Introduction

The crypto market presents many chances to make money, and a popular way to get involved is through crypto futures trading. In this article, we will look at a few strong reasons why you should think about futures trading on CoinSwitch Pro. But first, let’s try to understand what crypto futures are all about.

Understanding crypto futures trading

Crypto futures trading is trying to make money by guessing the future price of a crypto, without owning it. Instead of buying and holding, you agree to buy or sell a certain crypto at a set price and date in the future.

This kind of trading lets you make money whether prices go up (going long) or down (going short). However, keep in mind that futures trading is riskier than regular trading. This is mainly because it uses leverage.

The basics of crypto futures

A futures contract is a legal agreement to buy or sell an asset, like a crypto, at a set price and time in the future. These contracts are the same in format and are traded on exchanges. They are often used for commodities and traditional currencies, and now for crypto.

The crypto futures trading contract specifies details like the name of the crypto, the contract size, the expiry date, and other important facts. Market capitalization is important in the crypto futures market. Coins with a high market cap usually have futures contracts that are easier to trade.

Traders use crypto futures for many reasons. They might do it to speculate, protect against price volatility, or gain access to crypto without having to own it directly.

Read More: Crypto Technical Analysis: Understanding The Basics

How crypto futures trading works

When you trade futures, you make a contract with another trader who believes the opposite about the future price of a crypto. Smart contracts help make these deals on blockchain platforms. They ensure that the trading process is automatic and clear.

If you guess the crypto’s price change correctly, you earn money. If you are wrong, you lose money. How much you make or lose depends on how much the price moves and the leverage you choose.

Before you start futures trading, it is important to know how it works. This includes things like margin requirements, types of orders, and ways to manage risk.

Advantages of crypto futures trading on CoinSwitch Pro

CoinSwitch Pro is a great platform for crypto futures trading. It has many features and benefits that can improve your trading experience.

Here are some of the advantages that make CoinSwitch Pro a top choice for crypto futures traders.

Better and deeper liquidity markets

Liquidity is very important in crypto futures trading. It shows how easily you can buy or sell a contract without changing crypto prices much. CoinSwitch Pro has good access to deep liquidity markets. This helps trades to happen smoothly and improves price discovery.

When there is high liquidity, you can likely buy or sell a contract at a good price. This is true even during high market volatility. It matters a lot in crypto futures trading, where price fluctuations can be bigger because of leverage.

CoinSwitch Pro gets its access to liquid markets by connecting with many global exchanges. This combines order books and gives you many trading opportunities.

Smooth fiat to crypto on-ramp services

CoinSwitch Pro knows how important it is to have a smooth trading experience, especially for people who are new to crypto. The platform provides easy fiat to crypto services. This lets you change your fiat currencies, like USD or EUR, into crypto right on the site.

You won’t need to use different exchanges or pay high exchange commission fees. Crypto enthusiasts enjoy the speed and ease of using CoinSwitch Pro’s services. This allows them to quickly add money to their accounts and start trading crypto futures.

The platform is designed to be user-friendly. It makes buying crypto with fiat a simple experience, even for beginners.

Why crypto futures is a 24×7 market

Unlike regular financial markets that have set hours, crypto futures markets are open all day and night, every day of the week. This constant trading gives traders both chances and difficulties.

You can respond to news, price changes, and world economic events at any time and from anywhere.

Benefits of a non-stop trading environment

Operating in a market that is open 24 hours a day, 7 days a week means you are free from the limits of time zones or market hours. With just an internet connection, you can trade whenever it works for you. This is very useful in the crypto market, which is known for its high volatility.

Having longer trading hours lets you catch price changes that happen when traditional markets are closed. For instance, news from Asian markets can affect crypto prices even when US markets are not open. This creates opportunities to trade even if you are in a different time zone.

Institutional investors are also in the crypto futures market. They help increase the trading volume and liquidity we see all day and night.

How it affects market liquidity and volatility

The crypto futures market is open 24/7. This gives you flexibility but also makes the market more volatile. Prices can change quickly and unexpectedly, especially during busy trading times or when news breaks.

