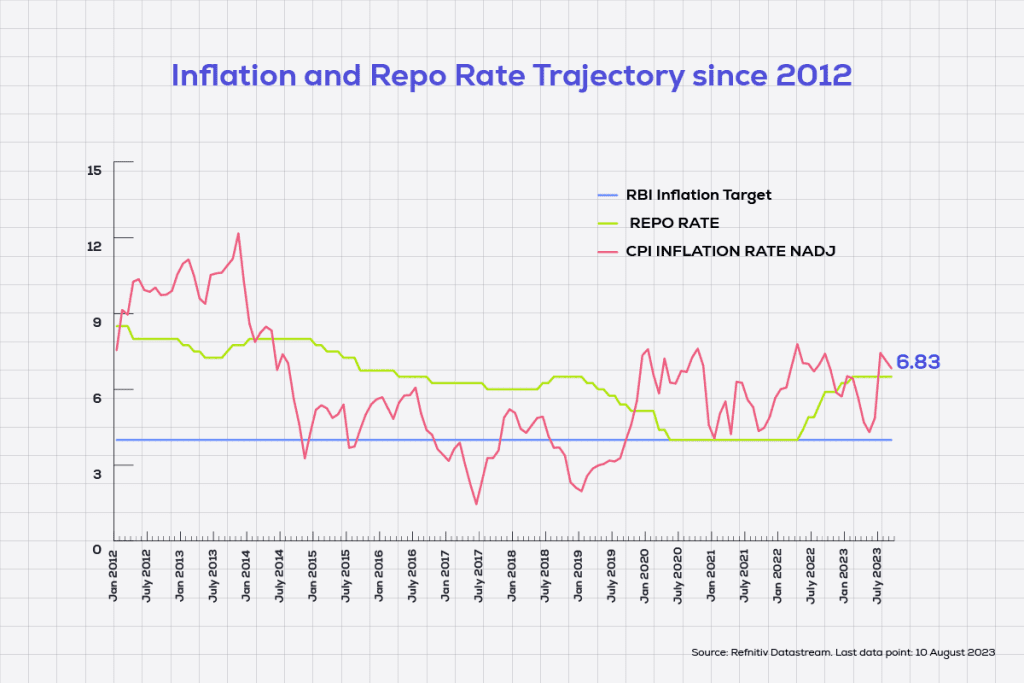

Every two months, India’s central bank’s Monetary Policy Committee meets to discuss the revision of Repo rates — the rate of interest at which commercial banks in India borrow money from the central bank.

Typically, this is done to manage inflation. By increasing Repo rates, the flow of capital into the economy comes down because it becomes costlier to borrow. Similarly, by decreasing repo rates, the supply of capital in the economy increases. This means, higher repo rates can be used to control inflation.

When the repo rate increases, the FD rates will increase and when the repo rate decreases, the FD rates will fall.

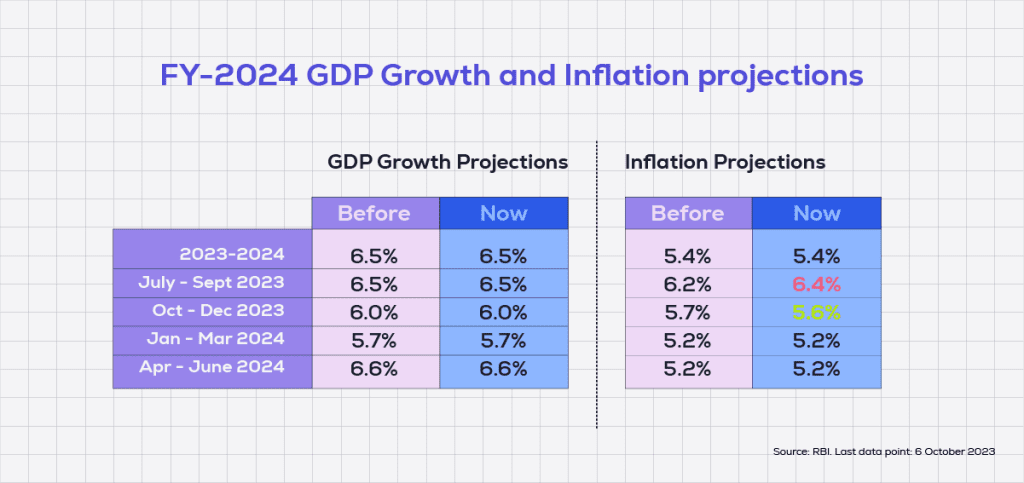

On 6 Oct 2023, RBI’s Monetary Policy Committee unanimously kept the policy repo rate unchanged at 6.50%. The committee reiterated its hawkish stance as it announced a rate hike pause for the fourth cycle in a row.

