The much-anticipated Ethereum Merge is almost here. Ethereum is adopting a more eco-friendly way of verifying transactions—Proof-of-Stake. But how is the Merge going to impact Ethereum’s price action? We think it might give the crypto market the push that it has been longing for since the beginning of 2022.

That’s only speculation of course, but at CoinSwitch, we don’t speculate without explaining ourselves fully and giving you every opportunity to decide whether you agree with our analysis. That’s why we are bringing you some data-backed insights to help you see where we are coming from.

1. Ethereum responds positively before each upgrade.

Almost every Ethereum upgrade in the past has ended with the start of a bullish phase for ETH. While some gains were immediate, some took a little time to come. For instance, the post-DAO fork saw ETH’s price go up by almost 10% in less than a week.

Here is a detailed analysis of the key Ethereum upgrades and the corresponding price movements.

2. Eco-friendliness will push adoption and therefore prices.

The Merge will make the network 99.95% more energy efficient, according to Ethereum Foundation, and that will in turn boost institutional adoption. When corporations and institutions begin to show interest in Ethereum after the Merge, we can expect a higher demand for ETH.

And higher demand is often synonymous with bumped-up prices.

3. ETH is going to turn net deflationary soon.

Do you happen to remember this tweet from a researcher at IntotheBlock called Lucas Outumuro?

$ETH will become deflationary following the merge

— Lucas (@LucasOutumuro) July 22, 2022

ETH's net issuance is likely to range between -0.5% to -4.5% depending on network fees

Here is a projection of what that would look like based on 2022 historical data pic.twitter.com/KdWq072Mbz

Outumuro claimed that after the Merge, ETH will begin to turn deflationary—meaning, making its demand exceed the supply. Turns out, there might be some truth to the claim. And if the deflationary move does kick in, it is naturally going to affect the token’s price.

We think that there is a good chance ETH may turn deflationary. Why? Because there are multiple factors that might make it go down that path.

