The crypto market had a roller coaster ride in Wednesday’s session, starting the day on a dull note with Bitcoin trading below the $19,000 level for the first time in three months. However, as the day wore on, the market recovered, supported by falling bond yield and a breakout in the tech-heavy Nasdaq, which closed the day up 2.14%.

However, this is more likely a short-term spurt in the market as global market conditions remain uncertain amid the impending energy crisis caused by the standoff between Russia and the West.

Despite the rebound in the crypto market, the Fear & Greed Index slid further by four points in yesterday’s session and is currently at the 20/100 level, signaling extreme fear among investors.

The total market capitalization of crypto stands at $975 billion, while the ETH dominance level has increased by 20.4%.

Key coins

After the initial sell-off, Bitcoin recovered but is now facing strong resistance at the $19,200 level. Weak investor sentiment and uncertain global macroeconomic conditions are pulling the market down. To reverse the bearish trend in the short term, the world’s largest cryptocurrency by market capitalization needs to break above the 50 *EMA slope, which has turned extremely resistive.

*EMA: Exponential Moving Average

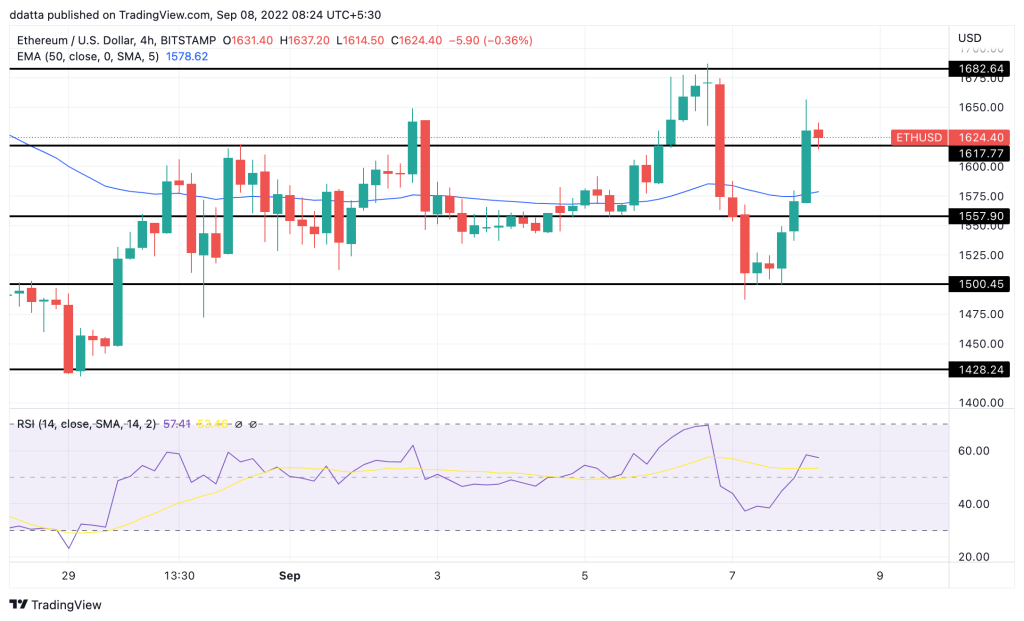

Thanks to the ongoing merge process, Ethereum is witnessing huge price action, gaining almost 8.11% in the last 24 hours. ETH reversed the trend quickly after the initial sell-off and is now above the resistive $1,620 level. Keep a close eye on how ETH moves around the key support and resistance levels. A break above the $1,680 level will help ETH to move even higher.

Other top coins witnessing huge price action include BNB, SOL, DOT, MATIC, ETC, and ATOM.

Top 5 gainers in the last 24 hours

- Fetch.ai (FET): 28.51%

- iExec RLC (RLC): 20.87%

- EOS (EOS): 19.45%

- Celer Network (CELR): 12.48%

- Curve DAO (CRV): 12.15%

FAQs

Why is crypto crashing?

Cryptocurrency markets can crash due to various factors such as regulatory concerns, market manipulation, economic uncertainty, and negative sentiment triggered by events like bans or restrictions

When the crypto market will go up?

Predicting exact timing is challenging, but historical trends suggest that cryptocurrency markets tend to recover after corrections, often influenced by factors like adoption, technology advancements, and market sentiment.

Will crypto go back up?

Historically, cryptocurrencies have experienced cycles of boom and bust, with periods of decline followed by recovery and growth.

What is happening with crypto 2024?

Specific events in 2024 may vary, but overall, the cryptocurrency market is expected to continue evolving, influenced by factors like technological developments, regulatory changes, and market sentiment