Introduction to Direct vs Regular Mutual Funds

Selecting the most suitable form of mutual fund can be challenging, particularly for new investors. Mostly, investors face the problem of choosing between a regular and direct mutual fund. Though they both have identical underlying portfolios, they vary in terms of how you invest and the expense ratio. Most investors are familiar with the distinction between regular and direct mutual fund plans. Yet, they often fail to grasp the impact this has on their returns or control over their investments.

The choice between the two will depend on various factors, including expenses, investment returns, and investment management. To create long-term wealth, consider your investment objectives and your level of participation. This blog post will help you choose the one that suits you. Let’s dig in.

What Are Direct Mutual Funds?

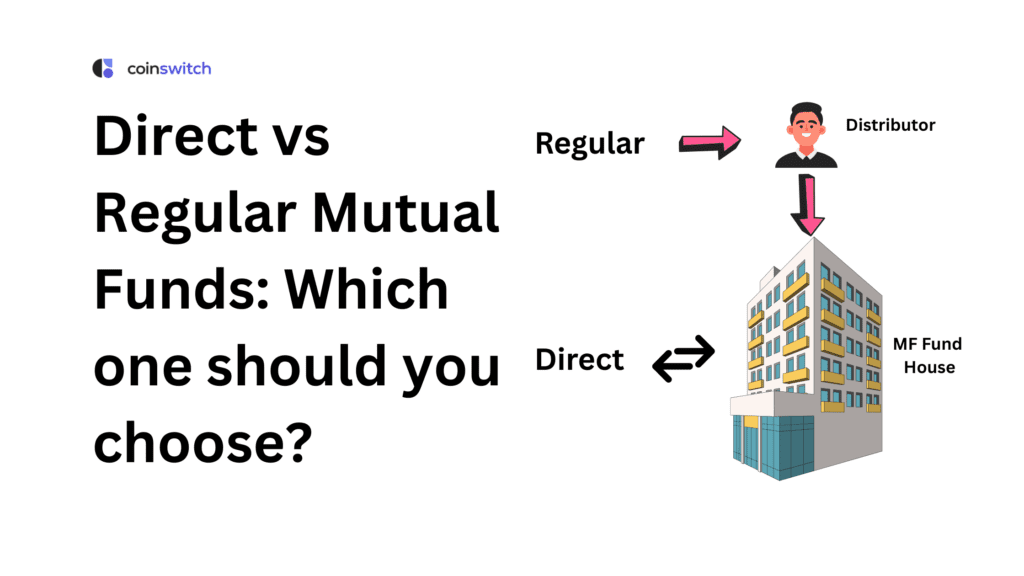

Simply put, direct mutual funds are those investments in which you invest in a mutual fund scheme without the help of a distributor or an agent. This reduces the expense ratio, thereby providing better returns than regular mutual funds.

Direct mutual funds are suitable for informed investors who are capable of managing their portfolios without any guidance.

What Are Regular Mutual Funds?

Regular mutual funds are investment schemes that you purchase from an advisor, distributor, or broker. They assist you in selecting the proper fund and do the paperwork. They get a commission from the fund house in turn. This commission is added to the total cost of the fund. Therefore, a regular mutual fund has a higher expense ratio compared to a direct mutual fund, which eats into your investment returns.

Such funds are beneficial to those who require professional help. The distributor provides frequent check-ins and provides advice on your investment process. They can be helpful for beginners to understand mutual funds. Therefore, the key difference between a regular and a direct mutual fund is the presence of an intermediary.

Direct vs. Regular Mutual Funds: Key Differences

One good option for growing your money is through investment in mutual funds. However, before making your investment, it is advisable to understand how to invest. Direct and regular mutual funds are the two popular choices. Selecting the right one can significantly impact your returns.

Investment Route

In regular mutual funds, investors must deal with agents, such as brokers or advisors. Such intermediaries assist in determining the funds, but also levy a commission.

In direct mutual funds, you are investing directly through the fund house or the asset management company (AMC). There is no commission involved, as no intermediary is involved.

Expense Ratio

The expense ratio is an annual charge that the fund charges for managing your investment. The expense ratio of regular plans is higher due to the distributor’s commission.

Conversely, direct plans exhibit a lower expense ratio since they eliminate the provision of a commission. This little gap accumulates over time and makes a significant difference to your returns.

