This September, we witnessed one of the most important milestones in the history of Ethereum as the Merge was finally completed after years of preparation. Many of the benefits that followed were well-established, such as the massive reduction in Ethereum’s carbon footprint and ETH’s new, potentially deflationary economics. Now that the network has had a chance to operate using a Proof-of-Stake consensus mechanism, it is helpful to take a deeper look into what has transpired since the Merge and examine some of the more subtle developments occurring beneath the surface.

One of the most heavily debated topics was around ETH staking concentration. Leading up to the Merge, two related patterns began to form. First, liquid staking derivatives emerged as a capital-efficient way for ETH token holders to stake and avoid the opportunity cost of locking their capital. Instead, users can send their ETH to a liquid staking smart contract and receive a derivative token in return (in theory, at a 1:1 rate), which can then be used to pursue other opportunities in the ecosystem.

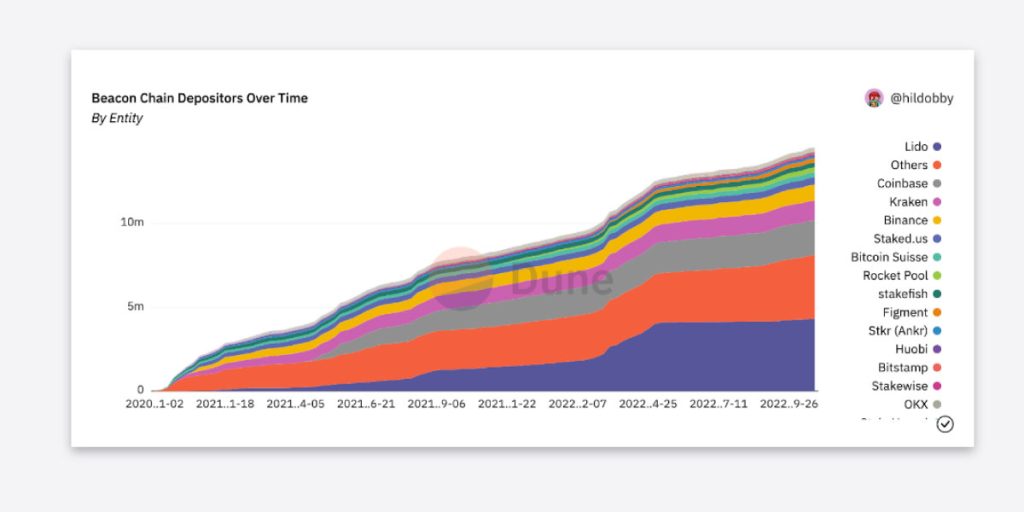

Liquid staking protocols such as Lido and Rocket Pool gained tremendous traction, with Lido amassing 30% of all staked ETH. The second pattern was that institutions, particularly centralized exchanges, developed custodial staking services that enabled users to deposit ETH for staking without friction.

