इस पोस्ट को हिंदी में पढ़ने के लिए यहाँ क्लिक करें।

We’ve been asked for our proof of reserves. A lot. Today we are going a step ahead: Providing a complete picture of our proof of reserves and liabilities, wallet addresses, and the exchanges from where we buy and sell crypto on behalf of our users.

Table of Contents:

1. The Beginning

2. Our Wallet Addresses

3. Custodial Services

4. Exchanges We Work With

5. Proof of Reserves and Liabilities Report

6. How Much Cash Do We Have

7. Next Steps

8. Frequently Asked Questions (FAQ)

The Beginning

First, here’s where we are coming from: Trust exists when there is transparency and accountability. At CoinSwitch, we have always taken our responsibilities very seriously. Our users trust us with their investments because we are diligent and responsible with their funds. We buy and sell crypto on behalf of our users, and we charge a small commission for this service. We do not reinvest or borrow against users’ crypto assets.

This mantra of always doing right by our users guided our decision to conduct an independent study of our holdings in July 2022. The context: the crypto market had crashed and set off a chain of liquidations. Companies like Voyager and Celsius went bankrupt and Vauld suspended withdrawals. The crash, and the contagion that followed, wiped out over $300 billion in value and shook the trust of a large number of crypto investors.

The exhaustive process to independently verify our total crypto and INR holdings, and matching them with our users’ investments was conducted by a third-party firm on November 4, 2022. We received the report a few days later and we published the key findings of this Proof of Reserves on our blog on November 17, 2022.

It was the first such independent report of holdings conducted by an Indian crypto platform.

You can read the full findings here: INMACS Report

We believe an independent report on the INR and crypto holdings is the right method to ensure a crypto platform holds the assets it claims to on behalf of the user at this point.

A few days after the independent report (on November 4), FTX collapsed. The alleged mismanagement of customer funds and market manipulation of what was once one of the largest crypto exchanges in the world raised tough questions. There was a crisis of trust. Users wanted to verify holdings on their own on-chain. The call to publish wallet addresses gained currency.

We took time to address this question, for we believe our Proof of Reserves report addresses the concerns through an independent study. Further, CoinSwitch is trusted by 19 million users for their investments, and we have always exercised an abundance of caution when it comes to security. We asked ourselves if ‘exposing the wallets could cause any security risks’. That we are an exchange aggregator also meant our trading data and holdings were not public as would be the case for a standalone crypto exchange. So we took our time to work out a solution. Today, having done so, we are ready with the answers to all the queries our users have been asking us over the last month.

Our Wallet Addresses

Our answer: CoinSwitch holds users’ crypto assets—and then some—in institution-grade custodial wallet services, and a small portion on exchanges we engage with.

