The gyrations in the crypto market generally make investors anxious, making them wonder what drives these movements. What makes crypto prices go up and down? Let’s attempt to answer this question with concrete points, examples, and data-backed validations, which will also help you make informed trading and investment decisions.

Why do crypto prices go up and down?

Before we dig in, let us identify why any asset—crypto included—goes up and down.

For starters, it all comes down to supply and demand. Prices shoot up if the demand for a specific crypto is high and there isn’t enough supply to meet the same. It’s simple economics. However, crypto is anything but simple. There are times when market sentiment acts as the price driver.

But in most cases, the crypto market responds to how Bitcoin—the most dominant crypto—moves. So, before we move any further, let us first understand what determines the price of Bitcoin.

How is Bitcoin’s value determined?

Bitcoin was the first commercial crypto, almost unrivaled when it began life. Hence, its price movement is the gold standard for the crypto market.

Here are some reasons for Bitcoin’s popularity:

- Bitcoin’s decentralized nature insulates it somewhat from standard monetary policies and global inflation rates.

- A fixed supply of 21 million BTCs.

- The associated cost of mining makes BTC akin to a commodity and not a security.

- Massive global following.

BTC’s stature as the first commercial crypto and the specific traits mentioned above determine its value. As of 4 December 2022, it enjoys a market dominance of 38.27%, making the entire crypto space respond to its price movements.

Fed rate hikes hold sway over Bitcoin prices

Even though BTC is supposedly immune to global financial developments, the Fed hikes and US inflation have tended to impact its price of late. But we shouldn’t be worried. Here is why:

US markets regulator Securities and Exchange Commission (SEC) recognized Bitcoin as a commodity, while other cryptos are securities. The growing popularity of Bitcoin draws a lot of centralized money (fiat) for trading and investment purposes. And it is known that Fed rate hikes impact the money flow into major asset classes, including BTC. The correlation between BTC and the rate hike is clear—hawkish Fed hikes drive BTC prices down, whereas dovish announcements act as positives. And Bitcoin moving up or going down impacts the prices of other cryptos. Now, let us focus on the specific reasons driving crypto prices.

What drives crypto prices

Here are some factors that tend to influence crypto prices over time:

Bitcoin

Bitcoin’s massive market dominance of over 38% makes it a major price driver for crypto. In most cases, BTC going up acts like a support to the entire market, driving the prices up in the process.

Project security

Different cryptos come with varying visions regarding the direction of their project. Besides, the quality of the blockchains housing them is also an important price-determining factor. Coming to the project, the overall security and network adoption make the related blockchain crypto move up or down in terms of prices. The desirable metric here is to have a growing number of nodes, which indicates a strong and growing community. Further, an increasing number of nodes makes the project sufficiently decentralized. Hence, more brownie points for the project and the related crypto.

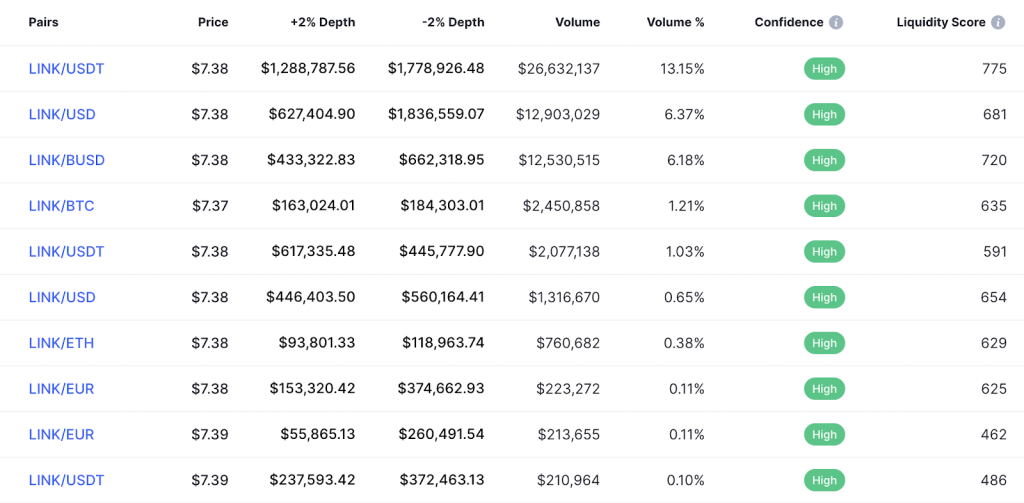

Liquidity and markets

If crypto is listed on multiple exchanges, and that too in the form of several trading pairs, it might bode well for its prices. Some content aggregators like Coinmarketcap even let you check the confidence score of the buyers for a specific crypto trading pair. Note that each trading pair over an exchange is a separate market for that crypto.

