DeFi, short for Decentralized Finance, refers to financial applications built on blockchains. DeFi applications aim to democratize finance by eliminating the need for centralized institutions like banks. In doing this, they revolutionize the financial system and challenge traditional finance. This article will help you understand how to present 4 things that make DeFi unique.

Understanding Decentralized Finance (DeFi)

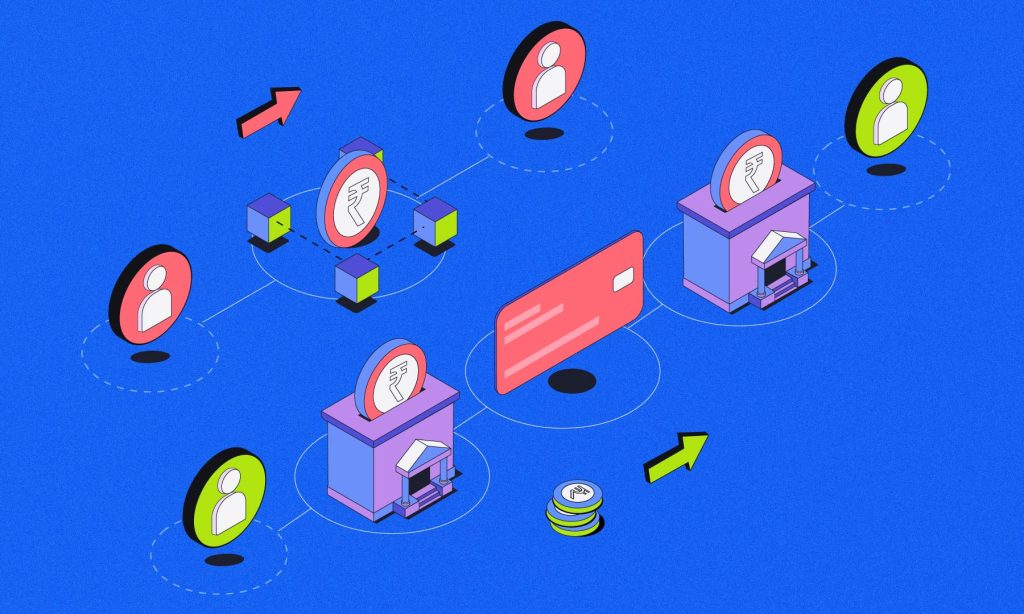

DeFi is a new approach to facilitating and managing financial services. It revolutionizes how we imagine exchanges and transactions with the help of crypto. The basic idea behind a DeFi coin is that there is no centralized authority to regulate transactions.

What is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) is a new type of financial system. Based on distributed ledgers similar to the ones that cryptos use, this system promises safer and speedier transactions. DeFi also lowers the extra charges that traditional financial organizations, like banks, impose.

Users can, therefore, transfer and receive money instantly and access their funds stored in a secure digital wallet from anywhere at all via the internet. And all of that for a lower fee.

How DeFi is different from traditional finance?

Public blockchains serve as the source of trust in DeFi transactions. Blockchains are what regulate all activities in the industry. Conversely, traditional financial institutions rely on public governance. That means governmental regulations and the licensing of financial organizations. In the traditional model, the government—elected or otherwise—is the basis of trust. So it is responsible for managing all operations.

Not only can anyone with programming skills contribute to the development of DeFi apps, the entry barrier for users too is lower.

All of this makes DeFi more transparent and accessible. And that is one of the key factors contributing to its continuing growth.

The benefits of Decentralized Finance (DeFi) over traditional finance

While many of the benefits may be evident from the description above, let’s list them to cement our understanding. Theoretically, anyone with internet access and a crypto wallet could communicate with DeFi. Due to blockchain technology and the absence of intermediaries, transactions are quicker and cheaper.

One of the most crucial uses of DeFi coins is the borderless payments they facilitate. The fact that these services operate across geographical boundaries ensures they are more easily accessible. What’s more, the entry barrier for access is lower due to the documentation requirements.

Users can also personalize their investments with non-custodial crypto wallets, smart contracts, and trust services. Finally, because the underlying blockchain is updated after each transaction, DeFi is a lot safer.

DeFi’s innovation allows crypto assets to be used in ways that were impossible before. Until now, crypto was very different from “real world” assets. But flash loans, synthetic assets, and decentralized exchanges have changed that.

More on all of this in the following sections, where we elaborate on three things that make DeFi unique.

1. Decentralization and transparency

The popularity of many innovations in the DeFi space has to do with the transparency that decentralization makes possible. The transparency and accountability that this new paradigm in financial infrastructure offers come with various benefits.

How decentralization makes DeFi unique compared to traditional finance

Decentralized finance eliminates the need for a centralized financial authority that provides and manages financial services. DeFi programs, therefore, give users more control over their finances. Customized wallets and trading services are part of this shift that DeFi effects.

The role of smart contracts in DeFi

Codes that have been written and digitally preserved on a blockchain are smart contracts. They thus permit DeFi protocols to switch over to an online state. DeFi smart contract software is routinely assessed to ensure it complies with industry standards. It cannot be altered once the buyer and the vendor have agreed upon the code. Users of centralized financial institutions can depend on intermediaries to handle transactions, while DApps must employ smart contracts to guarantee that every transaction is lawful, transparent, and trustworthy.

