The much-anticipated Ethereum Merge turned out to be anticlimactic. On 15 September 2022 (the day of the Merge), the broader crypto market lost over 7%. And the correction extended through the weekend. The market seems to have lost another 4.22%, day-on-day, at the time of writing.

Almost every top crypto player is in the red. If you are a trader/investor, it is better to wait this period out, especially with the Fed interest hikes expected on 21 September 2022.

Significant developments

It is the first week post-Merge. Here are some developments that caught our attention:

- The overall crypto market is currently valued at $932.02 billion.

- Bitcoin dominance has shot up over the past few days to settle at 39.92% at release.

- Ethereum’s market dominance has dropped after the PoS transition, and the native token is currently holding steady at 17.63%.

- CRE8, India’s onshore crypto rupee index, is currently trading at ₹2,650.49, down by almost 9%, week-on-week.

Key coins

The big guns have had a pretty dismal week in terms of price action. While BTC dropped 11.79% over the week, ETH corrected by 23.98% despite the Merge harboring positive sentiments.

Chiliz—the popular metaverse token—is the top gainer this Monday. It is up by almost 7.80%. The positive price action can be attributed to the nearly 100% increase in daily trading volumes. Following Chiliz is AirSwap (AST), a DeFi project that is marginally in the green with a 0.94% uptick against its name.

Another DeFi project, Kyber Network (KNC) is the biggest loser today, down by 28.89% at the time of writing.

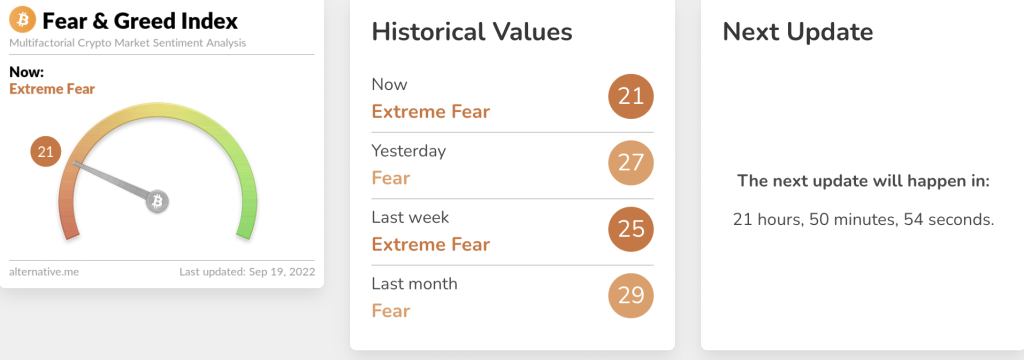

Crypto Fear and Greed Index (CFGI)

The Crypto Fear and Greed Index (CFGI) is at 21, down eight points since yesterday. The index is in extremely fearful territory for now. This time last week, the index was at 25. The bearish vibes might thus be gaining the upper hand.

Keeping a close eye on upcoming Fed news is vital as a 75 bps hike is on the cards. Cardano’s Vasil fork is slated for 22 September. Any change in plans may also contribute to price action in the market.

Sitting on the sidelines with an airtight DYOR strategy seems to be the way forward for now.