On the bright side, this constant trading helps with liquidity. Since traders are always active, it’s usually easier to buy or sell crypto futures trading contracts. You can do this without big price changes or affecting the market too much.

Traders should remember that higher volatility means prices can move suddenly. It’s important to have solid risk management plans to reduce any possible losses.

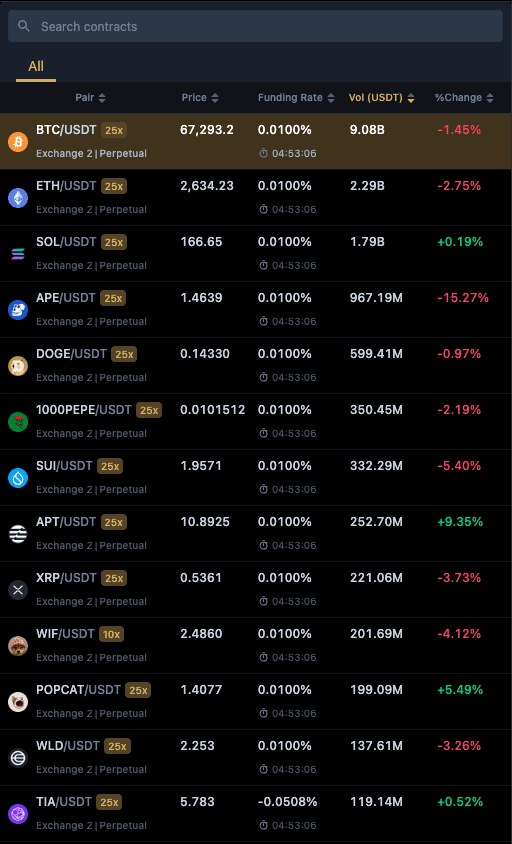

A wide variety of USDT trading pairs

USDT is a stablecoin that is linked to the US dollar. It is very important in the crypto futures market. CoinSwitch Pro has many USDT trading pairs. This gives traders many options to diversify and create different trading strategies.

Having so many trading pairs allows for chances to make money from the price changes of various altcoins while using the stability of USDT.

Exploring available trading pairs

CoinSwitch Pro lets you trade a wide range of altcoins with USDT. This includes popular pairs like BTC/USDT, ETH/USDT, BNB/USDT, and many others. Having many trading pairs gives traders more options to take advantage of market trends.

For example, if you think a certain altcoin will do better than Bitcoin, you might want to open a long position on that altcoin/USDT pair. On the other hand, if you expect the market to drop, and believe Bitcoin will stay strong, a short position on an altcoin/USDT pair could be a good idea.

Having many USDT trading pairs allows traders to try different strategies depending on how they see the market and how much risk they are willing to take.

Strategies for Trading USDT Pairs

Traders can use different strategies to trade USDT pairs in the crypto futures market. These strategies often rely on technical analysis, chart patterns, and market sentiment to find good trading opportunities.

One common strategy is trend trading. Here, traders look to take advantage of the movement in an asset’s price. For instance, a trader may enter a long position on an altcoin/USDT pair during a rise in price, expecting to increase profits as the altcoin does better than USDT.

It is important to keep in mind that while using leverage can increase profits, it can also increase losses. Having strong risk management strategies is thus key when trading USDT pairs with leverage.

