What Is a Hedging Contract?

A hedging contract in crypto is like armor for your portfolio. It’s a risk management strategy designed to protect you from market volatility. Instead of predicting where Bitcoin or Ethereum might go next, hedging prepares you for both possibilities. Professional traders, DeFi users, and even institutions use hedging contracts to lock in prices and smooth out volatility.

Buying a hedge is like buying insurance on your digital assets. Here, you pay a small amount today to avoid a big loss tomorrow. When your holdings drop, your hedge gains value, keeping your total returns balanced. It’s not about avoiding risk altogether; it’s about managing it with precision so you can keep your long-term conviction intact.

How It Works

Picture this: you hold ₹10 lakh worth of Bitcoin. The market looks bullish, but a sharp correction could hit at any time. Instead of selling your Bitcoin, you open a short hedge using BTC futures or perpetual contracts on an exchange. If Bitcoin’s price falls, your short position earns profit that offsets the loss in your holdings. If it climbs higher, your Bitcoin gains outweigh the small loss on your hedge.

That’s how hedging works; it keeps your portfolio steady in a market known for chaos. Crypto traders also hedge stablecoin yields, NFT positions, and DeFi liquidity pools the same way. The principle stays simple: when markets zig, your hedge zags.

Downside

Every hedge comes at a cost. You pay fees, premiums, or interest to maintain positions, and sometimes that chips away at your profit. If the market keeps rising, the hedge feels unnecessary. But most seasoned crypto traders still hedge because they know volatility never sleeps.

Complexity is another challenge. Over-hedging can limit your gains; under-hedging leaves you exposed. Getting the balance right takes experience and a clear read on market conditions. Liquidity can also tighten fast in smaller tokens, making it harder to close out hedges quickly.

Hedging is brilliant when used wisely. It won’t make you invincible, but it will keep you standing when others panic.

Read More: The use of crypto exchanges for trading and hedging

Hedging With Derivatives

Derivatives are the core of crypto hedging. They are financial instruments that derive their value from an underlying asset, say Bitcoin, Ethereum, Solana, or even meme coins. Futures contracts let traders lock in a price for a future date. Options give flexibility, the right, not the obligation, to buy or sell later. Swaps and perpetuals handle everything in between.

For example, a miner can use Bitcoin futures to fix the selling price of mined BTC before it’s even produced. A DeFi investor holding altcoins can buy put options on Ethereum to guard against a market-wide dip. Even institutions hedge stablecoin reserves through derivatives to manage funding rates.

These tools might sound complex, but their goal is simple: to control risk in a market that moves faster than traditional finance ever did.

