The broader crypto market held surprisingly steady over the past 24 hours, despite Fed Chair Jerome Powell’s comments during the day, as part of a Cato Institute interview. During the interview, Powell hinted that there may again be aggressive rate hikes to check inflation.

Powell’s remarks may have been balanced out by data showing a significant addition to jobs in the US. Another factor could be the optimism garnered on account of the upcoming Ethereum Merge and Cardano’s Vasil fork.

The overall crypto space is up by 2.12% as of 9 September 2022.

Significant developments

Here are some of the key developments to surface this Friday morning:

- Europe is witnessing its biggest hike in interest rates, which have risen to 75 bps.

- The global crypto space is valued at $985.78 billion, as of 9 September.

- Bitcoin’s market dominance keeps falling but is currently steady at 37.63%.

- CRE8—the onshore crypto rupee index—is up by 0.81% over the past 24 hours.

The crypto market has failed to keep its pre-merge gains from 6 September 2022. However, most cryptos are seeing steady price action and that may be cause for some optimism.

Key coins

Bitcoin (BTC) and Ether (ETH) showed minor gains in the last 24 hours, up by 0.81% and 0.78%, respectively. Solana (SOL) was the outperforming crypto on the top 10 list, with a 4.89% uptick to its name at the time of writing. Following Solana was Polkadot (DOT), the Layer-0 blockchain network. DOT is up by 3.37% as of 9 September.

When it comes to key levels, BTC was last seen trading at $19,392. ETH looked a tad stronger in comparison—holding steady at $1,639.

When it comes to top gainers, decentralized marketplace Polymath turned out to be a dark horse, with 70% in unregistered gains, day-on-day, for its token POLY. Golem (GLM), the famed payments ecosystem, was also seen trading aggressively, up by 34.50% at release.

Fetch.ai (FET) of the Cosmos Ecosystem corrected the most, down by 4% over the past 24 hours.

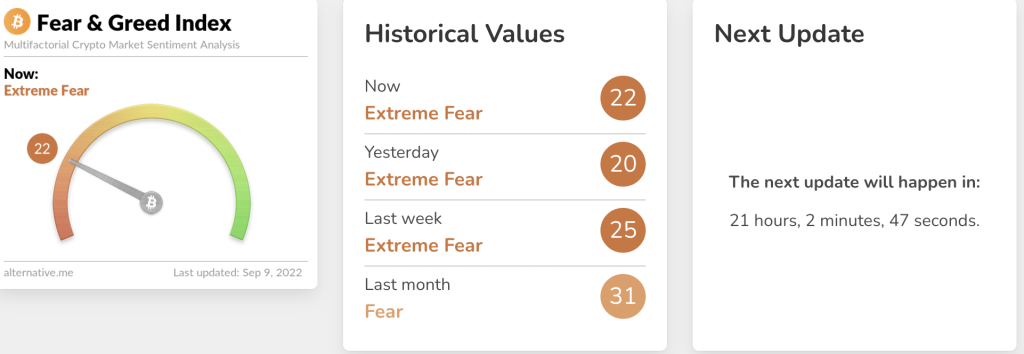

Crypto Fear and Greed Index (CFGI)

Market sentiments continue to remain fearful on Friday. Currently, at 22, the crypto fear and greed index needs to cross the 35 mark and stay there for us to expect any signs of buyer optimism.

However, the levels have gone up (moderately) as compared to yesterday. Weak and fearful sentiments may persist for a while, with US CPI (Inflation) data for September being released next week.

Despite broader financial apprehensions, the Merge still stands out as a glimmer of hope for the overall crypto community. Still, we recommend using your discretion and doing your own research over everything else.

FAQs

How far will crypto fall in 2022?

Crypto prices experienced significant volatility in 2022, with Bitcoin fluctuating between $30,000 and $50,000 due to various factors, including regulations and environmental concerns.

What is the next trend in crypto?

The next trend in crypto is uncertain, but experts suggest continued adoption of blockchain technology, decentralized finance (DeFi) innovation, and potential growth in non-fungible tokens (NFTs) as notable areas to watch.

How much was Bitcoin in September 2022?

Bitcoin’s price in September 2022 varied due to market fluctuations. However, it was within the range of $30,000 to $50,000, reflecting the volatile nature of cryptocurrency markets during that period.

Will the crypto market recover?

The crypto market has shown resilience in the past, with periods of recovery following downturns. However, future performance depends on various factors such as regulatory developments, technological advancements, and market sentiment.