The intersection of policy and market sentiment became strikingly evident in the year 2024, as Donald Trump’s re-election to the U.S. presidency ignited a pro-crypto asset wave that pushed Bitcoin – the largest digital asset by market cap – past the $100k mark. This remarkable milestone underscored the impact of supportive administration on market dynamics and emphasised the vital role of regulations in driving innovation and bolstering confidence in the Virtual Digital Asset (VDA) sector.

While the U.S. captured attention late in the year, global regulatory milestones defined 2024. Highlights included the approval of Bitcoin Exchange-Traded Funds (ETFs), the European Union’s implementation of the Markets in Crypto-Assets (MiCA) regulation, and advancements in implementing the G20 Roadmap on CryptoAssets and adopting the FATF Standards by Virtual Asset Service Providers. These developments signalled meaningful progress toward establishing a more regulated and transparent global cryptoasset ecosystem.

India made a significant stride in the global crypto ecosystem this year with the announcement of its Discussion Paper on cryptoasset regulations, marking a crucial first step toward a formal regulatory framework. The CoinSwitch (CS) Public Policy team continues to educate, inform, and engage with stakeholders at all levels, shaping the policy narrative toward a constructive and robust regulatory framework for crypto-assets. Alongside this, other notable developments highlighted the increasing acceptance of virtual digital assets and the Web3 sector in India.

Discussion Paper

The announcement by Ajay Seth, Secretary of the Department of Economic Affairs (DEA), regarding the upcoming release of a Discussion Paper on cryptoasset regulations marks a transformative step in India’s journey toward establishing a regulatory framework for the sector. This milestone is the result of over two years of strategic advocacy by the CoinSwitch (CS) Public Policy team, in collaboration with other industry stakeholders, to drive informed dialogue and policy action. The announcement signals the government’s openness to exploring regulatory pathways that balance innovation with risk management.

During the recent winter session of the Parliament, the Ministry of Finance, in response to a question on virtual digital asset (VDA) regulations, stated: “All jurisdictions, including India, are expected to evaluate their country-specific characteristics and risks, and engage with standard-setting bodies and the G20 to appropriately consider any necessary measures for crypto assets. A part of such a process may involve the publication of a Discussion Paper to obtain feedback on the stance or various stances under consideration by jurisdictions.”

At CoinSwitch, we look forward to the release of the paper and actively contributing to it. We welcome the consultative approach adopted by the Ministry of Finance on policy formulation of crypto assets.

A Year of Growth in Our Engagement with the Ministry of Finance

R Venkatesh (SVP & Head Public Policy) with Director & Additional Director of FIU-India at training and awareness workshop for VDASPs

R Venkatesh (SVP & Head Public Policy) with Hon’ble Finance Minister Nirmala Sitharaman

In 2024, the Ministry of Finance remained a key stakeholder in the sector, with CoinSwitch achieving significant milestones through its collaborations with the ministry.

After securing ‘Reporting Entity’ (RE) status for VDA Service Providers (VDASPs) under the Prevention of Money Laundering Act (PMLA), CoinSwitch worked closely with FIU-IND to strengthen this partnership. We played a key role in hosting the first-ever industry workshop for VDASP REs, in collaboration with the Bharat Web3 Association (BWA) and FIU-IND. This landmark event featured participation from FIU-IND Director and Additional Director. At the event, a comprehensive report titled VDASPs—Road to Effective Compliance under PMLA, with key contributions from CoinSwitch was unveiled.

This trust and partnership have resulted in significant recognition for CoinSwitch. It was the only VDASP invited to the Asia Pacific Group Typologies Workshop in Kuala Lumpur and one of only two VDASPs invited to the Eurasian Group’s 41st Plenary in Indore.

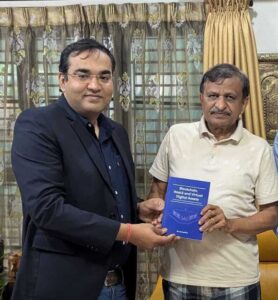

In a rare honour, CoinSwitch was featured in Digital Fortunes: Value Investing in the Digital Economy, a book authored by the Financial Action Task Force (FATF) Director in the Ministry of Finance. R. Venkatesh, SVP & Head of Public Policy at CoinSwitch, was quoted for his key insights on the sector, with the author praising him as “a consistent advocate of virtual assets” and “a strong proponent of transparency through anti-money-laundering regulations to help the crypto industry thrive.”

Additionally, in recognition of CoinSwitch’s contributions to India’s Mutual Evaluation by the FATF, we were invited to a celebratory dinner hosted by the Department of Revenue. During the event, Venkatesh had the opportunity to engage with the Hon’ble Finance Minister Nirmala Sitharaman, discussing the team’s work on AML/CFT compliance. We did a detailed blog on India’s Mutual Evaluation progress here.

