You’re probably already familiar with the idea of “high risk, high reward.” The feature of leverage in crypto enables users to act on this idea. Exchanges offer the leverage feature to help those with small holdings to make the most of their money.

Using leverage, you can get access to a lot more of your preferred asset, so that you can trade with larger quantities without buying them. In fact, there is no buying involved at all. Instead, it involves borrowing the asset. Keep reading to learn more about this option.

Understanding Leverage in Crypto Trading

Leverage is a kind of loan. In leverage trading, the borrowing of crypto enables traders to finance any trades they want to make, based on the direction they think the crypto’s price might move in. The trading decision is ideally based on research they have done. The use of borrowed funds for trading gives them “leverage” in the market. Hence the name.

Interest is, of course, charged for borrowing the asset. Different crypto exchanges allow different types of loans. The loan could give you a wide range of profit—anything from 10x to 100x.

Leverage is best paired with an unstable asset. Traders use the volatility in prices to their advantage, and the leverage helps them get a better deal. Leverage is therefore an especially popular concept in crypto because this type of market is very volatile.

The leverage feature is useful because it allows traders to trade with a lot more than what they actually own. A wider audience can access trading due to this option.

How does leverage trading work?

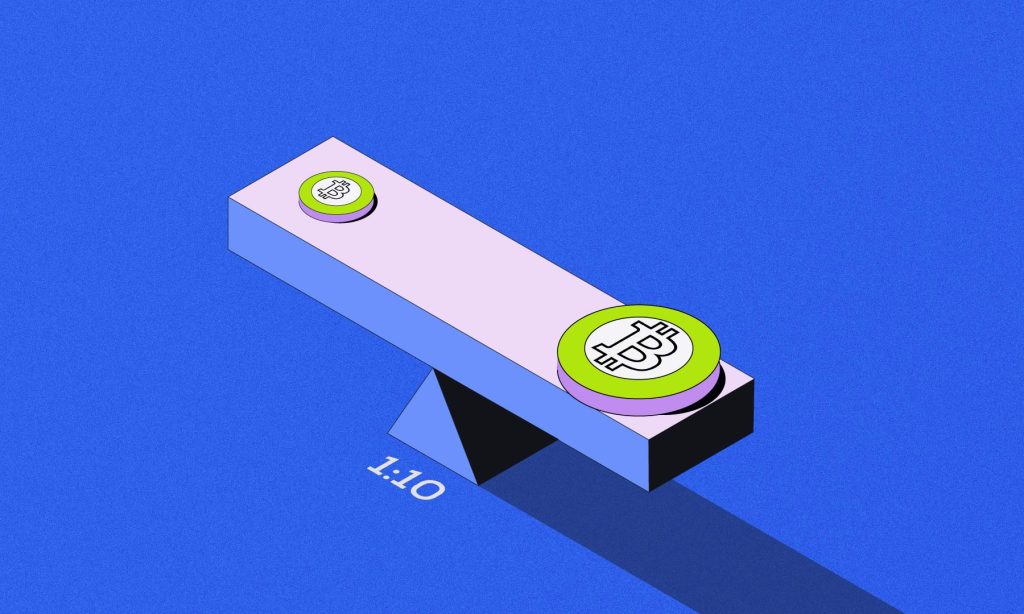

Let’s look at an example to understand the working of leverage trading. Suppose you want to trade with the ETH token worth ₹500 because the Ethereum Merge has just happened and you think the chances of profit are pretty high. But you only have ₹50 in your wallet. The 10x leverage feature on a crypto exchange will allow you to use what you have to get access to ETH worth ₹500 (that is ₹50 multiplied by 10). That’s because the ₹50 can be used as collateral to borrow 10x funds.

The collateral given for borrowing in leverage trading is also known as “margin.”

But why would anyone give you this huge loan for such a small margin? Well, you’re a small drop in the ocean of the massive leverage trading market, but they know that it all adds up. There are millions of users giving the platform ₹50 margins, so that leaves the service provider with a sum that isn’t so small after all.

That’s broadly how to leverage trading works. But there are many more nuances to it. To engage in leverage trading in crypto, you will need a derivative. Derivatives are what make leveraging very different from buying the dip and HODLing, in the hope of getting rich slowly.

