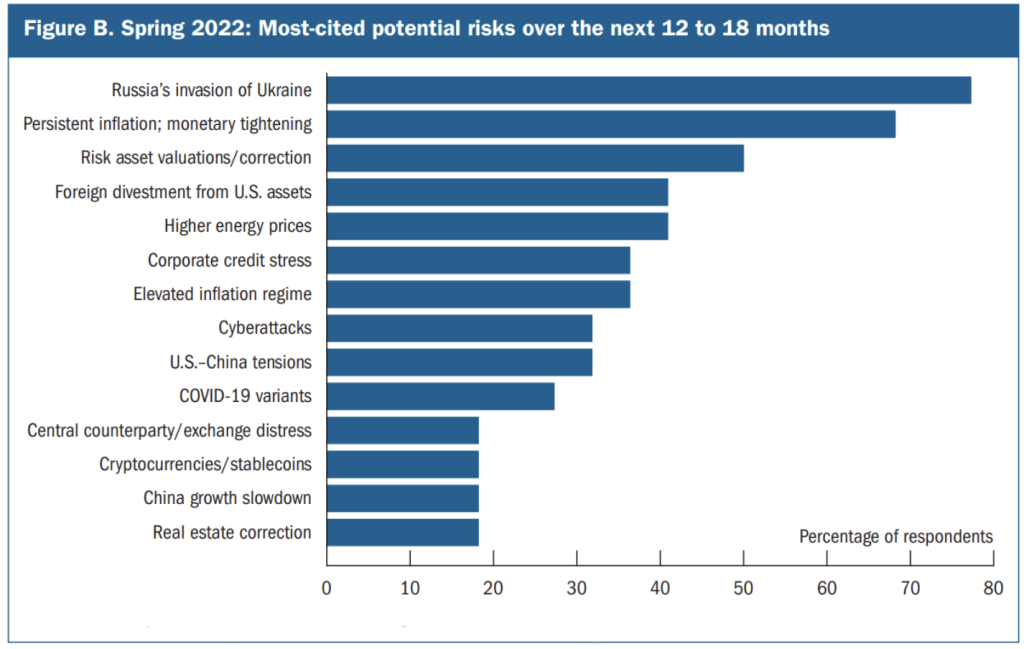

Russia’s invasion of Ukraine tops the list of the top 10 most-cited potential risks for the US economy. Other geopolitical issues, like the US–China tension, also made it to the list. Other pressing risk concerns raised by respondents of the survey include persistent inflation, foreign divestment from US assets, higher energy prices, the COVID-19 pandemic, and cyberattacks.