Here is how multiple trading pairs, volume, confidence, and liquidity look like:

We are using LINK as a reference:

Demand-supply and other metrics

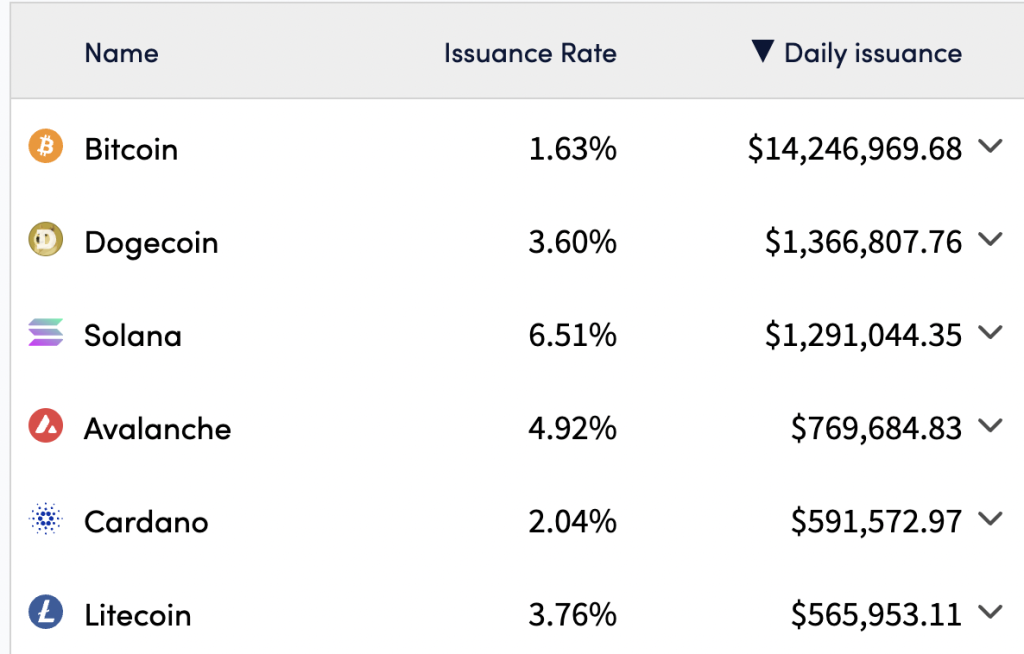

Cryptos can have limited and unlimited supplies based on the project tokenomics. Like any other valuable asset with fixed supply and growing demand, select cryptos also respond positively to overall scarcity. Hence you might see BTC gaining more popularity as it has a fixed supply, and at some point, it will turn deflationary.

However, if you are looking at some other crypto, checking for the ecosystem inflation rate or yearly issuance percentage is an excellent metric to evaluate the price growth (or degrowth) over time. Crypto assets with low issuance percentages are more sought-after.

See how BTC still has the best outlook in terms of issuance rate:

Hype

Several cryptos have massive communities. Some even have celebrated entrepreneurs like Elon Musk, directly and indirectly, endorsing them. Yes, we are talking about Dogecoin. Sentimental drivers can answer your question: What makes crypto go up and down?

Recall how Dogecoin (DOGE) rallied when Elon Musk finally took over Twitter on 27 October 2022.

Not just DOGE, sentimental drivers work for many cryptos, especially the ones with massive social communities and celebrities backing them.

Social presence

Crypto is a nascent space. Plus, we do know how big Crypto Twitter is. Therefore, the more social mentions a project gets over time, the more chances it has of rising in value. Similarly, tepid social existence can lead to flattening prices.

To evaluate the social presence, you can look at the Crypto Fear and Greed Index, which uses social activity as a calculation metric. However, the index gives you a picture of the broader market rather than pointing to a specific crypto.

Tokenomics

Tokenomics—concerns everything that makes crypto valuable, including its supply and utility. For instance, it talks about how much of the token supply is locked, what is the market cap for the given crypto, its global rank, etc. Some projects have planned token unlock schedules, which for a moment, can lower the prices due to an increase in supply.

Similarly, some projects schedule token burns, adding to the scarcity and positively impacting the prices.

So now, if someone asks you what makes crypto go up and down, you have the answers. However, crypto is still volatile and a hugely speculated space. Hence, global regulations, bans, and pro-crypto stances can also impact prices. Due to the plethora of price-influencing factors at play, you should always do your research before making any crypto-specific decision.

FAQs

What are the factors that affect the rise and fall of crypto?

1. Factors influencing the rise and fall of crypto include:

1. Supply and demand dynamics

2. Market sentiment and speculation.

3. Government regulations.

4. Cost of production.

5. Market capitalization.

6. Node count and network participation.

What determines if crypto goes up or down?

Crypto prices fluctuate based on supply and demand, market sentiment, regulatory news, and technological developments.

What determines the rise of crypto?

The rise of cryptocurrency is determined by increasing demand, positive market sentiment, adoption by mainstream financial institutions, and technological advancements like upgrades in blockchain protocols.

How do you predict the rise and fall of crypto?

Predicting the rise and fall of crypto involves analyzing market trends, conducting fundamental and technical analysis, monitoring regulatory developments, and assessing investor sentiment