Understanding Delta Hedging

To grasp delta hedging, you first need to understand delta itself. In trading, delta measures how much an asset’s price is expected to move when the underlying asset changes. Think of it as the sensitivity meter between two related assets, one derivative, one real.

If Bitcoin rises by $1,000 and your option position increases by $500, your delta is 0.5. In simple words, for every dollar Bitcoin moves, your position moves by half. A delta of 1 means your position mirrors Bitcoin completely. A delta of 0 means your position doesn’t react at all.

Now, when you bring delta crypto into the picture, this metric becomes the heartbeat of crypto derivatives, options, perpetuals, and structured strategies. Traders, especially institutional players and funds, use delta to understand how exposed they are to sudden price swings.

For example, a crypto options trader might hold a Bitcoin call option with a delta of 0.6. That means if Bitcoin jumps $1,000, the position gains $600. But what if the trader doesn’t want exposure to Bitcoin’s moves and wants to stay market neutral? That’s where delta hedging comes in.

How Delta Hedging Works in Crypto

Delta hedging is a risk management strategy used to offset price risk. It helps maintain a balanced portfolio so that if the underlying crypto asset moves, your overall position stays stable. In traditional finance, it’s standard practice among options traders. In crypto, it’s now becoming essential, especially as the market matures with instruments like BTC and ETH options, perpetual swaps, and structured products.

Let’s break it down:

Imagine you own a Bitcoin call option with a delta of 0.6. That means your position gains value when Bitcoin rises. But you want to remain delta neutral, meaning your total exposure to Bitcoin’s price movements equals zero.

To hedge, you sell 0.6 BTC in the spot or futures market. Now, if Bitcoin’s price goes up, your call option gains value, but your short BTC position loses equally. If Bitcoin falls, your call loses value, but your short BTC gains. In both directions, the portfolio stays stable; that’s the beauty of a delta hedging strategy.

Why Traders Use Delta Hedging in Crypto

1. To Reduce Volatility Exposure

The crypto market is inherently volatile. By keeping the portfolio delta neutral, traders protect themselves from wild swings while still collecting income from options premiums or funding rates.

2. To Lock in Profits

Suppose your Bitcoin option trade is already in profit. Instead of closing it, you hedge the delta to protect gains from market reversals.

3. To Run Systematic Strategies

Many market-making desks and funds in crypto use delta hedging to maintain balanced exposure. They quote both buy and sell prices on exchanges, hedge instantly, and earn consistent fees while neutralizing risk.

4. To Manage Options Books

Delta hedging allows them to balance exposure to calls, puts, and spot BTC simultaneously.

So while delta hedging might sound technical, at its core, it’s about balance, keeping your trading boat steady in the turbulent sea of crypto volatility.

Read More: What are Hedging Contracts: An Explainer

The Challenges of Maintaining a Delta Neutral Crypto Portfolio

In theory, delta hedging sounds neat. In practice, it’s like walking a tightrope. Crypto’s 24/7 nature, rapid volatility spikes, and thin liquidity during extreme moves make it harder to stay perfectly hedged.

Constant Rebalancing

Delta changes every second as prices move. If Bitcoin jumps from ₹80 lakh to ₹85 lakh, your original hedge may no longer hold. Traders must rebalance positions constantly to keep the portfolio delta neutral. This frequent adjustment adds both cost and complexity.

Transaction Costs and Fees

Every rebalance means a new trade, and in crypto, fees can stack up. Between exchange fees, slippage, and spreads, maintaining neutrality becomes expensive for smaller traders.

Gamma Risk

As prices change, delta changes too. This rate of change is called gamma. High gamma means delta shifts faster, forcing more frequent hedging. Crypto’s inherent volatility makes gamma management a nightmare for unseasoned traders.

Liquidity Gaps

While Bitcoin and Ethereum options trade actively, altcoin derivatives often face low liquidity. Hedging an option on a mid-cap coin may sound great in theory, but finding counterparties can be tricky, especially in volatile hours.

Emotional Fatigue

Delta hedging demands discipline. You’re not chasing direction, you’re managing exposure. Watching profits move up and down without reacting emotionally separates professional traders from impulsive ones.

Still, professional desks, market makers, and algorithmic funds continue to use delta hedging in crypto because it gives them control over chaos.