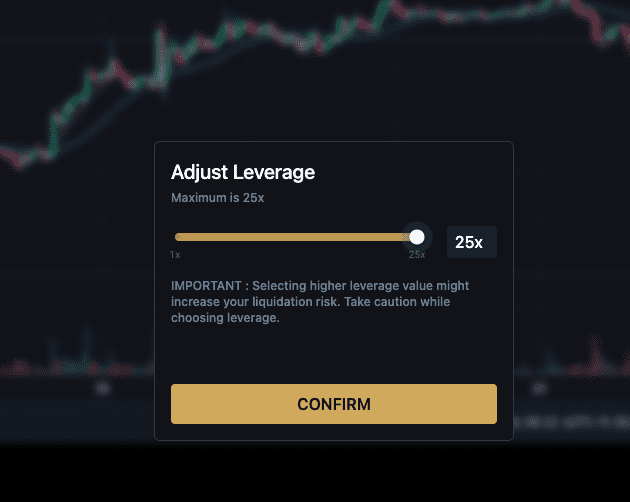

Leveraging your trades with up to 25x leverage

CoinSwitch Pro lets traders boost their trades with up to 25x leverage. This can lead to higher profits, but it’s important to use leverage carefully. You should know what it means and how it affects your trading.

Let’s look at how leverage works in crypto futures trading. We will also discuss why managing risk is so important.

Understanding Leverage in Crypto Futures Trading

Leverage helps you manage a bigger position in the market without using much money. For example, if you use 10x leverage, you can manage a position worth $10,000 by only using $1,000 of your own money.

While leverage can increase your chances for higher returns, it also brings more risks. Small price fluctuations can lead to big gains or large losses, especially with volatile assets like crypto.

So, it’s important to use leverage carefully and plan wisely. Keep in mind your comfort with risk and know about the possible downsides.

How to use leverage wisely

Using leverage wisely means being careful and managing risks. You also need to understand your trading plan well. Before you trade with leverage, make sure you know the possible risks. Understand how leverage can affect your trades.

It’s important to practice good risk management. For example, set stop-loss orders. This helps limit your potential losses. Also, take profits at levels you decide in advance. Try not to let greed affect your decisions when you use leverage. It’s easy to focus on potential profits, but remember to protect your capital first.

Here are some extra tips for using leverage responsibly:

- Start with low leverage: If you’re new to using leverage, begin with low ratios, like 2x or 5x. You can gradually increase them as you become more experienced.

- Understand margin requirements: Margin is the money needed to open and keep a leveraged position. Make sure you have enough funds in your account for any potential losses.

- Don’t risk more than you can afford to lose: Trading with leverage carries risks. Only use money that you can afford to lose.

The low entry barrier for new traders

CoinSwitch Pro is easy to use. The platform provides a simple interface that helps new traders to start trading in crypto futures.

Its friendly design and learning materials help traders at all levels, whether they are just starting or have more experience.

What makes CoinSwitch Pro accessible to beginners

CoinSwitch Pro is known for its easy-to-use design. It helps make crypto futures trading simple, even if you have little experience.

Whether you are an experienced trader or just starting, CoinSwitch Pro makes your trading experience super comfortable. The mobile app makes it easy for you to manage your trades and watch market changes when you are on the go, as long as you have an internet connection.

CoinSwitch Pro’s goal to be user-friendly makes it a great choice for people wanting to dive into the exciting world of crypto futures trading for the first time.

Read More: Crypto Futures Trading Strategies For Beginners

Tips for getting started with low investment

CoinSwitch Pro also makes it easy for you to start trading crypto with a small amount of money. This helps more people join in on the crypto futures market. You don’t need a lot of money to begin your journey.

- Start Small: Start with an amount you feel safe risking. As you learn and get more comfortable, you can slowly add to your investment.

- Dollar-Cost Averaging: Think about dollar-cost averaging. This means putting in the same amount of money at regular times, like every week or month. It can help lessen the impact of market ups and downs on your investments.

- Use a Stablecoin for Initial Funding: When you are just getting started and investing a small amount, it is usually a good idea to begin with a stablecoin such as USDT.