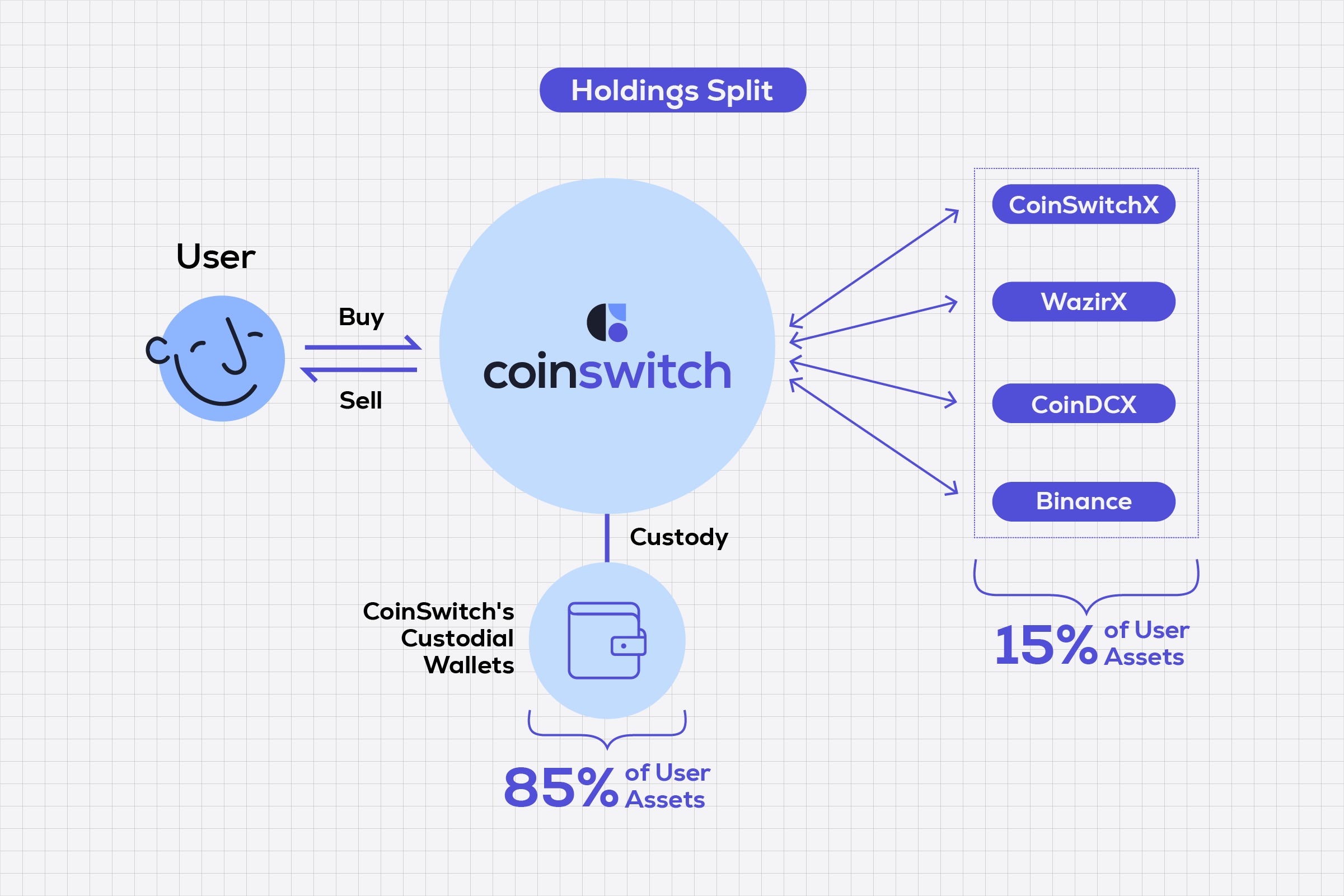

Our holdings are approximately split as follows:

- 85% of crypto assets on custodial wallets

- 15% of crypto assets on exchanges

The addresses of our major wallets are provided below. These wallets account for nearly 85% of our crypto holdings.

The total value of user assets held by CoinSwitch as of January 6, 2023, 8 am IST is $131.096 million approximately, or ₹1,083.45 crore. Of this, assets held on the wallets listed above, as of January 6, 2023, 8 am IST is approximately $112.99 million, or ₹933.83 crore.

At the time of evaluation (January 6, 8 am IST) this accounted for 86.2% of all user assets in our custody. The remaining are held on exchanges, and the value of these assets as of January 6, 2023, 8 am IST is approximately $18.1 million, or ₹149.62 crore.

- Total value of assets on custodial wallets: ₹933.83 crore approx.

- Total value of assets on exchanges: ₹149.62 crore approx.

Users can independently verify the holdings using any of the publicly available blockchain explorers. Do note, depending on the price of the crypto at the time you check, and the exchange rates of the time, the total value may differ slightly.

For full transparency, we are also providing the value of these assets as on November 4, 2022—the date of our independent Proof of Reserves report. The total value (INR equivalent) of the users’ crypto in our custody at the time of the report was ₹1,392.45 crore.

Custodial Services

The custodial wallets CoinSwitch uses to hold these crypto assets are provided by institutions of international repute. Access to these wallets are with CoinSwitch. Further, these wallets require multi-party computation, which is to say no single individual even at CoinSwitch can execute a transaction; all transactions require a maker-checker mechanism.

Exchanges We Work With

The rest of our crypto holdings (about 15% at the time of writing this) that are not held in the aforementioned wallets are held on exchanges from where we buy and sell crypto on our users’ behalf.

The reason why we hold funds on other exchanges is to enable the seamless execution of customer orders. The exchanges we work with include CoinDCX, WazirX, Binance, and CoinSwitchX.

This is how it works:

Proof of Reserves & Liabilities Report

The wallet addresses above tell one side of the story. They tell you how much crypto assets we hold. To paint a complete picture, it is necessary to prove that the crypto assets held by us match up with the holdings of our users.