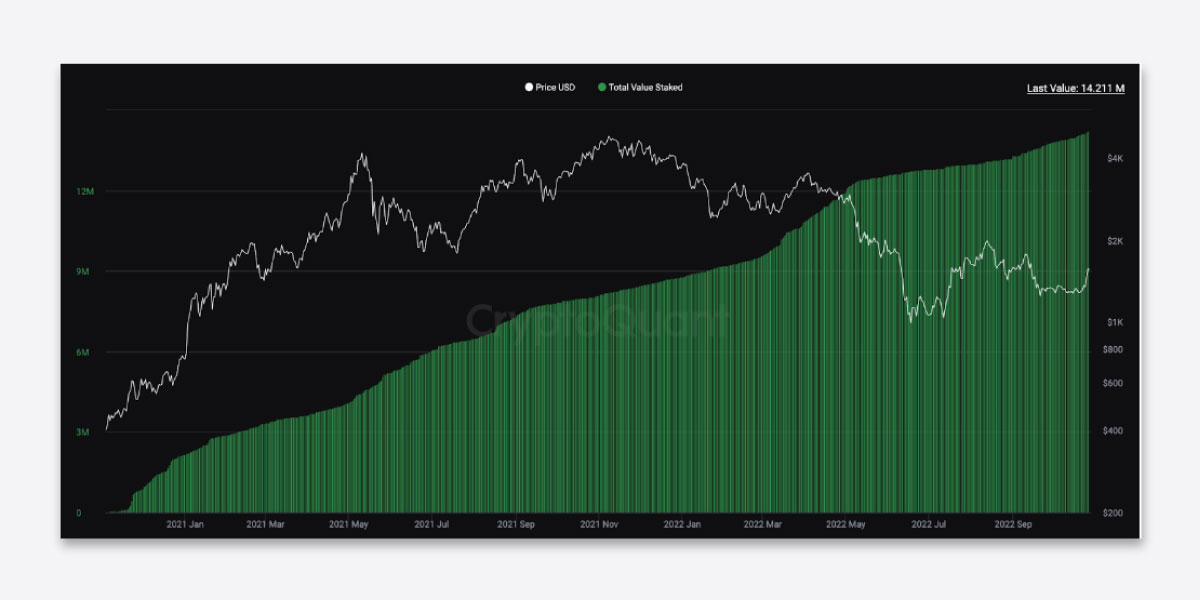

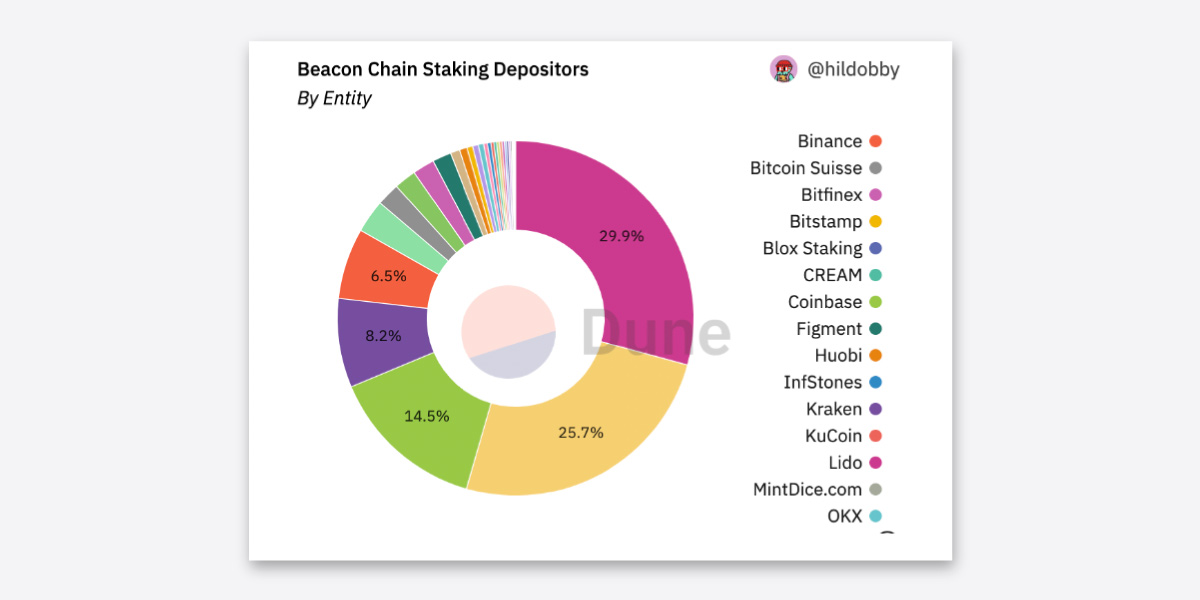

Both liquid staking protocols and professional staking services began accumulating a significant market share of staked ETH. While the total amount of staked ETH has leveled off, the pattern of consolidation has not changed. In fact, it continues to persist. Collectively, at the time of publishing, four entities, namely Lido (29.9%), Coinbase (14.5%), Kraken (8.2%), and Binance (6.5%) now account for roughly 60% of all staked ETH.

