In the physical world, the idea of land and property has always been tied to location and geography. But now a new frontier is opening, digital parcels, not physical plots. Virtual real estate is emerging as a new asset class, allowing anyone to own “land” inside digital worlds built on blockchain. This changes what “owning property” means. It also opens opportunities for people who want to explore, build, or invest beyond physical constraints. As platforms advertise “metaverse land,” people often ask: How to buy land in the metaverse?

What is Virtual Real Estate?

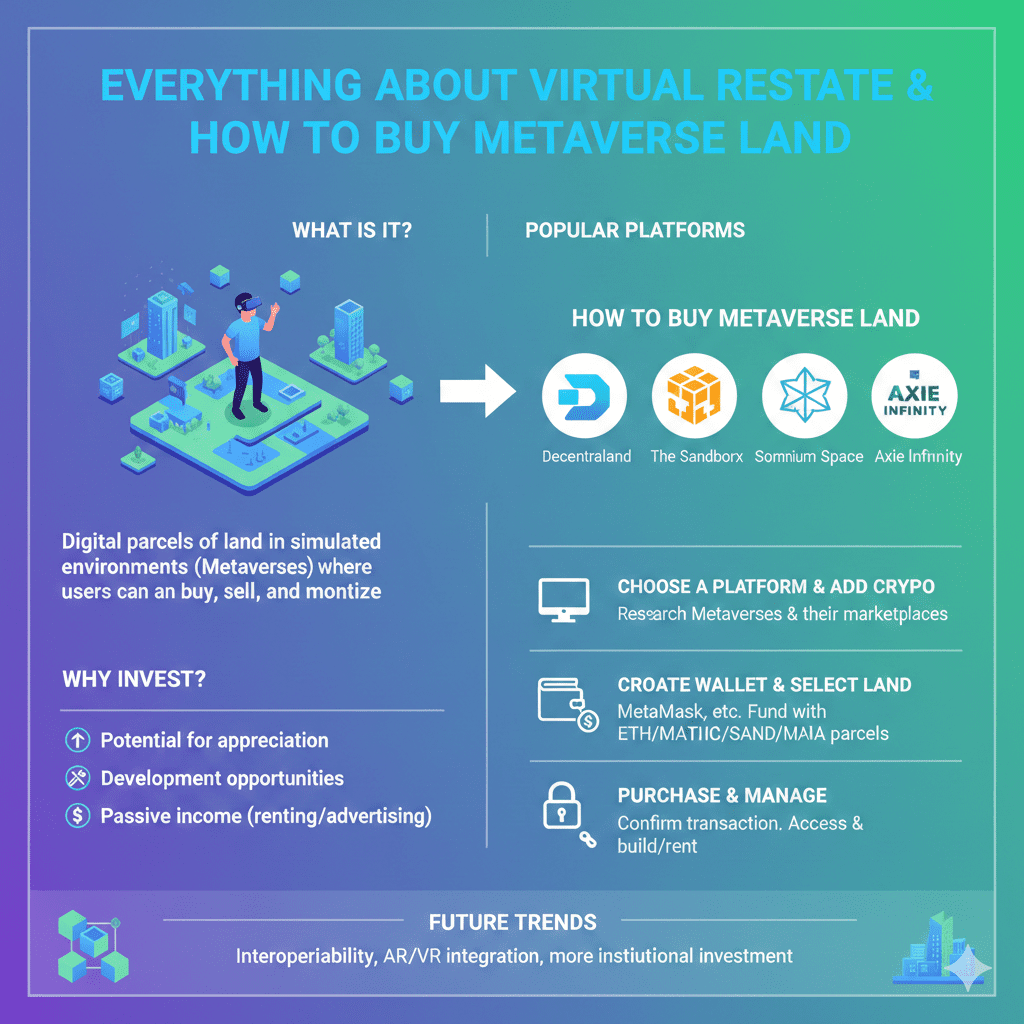

Virtual real estate refers to land, buildings, or property that exists entirely in digital, blockchain-enabled worlds. Instead of concrete or soil, virtual real estate is stored as a digital token, typically a non-fungible token (NFT) that proves you own a unique parcel of land or property in a metaverse.

These virtual spaces, plots, parcels, and buildings can be bought, sold, traded, developed, and even rented. Some platforms let owners build virtual houses, offices, galleries, event spaces, or even stores and entertainment zones inside their digital land.

Virtual real estate behaves a lot like physical real estate: scarcity, location, and demand matter. But unlike physical real estate, virtual land requires near-zero maintenance, has no physical boundaries, and is globally accessible.

When we talk about metaverse land, virtual land, virtual real estate, or metaverse property, we refer to blockchain-backed parcels that grant users ownership rights (via NFTs) in digital worlds.

How Does Virtual Real Estate Work?

Virtual real estate lives on blockchain technology. Every plot, every parcel, every “piece of land” is represented by a unique token, an NFT. This token acts as a deed, proving your ownership on the blockchain ledger.

Just like physical real estate, the value of virtual land depends on several factors:

- Location: Parcels near high-traffic zones, near popular landmarks, or in central “city” areas of the metaverse tend to have higher demand and value.

- Scarcity: Each metaverse world has a limited number of land parcels. As supply remains fixed (or limited), demand from more users or investors pushes value up.

- Platform popularity and user activity: Real traffic, events, social interactions, and use-cases (gaming, commerce, social hangouts) boost interest. Land within popular or active platforms draws more demand.

- Ownership and liquidity: Because ownership is via blockchain/NFT, buying or selling virtual land is easier and faster. Some platforms work like marketplaces; others use external NFT marketplaces, simplifying transfer of ownership.

Once you own a parcel, you can build, develop, rent, or sell it. Some people treat it purely as an investment asset; others create virtual experiences, virtual stores, event venues, galleries, social hangouts, or even virtual offices.

