The solutions to complex problems are often simpler than we think.

How does one decide when to invest? How do you mitigate volatility? How do you beat the market?

These questions have troubled many an investor. In equities markets then, and crypto now. Adarsh Pai knew this all too well.

“Time for a story. Back in 2017, hours before the infamous crypto crash of the year, I invested roughly ₹10,000 in the market. I was still in my 3rd year of college, so I made the investment and went to appear for an exam. In the next few hours, and by the time I got wind of the crash, my investment was reduced to just ₹2,000.”

Bitcoiners on Dec 16, 2017 vs. Bitcoiners on Dec 22, 2017 pic.twitter.com/76oQPMmD5i

— Neeraj K. Agrawal (@NeerajKA) December 22, 2017

A bitter ordeal no doubt, but a valuable lesson learned.

Years later, this personal experience drove Adarsh, now a Product Manager at CoinSwitch, to walk up to his manager and pitch a solution.

“My experience with equities led me to understand that the solution wasn’t too obscure or unheard of,” Adarsh says. “In fact, it’s something most retail investors and even the average layman are well acquainted with.” The solution was simple: an SIP.

And as it turned out, a recurring order product was in the works at CoinSwitch, awaiting a driving force. So Adarsh took on the role.

A self proclaimed crypto nut, Adarsh has been trading in crypto since 2017, and in equities for even longer. Enough time to arrive at a few key observations: “I can tell you firsthand how stressful it is, going in with a large investment. The risk of exposing your entire investment brings a lot of anxiety and fear—ultimately resulting in lower motivation to trade,” he says simply.

“The second is widely known. Equity markets make it easy for new investors to invest—with an abundance of data, trends and indications. The crypto market doesn’t answer important questions like ‘What data should I consider?’ or ‘How much to invest?’”

This lack of information and fear of risk make for a potent combination of reasons to dissuade new investors from taking the plunge into crypto. “Everyone wants to get a bite of incredible gains but immense losses are a bitter pill to swallow. It’s what keeps those unfamiliar with crypto out.”

A complex challenge no doubt, but with a simple solution.

Are Systematic Investments at odds with crypto?

Crypto is fast. Crypto is now. Crypto moves at lightning speed. How does a measured, planned approach to investing work for a volatile asset like this?

Surprisingly well, quips Adarsh.

It’s where something as simple as an SIP comes to the rescue. They can help mitigate the risks of the market. It’s just the right solution for anyone looking to get into crypto, without the baggage of too much risk.

Getting it off the ground

“The really interesting stuff is what came next,” says Adarsh. “Whether we could find a product market fit.” So they began scoping out the playing field, to see whether people were talking about such a product, and how they were finding ways to make monthly crypto purchases.

More questions arose: Where to start? How can this be simple enough for users to intuitively understand?

“We figured that the best way to go about this was to integrate this into the instant order flow. Monthly, biweekly and weekly recurring orders were on the table, but we realized that this might have been too much for the user to digest. To understand the product, the user would need to make a simple shift from instant to automated repeating orders. So we decided to start with Monthly SIPs, since equity investors are already familiar with them. We could then add other kinds of repeating orders once the users were comfortable with this,” Adarsh says.

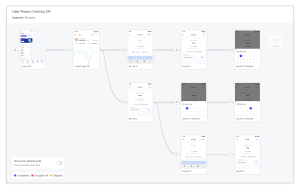

With the destination in sight, Adarsh turned to Kushagra Swami, one of CoinSwitch’s first product designers, for help. “The great thing about Kushagra is his belief in user testing to ensure that whatever product goes out is a simple, easy-to-understand version of the concept. I worked with Kushagra on the product designs, and at every step, evaluated how the user would feel.” To further fortify their understanding, Kushgra and Adarsh would test their prototypes on groups of 5-10 people.

The test was simple: Create an SIP for Bitcoin (BTC) at Rs 100, and then pause it. “We observed how the user discovered the product and navigated through it. Then we tweaked the prototype to smoothen out all the kinks. After about 4-5 rounds of these tests, we had a product that we were quite happy with.”

From us to the world

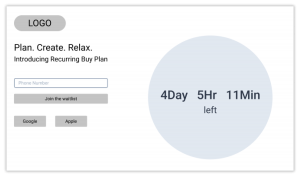

On the suggestion of the growth team, Adarsh chose to go the waitlist route for the launch. “We had planned to give about 10 thousand users early access. The idea: The more people you referred, the higher up the waitlist you’d move.” On the first day, nearly 23 thousand people signed up, and the number ballooned to 50 thousand in the following days.

“Seeing the response to the announcement was a huge confidence booster. All of our research and prototyping eventually led us to the right place.”

All in the name

Now, you may remember this a bit differently.

“We launched the SIP product under the name Recurring Buy Plan or RBP. The product was initially built with the name crypto SIP, however so as to not be confused with mutual fund SIPs, our policy teams suggested we choose an alternative name.” Adarsh remembers.

“Soon after launch, however, we learned that other asset classes including gold were offering SIP, and we thus chose to revert to the original name. SIP is now what you will see on the app,” he concludes.