We’ve reached the final day of September, and the crypto market today is looking dramatically different from just 48 hours ago. After yesterday’s massive, whale-backed recovery, Bitcoin price today India is doing what matters most: holding above the ₹1 Crore mark with confidence. This quarter-end stability suggests the “Red September” volatility has finally run its course.

The mood has shifted from uncertainty to strategic positioning. Traders are no longer scrambling for cover but are actively assessing assets ahead of major Q4 macro events. This is a clean break, the market has absorbed the liquidations and is now building a strong technical foundation for the months ahead.

Key Indices & Statistics for the Indian Market

The overall environment is stable, with Bitcoin gaining ground and market dominance firming up.

| Metric | Value | Commentary |

| Global Market Cap | ~$3.92 Trillion | A clear rebound since the weekend lows, confirming renewed institutional and retail participation. |

| 24‑h Trading Volume | ~$155 Billion | Volume remains healthy but cool—a sign of stabilization rather than panic or manic buying. |

| Bitcoin Dominance | ~57.9% | BTC is absorbing capital from the broader market, reinforcing its leadership position into the quarter-end. |

| INR Price Reference | ~₹88.79 per US Dollar | Domestic currency stability keeps the local price action closely tethered to global spot prices. |

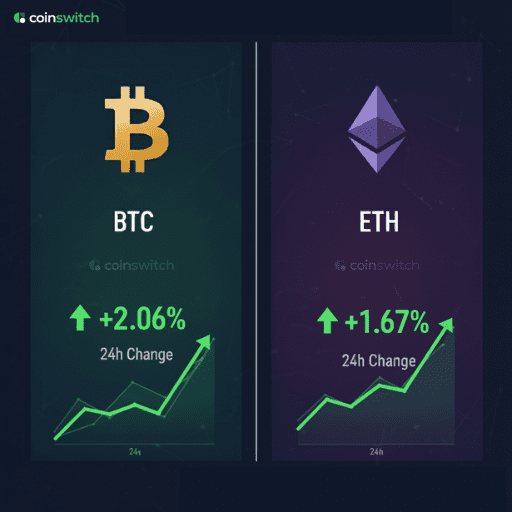

Bitcoin & Ethereum Price Movement (24-hour)

The latest live data confirms a continued upward push from the strong Monday morning rally, defying any lingering fears of a deeper correction.

| Metric | Bitcoin (BTC) | Ethereum (ETH) |

| Price (approx. INR) | ₹1,01,14,240 | ₹3,71,675 |

| Price (approx. USD) | ~$114,027 | ~$4,188 |

| 24‑h % change | +2.06% | +1.67% |

| 24‑h high | ₹1.018 crore (≈ $114,850) | ₹3.74 lakh (≈ $4,204) |

| 24‑h low | ₹99.2 lakh (≈ $111,582) | ₹3.63 lakh (≈ $4,098) |

| Sentiment | Decisively Bullish; BTC successfully tested and held the ₹1 Crore level, effectively turning a major resistance point into reliable support. The focus shifts to breaking $115,000. | Strong & Steady; ETH is moving closely with BTC, demonstrating resilience. The underlying strength of its DeFi and smart-contract ecosystem keeps the Ethereum price prediction INR positive. |

| Commentary | Bitcoin is showing a classic “safe haven” correlation, moving in tandem with the record rally in gold. This E-E-A-T signal is attracting traditional investors looking for hard asset exposure. | Ethereum’s slightly muted percentage gain compared to BTC confirms the quarter-end risk management theme. Investors are consolidating, but the long-term outlook remains bright. |

Top Gainers (Altcoins)

Capital rotation is underway, favoring utility and infrastructure projects with clear narratives for the coming quarter.

| Altcoin | 24‑h change (approx.) | Commentary |

| Centrifuge (CFG) | ▲ 20.39 % | Leading the RWA (Real World Asset) segment. The trend is clear: investors want yield and exposure to real-world collateral. |

| Kaito (KAITO) | ▲ 18.98 % | A major spike in this micro-cap token, likely driven by technical hype and low liquidity. Traders should approach this highly volatile asset with caution. |

| Aethir (ATH) | ▲ 10.06 % | A continuation of the AI and DePIN narrative. This surge highlights strong conviction in decentralized infrastructure and processing power. |

| Zcash (ZEC) | ▲ 8.29 % | Maintaining strength, reflecting a growing appetite for privacy assets as part of a well-rounded crypto investment portfolio. |

| Avalanche (AVAX) | ▲ 5.03 % | A strong bounce for this Layer-1, benefiting from renewed developer activity on its subnetworks and the broader sentiment recovery. |

Top Losers (Altcoins)

Losses today are a reflection of final, tactical selling and residual liquidations in projects with lower liquidity.

| Altcoin | 24‑h change (approx.) | Potential reason for decline |

| Velar (VELAR) | ▼ 23.57 % | An illiquid token seeing an outsized loss. This is standard quarter-end volatility for low-cap projects where selling is amplified. |

| Data Ownership Protocol (DOP1) | ▼ 19.92 % | New, speculative small-cap projects often suffer when the general market rally pauses, as initial gains are aggressively taken by early investors. |

| Four (FORM) | ▼ 19.81 % | A sharp technical reversal after a volatile run. Investors rotating profits out of hype-driven assets and into established Bitcoin and Ethereum. |

Crypto Market Movements and Cues: Q4 Launchpad

The Finality of Red September

The core takeaway today is that the brutal September correction, which saw over $1.7 billion in forced liquidations, has now served its purpose. The market is cleaner and less leveraged. This recovery is supported by whale accumulation—a robust signal indicating that institutional money is not leaving; it is simply repositioning.

Macro Focus: Gold, RBI, and Risk

The crypto rally coinciding with gold hitting a record high is not a coincidence; it’s a safe-haven narrative coming back into play. Domestically, all eyes are on the upcoming RBI Monetary Policy Committee (MPC) meeting. While policy is focused on the INR, any dovish tone could flood the Indian crypto market with fresh risk appetite, potentially driving Bitcoin and Ethereum even higher.

Key Coins to Watch for October

The month-end rejig saw institutional capital rotating toward tangible utility. We expect tokens focused on RWA (Real World Asset) and core infrastructure to lead the market into Q4.

Outlook for Tomorrow: A Strong October Open

The outlook for tomorrow is cautiously optimistic and structurally sound.

- BTC Target: The next major technical hurdle is $115,000 (approx. ₹1.02 Crore). Successfully breaching this early in October could set the stage for a strong, sustained Q4 rally.

- Altcoins: Expect Layer-1s like Solana and utility tokens to show strong performance, continuing the bullish rotation out of BTC.

- Strategy: This is a market for disciplined accumulation. The large-scale risk has subsided; look to buy quality assets on any minor dips early in the new month.