I. Introduction

Traders use pivot points as a main form of technical analysis to predict market movements by means of support and resistance levels. Pivot points are derived from the previous trading session’s data to help you reverse and locate important price levels where trends can be shifted. Because traders can analyze these levels, they can make informed decisions, achieve reversals, and set in and out points appropriately and thus have an enhanced trading strategy and better trading success.

A. An overview of pivot points

Pivot points are essentially market indicators many intraday traders use to evaluate their trading moves. They can be a good indicator of future market trends ensuring a successful trade.

B. The importance of pivot points in technical analysis

Pivot points play a significant role in technical analysis; it is used in a trade that relies on the previous day’s closing price along with the current day’s average highs and lows to predict the future.

C. The objective of this blog post

As a budding investor, if you are eager to understand the pivot point calculation formula, keep reading. This blog post covers everything you need to know about pivot point calculation including its formula, explanation, examples, real-world applications, and more.

Read More:

II. What are pivot points?

A. Definition and purpose

Before we dive deep and learn about the pivot point calculation formula, let’s learn about the definition and purpose of pivot points. By definition, a pivot point is a technical analysis tool that helps to determine different market trends over different time frames.

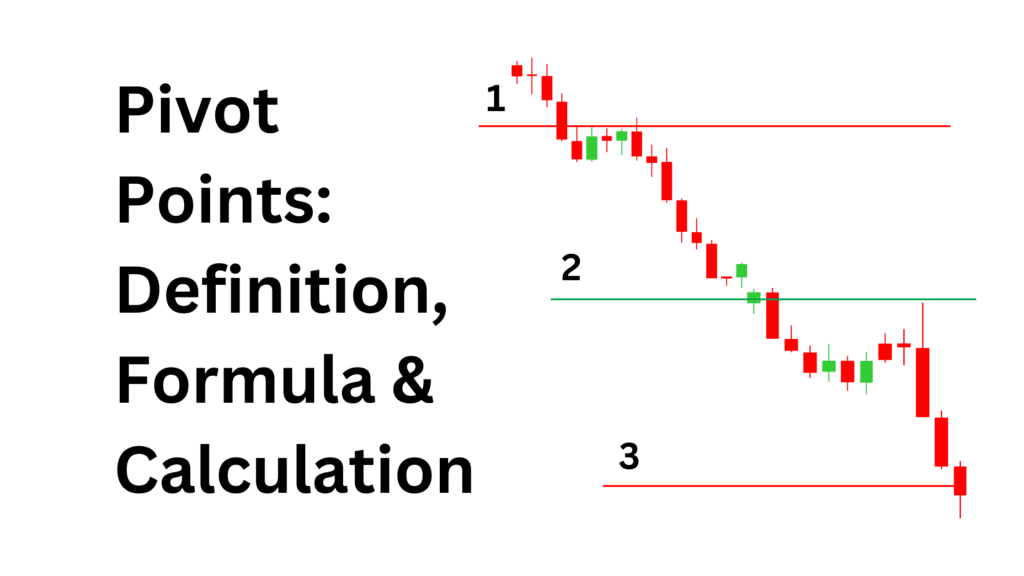

Pivot S1, S2, and R1 and R2 refer to the first support, second support, first resistance and second resistance respectively in the calculation of pivot points.

B. Historical context and use in trading

Pivot points are market price level indicators that use historical data to evaluate future trade prices. In trading, pivot uses the previous day’s closing price data and the current day’s average highs and lows to predict future price movements.

C. How pivot points fit into technical analysis

Pivot points fit into the technical analysis as they focus on data-driven analysis and try to predict future trends by analyzing the past trends of the market.

III. Types of pivot points

You can have several types of pivot points and you must have a clear idea of them before learning about the pivot point calculation.

A. Standard pivot points

As the name suggests, classic or standard pivot points are the most common and simple kind of pivot point.

The formula of the classic pivot point includes the simple average of price highs, lows and close.

B. Fibonacci pivot points

Fibonacci Pivot Points popularly known as Fibonacci PP is also a type of pivot point. It has the same calculation method as the standard or classic pivot point.

The formula of the Fibonacci pivot point includes the support and resistance evaluation through a simple average of the previous day’s closing price with the current day’s average highs and lows.

C. Woodie’s pivot points

Woodie’s pivot points are another essential pivot point type that has a similar calculation to classic or standard pivot points. However, the only point of difference here is Woodie’s pivot point doesn’t include the previous day’s closing price.