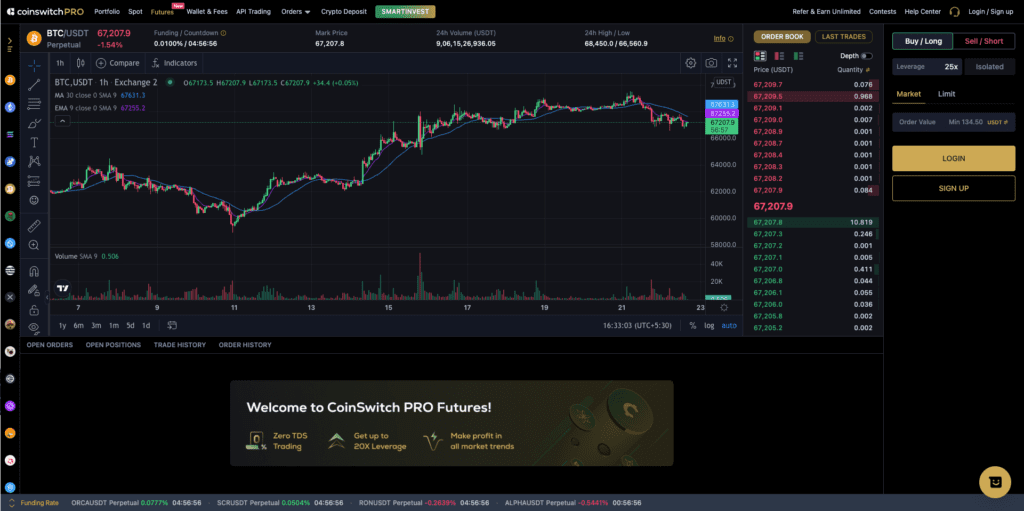

Utilizing cutting-edge trading tools

CoinSwitch Pro knows how important it is for traders to have the right tools in the changing crypto futures market. The platform has advanced trading tools and features. These are made to help traders make better choices and get better results.

Now, let’s look at some of the key tools traders can use.

Key tools every trader should know

CoinSwitch Pro gives you access to real-time market data. It also has advanced charting tools, technical indicators, and analytical tools. These tools help traders make better choices.

You can use these charting tools to see price changes. You can spot patterns and use technical indicators like moving averages or the Relative Strength Index (RSI). The analytical tools show market sentiment, trading volume, and important data that may affect your trading choices.

Even though these tools provide helpful insights, it’s really important to do your own research. You should also understand what these tools can’t do before you decide to trade.

Customizing tools for effective strategies

CoinSwitch Pro knows that every trader is different. Each person has their own style and preferences when it comes to trading. The platform thus lets you customize trading tools and layouts to make your experience fit your approach.

You can change chart settings, pick your favorite indicators, and set up watchlists to follow specific cryptos or trading pairs. These features help make trading easier and let you focus on what matters for your strategy.

No matter if you are a scalper, day trader, or swing trader, CoinSwitch Pro gives you the ability to make your trading space your own. This can improve your overall trading experience.

Flexibility in trading strategies

The crypto futures market is always changing. Traders need to change their strategies based on the new market conditions. CoinSwitch Pro allows you to use different trading strategies. This means you can adjust your approach depending on how you see the market and your risk level.

If you like trend trading, arbitrage, or a mix of both, CoinSwitch has the platform and tools to support your chosen strategy.

Read More: Successful Crypto Futures Trading Strategies [Advanced]

How to adapt strategies in a 24×7 market

Adapting your trading strategies in the crypto futures market can be tough. The market is known for its high volatility and non-stop activity. You need to be flexible, disciplined, and always willing to learn.

Stay updated on market news and economic signals that might affect crypto prices. It is important to check and adjust your trading plan as market conditions change.

If you keep a trading journal, take time to review it regularly. Look at your wins and losses to find ways to improve your strategies.

Examples of flexible trading strategies

Here are some flexible trading strategies you can use in the crypto futures market:

- Trend Trading: This means finding and taking advantage of the price trend of crypto. Traders look at charts and use indicators to find the right time to buy or sell.

- Arbitrage: This strategy is about making money from price differences for the same asset on different exchanges. Traders buy at a lower price on one exchange and sell at a higher price on another. This way they can make a profit without risk, except in case of any problems during the trade.

- Hedging: This means taking a position in a related asset to lower possible losses from an existing trade.

Competitive edge with low trading fees

Trading fees can greatly affect how much money you make from trading. This is true in the fast-moving crypto futures market. CoinSwitch Pro has low trading fees. This helps traders keep more of their profits.