The transition to PoS and its impact on the issuance rate of tokens

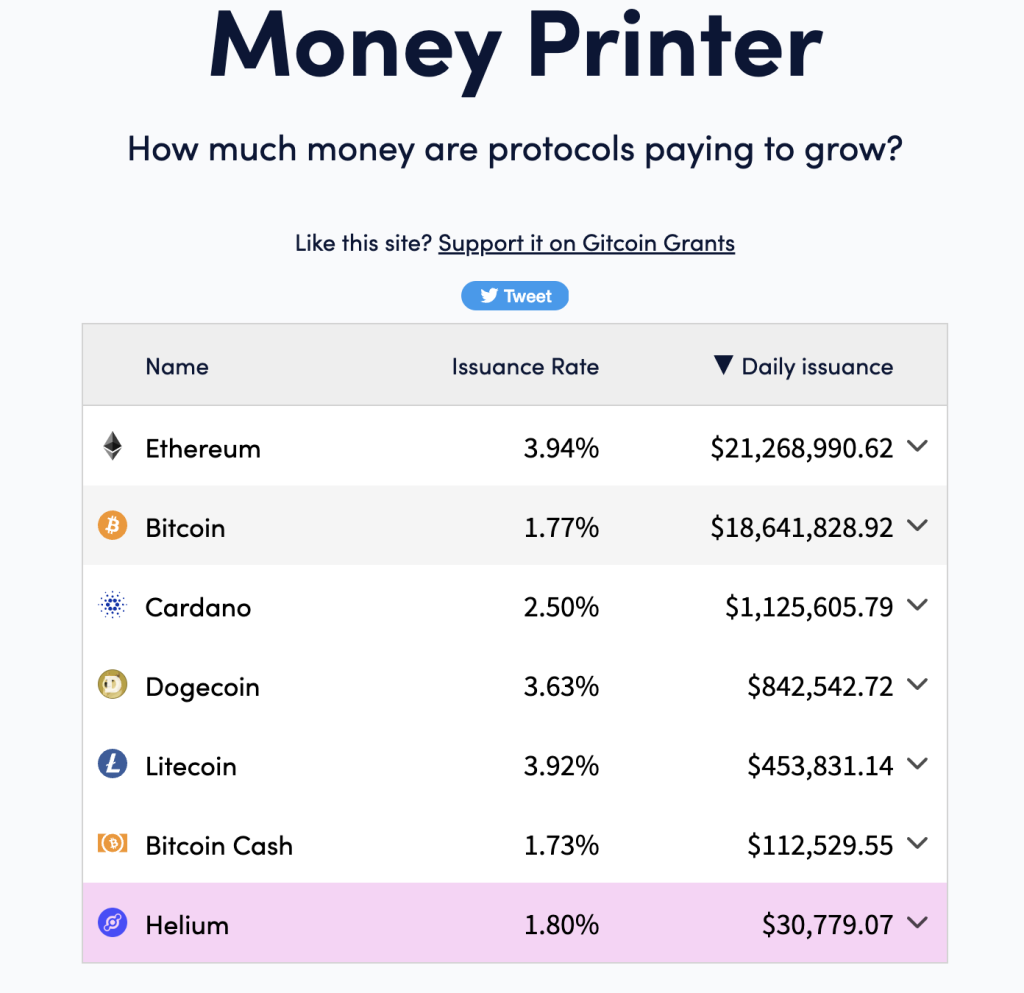

Currently, with the PoW (Proof-of-Work) transaction verification mechanism, close to 13,000 ETH tokens are pushed into the network every day. Once Ethereum adopts PoS, only 1,600 ETH tokens will be issued per day—registering a 90% drop. The issuance rate will drop from 4.01% to 0.40%, according to data from Money Printer.

Read more about this here.

Source: Money Printer

Makes sense, yes? But that’s not the only thing that pushes ETH towards a net-deflationary tag.

EIP-1559’s comeback

The EIP-1559 upgrade was launched on 5 August 2021. The primary purpose of the upgrade was to burn select ETH tokens, thereby reducing their overall supply and boosting their value.

With token issuance already heading downward in the context of the Merge, and the EIP-1559 in action, we can expect the ETH tokemomics to even turn net-deflationary over time.

Staked ETH

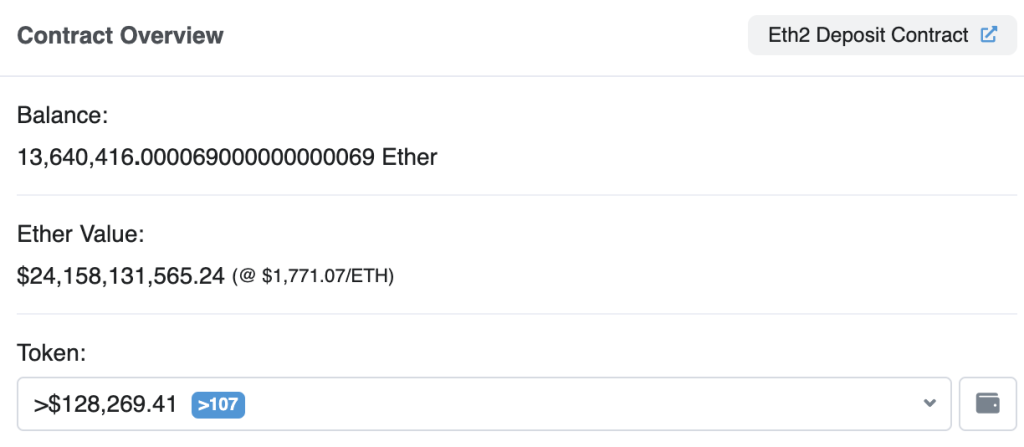

With the adoption of PoS, Ethereum users will be staking their ETH in order to earn the right to verify transaction blocks. Every individual will need to stake a minimum of 32 ETH to be a validator. In fact, 1,36,40,416 ETH tokens have already been deposited in staking contracts, as per data available at Etherscan.

Source: Etherscan

A large amount of staking ensures that the number of ETHs in circulation is limited. This contributes to the deflationary nature.

And even after the Merge is complete and the excitement fades, people won’t be withdrawing their staked ETH, causing supply to increase and prices to drop.

Because Ethereum has ensured that doesn’t happen. The network’s staking deposit contracts ensure that the staked ETH cannot be unlocked for 6 to 12 months after the Merge. The staked ETH can only be withdrawn after the next big upgrade, the Shanghai upgrade.

