While there are a mind-boggling number of crypto exchanges, they mainly are of only three types—CEXs, DEXs, and Hybrid Exchanges. So which one should you choose? Is any one of them safer than the others, and if so, what are the trade-offs? If you’re looking for a simple guide that will help you answer some of these questions, read on.

What is cryptocurrency?

A cryptocurrency is a type of digital asset that runs on a decentralized network—such as a blockchain. Unlike fiat currencies and many assets in the real world, these assets do not have the backing of a centralized agency. And the transactions are not conducted via one. Instead, a network of computer users supports and manages the creation and circulation of these assets. So while they are like your upcoming digital rupee, they are surely not the same thing.

What are exchanges?

An exchange, of course, is a platform where buyers and sellers exchange things of value. Users of crypto exchanges buy crypto on them, deposit them in wallets, or trade them with other users.

Types of crypto exchanges

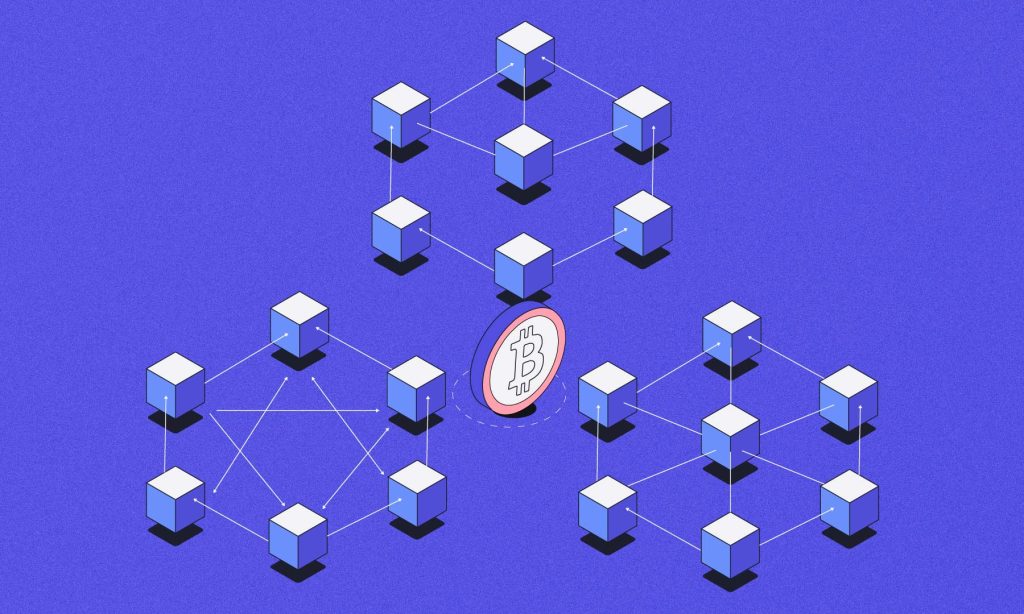

There are basically three types of crypto exchanges—Centralized Exchanges (CEXs), Decentralized Exchanges (DEXs), and Hybrid Exchanges (HEXs).

Centralized Exchange (CEX)

A centralized crypto exchange—abbreviated as CEX—is one such platform. The exchange is usually run on a centralized server, hence the name. It works by matching buyers and sellers, thus facilitating the transaction. In exchange, CEXs charge a fee for each trade.

CEXs offer a user-friendly and familiar trading interface. They, therefore, make it easier for new users to enter the crypto market.

Although such exchanges follow high governance standards, they have several drawbacks. CEXs are vulnerable to hacks and security breaches, as all funds are held on the exchange’s servers. They can also suffer from poor liquidity, resulting in high fees and slower transaction times.

Additionally, centralized exchanges can be subject to regulatory scrutiny and may require users to share personal information. The sharing of such information leads to less privacy and security. However, they mainly do this to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) laws—a fact that makes them more government-friendly.

Decentralized Exchange (DEX)

Unlike CEXs, a decentralized crypto exchange, or a DEX, is a platform that does not rely on a central authority. Instead, it has an automated system that enables exchanges between buyers and sellers. The transaction it enables is a Peer-to-Peer one. They also use smart contracts (self-executing bits of code on a blockchain) to facilitate private transactions. You can read more about them here.

How are decentralized exchanges different?

Simply put, DEXs are different from CEXs in that they do not rely on a central authority to facilitate trade. Instead, DEXs use smart contracts and blockchain technology to enable peer-to-peer trading of crypto assets.

DEXs have significant advantages, such as relatively low transaction costs and higher security. However, they do have disadvantages. Low volumes, liquidity, and the absence of a trusted intermediary for conflict resolution are some of them.

Hybrid crypto exchanges

Hybrid crypto exchanges combine the best of CEXs and DEXs. They allow users to trade crypto assets on a centralized platform with the added benefits of decentralized trading, such as increased security and control over funds.

What’s the need for hybrid exchanges?

Such exchanges offer big volumes at lower transaction fees while also securing much-desired security and governance standards. Moreover, hybrid crypto exchanges allow trading in a broad range of currency pairs.

Hybrid exchanges offer users the best of both worlds. There’s high liquidity and fast transaction speeds, with greater control over one’s funds, thanks to blockchain technology.

CEX vs. DEX vs. HEX: The three types of crypto exchanges at a glance

CEXs are centralized exchanges that are owned and operated by a central authority. DEXs, on the other hand, are decentralized. So they rely on smart contracts and peer-to-peer trading to facilitate trading. HEXs are hybrid exchanges that combine the benefits of both types of exchanges. That’s the broad answer. For a more specific answer, read on.

Ease of use

CEXs are generally considered easier to use than DEXs. That’s because the former has a user-friendly interface, and it supports a wider range of trading pairs.

Custody of funds

DEXs are generally better for the safekeeping of funds, as users control their own wallets and private keys. In other words, the funds are in their custody. This reduces the risk of security breaches and hacks.

Transaction speeds

CEXs generally offer faster transaction speeds than DEXs. They can process a larger volume of transactions and have a more sophisticated infrastructure.

Security

A secure exchange should have strong security protocols, such as multi-factor authentication, cold storage of funds, and regular security audits.

Conclusion

When choosing a crypto exchange, it’s important to consider factors such as security, reputation, fees, liquidity, and supported cryptos. Research the exchange thoroughly before signing up and depositing funds. Also, it’s often safer to opt for a reputable exchange with a good track record of secure operations.

FAQs

What are the types of crypto exchanges?

Broadly there are three types of crypto exchanges—centralized exchanges (CEXs), decentralized exchanges (DEXs), and hybrid exchanges. Each has its own unique features and benefits.

What’s the difference between a CEX and DEX?

CEX and DEX are two types of crypto exchanges. CEXs are run by a centralized authority or intermediary and offer a more user-friendly experience. But they are less secure than DEXs. DEXs, on the other hand, operates on a decentralized network. So they offer increased security and control over funds but are typically less user-friendly.