I. Introduction

If you are into share market investment and wondering what CAPM or Capital Asset Pricing Model is, then we have got you covered. Today, we discuss the assumptions of the CAPM model, their meaning, and more.

A. Understanding CAPM

Capital Asset Pricing Model, or CAPM, is a financial tool that helps estimate the returns you can expect from a security investment. In other words, it is a financial metric that determines the value of a security.

B. Importance of CAPM in finance

CAPM is an important concept in finance and investment matters. It helps investors gain a clear idea about a security’s ability to offer returns to the investor. It also evaluates the risks and the investment’s sensitivity to market changes. Therefore, the CAPM plays a crucial role in determining risk-free assets and boosting investment decision-making.

II. Key components of CAPM

The Capital Asset Pricing Model has several components. Before we discuss the assumptions of CAPM, let’s learn about these components briefly.

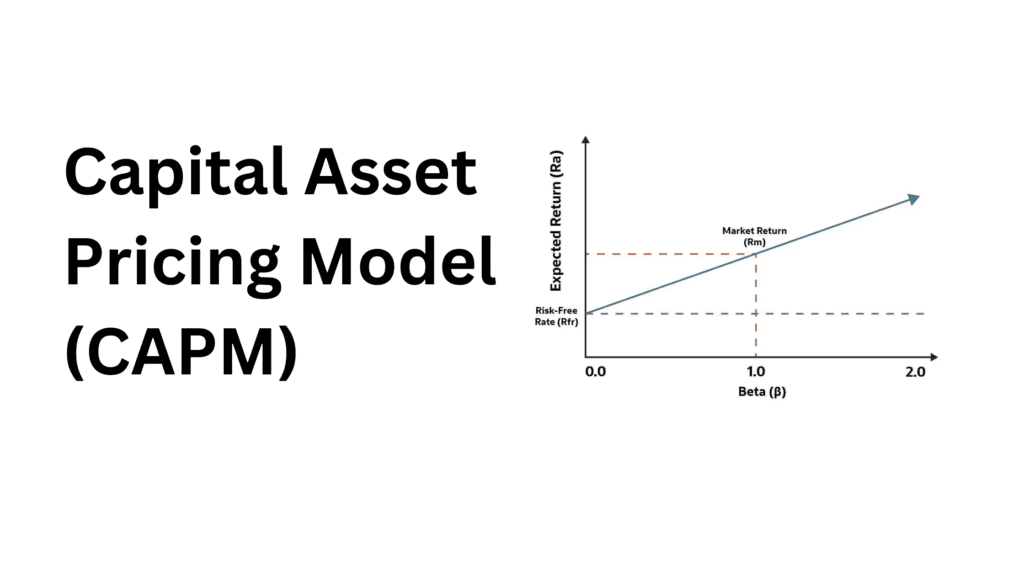

A. Risk-free rate

The first and foremost important component of the Capital Asset Pricing Model is the Risk-free rate. Let’s assume the risk-free rate is 2% PA. This is typically represented by the profit yield on government bonds. Therefore, they tend to be considered as no-risk virtually.

B. Beta

Another essential component of the CAPM model is Beta. Beta denoted as Ba or BI is a measurement of a security’s risk reflected through its market price fluctuations relative to the overall market. In simple terms, beta is the market sensitivity of the stock.

C. Market risk premium

Lastly, the market risk premium is also an important component of the CAPM model. Market risk premium represents the additional return over the risk-free rate, which is the compensation for investing in these riskier asset classes.

Read More: What is a Shareholder (Stockholder): Meaning, Equity, and Rights

III. Assumptions of CAPM

If you want to apply the CAPM model in your investment strategies you must have a clear idea of the assumptions of the CAPM model.

A. Market efficiency

The first and foremost important assumption of the Capital Asset Pricing Model is its belief that markets are efficient. According to CAPM, the investment market is highly efficient. This means the market price of different securities reflects all essential information about the stock or security.

B. Investors’ rationality

Investors’ rationality is also one of the popular assumptions of the CAPM model. According to the Capital Asset Pricing Model, investors can reasonably or rationally accept or decline risky investments. It claims that investors have the freedom to choose risk-averse assets by simply taking systematic risks and diversifying unsystematic risks in investment.

C. Single-period transaction

According to the Capital Asset Pricing Model, it holds a standard investment holding period to make every invested asset compatible. For example, as per CAPM, an investment return of 6 months cannot be compared with the 3-month holding returns. Generally, CAPM holds 1 year as a standardized holding period for any classes of asset.

D. Homogeneous expectations

The assumptions of the CAPM model, including homogeneous expectations, are very crucial. This assumption says that there is a linear relationship between the return on an asset and its diversified risks can lead to a significant change in the market dynamics. Not only that, but it also consequently, impacts asset price determination and marks it as high-risk.