Returns on Investment

Compared to regular plans, direct mutual funds offer high returns as their expense ratio is lower. Although this difference may not appear to be significant on an annual basis, over the longer term, the disparity increases.

Even a 1% increase in return can result in significant wealth growth over 10-15 years. It is one of the most vital aspects to note when discussing the differences between a regular and a direct mutual fund.

Convenience and Guidance

Regular funds are accompanied by advisory support. The distributors make proposals tailored to your risk profile, which is helpful during your initial investment phase. They also do the paperwork for you to start your investment.

Direct funds, though, require self-research. The choice, monitoring, and reviewing of investments is your responsibility. This would demand time and a certain familiarity with mutual funds. Direct mutual funds are preferable if you are sure of your ability to monitor investments.

Openness and Control

Transparency is provided in direct mutual funds. You do not need to go through an intermediary because you are dealing directly with the fund house. You also control your portfolio.

In regular funds, advisors often make recommendations based on their interests. They might sell you mutual fund schemes that pay them a hefty commission.

Read More: SIP vs. Lump Sum: Which is the better way to invest in mutual funds?

Why Should You Opt for Direct Funds

Direct mutual fund plans offer a smarter alternative that eliminates the need for intermediaries. They are ideal for investors who like to have control over their investments.

Reduced Expense Ratio

The expense ratio in direct mutual funds is lower compared to regular plans. Here, there is no intermediary to be paid. This would help save a tiny fraction each year, and over time, with compound growth, that amount becomes huge.

Greater Return in the Long Run

Improved returns are a result of cost savings. When two plans yield the same, the least expensive one typically provides higher returns. This premium is particularly evident in the long-term investment.

No Commission or distributor fees

Direct plans are known for their zero-commission feature. Essentially, you invest in a mutual fund scheme of your choice directly. Thus, all the money invested is used to purchase mutual fund units without any deductions being made.

Additional Visibility and Management

Your investment may be followed, changed, or redeemed at any time. It does not rely on a distributor. You are updated in real-time and have complete visibility of your portfolio’s performance.

Enhanced Long-Term Compounding

The lower the charges, the more your money remains invested and continues to grow. Over a 15- to 20-year timeframe, this can help build a larger corpus. Compounding can be most effective when expenses are low.

Effective Portfolio Management

You are in charge of your portfolio, and you plan it according to your objective, not the interests of someone or something. The practical approach leads to more individualized and effective investing. Understanding the difference between regular and direct mutual fund options helps you make more informed investment decisions.

Read More: Everything you need to know about gilt mutual funds

Who Should Consider Regular Funds?

Regular mutual funds are best suited to investors who require professional advice. Regular funds are helpful when you are new to investing in mutual funds or when you may not have the time to monitor markets regularly. These are usually sold by advisors who recommend the correct funds in consideration of your goals. They also help with paperwork and routine reviews.

Nevertheless, the assistance may be helpful if you are unsure about selecting a fund. The difference between regular and direct mutual funds lies in who is in control of your investment decisions, an adviser or you. Regular funds are a viable alternative for your financial journey if you prefer guidance and personalized advice.

Final Verdict

The choice between direct and regular mutual funds would rely on your financial literacy and confidence in working with online services. Direct funds are more economical and better suited for investors who can conduct their research and make informed investment decisions. On the other hand, regular funds are suitable for those who want the services of professional advisors and are willing to pay a premium for that.

Knowing what you want to achieve, the risk level, and experience will assist you in making the right choice. The primary difference between regular and direct mutual funds is whether an intermediary is involved or not.

FAQs

1. Should I invest in direct or regular mutual funds?

Direct plans are better if you understand mutual funds and can select funds yourself. They provide higher returns due to reduced costs. It is advisable to opt for regular plans when you require the assistance of an advisor.

2. Is it good to switch from a regular to a direct plan?

Yes, it is possible to switch to a direct plan to save the commissions and get higher returns in the long run. Nevertheless, before switching, examine exit loads and taxation.

3. Which is better, direct growth or regular growth?

It is preferable to opt for direct growth if you desire a better long-term income and want control over investments. It does not charge a commission. Regular growth is suitable for investors who want the help of an advisor and are willing to pay a commission.

4. What is the disadvantage of direct mutual funds?

In direct mutual funds, investors are responsible for making their own investment decisions, as there is no professional assistance provided. Investors are expected to have fundamental knowledge about the market.