How will this rate-hike pause impact FD rates? And why does this make it the right time to invest in fixed deposits? Read the blog post below to understand how FD interest rates are likely to behave in the coming few months.

High FD interest rates trigger fixed deposit rush

Fixed deposits are one of the safest investment alternatives available to investors. Unlike mutual funds or gold investments, the maturity value of an FD is fixed, which makes financial planning easy.

To rewind a bit, FD rates were abysmally low some two years ago, making it unattractive to investors. But this changed after February 2023 as RBI increased the repo rate to curtail inflation. A rise in the repo rate translated to a rise in the FD interest rates, making them attractive again.

For investors, fixed deposits made sense as increased FD rates meant the investment could just about beat inflation. If the FD return is positive, you’ll have something left after adjusting for inflation, and your money will be gaining value. A negative real rate of return means inflation is chipping away at the real value of your money.

The rise in FD interest rates

Fixed deposit interest rates have gone up significantly in the past one and a half years, thanks to the 250 basis points (100 basis points is 1 percent) rate hike in 10 months from May 2022 to February 2023. However, the rising interest rate cycle is likely almost over as the RBI maintained the status quo for the fourth consecutive monetary policy review today. This could also mean that Fixed Deposit interest rates have peaked and could even fall if rate cuts are announced in the future.

RBI repo rate impacts FD interest rates

The correlation between the repo rate and the fixed deposit interest rate is relatively straightforward. When the repo rate increases, the FD rates will increase and when the repo rate decreases, the FD rates will fall.

Will FD rates fall?

Fixed deposit interest rates are likely to remain stable for now though some specific-tenure FD rates have come down marginally after today’s RBI policy review.

Economists and experts see year-end 2023 or the beginning of 2024 as the period when global central banks will start cutting interest rates. So, if there is a durable sign of inflation subsiding, the RBI may also follow suit.

Naturally, fixed deposit interest rates will fall as the RBI starts cutting the repo rate. The rate cut cycle will mark the end of the high-interest rate era for the FD investors.

Will FD rates rise further?

Inflation is a significant economic indicator that drives the RBI’s monetary policy. Yet, we appear to be at the peak of the rate hike cycle. The current fixed deposit rates are one of the highest India has witnessed in the past few years.

It is unlikely that there will be any further rate hikes in the FD rates in the coming few quarters. However, the rates may start falling in 2024.

This means that it is unlikely that there will be a rise in the FD rates next year.

What should FD investors do?

FD investors should start booking their fixed deposits in the next three to six months. The next two quarters will be the golden period for FD investors as they will be able to lock in high-interest rates for their FDs.

Depending on the investment goal and timeframe of investment, investors can also make their FDs in different commercial and small finance banks as well as NBFCs to benefit from the higher rate of return while distributing risk.

Should you book long-term FDs now?

If you are looking to book a long-term FD at a high-interest rate, you should book it now!

This is because several commercial banks have already started reducing their interest rates. But you will still find some small finance banks and NBFCs offering FDs with an 8% annual interest rate for a tenure of two-to-three years.

Thus, depositors seeking higher returns from fixed-income instruments should book these high-yield FDs after factoring in their investment horizon. Locking these high-yield FDs now should allow depositors to earn higher FD interest income even if the rates fall.

Re-evaluating your existing FD deposits

Several commercial banks, small finance banks, and NBFCs are offering higher interest rates on FDs for short-term as well as medium-term tenure.

If you want to lock in high rates for your existing fixed deposit, now is the time to evaluate your FD portfolio. You may consider breaking your FD and reinvesting the sum at a higher rate of return in a medium-term FD. However, you need to do a net-profit analysis before you decide to do so.

What happens to your FD if the interest rate goes up or down?

A fixed deposit, by definition, is locked with a specific rate of interest for a specific tenure. You will continue to receive the locked-in rate of interest till maturity even if the interest rate goes up or down. If you wish to avail the new rate, you need to invest in a fresh fixed deposit.

High interest rate makes it the right time to book an FD

Currently, we are at the peak of the interest rate cycle. Today’s RBI Monetary Policy Committee review emphasized that it is most likely that there won’t be a rate hike in the near future. Moreover, if and when inflation is within the tolerance band of 4%, it is possible that the cycle of rate cuts will start. The rate-cut cycle will lead to new interest rate regime and trigger a fall in FD interest rates impacting the depositors’ return on investment.

To conclude, the coming few months may be the best time to book an FD as depositors will be able to lock in a higher rate of return on their investment for their chosen timeframe.