While there have been minor changes in the overall distribution of staked ETH, the largest staking providers have retained their market share, especially relative to other smaller staking services. Nevertheless, there is now more than 14.4M ETH (approx. $18 billion) staked. This reinforces Ethereum’s security, makes the network incredibly costly for hostile agents to attack, and positions it to become the de facto settlement layer.

However, there are a few important distinctions to address here rather than simply labeling the outcome as centralization. To begin, staking is shaping up to be a natural monopoly. Similar to the utility industry in traditional economies, which involves significant infrastructure costs, considerable barriers to entry, and can only operate efficiently with economies of scale, ETH staking also functions similarly.

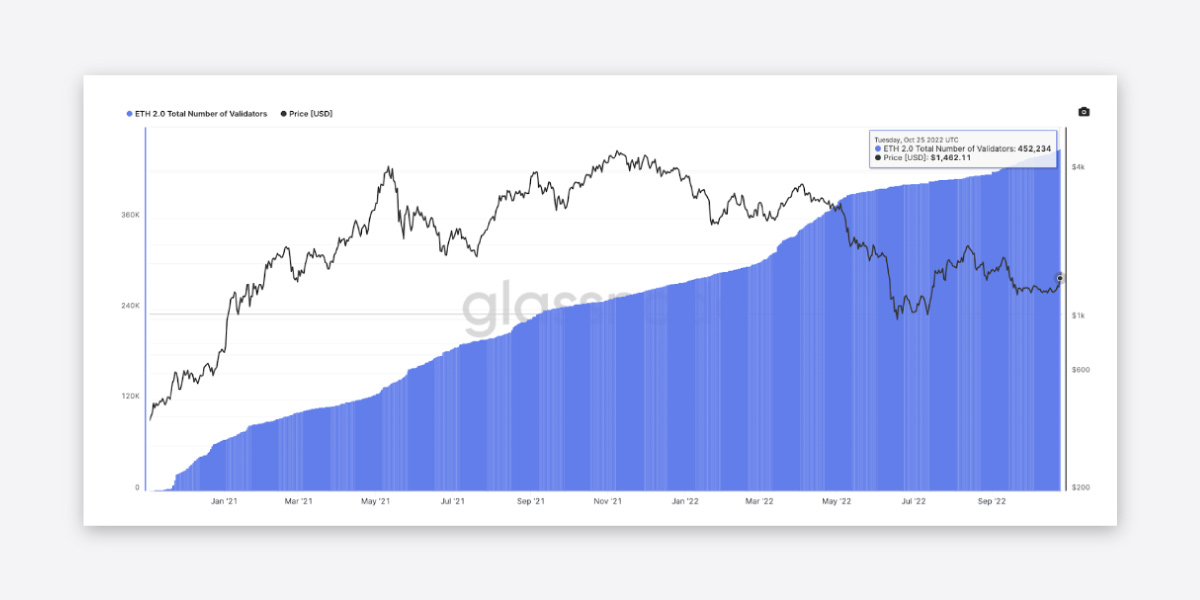

For instance, the process of staking ETH to run a validator is by no means a trivial task, requiring considerable technical wherewithal, constant upkeep, and a minimum of 32 ETH in capital. This makes it quite challenging for mainstream adoption. Moreover, the profitability of running a validator lends itself to a certain element of randomness as block proposers in PoS are now selected at random rather than racing to produce a block under PoW. One interesting takeaway of the shift to PoS is that while the number of staking services is heavily concentrated, the number of individual validators participating in the network is now over 450,000 in total. In terms of rewards, this means that any single validator has less than a 0.0002% chance to be selected as a block proposer during any given epoch.

