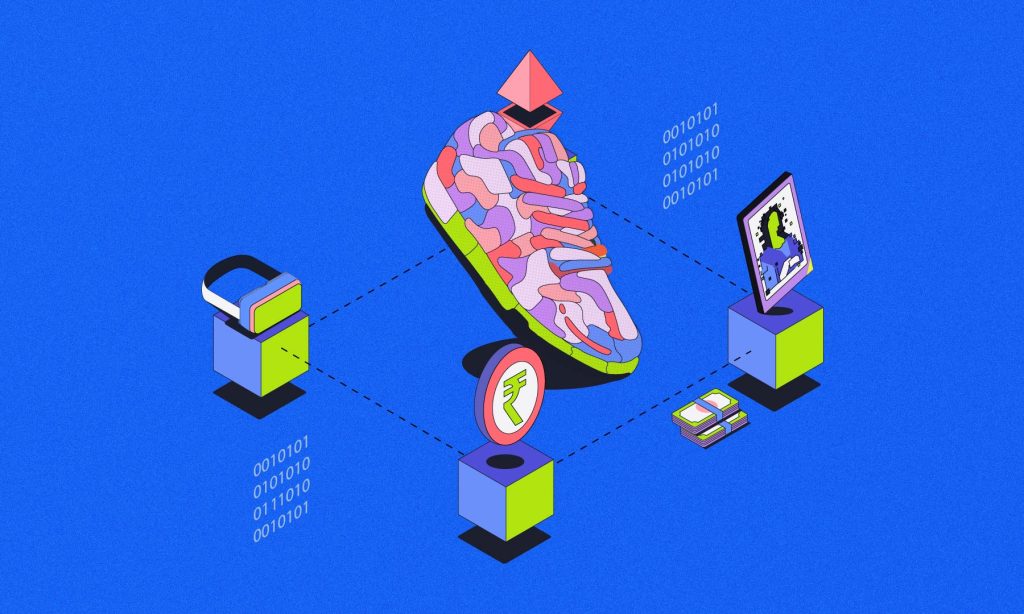

Believe it or not, nonfungible token (NFT) sneakers are a rage in the crypto world. The sneaker bug has bit independent designers, artists, tailors, and collectors who are looking to create a new market for digital fashion and art. Armed with blockchain technology, these creators can actively trade in sneakers for a cool profit. Sounds enticing? This blog post will discuss how NFT sneakers make money.

NFT sneakers and making money

The first pair of NFT sneakers launched in 2019 was a runaway hit. The pair of sneakers was auctioned off for a cool $10,000 or 30 ETH then. The sale represented one of the earliest instances of a major brand experimenting with NFTs and digital sneakers. A company called RTFKT (pronounced artifact) developed a digital fashion brand in March 2021 to create virtual sneakers and other digital wearables for NFT collectors.

Nike launched its first line of NFT sneakers, called Sneakers of the Metaverse, in collaboration with several popular NFT artists, including Ferocious and Mad Dog Jones. The sneakers came in limited editions of 10, and each was unique in its design and characteristics. In fact, Nike has apparently made $30 billion in sales in the metaverse.

Introduction to NFT sneakers

NFTs, like digital sneakers, represent a new way of valuing and exchanging digital assets. They allow creators and collectors to establish the ownership and authenticity of digital items in a way that was not possible before. The trend has opened up new opportunities for artists, designers, and creators to monetize their work and reach a global audience.

Unique features and characteristics of NFT sneakers

NFT sneakers have unique features and characteristics that distinguish them from traditional physical sneakers. Many NFT sneakers are rare or special edition digital assets. They are customizable, interoperable, verifiable (digital certificate confirming authenticity), and—above all—can be programmed with certain features and functionalities, such as the ability to change colors or designs based on external factors like the weather or time of day.

Making money with NFT sneakers

Crypto ushered in nothing short of a financial revolution. NFTs cash in on this new trend, heralding the emergence of a new economic model that challenges traditional notions of value and ownership.

One way to make money with NFT sneakers is to buy them and hold onto them for a period, hoping their value will increase over time. However, this requires a good understanding of the market and factors impacting NFT sneakers’ value. One can buy and sell NFT sneakers on marketplaces such as OpenSea, Rarible, or Nifty Gateway. You can profit from your investment by buying low and selling high. If you are a designer or artist, you could create NFT sneakers and sell them on various marketplaces. Creating NFTs requires talent technical skills and a good understanding of the market and the preferences of NFT collectors.

