The price of Bitcoin witnessed signs of an uptick on 11 November. Positive US inflation data might have triggered an upmove despite the global crypto space reeling under the impact of the FTX fiasco. However, the worst might not be behind us yet as exchange inflow—a reliable on-chain metric—points to a worrying trend.

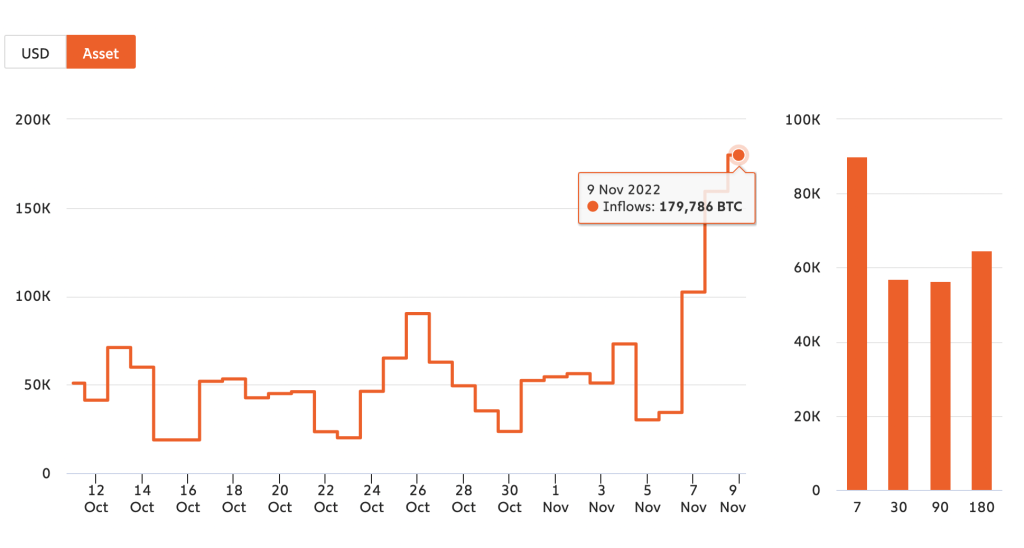

As of 9 November, exchanges across the globe saw an inflow of 179,786 BTC, according to data from on-chain analytics platform Chainalysis. In fact, the number of BTCs flowing into the exchange is the highest in the last 57 days.

Bitcoin exchange inflow and impact on Bitcoin prices: Chainalysis

The increase in exchange inflow might mean that people holding BTC are looking to sell, primarily by sending bitcoin to exchanges. Another metric that needs our attention is the “Exchange Withdrawing Addresses.” The metric concerns people who take their BTCs out of exchanges, hinting at long-term holdings, especially in hardware or cold crypto wallets.

Data from Cryptoquant shows that “Exchange Withdrawing Addresses” have dropped over the past week, meaning the concentration of exchange-adhering traders is more than long-term holders. This might be a worrying sign if you are concerned about BTC’s short-term price action.

Exchange Withdrawing Addresses: Cryptoquant

Increasing exchange inflow and reduction in the withdrawing addresses are tell-tale signs that the Bitcoin price action might not be out of the woods, as of yet.

But why are BTC holders exiting?

The liquidity crisis, courtesy of the FTX implosion, is forcing the hand of several BTC holders. Further, with the Bitcoin prices dropping due to weak sentimental drivers, miners are also facing a difficult situation. A note shared by MAC_D—a Cryptoquant contributor—mentioned that mining volume is slowly depleting.

The contributor added that there are many NASDAQ-listed mining pools that are finding it hard to pay off their debts and might eventually contemplate selling their BTC holdings. Miners selling BTC can also be another reason for an increase in exchange inflow.

These on-chain metrics can impact the Bitcoin prices in India and even across the globe. For now, BTC is trading at $17,361, up 4.13%, in the past 24 hours.