It’s been over a month since WazirX, a major crypto exchange operating in India, claimed that a cyber attack on their platform led to the theft of $230 million (~ Rs 2000 cr) worth of funds.

We have attempted to be in regular touch with WazirX since the day of the incident but have not been able to reach a solution to recover the funds that are stuck on their platform. Further, their announcement earlier this week is unclear about how a full recovery would happen. So we are now taking steps, including legal action, detailed later in this post to recover the funds stuck on WazirX.

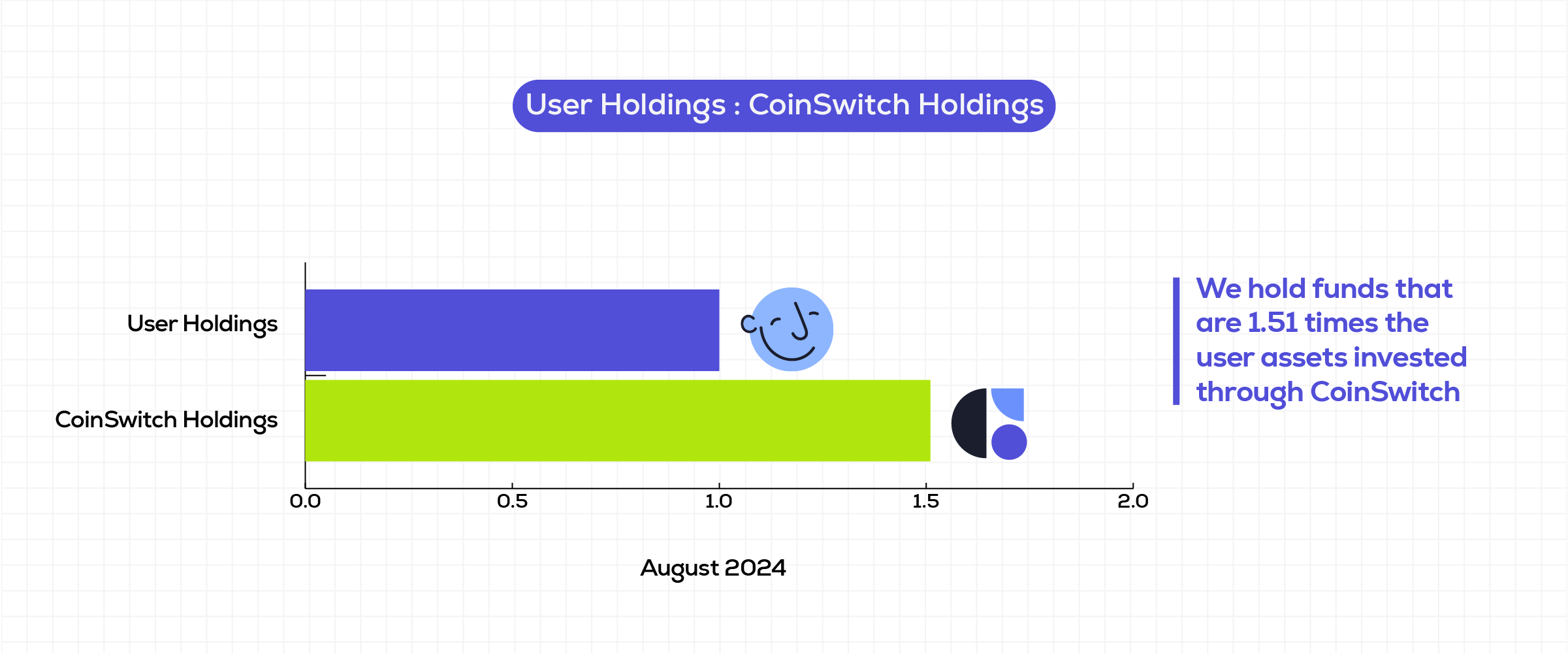

Firstly, we want to assure that all user funds are safe and secure on CoinSwitch. Given the unprecedented situation, right after the alleged incident we utilized our own treasury to make sure that we maintain at least a 1:1 ratio for every user’s crypto holding on CoinSwitch. Don’t just take our word for it; we will be publishing our proof of reserves for the second time this year for better transparency.

How much funds were on WazirX?