Selling NFT sneakers on online marketplaces

Online marketplaces like OpenSea provide a platform for these creators to sell their digital sneakers directly to buyers, obviating the need for intermediaries like galleries or auction houses. The marketplaces often use a bidding or auction system to determine the price of NFT sneakers, and they typically take a commission on each sale.

Earning royalties from NFT sneaker resales

As an NFT sneaker creator or owner, you can earn royalties from the resale of your NFT sneakers. Smart contracts, which are self-executing digital agreements that automatically enforce the terms of a contract, make this possible. When an NFT sneaker is resold on the marketplace, the smart contract automatically deducts the royalty fee from the buyer’s payment and sends it directly to the creator’s wallet. The mechanism ensures that creators are fairly compensated for their work, even after it has been resold multiple times. Interestingly, NFTs have applications beyond sneakers. In fact, Smart NFTs have considerable applications in gaming and healthcare. To learn more, read this article from CoinSwitch.

Using NFT sneakers as collateral for loans

Several decentralized finance (DeFi) platforms like Aave, Nexo, and MakerDAO accept NFTs as collateral. It’s essential to do your research and choose a reputable and trustworthy platform. You could also use the DeFi platform to connect with your digital wallet to trade or use the digital sneakers as collateral for loans easily.

Challenges and opportunities in the NFT sneaker market

The NFT sneaker market presents both challenges and opportunities. One challenge is the potential for fraudulent or counterfeit NFTs, which could undermine the market’s credibility. The volatile nature of the crypto market can impact the value of NFTs. Besides, there is the risk of regulatory intervention, which could disrupt the market.

On the other hand, the NFT sneaker market also presents several opportunities. NFTs allow sneaker enthusiasts to collect and trade limited-edition digital sneakers, which can create new revenue streams for creators and sellers. Additionally, NFTs provide authenticity and provenance that is difficult to replicate in the traditional sneaker market. Using smart contracts in NFTs also allows for automated royalty payments, ensuring that creators are compensated fairly for their work. The NFT sneaker market can potentially revolutionize how we think about sneaker collection and ownership. But it also requires careful consideration of the risks and challenges involved.

Future of the NFT sneaker market and its impact on the fashion industry

The future of the NFT sneaker market is promising as it offers a new way for sneaker enthusiasts to collect and trade limited-edition digital sneakers. The impact of NFTs on the fashion industry is significant. NFTs open up a new revenue stream for designers and brands and change how we think about ownership and authenticity in the digital age. However, careful consideration of the risks and challenges involved is necessary to ensure the continued growth and success of the NFT sneaker market.

Conclusion

With established brands like Nike making fast inroads into the NFT metaverse industry, NFT sneakers seem like an attractive way to earn money. However, it’s important to note that the value and prices of NFTs and digital sneakers can be highly volatile, and there is no guarantee of making money. As with any investment, it’s crucial to do your research and invest only what you can afford to lose.

FAQs

How does an NFT make money?

It’s important to note that the NFT space is dynamic, and success can vary based on factors such as the popularity of the creator, the uniqueness of the content, and the overall market trends. Additionally, individuals should carefully consider the environmental impact and sustainability of NFTs, especially in ecosystems that use energy-intensive consensus mechanisms like proof-of-work.

What does NFT mean in sneakers?

It’s important to note that while NFTs in the sneaker space provide new opportunities for ownership and engagement, they also come with considerations such as environmental impact (depending on the underlying blockchain technology) and potential challenges in the physical-to-digital authentication process. As with any emerging technology, the application of NFTs in the sneaker industry may evolve over time.

How can I earn from NFT in India?

1. Create NFT Art or Content:

If you are an artist, designer, musician, or content creator, you can create digital art, music, or other digital content that can be tokenized as NFTs. Many artists use platforms like OpenSea, Rarible, or Mintable to mint and sell their NFTs.

2. Use NFT Marketplaces:

Explore popular NFT marketplaces to list and sell your NFTs. Some well-known marketplaces include OpenSea, Rarible, Mintable, and others. These platforms provide a marketplace for creators to showcase and sell their digital assets.

How does Stepn shoes work?

If Stepn shoes is a platform, marketplace, or service related to NFTs, digital assets, or virtual fashion, it’s possible that it involves the tokenization or representation of shoes as non-fungible tokens (NFTs) on blockchain platforms. In such cases, users may be able to buy, sell, or trade virtual representations of shoes, and ownership could be verified through blockchain technology.