Proving this on-chain is difficult, as exchanges may have undeclared liabilities or may have borrowed the assets shown in the wallets. Proof of reserves and liabilities (i.e. holdings of our users) thus can be established only through an independent report of the company’s books and custody services.

As detailed in the beginning, CoinSwitch initiated such a process in July 2022. The exhaustive and independent report was executed on November 4; a summary of this was published on November 17. Now we are publishing the full report at the end of this article. To make it easier, we are also publishing the highlights of the findings below.

The independent report was conducted in accordance with the Indian Standards on Related Services (SRS 4400) Engagement to perform Agreed Upon Procedures issued by the Institute of Chartered Accountants of India (ICAI), and compatible to international standard, ISRS 4400.

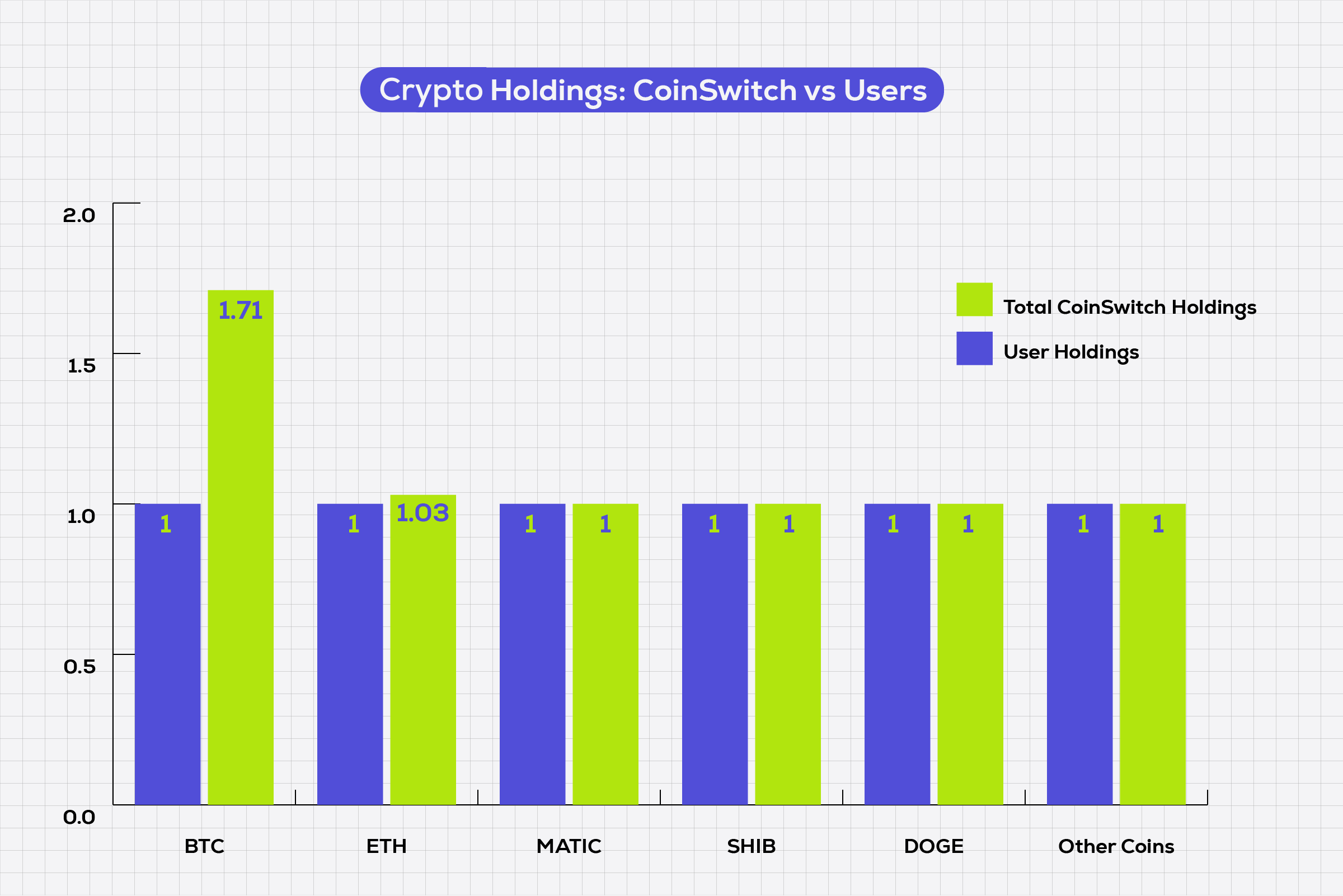

Our Total Crypto Holdings > User Holdings

As shown in the table above, we hold significantly more crypto assets than our users. This data is from the independent report of our holdings and balances conducted on November 4, 2022. This report shows that every crypto asset our users have bought on our platform is held by us on behalf of the users, and are accounted for.