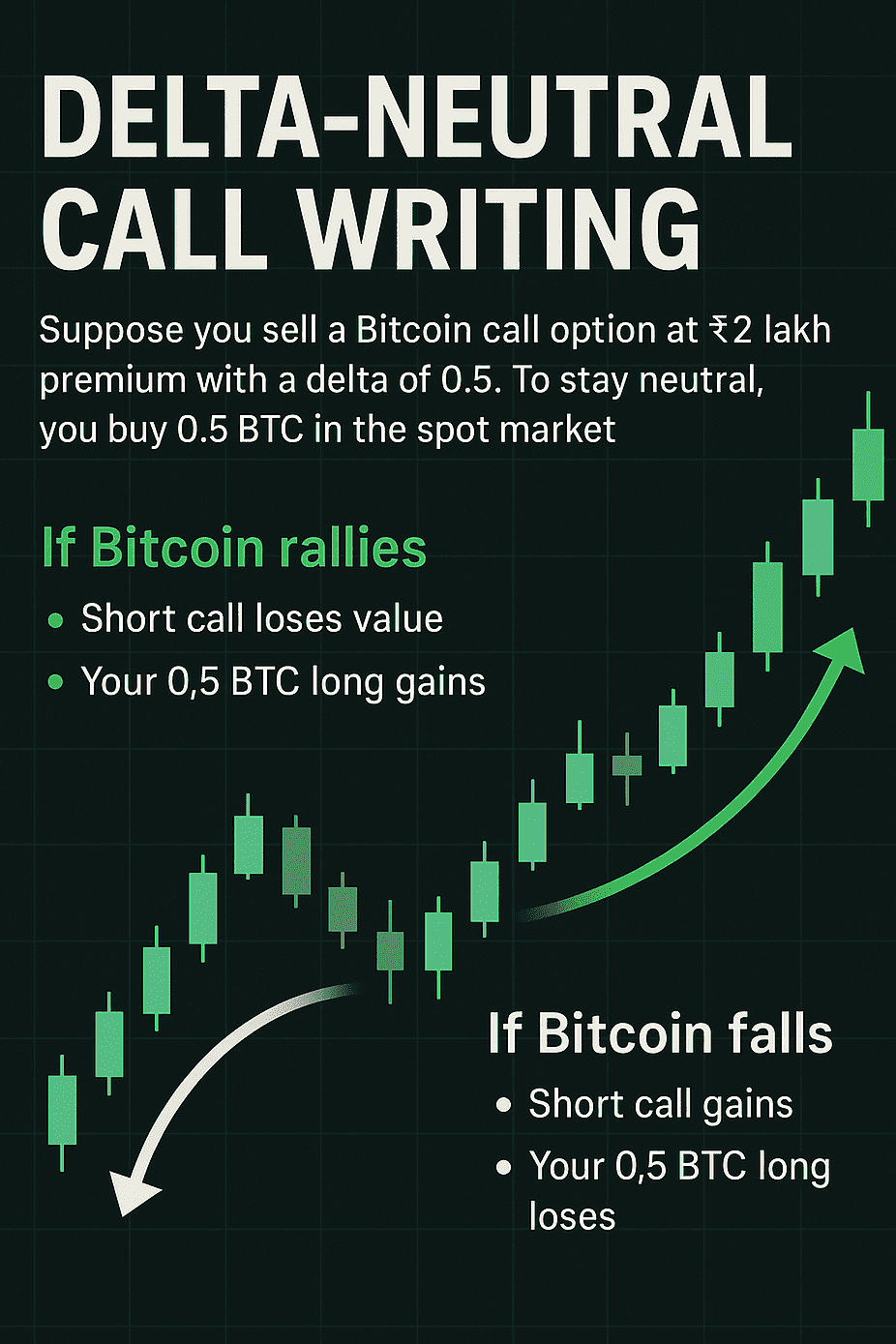

Writing Delta Neutral Options Strategies

When you “write” an option, meaning sell it, you collect a premium upfront. But this comes with directional risk. If the market moves against you, losses can mount fast. Delta hedging helps offset that exposure.

Let’s take an example.

Suppose you sell a Bitcoin call option at ₹2 lakh premium with a delta of 0.5. To stay neutral, you buy 0.5 BTC in the spot market. Now, if Bitcoin rallies, your call option position loses money, but your long BTC offsets it. If Bitcoin drops, your BTC loses, but your sold call gains value as it moves toward expiry.

That’s delta hedging in action for an option writer.

Professional desks often combine this with other tools to stay fully neutral:

- Gamma Hedging: Managing how quickly delta changes.

- Vega Hedging: Balancing sensitivity to volatility.

- Theta Decay Capture: Earning profits as time passes while keeping direction neutral.

In the crypto world, many yield-enhancing structured products, like covered calls or cash-secured puts, use delta hedging underneath. The aim is to earn premiums while neutralizing directional exposure.

Over time, traders refine these strategies into algorithms. Bots can track live delta values and auto-hedge using perpetual futures or spot positions. It’s where traditional quant finance meets the 24/7 speed of crypto markets.

Read More: The use of crypto exchanges for trading and hedging

The Final Word

Delta hedging is one of those strategies that sound complex but rely on a simple principle: balance. It’s not about predicting where Bitcoin will go next. It’s about making sure that wherever it goes, your portfolio stays calm.

In the world of delta crypto, traders use this balance to handle volatility, protect profits, and run neutral books that earn income regardless of direction. Whether you’re a fund hedging millions in BTC options or an individual experimenting with small positions on Deribit, the logic remains the same: control exposure, don’t chase prices.

FAQs

1. What is delta hedging in simple terms?

Delta hedging means balancing your crypto positions so price movements don’t affect your overall profit or loss. If one position gains when Bitcoin rises and another loses equally, your portfolio stays neutral. It’s how traders manage volatility without constantly predicting direction.

2. What is delta in crypto trading?

Delta measures how much an option or derivative changes when the underlying crypto moves. A delta of 0.7 means if Bitcoin goes up ₹10,000, your option’s value rises ₹7,000. Traders track delta to understand how sensitive their portfolio is to price swings.

3. What is delta and gamma hedging?

Delta hedging balances exposure to price changes. Gamma hedging manages how fast that exposure changes. In crypto, high gamma means delta shifts quickly during volatility, forcing frequent re-hedging. Together, delta and gamma hedging help traders maintain a smoother risk curve.

4. What is the hedging strategy in crypto?

A hedging strategy in crypto reduces risk from unpredictable moves. Traders use tools like futures, options, or perpetual swaps to protect profits. Delta hedging is one of the most advanced versions; it aims to neutralize exposure completely, keeping profits steady across market conditions.