Tesla has done well in the stock market. Its stock gave investors solid returns for five years, till January 2022.

The iconic cars the company manufactures and its technological lead has helped it stay well ahead of rivals with its market share. The stock has had an exciting bull run despite the challenges it has faced.

Recently, CoinSwitch, a crypto-first company, has decided to make trading in US stocks such as Tesla available for Indian users on its platform. So here’s tracking the company’s journey, the milestones, and the way forward.

History

Established in the year 2003, Tesla Inc. has captured the imagination of consumers worldwide with its innovative product lineup. In fact, the firm is known to have a long waiting list of customers.

Some of Tesla’s Electric Vehicle (EV) models such as Model 3, Model Y, Model S, and Model X are well-known globally. Tesla had revenues of $53.8 billion in 2021, and it has a market capitalization of $567.83 billion at the time of writing. To top it all, the company has a good profit margin for the cars it sells.

Besides electric vehicles, the company is also engaged in the business of manufacturing solar storage systems.

Tesla entered the S&P 500 index of large-cap US companies in December 2020, and it currently figures among the index’s top 10 constituents.

Stock split

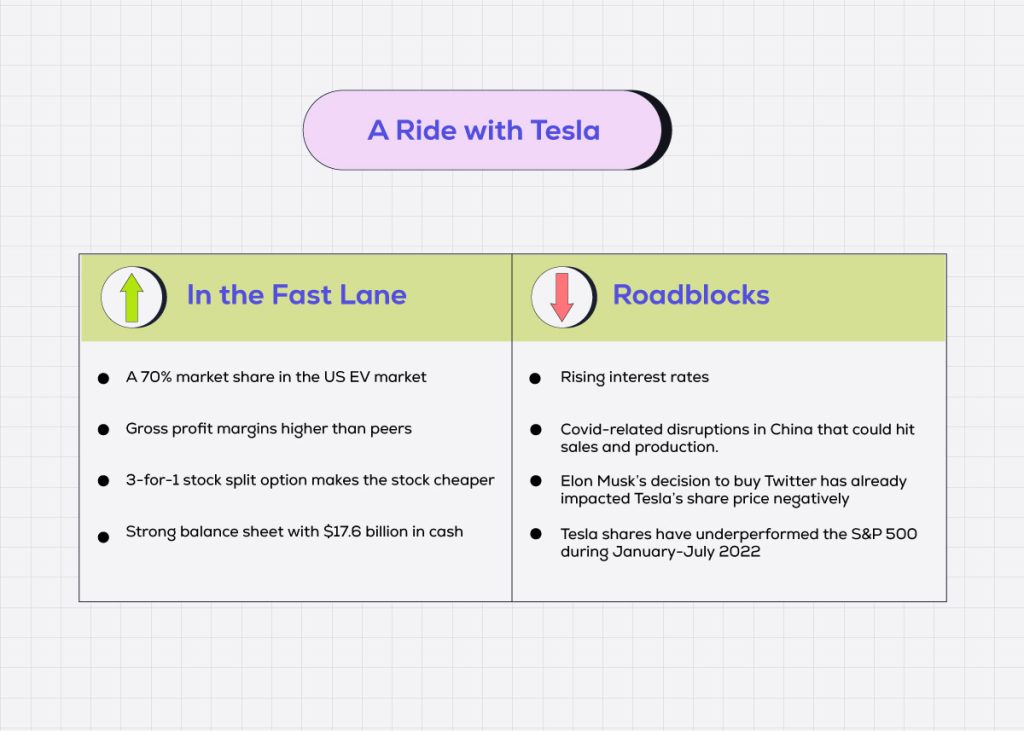

Tesla announced a 3-for-1 stock split, which was approved by shareholders on August 4, 2022.

Stock split is a corporate action by a company wherein it issues additional shares to investors, increasing the number of shares in circulation.

After the split becomes effective, each Tesla investor will own three shares for each share originally held.

The shares, trading at $174.04 at publishing time following the recent fall in prices, are expected to become even more affordable.

In addition, trading in US stocks comes with the added advantage of fractional trading. That means CoinSwitch customers can now own a portion of the Tesla stock—for as little as $1 (about ₹82 at the time of writing).