On BTC, for instance, the ratio of our holdings against users is 1.71:1. This is to say, for every Bitcoin, our users remain invested in our platform, CoinSwitch holds 1.71 BTC. The higher ratio is a reflection of CoinSwitch’s own holdings in bitcoin. Our ETH holdings are also higher than user holdings. For all other crypto assets, CoinSwitch maintains at least a 1:1 ratio or more as shown in the chart above.

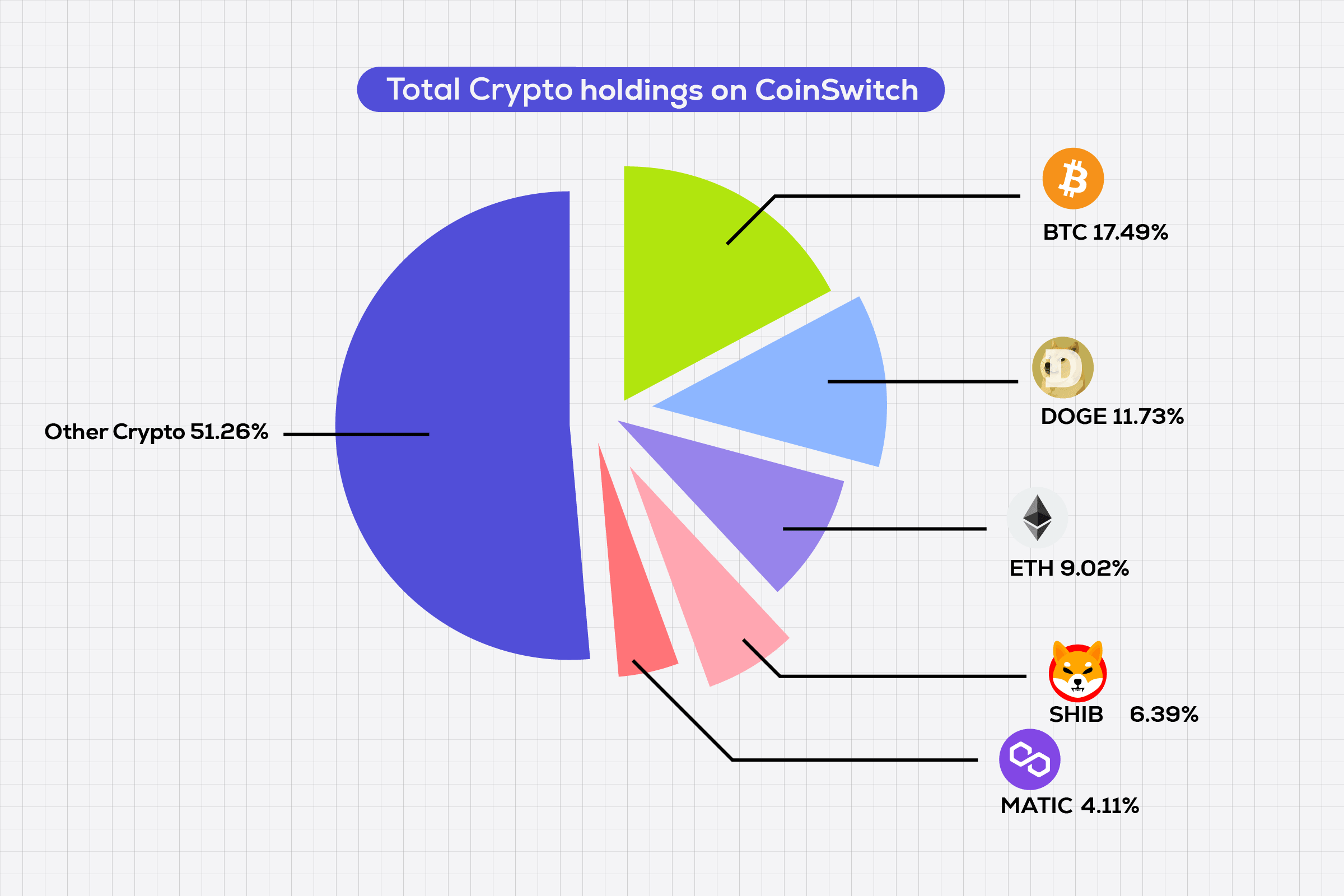

Total Crypto Holdings on CoinSwitch

To go a level deeper, we’d like to share more details on the crypto we hold. Here’s a look.