Unstaking to enable competitive markets

So while there has been a trend toward staked ETH consolidation, the driving force extends beyond centralization. Liquid staking and professional staking services remove many hurdles and manage all of the heavy lifting for end users. Ultimately, they allow users to stake ETH without friction or overhead, and enable essentially any ETH user to participate by fractionalizing deposit requirements and removing the need for 32 ETH minimum. In addition, as a staking pool grows in size, it helps to smooth expected returns. This relates to how fees are distributed and the random selection of validators. In short, participating in a larger pool of staked $ETH increases the odds of earning block rewards and tips over the long run.

Another reason for the relative concentration of staked ETH is that withdrawing it is currently impossible and will not be available until the next major Ethereum upgrade, Shanghai, goes live (under EIP-4895). This is tentatively expected to be released later in 2023. So users that staked their ETH into one of these services are effectively locked into that original position until the unstaking function is implemented on the mainnet. Once unstaking is available, the current landscape could undergo significant changes as users move between different service providers, seeking higher returns and lower commission fees, for instance.

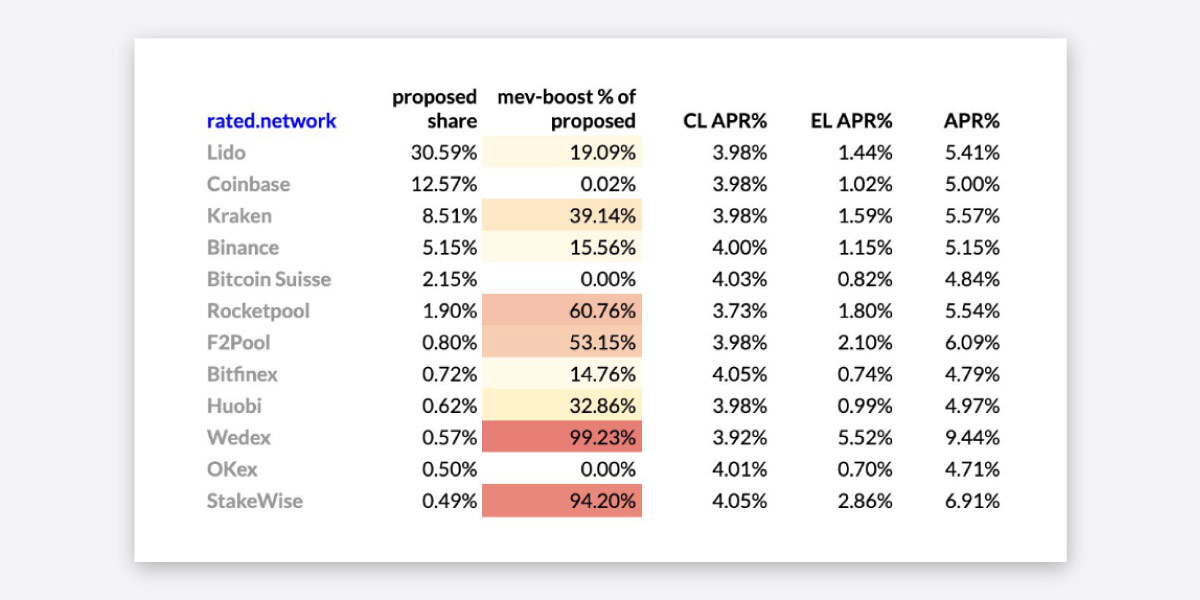

Another area of focus ahead of the Merge was around expected staking pool returns. The yield earned through staking is particularly powerful given its potential to drive both mainstream adoption and institutional interest in Ethereum. Overall yield depends largely on the amount of ETH staked and network activity, including block rewards, transaction tips paid for prioritized transactions, and tips related to maximum extractable value (MEV). More transactions and higher transaction costs result in larger tips. This also results in higher amounts of gross MEV profit, and more ETH burned. Most staking pools have earned about 5.5% APR thus far. This outcome is much lower than many of the pre-Merge expectations, which generally ranged between 8-12%.