The formula of Woodie’s pivot point focuses on current highs and lows instead of taking the previous day’s closing price into account.

D. Camarilla pivot points

In one word, the Camarilla pivot point is one of the advanced or improved forms of the standard or classic pivot point. The Camarilla pivot point uses a wide range of given time frames including days, weeks, and months.

The Camarilla pivot point calculation formula takes the previous day’s highs, lows, and closing prices as input to identify support and resistance levels.

E. Demark pivot points

Demark pivot points are a bit different from other pivot points. They have a conditional relationship between closing and opening price levels.

The demark pivot point calculation formula is:

Pivot Point (PP) = (High + Low + Close) / 3.

Read More: Positional Trading Strategy: Definition, Pros & Cons

IV. Pivot point formula and calculation

Now that we know the different types of pivot points, let’s see how to calculate it using a formula.

A. Standard Pivot Point Formula

Here is the standard Pivot Point calculation formula:

(Previous High + Previous Low + Previous Close) / 3 = Pivot point (P)

Here, the three primary components of the pivot point formula are High, Low, and Close where:

● High is the highest market price of an asset or stock from the previous trading day.

● Low is the lowest market price of an asset or stock from the previous trading day.

● Close is the closing market price of an asset or stock from the previous trading day.

B. Support and resistance levels

Support and resistance levels are also key elements of the formula.

1. First-level support and resistance

First-level support and resistance refer to the first-level price ceiling and floor respectively.

To calculate first-level support:

(2xPP) – High = S1

To calculate first-level resistance:

(2xPP) – Low= R1

2. Second-level support and resistance

Second-level support and resistance refer to the second-level price ceiling and floor respectively.

To calculate second-level support:

PP – (High – Low) = S2

To calculate second-level resistance:

PP + (High – Low)= R2

3. Third-level support and resistance

Third-level support and resistance refer to the third-level price ceiling and floor respectively.

To calculate third-level support:

Low – 2 x (High – PP) = S3

To calculate third-level resistance:

High + 2 x (PP – Low) = R3

C. Fibonacci pivot point formula

Fibonacci’s pivot point formula is considered the standard formula for calculating pivot points.

Here is Fibonacci’s Pivot Point formula:

P = High + Low + Close / 3

R1 = (P × 2) − Low

R2 = P + (High − Low)

S1 = (P × 2) − High

S2 = P − (High − Low)

Here:

P = Pivot point

R1 = Resistance 1

R2 = Resistance 2

S1 = Support 1

S2 = Support 2

D. Woodie’s, Camarilla and Demark Pivot Point Formulas

Here are some other formulas for the calculation of pivot points:

● Woodie’s Pivot point formula:

PP = (H + L + 2C) / 4

R2 = PP + High – Low

R1 = (2 X PP) – Low

S1 = (2 X PP) – High

S2 = PP – High + Low

Here,

C= Closing Price

H = High

L= Low

● Camarilla’s Pivot point formula:

PP = (H + L + C) / 3

R4 = C + ((H-L) x 1.5000)

R3 = C + ((H-L) x 1.2500)

R2 = C + ((H-L) x 1.1666)

R1 = C + ((H-L) x 1.0833)

S1 = C – ((H-L) x 1.0833)

S2 = C – ((H-L) x 1.1666)

S3 = C – ((H-L) x 1.2500)

S4 = C – ((H-L) x 1.5000)

Here,

C= Closing Price

H = High

L= Low

● Denmark’s Pivot point formula:

Support 1 (S1) = X / 2 – High

Resistance 1 (R1) = X / 2 – Low

X/4 = Pivot point

Three formulas can be used for Denmark’s Pivot point calculation:

(2 x High) + Low + Close

Or

High + (2 x Low) + Close

Or

High + Low + (2 x Close)

V. How to use pivot points in trading

Pivot points are a powerful tool for traders to identify market trends, determine support and resistance levels, and spot reversal points. By analyzing the previous trading day’s data, traders can set stop-loss, and take-profit levels and make informed entry/exit decisions, enhancing their intraday and day trading strategies. Here’s how you do it.

A. Identifying market trends

Pivot point is an efficient tool to identify market trends for day and intraday trading. The pivot point calculation formula helps to analyze the bearish and bullish trends in the market and the performance of a stock.

B. Determining support and resistance levels

The formula uses the previous trading day’s high, low and close to predict the support and resistance levels of a price.

Movements below and above support and resistance levels help intraday traders set up stop-loss, take-profit levels and target prices. For example, one can set a take-profit level at S2 and exit the market accordingly.

