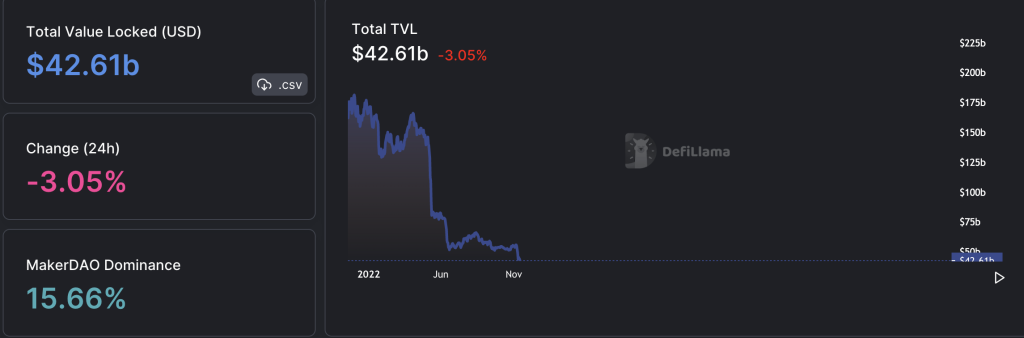

Total Value Locked (TVL), an important metric that tracks the performance of Decentralized Finance (DeFi) platforms, has tanked. The TVL of various DeFi platforms fell to $42.61 billion this Monday, according to DeFi tracking platform DefiLlama. Over $10 billion was lost in a span of three days. Down from $55 billion at the start of last week, the TVL score is currently at a 19-month low.

The drop in TVL is not due to large-scale withdrawals. Instead, it has to do with a drop in the price of DeFi tokens. Slumping by over 60% in the last seven days, the Solana ecosystem was the worst hit. Its TVL fell from $1 billion level to $325 million at the press time.

For a few weeks, the TVL showed some stability and even a little recovery with the price of ETH approaching $1,600. However, following the FTX saga, all the gains have reversed. The second-largest valued blockchain protocol, Ethereum, has now lost close to $7 billion in TVL. It is currently at $25 billion, putting it close to its two-year low.

The reports have emerged at a time when investors have had very little to look forward to. The crypto market and global financial market are both confronted by the perils of a centralized financial system. Additionally, the failure of centralized crypto platforms is one of the main causes of the crypto market’s poor performance.

Other leading DeFi protocols, including AVAX, LINK, and AAVE, have also seen a double-digit decline. However, Polygon witnessed a small drop of 4% in TVL in the last seven days, declining from $1.36 billion to $1.11 billion level. Meanwhile, Loopring (LRC) TVL stayed stable.

With the price of crypto assets dropping, fears becoming frequent, and the markets facing more withdrawal requests, the TVL of top smart contract protocols is likely to remain under pressure.