What does this mean for us? There will be no panic selling from the stakers, but validators will continue getting the staking rewards. So again, some more deflationary tendencies for ETH.

Withdrawal limits

Post-Shanghai, too, when the deposit contracts are opened, Ethereum should still be able to prevent a mass sell-off of the staked ETH. The Ethereum network intends to place withdrawal limits to control the liquidations. This will also mean ETH stays deflationary.

The upgraded Ethereum network will thus have a positive impact on the price action.

4. Ethereum’s market dominance is growing.

Over the past few months, Ethereum’s market dominance has grown significantly. A few weeks ago, it went all the way up to 20%. Also, with Bitcoin’s dominance falling under 40% (39.4% currently), Ethereum is now a strong force to take the market higher with itself. A bull run at Ethereum’s counter is therefore likely to take the market higher.

Something similar happened in the first few weeks of August, too. The onshore crypto rupee index, CRE8, peaked at ₹3,339.89 at the time. Back then, it was ETH that took the lead by briefly crossing $2,000.

5. There will be more stakers.

The idea that staking APR will rise to 19%, a 200% increase after the Merge is floating around the internet these days. That’s not a realistic figure, though, because it rests on the assumption that the network activity will be at the highest possible level.

Post-Merge, Ethereum is surely going to attract more stakers. But that has more to do with its credibility as a network and the expected 50% increase in the base Annual Percentage Rate (APR). If we calculate the rise keeping the recent network activity in mind, the APR might touch 7%.

The rise in APR is expected because staking requires a smaller fee as compared to mining, the 10% gas fees currently offered to miners will be equivalent to 7% of staking APR.

Wrap-up

Ethereum hasn’t had the best year. And despite trading at a 68% discount on its all-time high level of $4,891.70, most of us are expecting a turnaround of sorts after the Merge. The price spike of course might not be immediate and there can be dips along the way. However, the mid-and long-term prospects of ETH do seem convincing. Or so we think.

Until you’re sure the bulls are arriving, we advise caution and an airtight DYOR plan.

FAQs

What are the benefits of Ethereum merge?

The Ethereum Merge refers to the transition of Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. Key benefits include

1. Energy Consumption: The Ethereum Merge significantly decreases energy usage, moving away from the resource-intensive PoW to the more eco-friendly PoS model, contributing to environmental sustainability.

2. Increased Network Security: By staking Ethereum, the PoS model enhances network security. Honest validators are rewarded, while dishonest behavior is penalized, making the network more secure and robust.

3. Enhanced Participation: The Merge allows more users to participate in Ethereum’s network by earning rewards on staked ETH, promoting broader inclusion in the Ethereum ecosystem.

What does the Ethereum merge mean for Ethereum?

The Ethereum merge signifies a pivotal transition for Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. Key implications include:

1. Reduced Energy Consumption: The merge drastically decreases Ethereum’s energy consumption, fostering sustainability by replacing the energy-intensive PoW with the more eco-friendly PoS model.

2. Enhanced Scalability: The upgrade aims to improve the scalability of the Ethereum network, addressing challenges associated with congestion and high gas fees.

3. Increased Security: The proof-of-stake model enhances network security by rewarding validators who stake Ethereum and penalizing dishonest behavior, making the network more secure.

Will Ethereum merge reduce supply?

Yes, the Ethereum merge has led to a reduction in the supply of Ethereum (ETH). The transition from proof-of-work (PoW) to proof-of-stake (PoS) during the merge, completed in September 2022, significantly altered the issuance dynamics of ETH

What is the Ethereum merge 2023?

The Ethereum Merge in 2023 refers to a significant upgrade and transition in the Ethereum blockchain’s consensus mechanism. Key aspects include:

Date of Execution: The Ethereum Merge was executed on September 15, 2022, marking a crucial milestone in the evolution of the Ethereum network.

Transition to Proof-of-Stake: The primary purpose of the merge was to transition Ethereum from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) consensus mechanism. This move aimed to enhance scalability, security, and sustainability.

Improved Energy Consumption: The merge brought about improvements in energy consumption, addressing concerns related to the environmental impact of traditional proof-of-work systems.