E. No taxes or transaction costs

No tax or transaction cost is also one of the primary assumptions of the CAPM model. According to the portfolio theory CAPM the risk-free return corresponds to the SML or interstation of the Security Market Line and the y-axis line. The SML is basically a graphical representation of the CAPM.

F. Risk-free borrowing and lending

Lastly, the CAPM model includes risk-free lending and borrowing. The CAPM model assumes that the lending is a risk-free investment as the investors have to pay interest on borrowed funds. Therefore, borrowing is also assumed to have the same risk-free interest rates as a result they are also deemed as risk-free borrowing.

Read More: What are Redeemable Debentures: Meaning, Formula & Examples

IV. Formula and calculation

Now that we know what the assumptions of the CAPM model are, it is time to elaborate on the formula and calculation of CAPM.

A. CAPM formula

Suppose:

ERi is the return on investment

Rf is a risk-free rate

βi is the beta of the investment

(ERm−Rf) is market risk premium

Then, one can use the following formula to calculate CAPM:

Rf+βi(ERm−Rf) = ERi

B. Example calculation

Let us assume that the value of a specific stock is $100 at the present day and it offers an annual dividend of 3%. This stock also seems more volatile than the overall market profile with a beta of 1.3 compared with the market. The risk-free rate in this case is 3% which is expected to rise by 8% per year. The formula to calculate CAPM will be:

3%+1.3×(8%−3%)= 9.5%

IV. Applications of CAPM

If you want to include the Capital Asset Pricing Model or CAPM, you must learn about its applications.

A. Stock valuation

CAPM, can be used for stock valuation. Both companies who are issuing stocks for trading and investors looking for suitable investment options use this CAPM model to evaluate the value of stocks listed on the index. The investors use the CAPM model to estimate the returns the security can offer, leading to an overall stock valuation before investing in it.

B. Portfolio management

The CAPM model is also used for portfolio management. CAPM helps to assess the risk and return relationship of an asset and how much return the asset can bring back to the investor. Therefore, the model works as an excellent tool to assess different stocks and security in relation to their sensitivity to market changes to offer appropriate guidance for portfolio diversification or management.

C. Capital budgeting

Last but not least, the CAPM model is also used for capital budgeting purposes. To be more specific CAPM is used to evaluate the expected returns given the capital costs and assets risk. Applying this model for capital budgeting requires the rate of return for the general market, the beta value of securities, and the risk-free rate.

V. Limitations of CAPM

CAPM has various benefits to offer for both investors and companies participating in the share market. However, this financial metric is not free of errors. It also contains several limitations that we will now explore in detail.

A. Unrealistic assumptions

A key limitation of the CAPM is its reliance on unrealistic assumptions. Some of the assumptions of CAPM, as we have seen above, include the idea that markets are perfectly efficient, investors act rationally, and that there is risk-free borrowing and lending. In reality, these conditions rarely exist, leading to inaccurate predictions of expected returns and risk.

B. Historical data usage

Another major limitation of CAPM is its dependency on historical data to predict future returns and betas. It assumes that the security performance will follow the trend that previously occurred but that cannot be held as true for all market investment scenarios.

C. Market changes

A third limitation of the CAPM model is its assumption of market changes. The model assumes that the market will change according to previous data investors’ homogeneous expectations, and rational and risk-averse behaviors which cannot be true as every market scenario is different and every investor has a unique investment approach. Although there can be fine similarities in situations and actions, they may not always work in the way the CAPM model assumes.

VII. Conclusion

CAPM, or Capital Asset Pricing Model, is a financial metric that most investors prefer to use to evaluate the ability of securities to bring returns and their sensitivity to market changes. The components of the CAPM model include beta, risk-free rate, and market risk premium. Additionally, the assumptions of the CAPM model include market efficiency, homogeneous expectations, risk-free lending and borrowing, etc.

However, you must remember that the CAPM model has its unique advantages and limitations. So, as an investor, you must equip yourself with all essential knowledge and expertise before applying CAPM to your investment.

FAQs

1. What is the CAPM model and its assumptions?

A. Capital Asset Pricing Model calculates an asset or investment’s expected rate of return. The financial model uses assumptions such as homogeneous expectations, market efficiency, constant beta, a one-period investment horizon, risk-free rate, etc. for prediction.

2. What is the assumption of CAPM and APT?

A. Generally, one of the primary assumptions of the CAPM model is that every investor has the same level of market risk tolerance. On the other hand, the Arbitrage Pricing Theory (APT) assumes that different investors have different levels of sensitivity to market risk

3. What are some alternatives to the Capital Asset Pricing Model?

A. Some popular alternatives to the Capital Asset Pricing Model are APT and the Fama-French-3-Factor Model.

4. Why is the CAPM model important?

The CAPM model is important because it provides a framework for understanding the relationship between risk and expected return. By linking an asset’s risk to its potential reward, CAPM helps investors assess whether an investment is fairly priced. It’s widely used for portfolio management and capital budgeting decisions.