In case it isn’t obvious to you, we’re not talking about putting your crypto into the freezer here. Cold storage in crypto is one of the ways in which you can keep your digital assets safe. While the freezer variety of cold storage preserves dead meat, the crypto counterpart is the key to maintaining your financial well-being.

What is cryptocurrency cold storage?

Broadly speaking, you could store crypto in one of the two following ways:

- Hot wallets: Put simply, the hot storage option refers to the use of hot wallets to store crypto. In contrast, cold storage is essentially an offline storage system.

- Cold wallets: The cold type of storage is a way of keeping your crypto safe by using a physical medium, also known as a cold wallet.

The cold wallet type of storage option is the focus of this article. It is potentially one of the safest ways to store crypto, so long as you keep your wallet safe. The fact that the storage is not connected to the internet means better protection. With there being a huge number of hacks and exploits in the crypto space in 2022, this advantage of cold storage makes it ever so relevant.

There are many different types of cold storage. But the two most common ones are paper wallets and hardware wallets.

How does cold storage work?

At the heart of the cold storage system are private keys. Crypto tokens are not stored in a wallet. Instead, they live on the blockchain. Wallets simply hold the private key.

But what are private keys? Well, they are one of the two types of keys in use. The public key is a set of numbers used to identify a crypto wallet. It is similar to an account name or an email address. Private keys are also numeric codes, but they serve as a kind of credit card or debit card PIN. The private key is what gives users access to their accounts. It must be kept secure to prevent hackers from accessing the storage. The end goal of all crypto storage, both hot and cold, is the protection of these keys.

By limiting access to funds, such wallets and their private keys play a role in ensuring security in the entire crypto economy.

Here are some steps you could use to switch to a hardware wallet:

- Plug your hardware into your computer and install the relevant wallet software based on whether you use Windows or macOS.

- Create a new wallet for the crypto you want to store.

- To enable access to your private keys in case you lose your cold wallet or if it gets damaged, you will be given a seed phrase or backup code. It is paramount to keep the code in a safe place and to remember where you kept it. Many prefer to write it on paper and store the paper in a locker.

- Next, to access your device for daily use, you will have to generate a pin. After that, the cold wallet will give you an address. You can use it to receive crypto from different blockchains.

- You can now go to the exchange wallet or hot wallet and send them to this new cold storage wallet address.

Each crypto will need its own wallet.

You will need to follow the same process to send money to an external party or to transfer funds from a hot wallet to a cold wallet.

The bottom line is never to share your private keys with anyone or store them carelessly. Because anyone who has access to them can access your funds.

Cryptocurrency cold storage methods

There are different kinds of cold storage systems. You can learn about some of the options below.

- Paper wallets: Paper wallets are the classic cold storage system in crypto. As the name suggests, this type of wallet involves storing public and private keys on a piece of paper. Given the low-tech nature of this cold storage system, it can be susceptible to exploits. So, while using this type of wallet, make sure you have a safe place to store it—away from the elements and other people.

