Wash trading—unless you are new to capital markets, you have likely heard this term. In traditional finance, it is illegal but not an uncommon phenomenon. Wash trading refers to an activity where a trader or a group of traders collude to buy and sell a security multiple times to create a false impression of interest in it. This interest, thus, contributes to the value of the asset. In nearly every country, such activity is barred, and stock market traders are penalized if found guilty. That is not the case for crypto assets and non-fungible tokens (NFTs). Both the byproducts of blockchain technology are yet to be regulated.

For those unaware, NFTs refer to the tokens on the blockchain that are unique and non-interchangeable. You could compare them to highly collectible trading cards, paintings, or one-of-a-kind jewelry, except they are all digital. However, the use cases of NFTs lie far beyond their aesthetics and collectibility attributes.

In 2021, NFTs became one of the most popular commodities to purchase, not just within the crypto community but amongst GenZs and millennials across the globe. However, with the hype came illicit activities, including wash trading. The lack of well-defined rules has provided a perfect opportunity for wash traders to capitalize on FOMO that NFTs have caused in the past year.

How is wash trading done?

Typically, an NFT seller or a group of traders repeatedly trades an NFT from one wallet to another to artificially inflate asset prices. For example, if a trader has a CryptoPunk worth 15 ETH and wants to sell it for a higher price, he can send it to another self-funded wallet address at a higher value of 17 ETH. By sending the NFTs back and forth at a higher value, the trader could create an artificial demand for that CryptoPunk NFT.

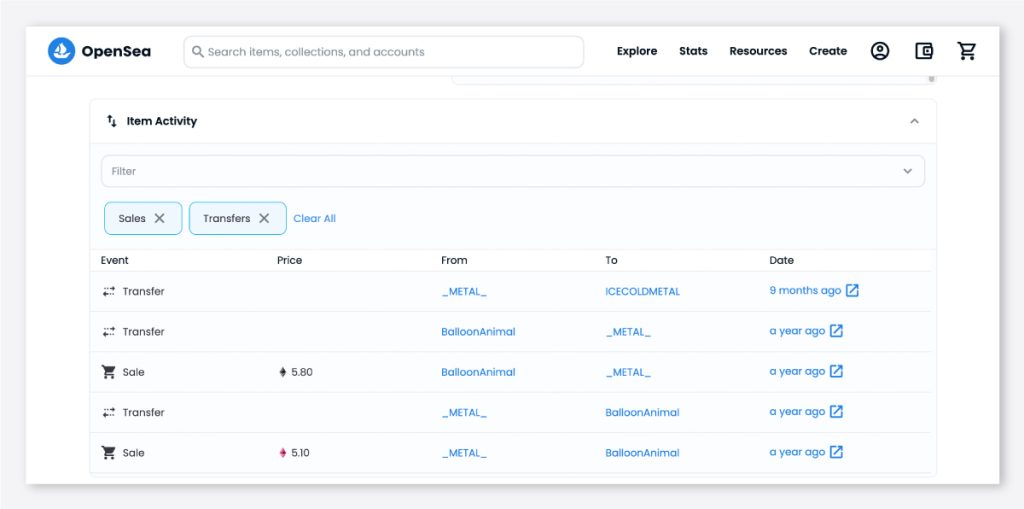

Wash trading isn’t a hypothetical scenario, of course. Last year, the price of an NFT of the popular CyberKongz collection was artificially inflated. On July 24, 2021, CyberKong #2526 was minted by a user ID “_METAL_”, who later sold it to user ID “BalloonAnimal” on November 21 for 5.10 ETH. As you can see from the image below, the “BalloonAnimal”, transferred the token back to “_METAL_” for 5.80 ETH on the same day—a classic example of wash trading.

While the above example was quite apparent, wash traders can use extremely complex patterns to cover their tracks.

How common is wash trading?

A study by Chainalysis, a blockchain analytics firm, revealed at least 262 users who have sold an NFT to a self-financed wallet address more than 25 times. While more than half of the wash traders were unprofitable due to the gas fees they had to incur, about 110 traders were able to generate $8.9 million in profit from such activity.

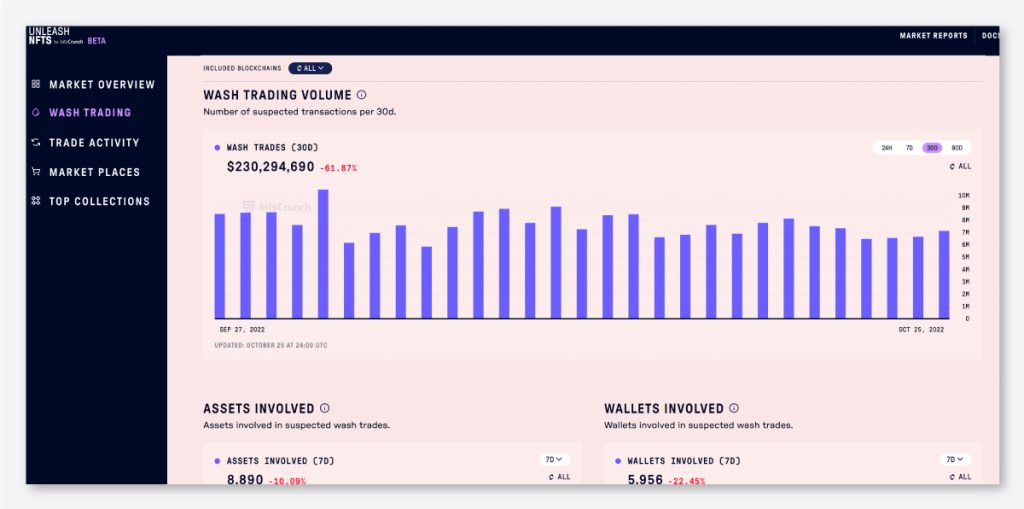

Further, according to research by bitsCrunch in April 2022, nearly 34% of the total transactions conducted on the Ethereum blockchain were wash-traded. The analytics platform also discovered that the value of top collections Bored Ape Yacht Club and CryptoPunks were inflated by 39.44% and 24.22%, respectively, some of which is likely contributed by wash trading. As of October 20, 2022, over $235 million worth of NFT trading volume was wash-traded in the last 30 days across top NFT marketplaces.

Clearly, wash trading has become a scourge as NFTs rose in popularity. When prices are artificially inflated, legitimate and unsuspecting collectors and investors could pay far more than an NFT is worth, putting their investments at risk. Artists and NFT startups also stand to lose their credibility in the long run, even if it may seem that wash trading may prop up NFT projects in the short run. Worse, wash trading can significantly reduce engagement in the NFT ecosystem, potentially hindering its development and use cases.

Can you prevent wash trading?

Identifying wash trading, thus, becomes crucial before investing in an NFT project. Doing your own research and determining the right tools before investing not only allows you to prevent malpractices but also offers you better insights into the ecosystem. Platforms like Etherscan and Chainalysis provide in-depth details into transactional activities in the blockchain ecosystem. Similarly, Unleash NFTs offers market insights, transaction details, and statistics into NFT collections and marketplaces.

The importance of NFTs cannot be understated. It benefits artists, creators, and collectors—people who have been exploited by centralized middlemen and tech giants. Fixing the flaws in the space is, therefore, essential.

Technology births technology and this truly stands for the Web3 industry. Some key developments in the space have ensured there is substantial transparency and awareness, ultimately leading to investors making informed decisions. It is, therefore, important to not let solvable issues throttle over the technological advancements the NFT and the wider Web3 industry are making.