C. Spotting reversal points and entry/exit signals

The pivot point formula also helps a trader understand entry/exit points and reversal points.

The pivot point indicates bearish and bullish market trends in the intraday and day trading charts by using the high, low, and close of the previous trading day. Traders usually take long positions near the support levels and short positions near the resistance levels.

Read More: Top 5 Technical Analysis Tools: Succeeding at Stock Trading

VI. Advantages of using pivot points

Pivot point calculation offers a wide range of benefits in intraday trading which include the following.

A. Simplicity and objectivity

Simplicity and objectivity are the first and foremost benefits of pivot points. It brings ease of calculation and interpretation with a simple average of the previous day’s closing and the current day’s highs and lows.

B. Predictive power

Pivot points also offer predictive power to the users. It helps to forecast possible market moves by analyzing the previous day’s closing and the current day’s average highs and lows.

C. Versatility

Pivot points also offer versatility which is essential for trading calculations. Although the pivot point calculation formula is majorly used for intraday trading it is also useful for various markets and trading environments.

VII. Limitations and considerations

Technical analysis uses pivot points to predict potential support and resistance levels. But they are hampered by market volatility, sudden news, and time frame selection. Varying methods of calculation and these methods’ adapted pivot points have to be considered by traders while they should also adapt pivot points to complement other analysis tools for better accuracy.

A. Potential for false signals

Pivot point uses historical data to predict market trends and price movements. In the case of assets with low liquidity where geopolitical events can create sudden market fluctuations, the pivot point formula can give false or unreliable signals.

Understanding the limitations of pivot point as a fixed formula is essential for using it for effective results.

B. Need for confirmation with other indicators

As the pivot point is a fixed formula based on historical data of market price movement, it needs to be confirmed with other indicators. Combining pivot points with other tools of technical analysis such as RSI can be helpful for traders wanting better prediction.

C. Market conditions and volatility

The pivot point cannot sudden market volatility with accuracy. It is also not useful for long-term trading.

Pivot points predict market trends and price movements based on the historical data of the same. Sudden changes in the market dynamics can render the formula effective.

VIII. Practical Example and Calculation

Technical analysis indicators that are used to provide information about the support and resistance levels in trading are pivot points. Using a practical example, this guide explains how to calculate pivot points

A. Step-by-Step Calculation Example

A step-by-step pivot point calculation formula is helpful for beginners who want to use this method.

Follow these steps to calculate the pivot point.

Step 1: Figure out the high and low of the trading day after the closing of the market or before the reopening of the next day.

Step 2: Figure out the close of the most recent prior trading day

Step 3: Add the High, Low, and the close and divide by 3

Step 4: The result of the formula is the pivot point. You can mark this as P on the chart.

Step 5: Finally, one can calculate S1, S2, and R1, R2.

Pivot points can be used in various charts. This method is mostly used by intraday traders. For example, if a price moves above the pivot point, there is a bullish market. On the other hand, if the price moves below the pivot point, there is a bearish market trend.

B. Interpreting the Results

To interpret the results of the pivot point formula, one must be aware of the various components of it and its meanings.

Here is an example of how to apply the results of pivot point calculation to an intraday trading:

Suppose, the opening price of a stock is above the Pivot point indicating a bullish market trend, and surpasses R1, a trader can consider buying the stock setting the target at R2. Vice versa can happen if the price is below the pivot point.

IX. Conclusion

The pivot point calculation formula is useful for intraday trading. It helps to determine market price movements by analyzing the market highs and lows. There are several types of pivot points and each has its unique calculation formula.

Pivot points are indeed helpful as they come with a simple and effective evaluation of support and resistance. However, it is not free of errors. So, as a trader or investor, you must take proper measures to mitigate the risks associated with pivot calculation to make the most of it.

FAQs

1. What is the formula for calculating pivot points?

The formula for calculating pivot points is as follows:

(Previous High + Previous Low + Previous Close) / 3 = Pivot point (P)

2. What is pivot S1 S2 R1 R2?

Pivot S1, S2, and R1 and R2 refer to the first support, second support, first resistance, and second resistance respectively in the calculation of pivot points.

3. What are the pivot points R1, R2 and R3?

R1, R2, and R3 in pivot points indicate the first, second, and third levels of resistance a stock can experience in the market.

4. What is the formula for CPR?

The formula for Central Pivot Range or CPR is as follows:

(Low+ High+ Close) / 3 = Pivot

(BC- Pivot) + Pivot = Top CPR

(Low + High)/2 = Bottom CPR