Taxes, let’s face it, are complicated. And things get a lot more difficult if your income is taxable in two countries instead of one. That’s why we are here to try to simplify the US tax system for Indian investors. Read on to learn more, so you can enter the exciting world of US stocks with more clarity and confidence.

While general Indian taxation standards on capital gains apply when you invest in stocks, investments in the US fall under that country’s tax rules. Fortunately, US taxation rules are pretty straightforward and are generally favorable to investors from India, thanks to the existing tax treaty between the two countries.

Indian investors can pay their capital gains tax in India

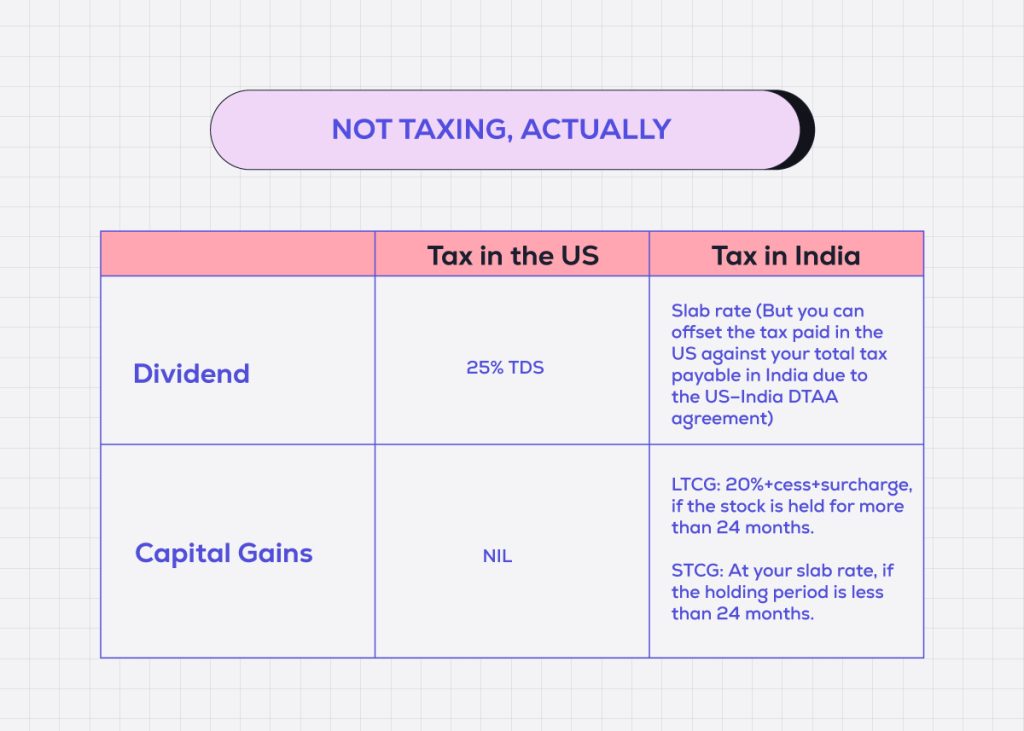

Indian investors who trade in US stocks don’t have to go through the painful process of paying their taxes in the US. However, Indian tax rules will be applicable to US investments, but the application will depend on the holding period.

For example, if you sell your US shares for a profit after 24 months of holding, you will have to pay a long-term capital gains tax at the rate of 20%, in addition to surcharge and cess. But if your investment was held for less than 24 months, the short-term capital gains tax will apply, and your income will be taxed as per your slab rate.

Dividend income is taxed differently

Dividend income is taxed differently

Many companies in the US are shareholder-friendly and issue dividends from time to time. Thus, your investments in US stocks and Exchange-Traded Funds (ETFs) can fetch you dividends that are taxed at the rate of 25%. Essentially, the dividend you receive in the US will be given to you after the deduction of tax.

For instance, if a company declares a dividend of say, $200, you will receive $150 in your account after the TDS of $50 is charged. In addition to this, you will have to pay tax on your US dividend in India also, as dividend income is taxable from the financial year 2020–21.

But you need not worry. Because India and the United States are signatories to the Double Taxation Avoidance Agreement (DTAA).

The DTAA treaty allows you to balance your tax liability in India against your dividend tax deducted in the US. So you will be able to adjust the tax paid in the US and adjust it with the tax liability in India.

For the TDS paid on your dividend earnings in the US, you will be given the Form 1042-S via the “Reports” section on the CoinSwitch platform. While filing your income tax returns in India, you can use this information to avoid paying double tax on your US dividend.

Consult your CA or tax advisor to learn how to take advantage of this provision as a taxpayer in India.

Residential status of investors also matters

Residents: If you are an Indian resident, your income earned abroad is taxable in India, which includes capital gains from trading in US stocks.

Non-residents: If you belong to the Non-Resident Indian (NRI), or Resident but Not Ordinarily Resident (RNOR) category, your global income is taxable only if it is received in India.

Advantages for Indian investors

It is clear that the tax system favors Indian investors who wish to trade in US stocks. Despite a flat 25% tax on US dividends, the option to offset tax paid in the US against tax liability in India is a big incentive for Indians to invest in US stock markets, besides superior investment returns from US holdings.