Given that stakers are unable to unlock their ETH, however, this removes a certain layer of competition between providers in terms of performance. Unstaking will enable competitive markets in which users can freely choose between providers. Ultimately, providers that miss proposals, go offline, or are otherwise inadequately contributing to the security of the Ethereum network will experience significantly less demand for their services.

In other words, only the top-performing providers will thrive. Moreover, if a provider engages in malicious behavior or is antithetical to the open principles of Web3, there could be crippling consequences, as users will react by unstaking and effectively decommissioning poor performance. So there are several market forces at play that will soon reinforce network integrity at a deeper level and help mitigate centralization risks.

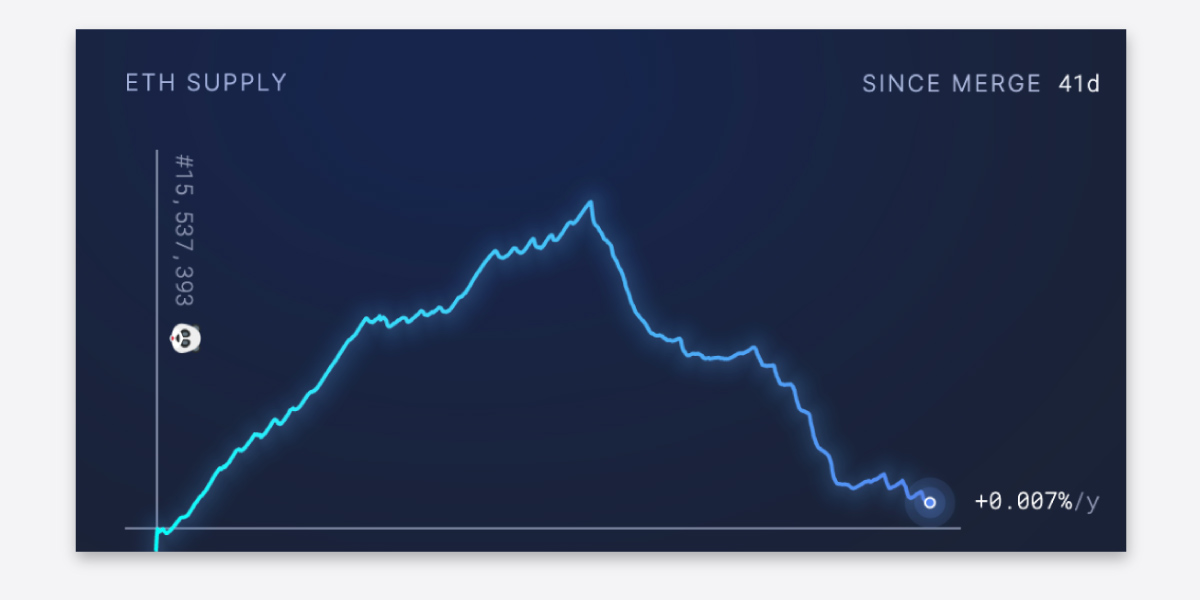

Ethereum’s New Economics

Finally, the Merge has redesigned the economics of Ethereum. The reduction in ETH issuance paired with a portion of transaction fees being burned has created considerable deflationary pressure on ETH. The end result is that increased network activity can lead to a net reduction to the circulating supply of ETH. As we move forward and mass adoption begins, it is important to monitor how the monetary supply mechanisms of Ethereum function under periods of high activity. In all likelihood, this will be a fluid process. Periods of high network activity, for instance, may result in a decidedly deflationary ETH issuance, while periods of low network activity may result in some, albeit small, ETH inflation.

Ultimately, improved user experience and interfacing for staking ETH, and the option to unstake freely and engage in competitive staking provider markets will help drive the future of post-Merge Ethereum through the remaining roadmap. The process will become easier and be achievable with less barriers over time. Staking services that are not performant will not persist and threats of centralization can be mitigated by token holders, who can unstaked and punish bad actors. Increased aggregate staking will help solidify Ethereum’s place as the de facto settlement layer and continue to make attacks on the network prohibitively expensive. The end result could be that more users are drawn to Ethereum to complete transactions and interact with the broader Web3 economy, serving as a catalyst to push the demand for Ethereum block space and creating sustained deflationary pressure on ETH issuance.