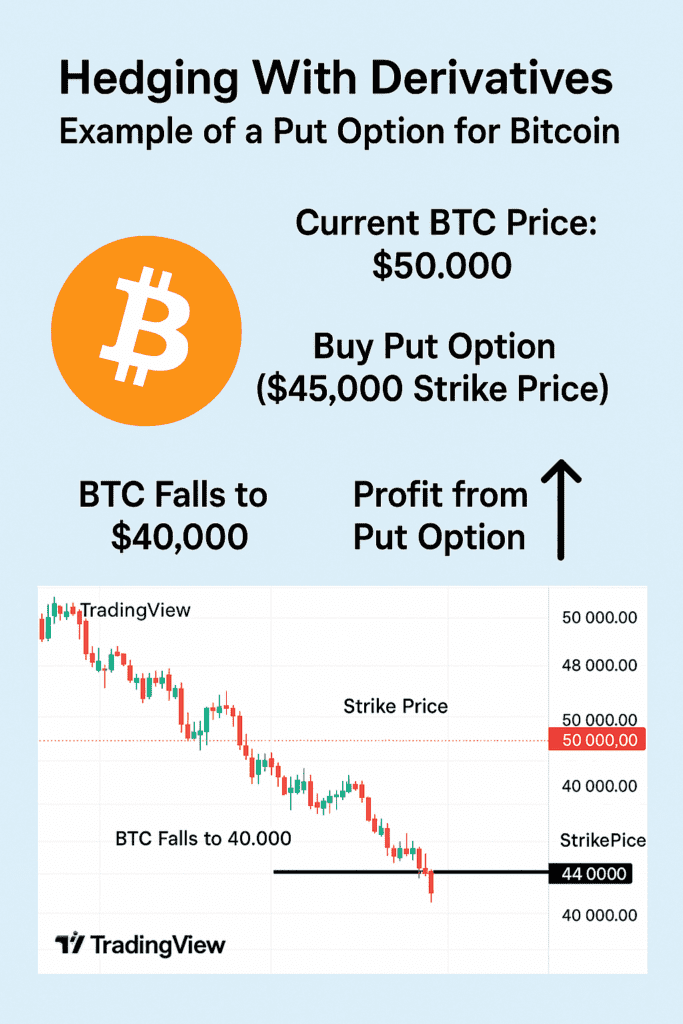

Example of a Put Option

Let’s say Bitcoin trades at ₹70 lakh, and you want to protect your profits. You buy a BTC put option with a strike price of ₹65 lakh, paying a premium for it. If Bitcoin crashes to ₹60 lakh, the put option gains ₹5 lakh per coin, offsetting your loss. If Bitcoin stays above ₹65 lakh, you lose only the premium but keep your holdings intact.

That’s the magic of a hedging contract, as it limits your downside while keeping your upside alive. In crypto, where a 10% swing can happen overnight, this kind of insurance is more a necessity than a luxury.

Hedging Through Diversification

Diversification is the simplest form of hedging. Instead of betting on one token, spread exposure across different sectors, Bitcoin for stability, Ethereum for ecosystem growth, Layer-2 tokens for innovation, and stablecoins for balance. When one dips, another often rises.

Holding a mix of assets across DeFi, NFTs, and centralized exchanges also hedges against specific risks like protocol hacks or liquidity freezes. Some investors even keep part of their portfolio in fiat or tokenized treasury assets to ride out bear markets.

Diversification doesn’t promise instant gains; it promises resilience. It keeps you in the game when others get wiped out.

Read More: Understanding Financial Swaps: Meaning, Features, and Types

Spread Hedging

Spread hedging focuses on relative value, not direction. Traders pair two assets that usually move together, say Ethereum and Solana, and bet on the difference in their performance. If Solana lags and Ethereum outperforms, a trader might go long ETH and short SOL. The goal isn’t predicting whether the crypto market rises or falls, but capturing the spread between two correlated assets.

It’s a strategy built for precision. Many professionals run short hedges within spreads to stay neutral while chasing smaller, consistent profits. In crypto, this method thrives on volatility, the very chaos that scares most retail investors away.

Hedging and the Everyday Investor

Hedging isn’t only for pros. Ordinary crypto holders can use simple tactics to manage volatility. If your portfolio holds a lot of altcoins, you can open a small short position on Bitcoin futures as a cushion. When markets dip, that short position covers part of your loss.

You can also park a share of profits in stablecoins to protect against sudden crashes. Holding Bitcoin, Ethereum, and a few blue-chip altcoins balances exposure across the ecosystem. Even automated bots on exchanges now help retail users hedge without needing to trade manually.

Think of hedging as a risk management strategy for your portfolio. It keeps emotion out, which is the only way to survive crypto’s wild mood swings.

Conclusion

A hedging contract in crypto isn’t about chasing profit; it’s about protecting it. The market will always swing between euphoria and panic. A short hedge, a put option, or a simple diversification plan keeps you calm through both extremes.

The smartest investors don’t try to predict every move; they build systems that keep them safe through all moves. Hedging is that system. It lets you stay invested through crashes, corrections, and recoveries without losing sleep.

In crypto, where one bad week can erase a year’s gain, hedging isn’t optional; it’s a strategy. It turns volatility from an enemy into a tool.

FAQs

1. What is an example of a hedging contract?

A trader holding Bitcoin can enter a futures contract to sell BTC at a fixed price next month. If Bitcoin’s price falls by then, the loss in spot value is offset by profit on the futures. That’s a classic hedging contract in crypto.

2. What does it mean to hedge a contract?

Hedging a contract means taking an opposing position to offset the potential for financial losses from adverse price movements in your primary investment. For example, going long on Bitcoin while shorting BTC futures to protect against short-term drops.