TLDR: CoinSwitch holds sufficient crypto assets—and then some more—to make your investment journey simple, safe, and seamless. The crypto assets are held in state-of-the-art custodial services with industry-leading security standards, including but not limited to multi-party computation and a maker-checker framework. Also, CoinSwitch does not reinvest or borrow against users’ crypto assets.

How Much Cash Do We Have

We didn’t stop at on-chain attestation and independent report of crypto assets. Our report also studied the cash holdings we have in bank accounts, payment gateways, and crypto exchanges using snapshots we provided, and matched them with the fiat currency (INR) funds our users have kept with us for buying and selling crypto on our platform.

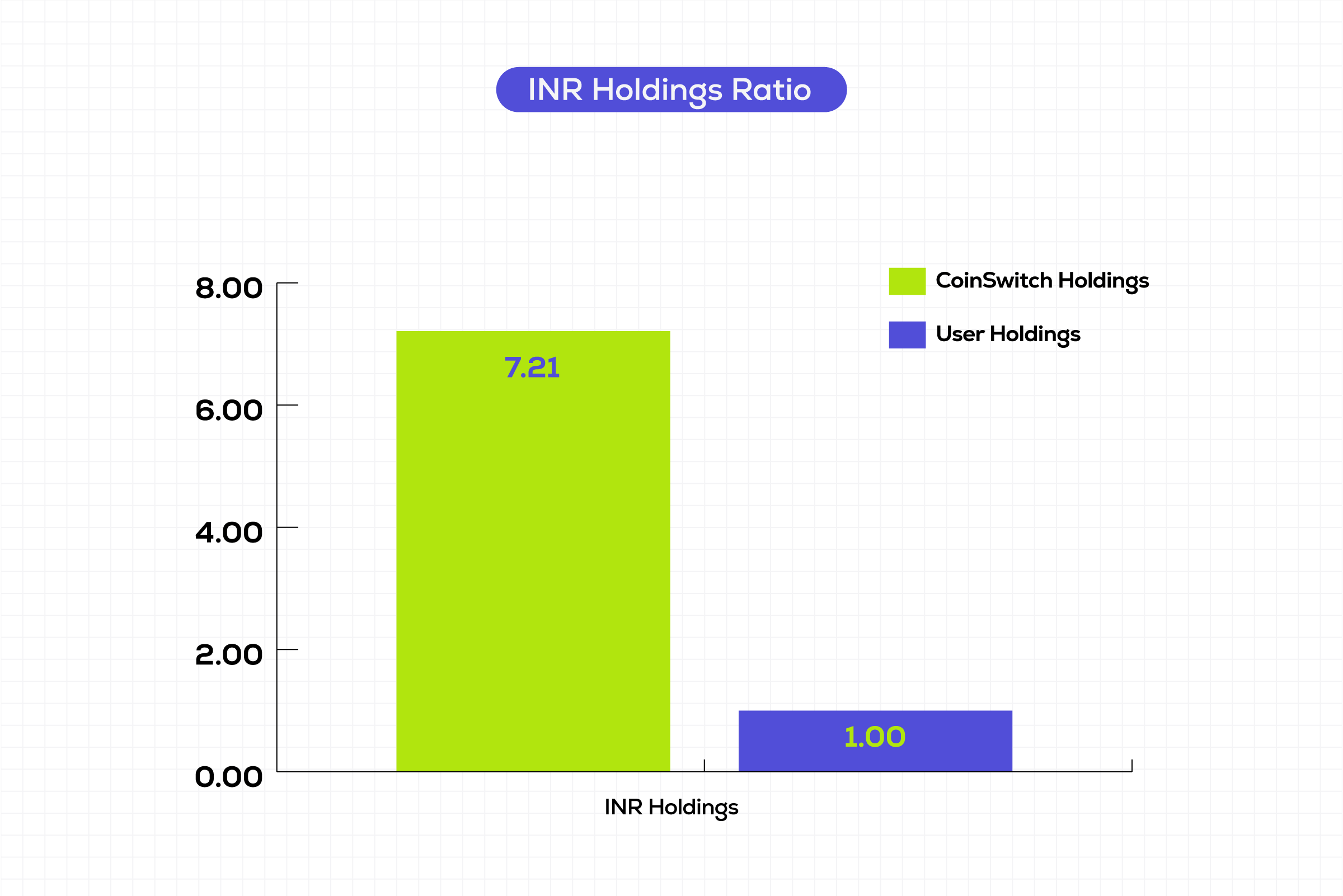

The independent report found CoinSwitch’s cash holdings in Indian Rupees are 7.21 times the Indian Rupees balance of our users.

