Your credit score shows how well you manage your finances. In other words, it measures how responsibly you use your money and manage loans. Having the highest credit score can help you get lower interest rates on loans and make it easier to get credit cards. Typically, the maximum credit score possible in India is 900 (CIBIL score), and you can get there by planning your finances wisely and sticking to good financial habits. A credit score above 700 tells lenders the individual is unlikely to default on payments.

If you think your score is low, you can improve it over time. Timely payment of bills, reducing your debt, and not maxing out your credit lines are good ways to improve your credit score. Understanding your credit score is the first step to getting a grip on your finances. This blog post will discuss how to achieve the best possible credit score for greater financial flexibility.

How do credit scores work?

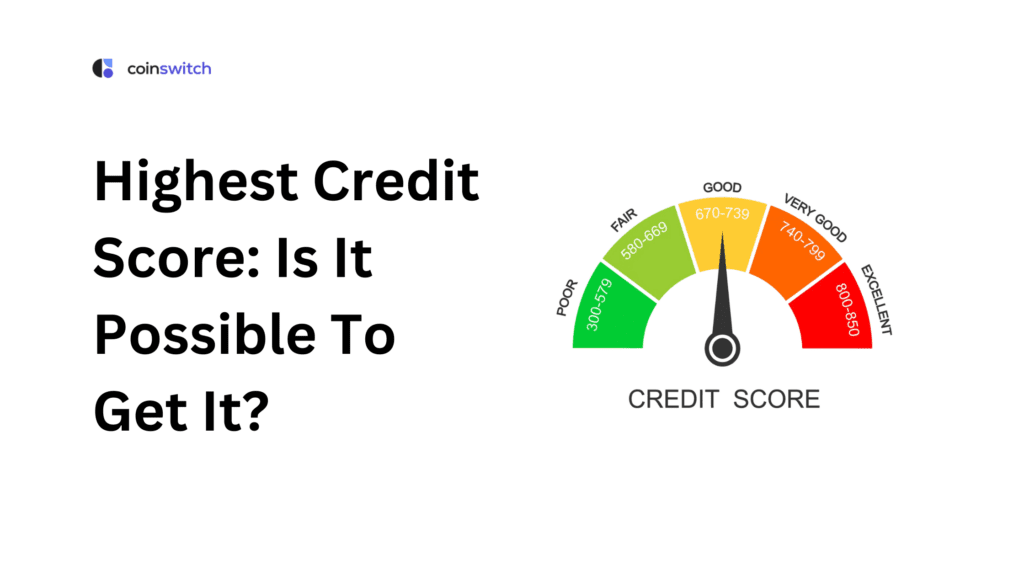

A credit score is a numerical expression of how you use credit and debt. It is determined by your credit history, including loan payments, use of credit cards, and other financial habits. This score is used by lenders to determine your eligibility for a loan or credit card. Credit scores usually fall between 300 and 900.

A good score implies that you are prompt in making on-time payments. A bad score indicates that you might have missed some payments, or you have borrowed a lot. On-time payment of bills, low balances on credit cards, and not taking too many loans will improve your score. Credit bureaus use your financial information to determine your score.

Websites or apps will enable you to monitor your credit score. Awareness of your score can assist you in the management of your money. A higher score that is near the maximum credit score can assist you in obtaining loans with lower interest rates. It also enhances your chances of having credit cards, home loans, or car loans approved. Try to maintain a good credit rating at all times. Between 2024 and 2029, it is forecast that the total number of credit cards in use in India will rise steadily by 2.3 million.

Credit Score Range

Credit scores in India are usually between 300 and 900. This score indicates your trustworthiness when it comes to paying back money. The highest credit score is 900. The higher the score, the more the lenders trust you.

These scores are given by different bureaus. The most common one is CIBIL. Credit scores are also given by Experian, Equifax, and CRIF High Mark. All are calculated by the same range, but the calculation varies.

In general, we can say

750 or higher is outstanding

700-749 is good

650-699 is average

A score lower than 650 is indisputably bad.

In your credit report, everything is disclosed: accounts, balances, payment dates, and credit inquiries. Using more than 30% of your credit can reduce your score. Experts recommend utilization below that.

High debt also brings your score down because roughly 30% relies on outstanding debt. When lenders check you, your score can be minimally decreased.

To get a better score:

· Make timely payments

· Maintain low balances

· Maintain old accounts

· Restrict hard pulls

Briefly put, the highest attainable credit score is 900. Good habits can qualify you to get a maximum credit score and sustain it.