When fees are lower, you can earn more. This is especially important for traders who make a lot of trades each day.

Understanding fee structures

Trading fees vary depending on the trading volume and the chosen crypto pair. Maker fees are charged when you place an order that adds liquidity to the order book, while taker fees are applied when you place an order that immediately fills your trade, removing liquidity from the order book.

How low fees impact profit margins

Lower trading fees can significantly affect how much money you make in the long run, especially for active traders who trade often. Every little percentage you save on fees goes right into your profits.

With lower fees, you can use more money for your trades instead of paying commissions. This is very important when you are trading a lot and making larger trades.

For institutional investors and high-frequency trading firms that trade many times each day, even small differences in fees can have a big impact on their total profits and how well they compete in the market.

Boosting earnings with a lucrative referral program

CoinSwitch Pro has a great referral program. It helps users earn more money by referring their friends and other crypto enthusiasts.

When you join the referral program, you share a trustworthy platform for crypto futures. At the same time, you can increase your chances of earning passive income.

Details of the referral program

CoinSwitch’s referral program is a great way to earn some extra income. You can invite your friends, family, and others to join CoinSwitch. They will get to enjoy trading on a safe and easy-to-use platform.

Every time someone you referred signs up and starts trading, you receive rewards and bonuses. This program is good for both you and the person you refer.

If you love crypto and want to share your positive experience, the referral program is a smart way to earn rewards. It also helps grow the CoinSwitch community.

Maximizing benefits from referrals

To get the most out of CoinSwitch’s referral program, share your special referral link on your social media, blog, or website if you have one. Personalize your referral message by explaining why you picked CoinSwitch. Talk about its strengths and your positive experiences with the platform.

When more people join and trade on CoinSwitch because of your referrals, you can earn more from the referral bonuses. This shows the power of having a network; the more users you bring on board, the more your earnings can grow.

Conclusion

In conclusion, choosing crypto futures trading on CoinSwitch Pro has many benefits. There are markets with good liquidity, 24/7 trading, and many trading pairs to pick from. The platform is easy to join because it has low entry barriers and low trading fees, which is great for beginners. Traders can use up to 20x leverage and modern trading tools to increase their profits. CoinSwitch also has a referral program that can help boost earnings. If you want to explore crypto futures trading, CoinSwitch offers a smooth and profitable platform, helping traders at any level to succeed.

FAQs

1. What is crypto futures trading on CoinSwitch Pro?

Crypto futures trading on CoinSwitch Pro allows users to speculate on the future price movements of cryptos without owning the underlying asset. Traders can enter long (buy) or short (sell) positions depending on whether they expect the price to rise or fall, making it a versatile tool for market strategies.

2. How is futures trading different from spot trading on CoinSwitch Pro?

In spot trading, you buy and sell actual crypto, which you hold in your wallet. With futures trading, you’re not purchasing the crypto itself but rather a contract that bets on its future price movement. This allows traders to profit from both rising and falling markets, offering more flexibility in volatile conditions.

3. What are the benefits of trading crypto futures on CoinSwitch Pro?

CoinSwitch Pro provides several advantages for futures traders, including:

• Leverage: Traders can control larger positions with a smaller initial investment.

• Hedging: Futures allow you to hedge your spot positions against market volatility.

• Profit in both directions: You can profit from both rising and falling markets by going long or short.

4. Does CoinSwitch Pro offer risk management tools for futures trading?

Yes, CoinSwitch Pro offers various risk management tools such as stop-loss orders and take-profit orders to help traders minimize potential losses and secure profits. Leverage levels can also be customized, allowing users to trade within their risk tolerance.

5. What cryptos are available for futures trading on CoinSwitch Pro?

CoinSwitch Pro supports a wide range of cryptos for futures trading, including popular assets like Bitcoin (BTC), Ethereum (ETH), and others. The platform frequently updates its listings to include trending and top-performing cryptos, providing traders with diverse options.