The Budget Session of Parliament was held from July 22 to August 9, 2024. As this was the first full-fledged sitting of both Houses of Parliament after the 2024 General Elections, there were considerable expectations on what the new government’s first Budget would offer for the Virtual Digital Asset (VDA) sector. While the Economic Survey highlighted the potential of blockchain technologies, the Union Budget did not change the existing tax framework for VDAs. At CoinSwitch, alongside the Bharat Web3 Association, we continued our advocacy for tax rationalization and regulatory clarity, engaging with policymakers and Members of Parliament. This blog post details the latest policy-related developments, highlighting the key discussions.

Economic Survey 2024

The Economic Survey 2023-24 was tabled in the Parliament on July 22. While there were no elaborate references to cryptoassets, the Survey highlighted the utility of blockchain multiple times.

Sharing some relevant excerpts below:

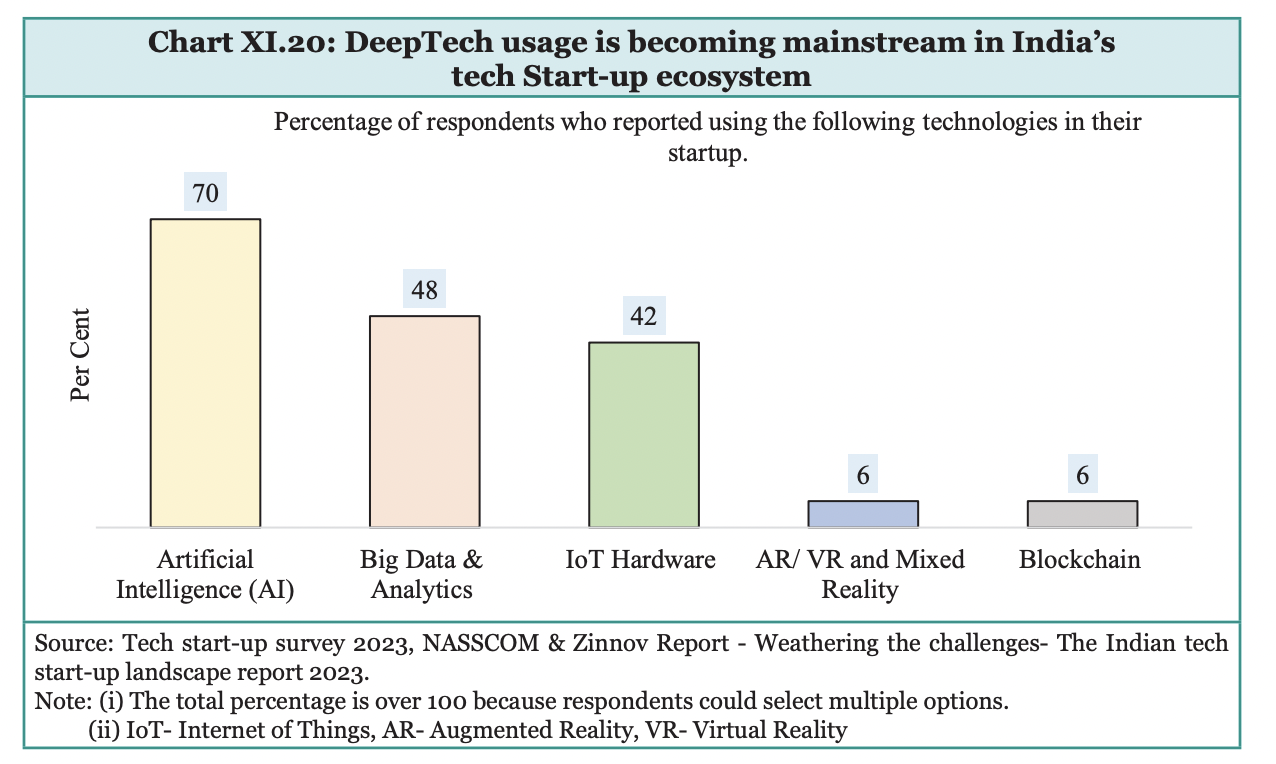

- The world is in the midst of a fourth industrial revolution characterized by novel ways in which technology is becoming embedded within societies through ‘cyber-physical systems,’ Internet of Things (IoT), big data, nano-technology, and networks. Evolving forms of machine learning, AI, blockchains, genetic engineering, quantum computing, advanced analytics, automation, and advanced manufacturing technology are some examples of what constitutes this technological revolution. Against the backdrop of this evolving revolution, the future of job markets in India is undergoing a significant transformation, as is happening in the rest of the world.