This is to say, CoinSwitch has enough and more cash in the bank accounts to fulfill INR withdrawals by users 24×7. Moreover, such a study of cash holdings shows that CoinSwitch has a healthy runway to continue to build and grow through turbulent times such as these.

This is so because, in October 2021, we closed a $260 million (Rs 2151.96 crore at current rates) Series C funding round from Andreessen Horowitz (a16z), Coinbase Ventures and existing investors Paradigm, Ribbit Capital, Sequoia Capital India and Tiger Global, at a valuation of $1.9 Billion.

But don’t take our word for it. We encourage users to go through the full report attached below.

About this…

An independent report of crypto exchange’s books and holdings is a time-taking process. We initiated the review even before the FTX crisis. We voluntarily started this exercise in July 2022 as part of our trust and safety practices sometime after the crypto market crash in mid-2022 and the collapse of Vauld. Now that we have published our wallet addresses, our current crypto holdings can be validated by anyone on-chain.

Did the FTX collapse have any impact on CoinSwitch?

To reiterate, CoinSwitch never had any exposure to FTX, its native token FTT, or the sister trading firm, Alameda Research. The FTT token was never listed on the CoinSwitch app and hence our users had no investment in the asset on our app.

Next Steps…

Yes, this is where we want to be. At CoinSwitch, our priority is to build a trustworthy and transparent crypto industry in India. Proof of Solvency, which establishes our Proof of Reserves and Liabilities, goes a long way toward this.

As Vitalik Buterin proposes in this article a way forward is to use the Merkle tree technique to publish deposit pairs (user, balance) so that each and every user can check that their balance is included in the list, and that (i) every balance is non-negative, and (ii) the total sum is the claimed amount.

To protect the privacy of the users—so that their holdings are visible only to them and no other outside individual—this approach has to be combined with privacy-focussed techniques such as Zero Knowledge-SNARKs.

This is a technologically complex solution. We will explore this and any viable cryptographic solutions that may arise in the future.

Full Findings by INMACS:

INMACS Report

Watch our CEO and Co-Founder, Ashish Singhal, discuss our approach to Proof of Reserves and fund safety

Frequently Asked Questions:

1. Do you reinvest user tokens while they are in your custody?

CoinSwitch does not reinvest or borrow against user assets held in our custody. We earn from the commissions we charge for executing the buy and sell transactions on your behalf. That is our business model.

2. How secure is your custody service? What are the Security Standards followed?

The custodial wallets CoinSwitch uses to hold users’ crypto assets are provided by institutions of international repute. Access to these wallets are with CoinSwitch. Further, these wallets require multi-party computation; no single individual can execute a transaction, all transactions require a maker-checker mechanism.

3. Who controls these wallets?

The custodial wallets are in CoinSwitch’s control. The wallets are provided by third-party institutions of international repute, but the access to these wallets are with CoinSwitch.

Further, these wallets require multiple signatures to make any transaction. This is to say, no single individual at CoinSwitch can make any transaction out of these wallets. At CoinSwitch, we have a make-checker mechanism to ensure there is no unauthorized access to user funds.

4. Do you have any insurance to safeguard our investments?

We are in the process of exploring possibilities to insure the crypto holdings from Indian insurance companies. However, we have certain standard contractual protections in our agreements with third-party custody service providers and third-party crypto exchanges against the loss of our Crypto holdings on their platforms.

5. During such a bear market how are you able to run a business? What if you shut down tomorrow? What will happen to our funds?

CoinSwitch has a healthy balance sheet as we have raised enough funds and more to continue to build and grow through these turbulent times. In October 2021, we closed a $260 million (Rs 2151.96 crore at current rates) Series C funding round from Andreessen Horowitz (a16z), Coinbase Ventures and existing investors Paradigm, Ribbit Capital, Sequoia Capital India and Tiger Global, at a valuation of $1.9 Billion.

