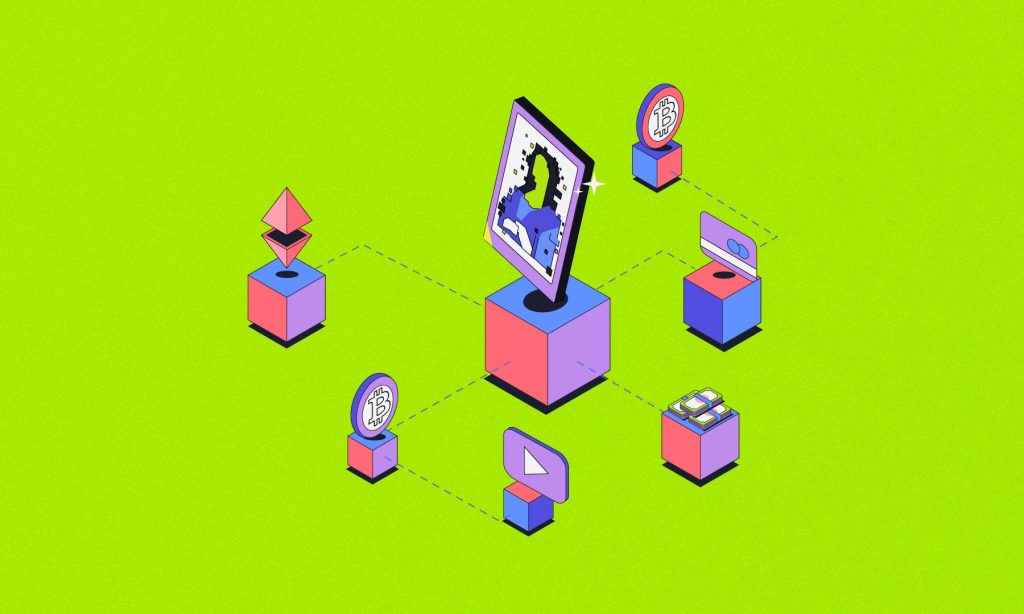

What do organizations look like in the world of Web 3.0 and decentralization? DAOs are the answer. But what are they exactly, and how do they work? Keep reading to find out.

What is a Decentralized Autonomous Organization (DAO)?

A Decentralized Autonomous Organization (DAO) is an organization that operates on the blockchain. The idea is to create decentralized self-governing entities that can operate transparently, efficiently, and independently.

The advantages of DAOs stem from the fact that they operate on a blockchain network. This reduces the potential for corruption and fraud and ensures all members have an equal say in decision-making. DAOs essentially work through rules encoded as computer programs called smart contracts. Smart contracts are what automatically and transparently enforce the rules without intermediaries.

In a DAO, decisions are thus made collectively and democratically. The token holders are the members of the DAO as they have a stake in it. They receive votes in proportion to the number of tokens they own. Many DAOs use crypto to incentivize members to contribute to the organization.

DAOs have the potential to revolutionize traditional organizational structures. They are often associated with the crypto and blockchain industries, but their potential applications are not limited to this field. Instead, they can be useful in various industries, including finance, healthcare, and governance.

What is the purpose of a DAO?

The purpose of a DAO is to create an organization that operates transparently, efficiently, and democratically, even when a central authority oversees it. DAOs enable members to make decisions collectively to execute projects.

DAOs can also be built to meet specific goals and objectives. For example, a DAO can help fundraise for a specific project, such as building a dApp. Alternatively, a DAO may be created to provide a platform for decentralized decision-making, so members can vote on proposals and allocate resources.

In addition, DAOs foster a sense of community.

Top DAOs

Here’s a quick list of some of the top DAOs in the market. You could use this list to kickstart your own research.

Uniswap

Uniswap is a decentralized exchange that operates on the Ethereum blockchain. It allows users to trade cryptos without intermediaries, such as banks or other centralized exchanges.

MakerDAO

MakerDAO is a crypto trading platform that allows borrowing and lending. It has two crypto tokens associated with it, stablecoin DAI and MKR.

BitDAO

This DAO focuses on funding blockchain projects and promoting the adoption of DeFi and Web 3.0 technologies. It runs one of the largest token-governed treasuries in the world.

Aragon

The Aragon platform creates and manages other DAOs. It provides governance, fundraising, and community management tools, allowing organizations to operate autonomously and transparently.

Decred

Decred is a crypto that uses a hybrid Proof-of-Work (PoW) and Proof-of-Stake (PoS) consensus mechanism. It is designed to be a more decentralized and democratic alternative to Bitcoin.

0X

0x is a decentralized exchange protocol allowing users to trade crypto without intermediaries. It is designed to be open, permissionless, and interoperable.

Dash

Dash is a crypto that aims to be a fast and secure alternative to Bitcoin. It uses a two-tier blockchain for faster transactions and more efficient governance.

Compound

Compound is a DeFi protocol that allows users to lend and borrow crypto. Its governance token (COMP) plays a key role in enabling community-driven decision-making.

Curve DAO

Curve DAO is a DAO that operates a decentralized exchange for stablecoins. It provides low-slippage trading and high yields for liquidity providers.

Aave

Aave is another protocol that allows users to borrow crypto without intermediaries. It uses a unique system of interest rate swaps to provide more stable and predictable returns.

Conclusion

DAOs are all the rage in blockchain technology. But they are complex to set up and operate. As with any new technology, there is also regulatory uncertainty surrounding DAOs. This can make navigating the legal landscape difficult and ensure compliance with local laws.

Additionally, DAOs are vulnerable to security risks like hacking and smart contract bugs. A hack can undermine the community’s trust in the DAO. So, while DAOs are decentralized and autonomous, they still require governance structures to function properly.

More importantly, DAOs rely on automation and operate based on code. That means there is no human interaction in decision-making. This lack of human interaction can lead to a lack of accountability and transparency in the long run.

FAQs

Why were DAOs made?

Decentralized Autonomous Organizations (DAOs) enable decentralized decision-making and governance on blockchain networks. They are more democratic and transparent than traditional institutions when it comes to communities organizing themselves and managing shared resources.

What is an example of a DAO?

MakerDAO is an example of a DAO platform. It is a decentralized lending platform that allows users to generate a stablecoin called Dai by locking up other cryptos as collateral. MakerDAO’s community of token holders governs it and can propose, vote on, and implement changes to the platform’s policies and functions.

What are the most popular DAOs?

Some popular DAOs include MakerDAO, Aave, Compound, Uniswap, and Curve DAO. These digital organizations provide decentralized financial services such as lending, borrowing, trading, and liquidity provision.

Where does DAO work?

Decentralized Autonomous Organizations (DAOs) operate on blockchain networks. A DAO is an organization represented by rules encoded as a computer program that is transparent, controlled by the organization members, and not influenced by a central government. DAOs leverage smart contracts, which are self-executing contracts where the terms are directly written into code.