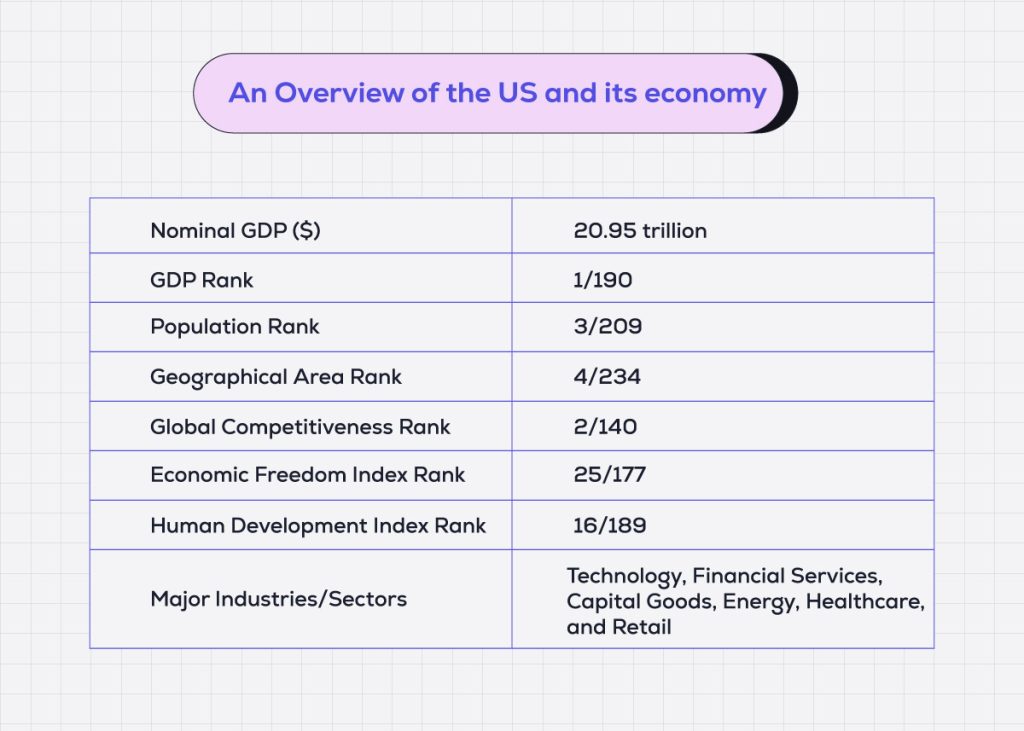

American brands such as Apple, Starbucks, and KFC have become such household names, we hardly think of them as foreign products! Yet, we know too little about the economy which is home to them.

First-time investors in US stocks are likely to find developing a basic understanding of how the US economy works, and what are some of the country’s important sectors, helpful. As you dive headlong into the world’s largest stock market, dig in here first.

America is the world’s largest economy. The US emerged as an economic superpower after World War II, thanks to the rise of the industrial sector. Coal satisfied the nation’s energy requirements, keeping the factories humming and lighting up homes. Large-scale industrial production in factories revolutionized the way goods were produced. Large corporations were born, which eventually led to the development of stock markets. The rest, as they, is history.

Key sectors of the US economy

The US is often called the capital of consumerism. Consumer spending contributes to about 70% of the country’s GDP, making service and retail industries the key pillars of the economy. Companies in technology, healthcare, financial services, and retail sectors come under the broad services sector.

It could be worthwhile to discuss some prominent sectors of the US economy and the important firms in each sector. Doing so will help investors as they select the US stocks of their choice.