The transparency of DeFi transactions

Every transaction and piece of data or code in DeFi is open to everyone. That’s because it runs on blockchains. Since everybody on the network can view the transactions, there is a greater level of trust among users. DeFi, in this sense, is significantly more transparent than traditional finance.

2. Accessibility and inclusivity

In the realm of financial technology, DeFi is among the more revolutionary ideas. It provides a different experience from conventional banking systems. With DeFi, users can access a vast array of previously unavailable opportunities with relative ease. There are no entry barriers in terms of paperwork. And the cost of transactions is lower too. This heightened accessibility ensures inclusivity.

The accessibility of DeFi for global users

Decentralized finance is becoming more and more well-liked with time. This has a lot to do with the fact that its offer of financial services transcends geographical boundaries with relative ease. The lower cost of cross-border transactions is a huge plus that takes finance beyond the established banking system.

How Defi is inclusive for the underbanked and unbanked population

Blockchains make payments cost-effective, efficient, and safer. One does not need access to a digital wallet—a compatible smartphone or computer will do. This means that the conventional prerequisites for financial inclusion—like a credit card or a bank account—are done away with. This is a huge plus for those sections of society that lack the privileges most of us take for granted.

The role of DeFi in providing financial services to the unbanked

DeFi solutions eliminate intermediaries. They do this by relying on smart contracts and blockchain technology to automate transactions. That is why Defi is gaining popularity in regions of the world that have large unbanked populations. Crypto remittances, led by US-based Mexicans, for instance, recorded a whopping 900% increase in 2021. With time, DeFi is thus likely to play a key role in providing financial services to the unbanked.

3. Interoperability and composability

The two crucial aspects of the development of DeFi are interoperability and composability. Let’s examine what each of these means briefly before getting into the details.

Composability refers to the effective cloning of dApps or the implementation of shared infrastructure. On the other hand, interoperability is the ability to facilitate transactions across blockchain platforms. It gives you the freedom to not be constrained by the rules and processes of a specific chain.

How DeFi enables interoperability across different platforms

The DeFi ecosystem powers cross-chain technology—meaning interoperability. DeFi users can create a bridge across chains by locking their coins in a smart contract. The contract then mints another crypto token of the same amount on another blockchain, which the user can access. Later, if the user wants the first set of coins back, the contract burns the tokens on the second chain before releasing the former.

The composability of DeFi protocols and applications

Another key characteristic of DeFi is composability. That means DeFi apps can combine protocols, smart contracts, and DEXs to offer new financial applications and services.

The potential of DeFi in creating new financial products

Thanks to both of these features, DeFi gives people access to financial services such as lending, borrowing, and trading. All of this is without a bank in the picture.

4. Liquidity and yields

In the DeFi space, liquidity refers to a token’s ability to be exchanged for another. DeFi facilitates liquidity in a sense through the services that its applications provide. Read on to learn more about it.

How DeFi enables liquidity for assets

Remember how DeFi helps with interoperability. That, and the various borrowing and lending platforms that the DeFi space offers should help you imagine how DeFi facilitates liquidity. The rewards that liquidity providers can earn are a key motivating factor behind the inclusion of tokens in liquidity pools.

The role of yield farming in DeFi

DeFi brings with it the possibility of yield farming projects. These projects use smart contracts to let users hold their crypto for a predetermined period in exchange for rewards.

The potential of DeFi to provide high-yield returns

Yield farming services need participants to stake digital assets to a liquidity pool secured by smart contracts. To lure participation, such pools share a portion of the fees they obtain as user rewards. In this way, you can earn substantially more interest than you would with conventional lending.

How DeFi is changing the traditional savings and lending models

Defi can also make borrowing and lending with collateral much more straightforward than conventional arrangements. It eliminates the paperwork and ensures greater security in transactions. DeFi thus surpasses the conventional financial system’s predominance and can revolutionize contemporary finance.

All of this should have helped you understand what sets DeFi apart from traditional financial institutions better. If you want to learn more about it, read this.

FAQs

How is DeFi different from traditional finance?

While DeFi introduces numerous benefits, it’s essential to recognize that the space is still evolving, and challenges such as security, regulatory uncertainty, and scalability need to be addressed for widespread adoption. Both DeFi and Traditional Finance coexist, and their relationship continues to be an area of exploration and development within the financial industry.

What is the main advantage of DeFi over traditional finance?

It’s important to note that while DeFi offers these advantages, it also comes with its own set of challenges, including regulatory uncertainty, security concerns, and the need for widespread adoption. Both DeFi and traditional finance coexist, and the relationship between the two continues to evolve as the financial industry undergoes significant transformations.

What is the difference between finance and DeFi?

Finance, in a broad sense, refers to the management of money and other assets. It encompasses a wide range of activities related to the creation, allocation, and management of resources to achieve financial goals. Finance includes both personal finance (managing individual or household finances) and corporate finance (managing the financial activities of businesses).

On the other hand, DeFi, or Decentralized Finance, is a specific subset of finance that leverages blockchain and cryptocurrency technologies to recreate and enhance traditional financial services in a decentralized manner. DeFi aims to provide financial services without relying on traditional intermediaries like banks and financial institutions. It operates on blockchain platforms and uses smart contracts to automate and execute financial agreements.

What differentiates these DeFi dapps from their traditional banks?

While DeFi dApps offer these advantages, it’s important to note that the space is still evolving, and challenges such as regulatory clarity, security, and user experience need to be addressed for broader adoption. Both DeFi and traditional banks coexist, and their relationship continues to shape the future of the financial industry.