The global crypto market continues to carry forth last week’s weakness with its flattish stance. But the broader space has managed to buck the bearish trends, even if only marginally, to regain the $1 trillion market capitalization, up by 0.06% daily.

Top players Bitcoin (BTC) and Ether (ETH) didn’t move much over the past 24 hours, registering 0.18% and 0.62% gains, respectively. The steady market could be attributed to the lack of impactful/sentimental activity over the past few hours, with the one exception to this being the liquidity crisis looming over NFT lender BendDAO.

Going forward, the Merge is expected to continue turning heads and influencing trading decisions over the next few weeks. But, with Fed Chairman Jerome Powell scheduled to speak at the Jackson Hole conference on 26 August, primarily about the extent of the upcoming rate hikes, waiting and watching the crypto space may be a safe bet.

Some highlights

Here are some of the highlights that might influence trading decisions going forward:

- Bitcoin market dominance has fallen under the 40% mark, down by 0.03% from yesterday.

- Trading activity across the crypto space seems steady, with $70.28 billion worth of trading volume registered in the past 24 hours.

- India’s first onshore crypto index CRE8 is seen trading at ₹2,912.01 at release, down by 0.84%, day-on-day.

Now let’s look at the coins that started moving the most, early Wednesday.

Key coins

None of the cryptos from the top 10 (by market cap) list are currently outperforming CRE8. In fact, Solana (SOL) and Dogecoin (DOGE) have shed 1.44% and 1.69% over the past 24 hours.

As for the top gainers, the metaverse project Chiliz (CHZ) looks strong, with day-on-day gains of almost 12.42%. Following CHZ is AST—a DeFi token—up by 8.93%. Bitcoin Cash, or BCH, is a surprise on the list as it gained close to 8% despite there being no significant sentimental driver.

EOS is the biggest loser of the day—shedding 6.54% early on Wednesday. The loss was triggered by news of an upcoming hard fork in the network.

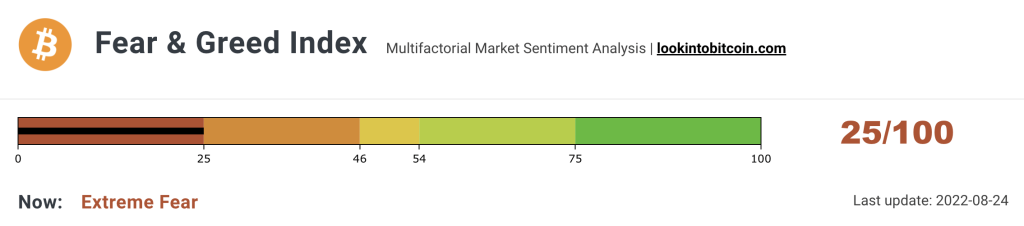

Crypto Fear and Greed Index (CFGI)

Last week, the Crypto Fear and Greed Index was at 41, inspiring confidence among buyers. However, the market-wide sell-off has pushed the index back to around the 25 mark—extreme fear territory. The index staying here can push the market lower if negative sentimental drivers are around.

If you plan on taking buying (trading) decisions as of now, we recommend caution and an airtight DYOR strategy. Also, it is better to wait for the CFGI levels to cross and stay for a while around 35 before taking the plunge.

FAQs

Is crypto expected to rise?

Cryptocurrency is expected to rise based on positive market forecasts, bullish momentum, and increased institutional interest.

Is the crypto market recovering?

Yes, the crypto market is recovering, with Bitcoin experiencing a resurgence in 2024 after facing significant downturns in previous years.

How is the crypto market doing today?

The crypto market is performing well today, maintaining its bullish momentum in 2024, with notable gains in cryptocurrencies like Ethereum and Bitcoin.

What is the biggest crypto crash in 2022?

The biggest crypto crash in 2022 resulted in a bearish downturn in the market, notably affecting Ethereum’s price.