Technology

From its humble coal-powered beginnings, the US economy has made rapid progress over the decades. Notably, one sector that has powered the country to the top in global innovation is technology. The tech sector boasts of world leaders such as:

Microsoft Corp. (MSFT)

Google parent Alphabet (GOOG)

Facebook’s new avatar Meta Platforms (META), and

Apple Inc. (AAPL)

Within the technology sector, the software services industry occupies a prime position. Within software, the System Software segment has companies such as:

Microsoft

Google

Apple

The Application Software segment has:

Adobe Inc. (ADBE)

Autodesk Inc. (ADSK)

Intuit Inc. (INTU)

The Enterprise Software segment boasts of companies like:

Vmware Inc. (VMW)

Salesforce Inc. (CRM)

Twilio Inc. (TWLO)

What’s more, technology and innovation have disrupted almost every other industry in the US, including energy, automobile manufacturing, and healthcare. Likewise, US automobile manufacturers have used technology to make self-driving vehicles a reality. Think of Tesla Inc. (TSLA), Elon Musk’s electric vehicle company.

Financial services

The US has a well-developed financial services sector, comprising Banking Services, Investment Services, Insurance, and Foreign Exchange segments. JP Morgan Chase (JPM) is the largest US bank, and there are other big financial sector firms such as Goldman Sachs (GS) and Morgan Stanley (MS).

The segment is often considered a benchmark for the economy’s health, as banks tend to do well in good times. Rising interest rates give a boost to banks and mortgage providers, as it allows them to charge their customers more.

Capital goods industry (manufacturing)

The capital goods industry, being highly cyclical, is mostly dependent on the economy. Typically, cyclical industries are closely aligned to the business cycle—performing well when the economy is booming and underperforming during downturns.

Most of the companies operating in the industry are global leaders. Some of the prominent firms in the sector are:

Caterpillar Inc. (CAT)

Honeywell International (HON)

Cummins (CMI)

Deere & Company (DE)

Stanley Black & Decker (SWK)

Automobile manufacturers such as Ford Motor (F), Tesla Inc. (TSLA), and aircraft maker Boeing Co. (BA) also belong to the broad manufacturing sector.

Energy industry (oil and gas)

The energy industry comprises producers of oil and natural gas. The industry has had its ups and downs over the decades.

Thanks to the discovery of shale oil, the United States became a net oil exporter for the first time in the year 2019. Yet, the prospects of the industry are largely a function of demand and supply. Large energy producers such as Exxon Mobil (XOM) and ConocoPhiliips (COP) benefited from the sharp rise in oil prices during the first quarter of 2022, thanks to the Russia–Ukraine war.

Healthcare industry

Healthcare companies are generally categorized as defensive stocks, which means that they tend to have stable earnings even if the economy is down. The simple reason for this is, people will attend to their healthcare needs, come what may.

Companies in the segment can be broadly classified into drug makers and medical equipment makers. US-based pharmaceutical firms known for their cutting-edge research capabilities include:

Pfizer Inc. (PFE)

Johnson & Johnson (JNJ)

Bristol-Myers Squibb (BMY)

Abbot Laboratories (ABT)

Some of the leading US medical device makers are:

Medtronic (MDT)

General Electric (GE)

Stryker Corp. (SYK)

Becton Dickinson (BDX)

Retail industry

The retail segment in the US is often considered an indicator of economic activity in the country as consumer spending contributes to about 70% of the GDP. In fact, the same-store sales of major retailers, published at the beginning of every month, give a clear signal about the health of the economy. Within the retail sector, consumer staples companies come under the category of defensive stocks as their business does not depend on the state of the economy.

Within the retail industry, there are some broad categories.

Megastores:

Walmart Inc. (WMT)

Target Corp. (TGT)

Grocers:

Kroger Co. (KR)

Wholesalers:

Costco Wholesale (COST)

BJ’s Wholesale Club (BJ)

Home improvement retailers:

Lowe’s Cos (LOW)

Home Depot Inc. (HD)

Drugstore chains:

CVS Pharmacy (CVS)

Walgreens (WBA)

E-commerce biggies:

Amazon.com Inc. (AMZN)

Wrap-up

The world’s largest economy has well-developed sectors such as technology, financial services, and health care. It offers investors a lot of attractive stocks to choose from.

Considering investing in one of them? Here’s our concluding two cents: Study the sectors well to identify the major companies in each of them, evaluate firms carefully using various metrics, and make an informed choice.