But don’t take our word for it. The independent report we undertook has attested to our cash holdings. This report shows CoinSwitch’s cash holdings in Indian Rupees are 7.21 times the Indian Rupees balance of our users.

6. Why are you not allowing us to withdraw our Cryptos?

CoinSwitch is a crypto investing platform and not a crypto utility platform. We enable our users to buy and sell crypto seamlessly in Indian Rupees. Users can sell their crypto assets and withdraw Indian Rupees into their registered bank account at any time. While we recognize that crypto withdrawal helps meet certain use-cases of crypto, that is not a service we provide at the moment.

Further, India does not yet have a well-defined regulatory framework to guide crypto platforms and users on transfer of crypto assets among individuals or across borders. Due to this regulatory void, we decided it is in the best interest of the users and the crypto industry, to disable the withdrawal of crypto assets on our platform. This is a balance we see necessary till there is more regulatory clarity in India.

7. Does CoinSwitch hold an emergency fund beyond the 1:1 assets to liabilities ratio?

Yes. CoinSwitch holds sufficient crypto assets and cash balance—and then some more—to make your investment journey simple, safe, and seamless.

On BTC, for instance, the ratio of our holdings against users is 1.71:1. This is to say, for every Bitcoin, our users remain invested in our platform, CoinSwitch holds 1.71 BTC. On USDT, the ratio of our holdings against users is 12.62:1. This is to say, for every USDT our users remain invested in our platform, CoinSwitch holds 12.62 USDT. The higher ratio is a reflection of CoinSwitch’s own holdings in bitcoin and USDT.

Further, as our independent report showed, CoinSwitch’s cash holdings in Indian Rupees are 7.21 times the Indian Rupees balance of our users.

8. Why not get audited by a Big Four firm?

The Big Four accounting and auditing firms in India do not verify proof of reserves of crypto firms. In such a scenario, we engaged with what we believe is the best available option. The credibility of INMACS and Mr. Vinod Jain, its founder, is well-known and can be validated from publicly available information. Mr. Jain is a respected Chartered Accountant with 42 years of rich industry experience, and has been a Member of the High Powered Committee appointed by the Finance Ministry to simplify Income Tax Law. He was also appointed by the Union Finance Minister as an Advisor to the GST Council for reviewing GST Law.

Further, an audit is not the same as proof of reserves. An audit is a process that involves going through the books of a company with a fine-tooth comb as prescribed by the authorities. Financial audits are usually done once every year. According to the laws of the land, once an audit is done, it has to be adopted by the company at an annual general body meeting and then filed with a corporate regulatory authority.

Our financials for the year ended 31st March, 2022 were audited, and we have filed the Statement of Account & Solvency with the regulators (The Union Ministry of Corporate Affairs); these filings can be accessed on the regulator’s website.

Our holdings report by INMACS is a separate engagement we initiated early this year to bring more transparency into our crypto and INR holdings and the assets we hold on behalf of our users. We provided INMACS with a detailed listing of crypto custody services and counter-party sources including crypto exchanges and wallet addresses of CoinSwitch, using a snapshot of web logins.