Factors that Can Affect All Your Credit Scores

Several factors can impact your credit scores. Remember, on-time payments are beneficial for your credit, but late or missed payments and bankruptcy can harm it. Using smaller portions of credit can improve your report. Keeping your credit utilization rate low can be beneficial.

Also, older historical accounts are more useful. If you use both credit cards and loans, your score may go up. In the end, your recent financial behavior is checked, and opening several accounts could result in a drop in your score.

Read More: Line of Credit (LOC): When to Use Them and When to Avoid Them

Getting the Highest Credit Score

Getting a maximum credit score doesn’t happen by using shortcuts. For that to happen, it is essential to maintain your smart habits consistently. The following tips will teach you how to maintain and strengthen your credit score.

● Pay Your Loans on Time

Pay your loan and credit card bills when they are due. Make payments automatically or add reminders to your phone. Your credit score suffers if you pay back your loans late. If there are any payments you missed, clear them up and stay on top of your credit score.

● Keep Credit Card Balances Low

Limit your use of your credit lines. Keep your spending at no more than 30% of the limit on your card. Don’t move all your debts to a single credit card. High utilization can hurt your credit, while low usage helps you.

● Build a Long Credit History

When you act responsibly with your credit over many years, your score goes up. Keep your accounts open, especially if they have always been in good condition. Individuals with a consistent history of paying their bills on time are more likely to be trusted by lenders.

● Only Apply for Needed Credit

Don’t open several accounts for cards or loans at once. It might appear that you’re having difficulty handling your finances. Don’t request credit if you don’t need it. There are risks to your credit score if you apply for multiple loans.

● Check Your Credit Reports

Check your credit report often to see if there are any errors. Address errors as soon as you notice them. It is also essential to look at accounts you haven’t used in a while. Being alert with your finances defends your credit and helps you get the maximum credit score.

Advantages of a Good Credit Score

A credit score showing you manage your finances well is like a good report card. It highlights the level at which you control your finances and settle your obligations. Now, let’s find out why a high score matters.

● Easier Loan Approvals

Lenders trust people with strong credit scores. It proves that you pay your bills on time. A high score makes it more likely for you to get approved for loans. Do your best to achieve a high credit score for improved benefits.

Lower Interest Rates

Having an excellent credit history gets you access to low-interest loans. As a result, you end up paying less for your loan. Scoring the highest credit score can help you save a lot.

● Better Credit Card Offers

Scoring high gets you attractive offers for credit cards. Among these are increased limits and better rewards. Having a high credit score increases your chances of being approved for exclusive credit cards with numerous benefits.

● Easy Approval for Rentals

Landlords usually want to see your credit report when you rent a house. A positive credit history is trustworthy. A high score can help make your rental application more successful. Getting a maximum credit score will make you more desirable to lenders.

● Stronger Job Prospects

In rare instances, employers screen job candidates based on their credit scores. A high score demonstrates that someone is responsible. Gaining a high credit score improves your chances in the job market.

Read More: Credit Cards vs. Debit Cards: What’s the Difference?

Disadvantages of a Poor Credit Score

Your credit score shows how well you manage the money you have borrowed. The higher the score, the better.

● A poor credit score can make it more difficult for you financially. There is also a significant risk that your loan will not be approved.

● If your score is not high, a bank may refuse to give you a loan. If they do approve it, the interest rate would be very high. You will incur higher fees throughout your use of the service.

Generally, a poor credit score means you have fewer choices available to you. It often leads to increased costs and adds stress to everyday life. To get a maximum credit score, make all your payments on time, pay down your debts, and review your report for any errors.

The Bottom Line

You must invest time and effort if you want the highest credit score. Making your payments on time, having limited debt, and avoiding adding many new accounts are essential.

A maximum credit score means you are good at handling your finances. Continue to develop good habits to maintain or approach your best possible credit score.

FAQs

1. Is it possible to have the highest credit score?

You can reach the highest credit score, 900, in your credit history. Pay every bill promptly, watch your debt, and make an effort to keep your credit accounts for an extended period.

2. Can I get a 900 credit score?

A CIBIL score of 900 is rare, as it is held by few people. If you achieve a score of 750 or more, you fall into a very good or exceptional category, which will help you secure better interest rates.

3. Can you have a 100% credit score?

You can never get a perfect 100% credit score. In India, 900 is the highest score on your credit report. If you build good financial habits, it could get you much closer.

4. How rare is an 800 credit score?

Achieving this credit score requires patience and effort, but it is not as daunting as it may seem. According to Experian, 22% of consumers already have excellent credit, and 28% are moving in that direction, classified as very good credit.