Read More: Metaverse Crypto Coins: Are They a Good Investment?

Participation in Virtual Real Estate

Getting involved in virtual real estate involves a few steps. First, you pick a platform. There are multiple metaverses: virtual worlds that host parcels of land as NFTs. Popular examples include land in platforms like Decentraland and The Sandbox.

Then you browse available parcels, sometimes during initial land sales, sometimes on secondary marketplaces (NFT marketplaces like OpenSea or in-platform marketplaces). Once you select a piece of virtual land, you complete the purchase, the blockchain records the transaction, and the NFT representing your land goes into your wallet. Ownership is yours; you hold the deed as a unique blockchain token.

After purchase, you have several options:

- Hold it as an investment, hoping the value rises as the platform grows.

- Develop it: Build virtual buildings, stores, galleries, or event spaces. Some landowners create virtual businesses, entertainment zones, or community hubs.

- Lease or rent the land to others. Some platforms allow rental or leasing arrangements.

- Sell or resell: Because of NFT ownership, selling is similar to real estate flipping, just that it is digital.

Participation doesn’t need huge capital. In many metaverses, smaller parcels remain available, and entry costs are lower than real-world real estate. This democratizes access: anyone globally with crypto and a wallet can join.

The Benefits and Risks of Virtual Real Estate

Benefits

- Global accessibility & easy entry: Anyone with internet and crypto access can buy virtual land. No geography, no physical constraints. You bypass land-use laws, property taxes, and maintenance hassles.

- Lower upfront and maintenance costs: Virtual land requires no construction, upkeep, or physical maintenance. Compared to real-world real estate, costs are minimal beyond the purchase itself.

- Flexibility & creativity: Owners can build almost anything: virtual homes, offices, galleries, shops, event spaces, art exhibits, games, social hubs. The only limit is imagination.

- Liquidity & ease of transfer: Because virtual land is an NFT, buying and selling occur quickly, securely, and transparently on the blockchain. Transfers and resales work like digital asset trades.

- Speculative upside: In early or growing platforms, early buyers may see strong appreciation. As demand increases and platform popularity grows, value can spike, similar to “buy land in the metaverse early” narratives.

- Utility and monetization possibilities: Owners can rent, lease, host events, sell virtual goods or services, or monetize traffic via ads or sponsorships, especially if their land sits in high-traffic blockchains.

Risks

- Speculative nature and volatility: Virtual real estate depends heavily on platform popularity, community activity, and demand. If user interest drops or new platforms overshadow older ones, value can decline rapidly.

- Platform risk: The platform hosting the land might shut down or experience technical failures. Since virtual land exists inside that world, any platform issue can devalue or nullify investment.

- Illiquid or uncertain resale value: Even though NFTs are tradable, demand may not always be there. Selling virtual land depends on other buyers seeing its value. If interest wanes, the property might sit unsold.

- Regulatory and legal uncertainty: Virtual land is a new asset class; laws and regulations are still evolving. Regulatory changes could affect ownership rights, taxation, or the legality of exchanges across regions.

- No physical value or guarantee: Unlike physical real estate, virtual land doesn’t provide shelter, privacy, or physical utility. Its value rests purely on demand, popularity, and digital offering. If those fade, value could vanish.

The Future of Virtual Real Estate

Virtual real estate stands at the intersection of technology, social interaction, and investment. As more people become comfortable with digital worlds, as VR/AR evolves, and as Web3 adoption deepens, demand for virtual land may grow significantly.

Platforms are experimenting with immersive experiences, interactive environments, VR meetups, gaming, virtual commerce, concerts, galleries, social spaces, and more. Virtual land could evolve into digital shopping districts, art hubs, event venues, or even virtual tourism spots.

Because each land parcel is unique and limited, scarcity will likely continue playing a role in value. As platforms mature, some plots may become digitally “prime real estate”, land near central hubs, high traffic areas, or popular venues, similar to city-center property in real life.

For creators, businesses, and brands, virtual real estate represents a new frontier. Companies might build virtual storefronts, immersive marketing experiences, digital showrooms, event spaces, or global communities without borders. That means demand may shift from pure speculation to utility-driven ownership.

Virtual real estate transforms the idea of property ownership. What once needed land deeds, physical space, and geography now fits inside a crypto wallet. Virtual land, digital parcels in metaverse worlds, exists via NFTs on blockchains. It captures scarcity, ownership rights, and potential for development, monetization, or speculation.

For those wondering how to buy land in the metaverse or invest in virtual property, the process is straightforward: choose a platform, hold the necessary crypto, purchase via NFT, and claim ownership. After that, the land becomes yours, ready for development, resale, or simply holding as an asset.

The opportunity is real, the technology is real, and the adoption may grow over time. But success requires caution: platform choice, understanding risks, watching liquidity, and respecting the speculative nature.

FAQs

1. How to sell land in the metaverse

Selling virtual land works like selling an NFT. You list your virtual land NFT on a marketplace (in-platform or external), set a price in crypto, and wait for a buyer. Once a buyer accepts, ownership transfers on the blockchain, and you receive payment.

2. How to rent land in the metaverse

Some platforms and communities allow leasing or renting virtual plots, where owners can lease virtual land or property to other users or businesses for a fee. This could support virtual shops, digital galleries, event venues, or other use cases.

3. Tips before buying NFT virtual land

• Research the platform: Check user base, activity levels, and long-term sustainability.

• Evaluate location: parcels near central hubs or high-traffic zones tend to appreciate more.

• Understand token economics: native crypto volatility, scarcity, and demand influence land value.

• Start small: consider smaller parcels or inexpensive land before scaling up.

• Have an exit plan: ensure that resale or rental markets exist before committing heavily.