- To incentivize GCCs in India, promoting specializations in higher education is essential. Focus areas should include Blockchain, Artificial Intelligence (AI), Machine Learning, Internet of Things, Cybersecurity, Cloud Computing, Big Data Analytics, Augmented Reality, Virtual Reality, 3D Printing, and Web and Mobile Development.

- As India looks forward to creating millions of jobs by 2030, dovetailing this transformation in the demand-supply dynamics of services is pivotal to meeting the hiring requirements in the medium term…Focus areas should include blockchain, AI, machine learning, Internet of Things, cybersecurity, cloud computing, big data analytics, augmented reality, virtual reality, 3D printing, and web and mobile development. Thus, the immediate task of the skilling program in India is to plan and equip itself to meet these requirements adequately.

Union Budget 2024

Finance Minister Nirmala Sitharaman made history with her seventh consecutive Union Budget presentation on July 23. However, there wasn’t any good news or relief for the Virtual Digital Asset (VDA) sector. Even after repeated requests for tax rationalization for VDAs, the Budget did not offer any relief. Neither were any changes or additional tax imposed on the VDA transactions, which can perhaps be considered a relief in itself.

CoinSwitch, along with industry bodies, including Bharat Web3 Association (BWA) have been asking for a reduction of TDS on VDA transfer from 1% to 0.01%, allowing offset/carry forward of losses, and revision of the high 30% tax on gains. CoinSwitch was part of the BWA delegation that participated in the pre-budget Consultation by the Ministry of Finance. Before the Budget, R Venkatesh, Senior Vice-President, Public Policy, CoinSwitch, published an article in the Economic Times on cryptoasset regulation and taxation.

The CoinSwitch Public Policy team engaged in post-budget interactions and discussions with the Ministry of Finance, organized by the Confederation of Indian Industry (CII). We had a one-on-one discussion with the Chairman of the Central Board of Direct Taxes. During the discussion, we reiterated our concerns regarding several taxation issues, including the 1% TDS, the 30% tax rate, and the lack of provision for offsetting losses.

We will continue to engage with the full range of stakeholders to foster a comprehensive regulatory and taxation regime for VDAs in India.

Engaging MPs

Almost half of the newly-elected Members of Parliament in the 18th Lok Sabha are first-timers. Many experienced MPs have also been re-elected. CoinSwitch team along with the Bharat Web3 Association met MPs from different political parties to discuss a wide range of issues including skill development in the Web3 sector, blockchain start-ups, VDA taxation, and regulations.

Parliamentary Q&A

There continues to be considerable interest among our MPs in Web3, blockchain, and VDAs. MPs across political parties have raised several questions to different government ministries on various issues around these sectors.

| Date | Member of Parliament | Topic | Reply |

| July 29 | Y S Avinash Reddy (Lok Sabha) | Regulations on Crypto Assets | Ministry of Finance |

| July 31 | Ayodhya Rami Reddy Alla (Rajya Sabha) | Training Programme For Emerging Technologies | Ministry of Skill Development and Entrepreneurship |

| Aug 5 | G M Harish Balayogi (Lok Sabha) | Regulation of Virtual Digital Assets | Ministry of Finance |

| Aug 6 | Lavu Sri Krishna Devarayalu (Lok Sabha) | Kasturi Cotton Bharat Programme | Ministry of Textiles |

| Aug 9 | K R Suresh Reddy (Rajya Sabha) | Technological Expertise for Blockchain Effectiveness for

MSMEs |

Ministry of Electronics and IT |

The interest in the Web3, Blockchain, and VDA sectors is encouraging, and points towards increasing confidence, even if gradual, towards these sectors. We continue to engage with a wide range of stakeholders on our key taxation and regulatory issues.