Tax Advocacy

We continue to advocate for a more balanced tax framework for the sector, as the current framework—comprising of 1% TDS, 30% capital gains tax, and the absence of offset of losses – has had unintended negative consequences for both the industry and its users. A study conducted by the Centre for Tax Laws at NALSAR University of Law underscores these challenges, revealing that these policies have driven Indian users to trade on non-compliant offshore platforms, resulting in a 97% decline in trading volumes and an 81% reduction in active users on Indian exchanges between February 2022 and January 2024. This shift has cost the Indian exchequer an estimated INR 2,489 crore in tax revenue during this period, with projected losses of INR 5,100 crore over the next three years if the TDS remains unchanged.

While the first Budget after the 2024 General Elections in July did not offer any tax relief for the VDA sector neither did it propose any new taxes. We also did a detailed blog analysing the Budget Session of the Parliament, where the Economic Survey discussed the potential of blockchain technologies.

The February 2025 Budget will be the first full-year Budget of the new government. We have been actively engaging with the Ministry of Finance to highlight these challenges posed by the current tax structure. Our efforts remain focused on fostering collaboration with key stakeholders to drive meaningful solutions and advocate for a tax regime that ensures transparency, compliance, and sustainable growth for the sector.

Demystifying Web3

This year, the Public Policy team actively engaged with government stakeholders to highlight Web3 use cases, focusing on their potential to drive innovation and contribute to India’s economic growth. By collaborating with industry leaders, the team gained valuable insights into how companies are leveraging blockchain and innovative business models to address key problem statements. These efforts culminated in presenting a variety of use cases to officials in the Ministry of Electronics and Information Technology (Meity), the National Institute of Public Finance and Policy, NITI Aayog, the Ministry of Finance, and the Ministry of Skill Development, fostering a deeper understanding of Web3 technologies and their role in enhancing India’s digital economy.

Bharat Web3 Association released a report titled India’s Web3 Revolution: A Compendium of Web3 Firms Led by Indian Innovators, which was unveiled by Ashish Singhal, Co-Founder & CEO CoinSwitch and the Secretary of the Ministry of Electronics and Information Technology (MEITY). The report highlights over 400 pioneering Web3 startups, each playing a significant role in India’s digital transformation. A number of these innovative companies have received support and investment from CoinSwitch Ventures, further contributing to the shaping of India’s evolving regulatory landscape.

Monya (Senior Public Policy Analyst) with Jayant Singh, Hon’ble Minister of Skill Development and Entrepreneurship (Independent Charge) and Dilip Chenoy, Chairman, BWA.

Vimal (Co-Founder &COO) with Dr CN Manjunath, Lok Sabha MP from Bangalore Rural

R Venkatesh (SVP & Head Public Policy) with TSumathy Lok Sabha MP from Chennai South

Vimal (Co-Founder & COO) with Tejasvi Surya, Lok Sabha MP from Bangalore South

We continue to engage with Parliamentarians from both Houses, recognising their crucial role in policy making. Our ongoing efforts focus on raising awareness, fostering understanding, and building credibility for the VDA sector. To capture the evolving government response to questions raised by Parliamentarians on Blockchain, Web3 and VDAs, CoinSwitch has refreshed and re-released a compendium on Parliamentary Q&As. This serves as a comprehensive reference for those interested in understanding the range of issues surrounding the sector and the ongoing discussions in Parliament.

We contributed to Bharat Web3 Association (BWA)’s new set of guidelines on fair trading and cybersecurity guidelines. This aligns with our goal to build a safer, more transparent Web3 ecosystem by fostering collaboration among industry stakeholders. CoinSwitch is also part of the recently-launched Alliance for Blockchain and Crypto Defence (ABCD).

2024 has been positive for the virtual digital assets industry, and the anticipated release of the Discussion Paper on cryptoasset regulations brings optimism for what 2025 holds. At CoinSwitch, we remain committed to collaborating with stakeholders, including policymakers and regulators, to develop balanced and effective regulations for cryptoasset in India, finding an equilibrium between fostering innovation and managing potential risks.

As we look forward to 2025, we have created a comprehensive calendar outlining the key events and reports that will shape the Web3, blockchain, and VDA industry. This calendar will help track the significant regulatory developments and milestones set to unfold throughout the year.

Public Policy Tracker 2025

| JFM 2025 | Budget Session of Parliament |

| Economic Survey (Jan 31) and Union Budget (Feb 1) | |

| First G20 FMCBG meeting (Feb 26 and 27) | |

| FATF Plenary (Feb 17-21) | |

| FATF event-Private Sector Collaborative Forum 2025, Mumbai (March 27) | |

| Release of FSB work plan for 2025 | |

| AMJ 2025 | 2nd G20 FMCBG meeting (April 23-24) |

| Release of FSAP report | |

| IOSCO work plan released | |

| National Risk Assessment Report (confidential report) | |

| FATF Plenary (June 10-14) | |

| RBI Financial Stability Report | |

| JAS 2025 | Monsoon Session of Parliament |

| 3rd G20 FMCBG meeting (July 18-19) | |

| OND 2025 | Global Forum Plenary in India |

| IMF Global Stability Report | |

| 4th G20 FMCBG meeting (Oct 15-16) & G20 Summit (Nov 22-23) | |

| FATF Plenary (Oct 20-24) | |

| Winter Session of Parliament | |

| RBI Financial Stability Report |

Tentative, indicative list; subject to change