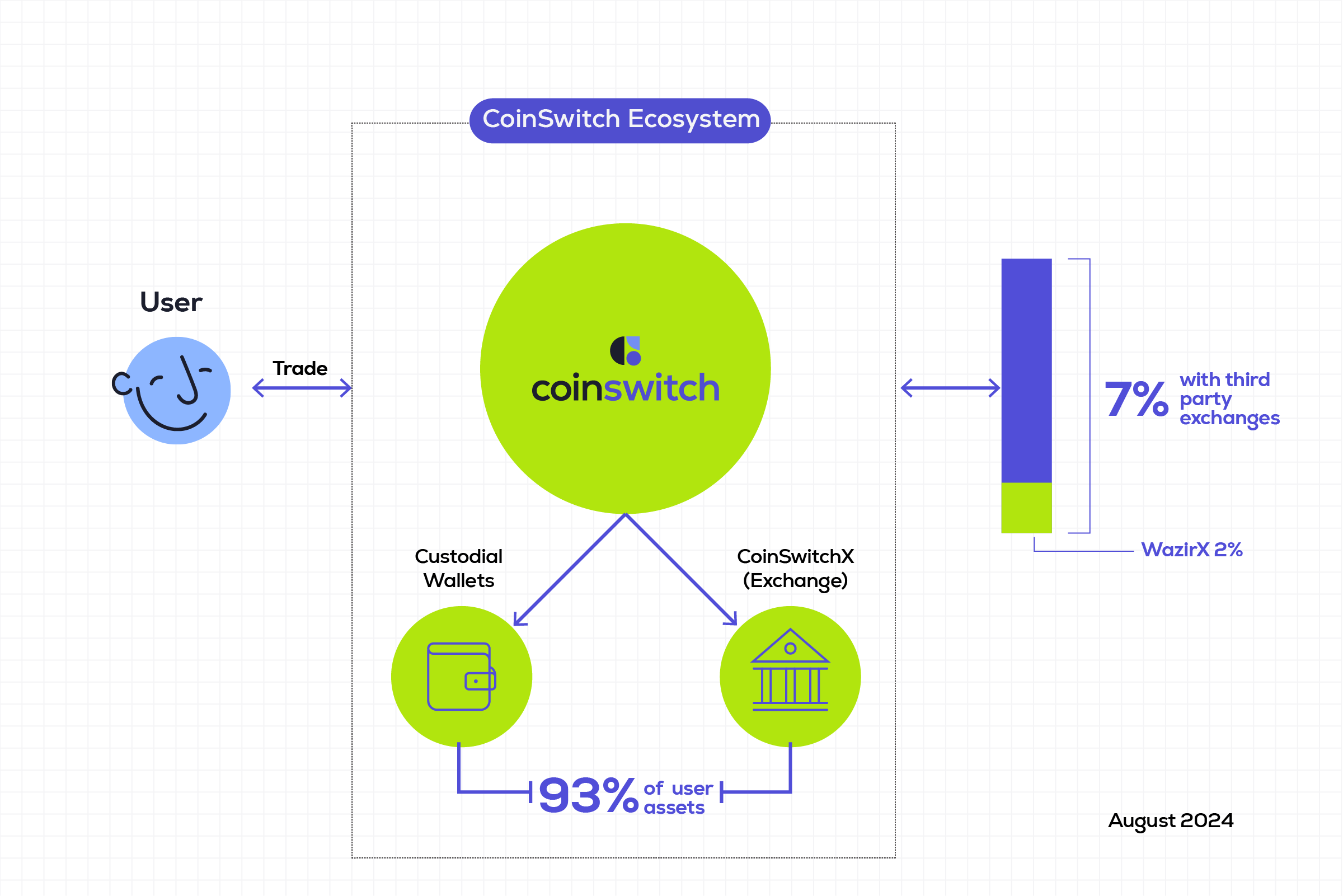

Cumulatively we have Rs 12.4 cr in INR, Rs 28.7 cr in ERC20 tokens, and Rs 39.9 cr in other tokens on WazirX. This amounts to about 2% of all funds of CoinSwitch. According to the WazirX claim, only ERC20 tokens were impacted in the alleged cyber attack. That translates to less than 1 % of total CoinSwitch funds.

Why do we have funds on other exchanges?

As an exchange aggregator, CoinSwitch maintains a small amount of liquidity on third-party crypto exchanges (7%) to ensure seamless trading for our users, as previously disclosed in our Proof of Reserves (Jul 2023, May 2024). To further minimize the risk, in 2022, we launched our own exchange named CoinSwitchX through which most of our user orders are executed. So in effect, only a tiny percentage of funds exists outside of the CoinSwitch ecosystem.

What did CoinSwitch do after the incident?

We always have a minimum 1:1 ratio of user funds at any time. After the alleged incident, we utilized funds from our own treasury to maintain the ratio.

We are able to do this because of the financial strength of our company and robust governance practices. CoinSwitch has raised about Rs 2500 crores from marquee global investors such as Andreessen Horowitz (a16z), Tiger Global, Coinbase Ventures, Sequoia Capital India, Ribbit Capital, and Paradigm.

Overall, we hold funds that are 1.51 times the user assets invested through CoinSwitch. Our total assets, which are significantly more than the user holdings, give us the ability to absorb external shocks.

Why we’re forced to take legal action against WazirX

From the day of the incident, we have tried to be in constant touch with the WazirX team, seeking recovery of the funds that are stuck on their exchange. However, our efforts have not come to fruition, leaving us with no choice but to pursue legal action to recover the funds.

In conclusion

Our exposure to WazirX has no impact on user balances and our ability to serve India’s crypto users. CoinSwitch continues to be a user-first, safe, and secure platform with a strong balance sheet and the backing of marquee investors.