Sales are in top gear

Sales of Tesla cars have been very good despite global supply chain issues and other issues faced in China. Tesla delivered 3,10,000 vehicles globally in the first quarter of 2022, a massive 68% increase from the same period a year ago.

Ahead in the race

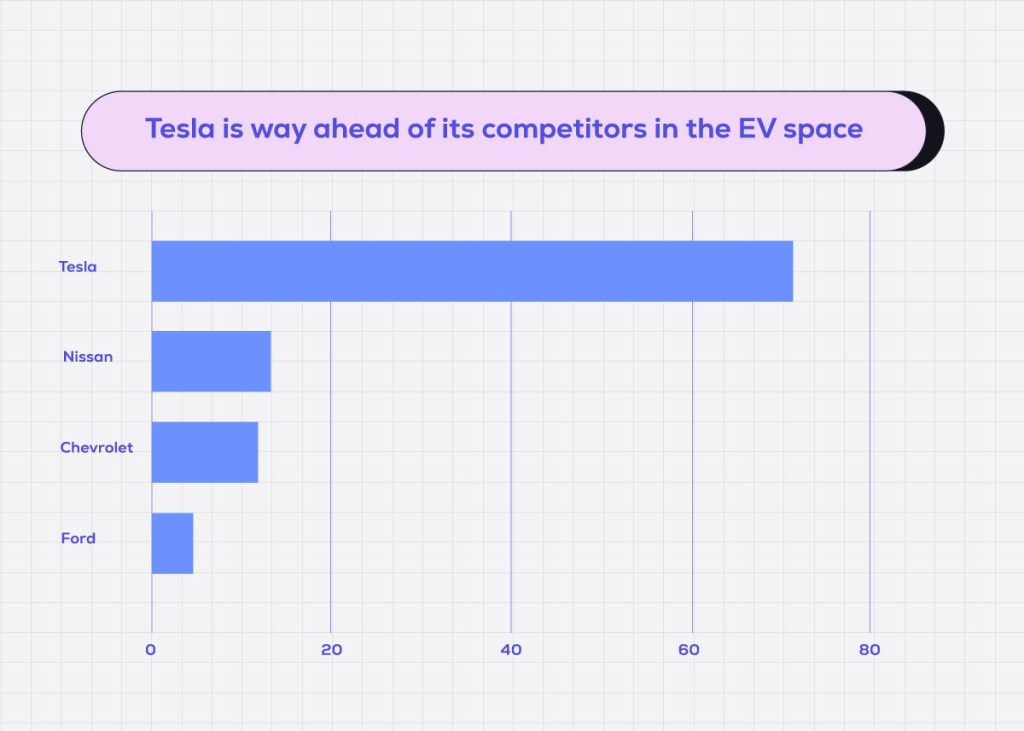

Market share in percentage

Source: Experian Automotive

While more and more manufacturers are entering the EV market segment, Tesla has ensured that the company is well-placed to take on the competition. It does this with its strong brand recall and top-selling car models across various segments. According to a report from Experian Automotive published by Electrek, based on new electric vehicle registrations, Tesla commands a 69.95% share of the US EV market.

Stock fundamentals

Tesla is cash-rich. It has a strong balance sheet with $17.6 billion in cash. And last year, it generated about $3.5 billion in free cash.

Tesla has a trailing 12-month price-to-earnings (P/E) ratio of 53.77, compared to the automotive sector’s multiple of 55.50, at the time of writing. The stock has a forward P/E of 31.94, while the sector has 28.28. The company’s gross profit margins are much higher compared to some of its industry peers, a reason often attributed to its higher share price.

A few concerns

On the downside, rising interest rates are known to push down share prices, and expensive stocks are likely to be hurt the most. The price of the stock may also be impacted by the fact that Covid-related disruptions in China could lead to lower sales and production. Rising material costs and not being able to run all production plants to full capacity can also impact the sales numbers for the company.

Elon Musk’s decision to buy Twitter also impacted Tesla’s share price negatively, and the company has announced that it plans to reduce 10% of its salaried workforce.

At the time of publication, Tesla’s shares have lost 40% of their value in 2022, compared to a 19.5% loss for the benchmark S&P 500.

However, before you go ahead and make an investment, it is essential to Do Your Own Research (DYOR) by checking out the P/E ratio, earnings per share, and other fundamental aspects of the company.