Nevertheless, there is now more than 14.4M ETH (approx. $18 billion) staked, which makes the network incredibly costly to attack.

One of the more interesting takeaways is that proposing validator rewards have grown considerably since the Merge. Pre-Merge, validators were earning about 0.03 ETH, post-Merge this increased to nearly 0.08 ETH. Part of the reason for this drastic change is that once the transition to PoS was complete, proposing validators began to receive execution layer transaction fees and MEV (maximal extractable value). This resulted in more than 170% in rewards per validator increase compared to the last pre-merge epoch. In terms of validators and blocks validated, there have been over 61,000 blocks validated since the Merge. Nearly 2,100 validators have been involved with this process.

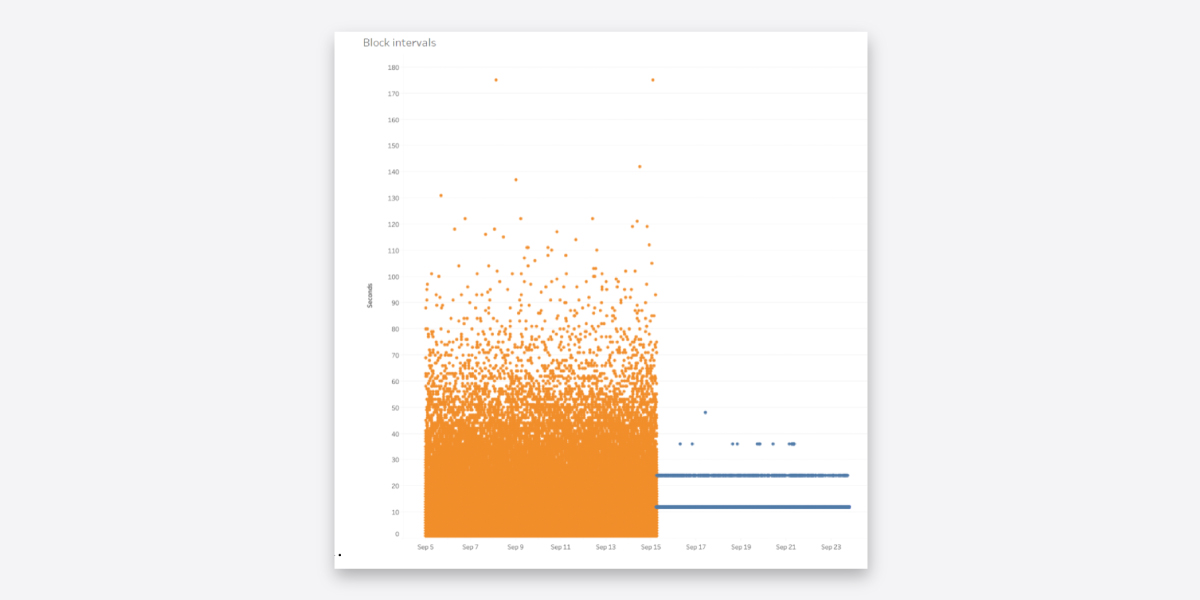

Performance, particularly around block intervals, is another exciting aspect post-Merge. Much was written about the relatively insignificant effects of the shift to PoS on block times, but how has this played out in practice? Under PoW, block intervals were generally around 13 seconds, but involved some randomness as miners raced to produce blocks. Under PoS, however, block times are much more consistent and are generally about 12 seconds. As we see on the right side of the chart below, block intervals have become quite predictable since the Merge. One crucial aspect of PoS block intervals is that in instances in which a validator goes offline, the slot is skipped, leading to increased interval times (as noted in some of the outliers above the trend line). So overall, block interval data is in alignment with expectations.