The role of derivatives in leverage

Traders use a tool called derivatives to denote a contract between two parties bidding on the expected price of a digital asset. Imagine you made a contract estimating ETH’s price moves. This type of contract, known as a derivatives contract, could state that you expect ETH to experience a three-fold hike. You have been lent ₹500 against an account balance of ₹50 (the margin). Now, if the price of ETH even drops by a few rupees, your holding could get liquidated without giving you any profits, and you would still have to pay the interest as debt. That’s the risk you take on with this type of derivative contract.

These derivatives contracts are pre-decided by both the price and date of the crypto. There are three types of derivatives contracts that can be used by traders for leveraging crypto:

- Futures derivatives contracts: Under this type of contract, the parties are obligated to buy or sell crypto at a specific time or date in the future at an agreed-upon price.

- Perpetual derivatives contracts: The contracting party here can buy or sell the crypto involved without a fixed expiration date. Such contracts can be held indefinitely, and there is no need to roll over the contract when it is about to expire.

- Options derivatives contracts: A contract of this kind also allows the parties involved to buy or sell a specific asset at a set price in the future. However, unlike futures, an options contract gives the user the option of deciding whether or not they want to buy the asset in the end. There is no legal obligation to buy it.

The choice of derivatives contract used in crypto leveraging varies from trader to trader. It completely depends on the trader’s trading strategy and risk assessment. Irrespective of how carefully you make the choice, things can go either way. So, while leverage trading is a quick fix for lack of liquidity, it comes with its risks.

Advantages of leverage for crypto trading

It is perhaps evident by now why it may not be a bad idea to use leverage sometimes. To sum it up, leverage trading offers the opportunity to trade large position sizes with minimal funds in their wallets. So small price movements in the market can be translated into hefty profits.

Since leverage frees up some money, it also allows traders to get invested in multiple assets via derivatives. They can open many positions without compromising on position sizes.

It does not only help diversify portfolios but increases the chances of making a profit.

That said, it is better to engage in leverage trading only if you are a seasoned trader and have enough to spare.

How to manage risks with leverage trading

All enterprises usually involve some risks. However large or small, it is important to be aware of them. If you over-trade with a small trading account, for instance, you could lose all of your funds should the market turn against them. So, while leverage trading does allow you to magnify your profits, the converse is also true. Sometimes, with great risk comes great losses, too.

The concept of leverage trading may be intimidating due to these risks. That’s why there are a few risk management tools that you could look at to help minimize the risk.

- Stop-loss orders: The stop-loss feature lets traders set a limit to the amount they are willing to lose on their open positions.

- Take-profit orders: This type of order, on the other hand, comes with a limit on the amount of profit a trader can make in an open position.

- Hedging: This risk management tool allows traders to open two contrasting positions that offset each other.

Using all of these tools and ensuring that you only take informed risks will make all the difference.

Conclusion

Leverage trading clearly looks like an exciting option. Who doesn’t want to invest less and earn more? But, at Switch, we always encourage our readers to keep doing their own research, and we place a special emphasis on the need for it with leverage in crypto trading. You should definitely not get into it without having done enough research and some money to spare.

Make sure you understand the concept and the underlying risks before taking the leverage route. Additionally, starting small is always a good idea.

FAQs

What is leverage in crypto trading?

Leverage in crypto trading refers to borrowing funds from a platform or exchange to increase the size of a trading position, amplifying potential profits or losses. It involves trading with borrowed capital, magnifying both gains and risks.

How does leverage work in crypto trading?

Leverage in crypto trading involves borrowing funds from an exchange to amplify trade size. It magnifies both potential profits and losses, requiring a minimum margin to avoid liquidation.

What are the benefits of using leverage in crypto trading?

The benefits of using leverage in crypto trading include the potential for higher profits, increased exposure to market movements, and the ability to trade larger positions with a smaller initial capital. However, leverage involves higher risks and requires careful risk management.

What are some popular leverage ratios used in crypto trading?

Some popular leverage ratios used in crypto trading are 2x, 5x, 10x, 25x, and even higher, depending on the platform or exchange. Traders should consider their risk tolerance and market conditions when choosing a leverage ratio.