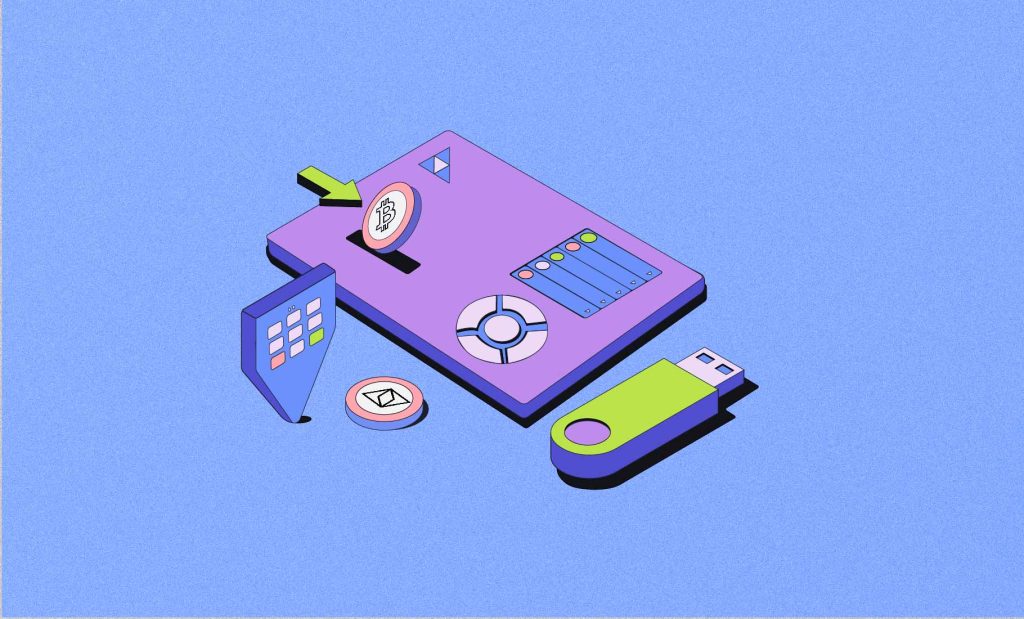

- Hardware wallets: This most commonly used type of wallet is considered the most robust cold storage option for crypto. A hardware wallet is basically an electronic device that resembles a flash drive. It stores private keys in offline, portable hardware. They work with different types of blockchains. Some hardware wallets even allow users to trade directly from the wallets. Users can rely on a backup seed key to recover funds in case of device damage or loss. This type of wallet usually doesn’t come cheap.

- USB drives: Given the high cost of hardware wallets, some prefer using a USB alternative to store their crypto keys. However, USB drives are not as secure as hardware wallets.

- Sound wallets: Sound wallets are a relatively outdated cold storage method. It involves encrypting and then recording the private key onto viny discs or Compact Discs (CDs). Deciphering the recording requires using a spectroscope application. While this type of cold storage system is great at security, it tends to be pretty expensive.

- Deep cold storage: This type of cold storage is for traders who are willing to go out of their way to secure their funds. Deep cold storage can involve a range of activities, from burying the private keys under the ground to breaking the private keys and putting them in different vault services.

Is cold storage the best option for crypto?

There is no clearcut answer to this question. It sure is helpful in some ways to keep your funds safe and secure, away from the platform that you use for trading. But there are so many ways to do it, and there are so many pros and cons to factor in.

Hot wallets are easy to use and access. You can use them daily to send and receive crypto or, in some cases, use them to pay for goods. However, accessibility comes at the price of always keeping your crypto online, which makes it a little more vulnerable to hacks.

While safer in that way, cold wallets are not so easy to access. The hardware variety, in particular, requires access to a computer.

Two other drawbacks of cold wallets are worth mentioning. Since cold storage options are physical devices, there is always the possibility of losing or misplacing them. The most well-known person to have landed themselves in this predicament is James Howells from Wales. Howells accidentally threw away his hard drive that contained a private key, losing access to 7,500 BTC. He has been pleading with local authorities to let him recover his BTC from the landfill ever since but to no avail. In addition to this disadvantage, cold wallets also face the risk of wear and tear.

If any such thing happens to a cold wallet, its holdings may become inaccessible, and the funds may even be lost forever.

What’s more, they come with a hefty price tag. They can cost anything from ₹5,000 to ₹15,000.

That said, many experienced crypto traders and experts do consider cold storage more secure than other options.

In any case, the type of crypto storage one prefers depends to a large extent on the trader’s specific needs. For instance, cold storage is a better option for HODLing crypto if you have long-term plans. But for crypto day traders, who enter and exit a position within the same day, a hot wallet may make more sense.

FAQs

What is cold storage in crypto, and why is it essential for security?

Cold storage in crypto means keeping your digital assets offline, like a hardware wallet or paper wallet. It’s crucial for security as it’s less vulnerable to online threats like hacking.

What are the potential risks or drawbacks of cold storage in crypto?

Cold storage in crypto offers enhanced security, but it has limitations. If you lose your hardware wallet or forget the access, your assets can become irretrievable. Additionally, it’s not as convenient for frequent trading.

What are the primary benefits of using cold storage for my crypto assets?

Cold storage for crypto provides enhanced security by keeping your assets offline, protecting them from online threats. It’s less susceptible to hacking, making it a reliable choice for long-term asset storage.

Can I use cold storage for all types of cryptocurrencies?

Yes, you can use cold storage for most cryptocurrencies. Popular hardware wallets support a wide range of coins, but it’s essential to check compatibility for specific cryptocurrencies you want to store.