In a 2019 letter to shareholders, Warren Buffet raised questions about how accounting earnings were reported. Despite making a profit of over $24 billion, his company Berkshire Hathaway had to file a meager $4 billion as earnings. The unrealized losses on some investments had to be excluded. Buffet’s example shows why “net income” isn’t in fact a fair estimate of a company’s performance or its investor confidence. A cash flow statement gives you a better view.

Cash flow is an important metric that could help individuals and companies evaluate their financial health, and this is where you can learn all about it.

What is cash flow?

Cash flow is a metric that enables us to study the flow of money into or from a business or an individual. It is a measure of the cash generated or consumed in a specific time frame. Cash flow helps make better budgeting and investing decisions.

If you want to plan your finances, you need to take a closer look at cash flow statements—your own and that of companies and institutions you want to invest in.

Cash flow vs. net income

Cash flow isn’t the same as income.

Net income/revenue generated/profit relies on accrual principles of accounting. It smoothes out expenses and tries to match revenue to product and service deliveries. Plus, as mentioned earlier in the Warren Buffet example, net income takes unrealized losses into account.

Cash flow, on the other hand, paints a clearer picture by taking into account every possible cash inflow and outflow stream. Also, the net income is a small part of it.

In this article, while we look at money flowing in or out of a company, the same principles hold even for generating, accounting, and improving individual cash flow.

Why cash flow is important

Cash flow is important because it has the following uses:

- It is used in calculating the Net Present Value (NPV), which in turn helps understand whether the business/portfolio is growing or not.

- Observing the flow of cash helps you analyze the liquidity a business or person is aiming for. Liquidity calculation come in handy while taking care of short-term financial obligations.

- Cash flow facilitates an understanding of funding gaps in operations. It also tells us how much additional cash will be necessary to plug them.

- It helps simplify how capital that can be reinvested into the business can be calculated.

To sum it up, positive cash flow—money flowing in—indicates better flexibility, liquidity, and overall financial health. Those with a good flow of cash fare better on those much-dreaded rainy days.

Types of cash flow

We can divide cash flow into different types based on which type of activity generates it.

1. Operations-specific flow: This is a measure of the amount of money generated or spent as part of normal business operations. To calculate cash flows of this type, you need to factor in taxes, salaries, inventory costs, and more. Both inflows and outflows determine the state the company is in.

2. Financing-specific flow: The net amount used to fund the venture is called the finance-specific cash flow. Calculating it involves looking at capital-based expenses, bootstrapping, dividend payments, issuing debt/equity, and other financing activities. The creation of a capital structure for the firm depends on it.

3. Investing-specific flow: Money made or spent from various investment-related activities during a specific period amounts to investing-specific cash flow. This type takes every investing activity into consideration. Cash generated from the likes of realized gains or cash spent in terms of realized losses is considered here.

How to calculate cash flow

Calculating the net flow of cash is pretty simple. Here is a formula that might help:

Net cash flow = Total inflow – total outflow

You can find the inflow–outflow data in your detailed cash flow statement.

There is also another formula for cash flow, in addition to the one discussed above. It reads as follows:

Net cash flow = Operations-specific cash flow + Financing-specific cash flow + Investing-specific cash flow

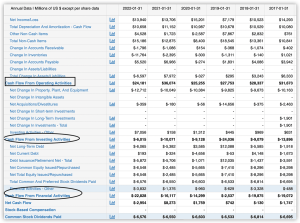

To understand this second formula better, looking at an annual cash flow statement may help. Here is what this type of statement looks like for Walmart. Now, look at the highlighted bits.

Walmart’s yearly cash flow statement

Source: Macro Trends

By applying the formula above, one may see that Walmart’s net cash flow (according to the formula and image above) is negative for 2021–22 and positive for the previous year. We can also term positive cash flow “free cash flow.” Because the company is free to use this sum in any manner of their choice.

How to generate cash flow

We know that a good flow of cash is what we are after. But how do we get there? Here is how:

1. Increasing revenue growth

This approach can be both volume- and price-specific. In terms of volume, businesses can add new customers, bring in returning customers, introduce new categories and products to attract new customers, and generate marketing leads. From a price perspective, cash flow generation involves raising prices or adding newer items to the list of products.

2. Reducing the operating margin

Companies can increase cash flow by upping the automation and getting better supplier-specific deals (in the case of a product-based company). Other strategies are payroll streamlining, reducing overheads, lowering shipping costs, and trimming the market budget.

3. Increasing capital efficiency

Finally, businesses can try and generate higher returns on specific assets, launch proprietary tech, and improve management. All this adds to capital efficiency.

How to improve cash flow

The following ideas should help improve your existing cash flow:

- Offering discounts to increase the volume of orders and hence the cash inflow.

- Refraining from buying resources to reduce cash outflow.

- Making credit checks mandatory for customers.

- Not procrastinating with sending out pending invoices.

- Using business credit to make payments to buy some time with paying off.

- Using a high-interest account, preferably one with an auto sweep to help generate more interest.

Apart from the strategies mentioned above, you can always consider buying at a discount, increasing product prices in a phased manner, improving inventory to reduce regular buying activities, and opting for frugality whenever possible. To sum it up, remember to maintain reserves, monitor outflows, lower expenses, increase inflow sources, and eventually streamline the entire process.

FAQs

What is cash flow in simple terms?

Cash flow is the net movement of cash into and out of a business. It represents the money a company receives and spends, providing a snapshot of its liquidity.

What are the 3 types of cash flows?

The three types of cash flows are operating, investing, and financing. Operating involves day-to-day activities, investing deals with assets, and financing handles sources of capital.

What is the meaning of cash flow statement?

A cash flow statement is a financial document that summarizes a company’s cash inflows and outflows, providing insights into its liquidity, solvency, and operational efficiency.

What is cash flow in one word?

Liquidity.