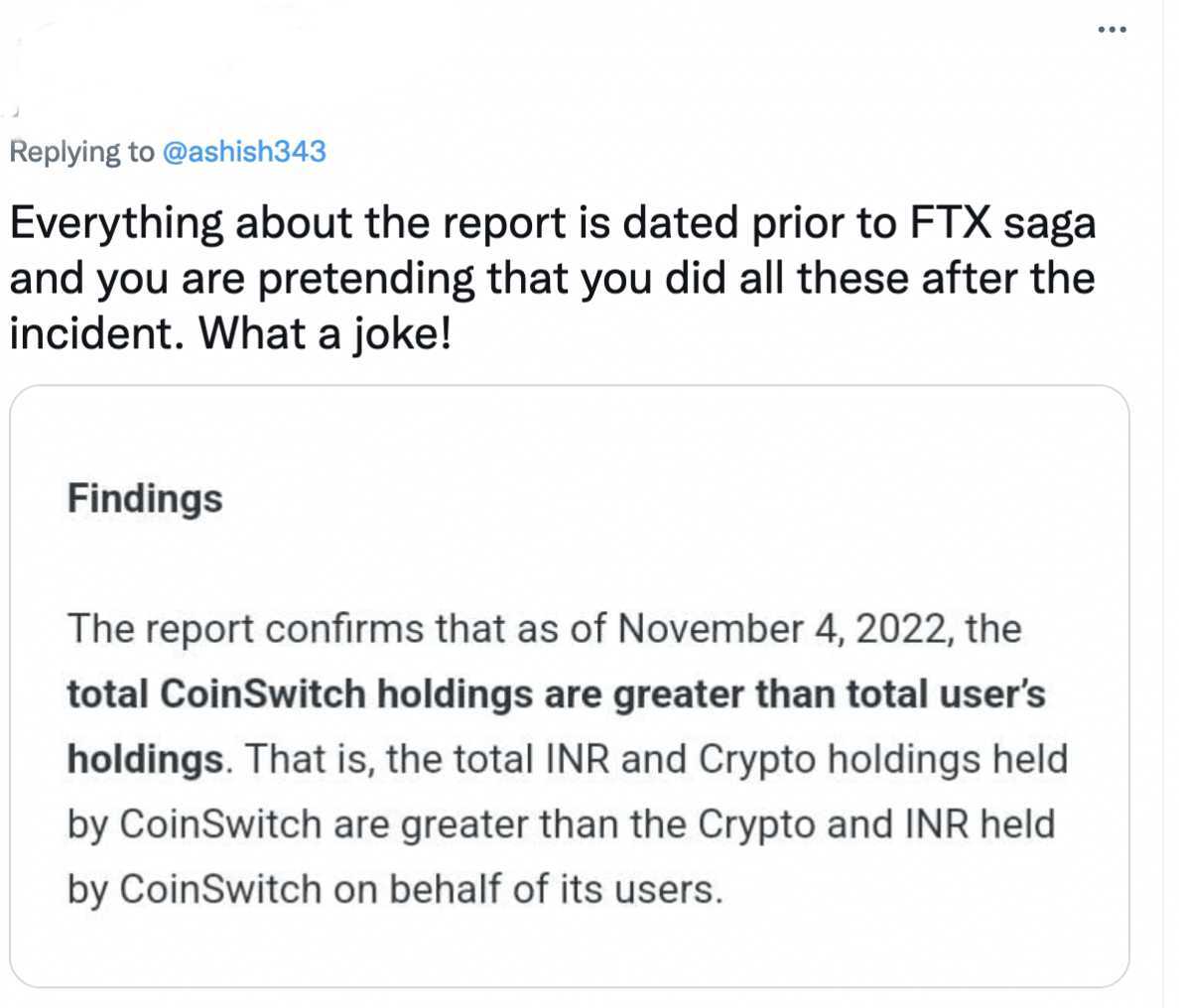

9. Why are you not publishing the report dated after FTX collapse?

We initiated the independent report even before the FTX crisis. We voluntarily started this exercise as part of our trust and safety practices in July 2022.

The report took time because they did extensive research on both our crypto holdings as well as Indian Rupee balances in various crypto custodians, crypto exchanges, bank accounts, and payment gateway accounts. The date of the report as well as the date of publishing the article summarising the report are intentionally published so we don’t end up misleading users.

But to reiterate, we have no exposure to FTX, its native token FTT, or the sister trading firm Alameda Research. FTT token was never listed on CoinSwitch, and no user of ours has bought them on our platform.

10. What about Merkle-Tree proofs?

A Merkle Tree proof is one of the ways to show proof of reserves. We are exploring how we can implement a Merkle tree technique to publish deposit pairs (user, balance) so that each and every user can check that their balance is included in the list, and that (i) every balance is non-negative, and (ii) the total sum is the claimed amount.

This is a technologically complex solution, and cannot be implemented in a short span of time. We will explore this and any viable cryptographic solutions that may arise in the future to provide our users with a complete overview of the assets and investments that we hold on their behalf.

11. Why not use services such as Nansen?

Since we have made our wallet addresses public, users or researchers may use any of the publicly available blockchain explorers to independently verify the holdings in these wallets. We believe this is a more open and flexible approach to validating the holdings.

Disclaimer:

This document/report is solely for information purposes, and is not intended to provide any legal, tax, accounting, or investment advice or recommendations. Users are strongly advised to do their own research (DYOR) before buying, selling, or storing any Crypto or INR on any Crypto platform. Crypto assets and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Your usage of the CoinSwitch platform shall remain subject to various terms and policies as available on www.coinswitch.co.