The crypto market today is displaying decisive two-part action: a massive, whale-driven rally early this morning, followed by a minor consolidation at midday. This rebound effectively reversed the slump that pushed Bitcoin below the critical ₹1 crore mark over the weekend. For the crypto India market, the narrative has shifted from fear to cautiously accumulating the dip.

While the current live percentages show a slight pullback from the morning highs (standard market consolidation), the main story is the strong defense of key support levels, suggesting that the recent sell-off was indeed a necessary deleveraging event. Institutional capital views these prices as a strong buying opportunity, underpinning the resilience of the ecosystem.

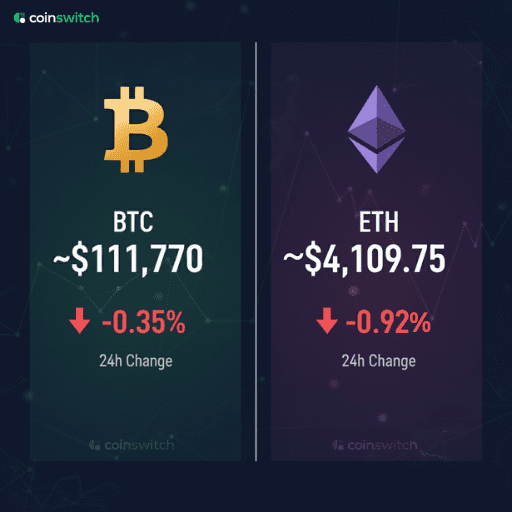

Bitcoin & Ethereum Price Movement (24-hour)

Live Aggregated Data Alert: The current negative 24-hour percentage reflects minor profit-taking after the initial sharp surge earlier this morning.

| Metric | Bitcoin (BTC) | Ethereum (ETH) |

| Price (approx. INR) | ₹99,13,018 | ₹3,63,925 |

| Price (approx. USD) | ~$111,770 | ~$4,103 |

| 24‑h % change | -0.35% (Consolidating after morning rally) | -0.92% (Showing relative weakness during the pause) |

| 24‑h high | ₹99.5 lakh (≈ $112,292) | ₹3.67 lakh (≈ $4,144) |

| 24‑h low | ₹98.9 lakh (≈ $111,500) | ₹3.63 lakh (≈ $4,098) |

| Sentiment | Consolidating Bullish; BTC is taking a breath after successfully reclaiming the ₹1 Crore level. Analysts see this as healthy coiling action above critical support. | Cautiously Bearish; ETH is showing deeper pullback during this consolidation, but its long-term Ethereum price prediction remains strong due to L2 adoption and upgrades. |

| Commentary | Bitcoin has demonstrated extreme resilience. The swift V-shaped recovery, despite global macro headwinds, validates its E-E-A-T and long-term crypto investment narrative. | Ethereum often dips harder in market pauses. However, the consistent whale accumulation witnessed today suggests strong underlying faith in the network’s fundamentals. |

Check out live Bitcoin price and live ethereum price movements with CoinSwitch

Key Indices & Statistics for the Indian Market

The market has proven its ability to absorb selling pressure quickly, leading to stabilized indicators and a high volume of trading activity.

| Metric | Value | Commentary |

| Global Market Cap | ~$3.86 Trillion | Showing a net positive trend from weekend lows, confirming renewed capital inflows into the sector. |

| 24‑h Trading Volume | ~$165 Billion | High volume supports both the rally and the subsequent consolidation, suggesting active participation. |

| Bitcoin Dominance | ~57.8% | Bitcoin remains the primary focus, confirming its role as the market’s key directional leader during uncertainty. |

| Indian Rupee (INR) Reference | ~₹88.7 per US Dollar | The stable rupee provides a consistent floor, meaning positive global moves translate directly to strong local returns. |

Top Gainers (Altcoins)

The recovery is fueled by tokens with genuine utility and institutional interest, confirming a flight to quality.

| Altcoin | 24‑h change (approx.) | Commentary |

| Wrapped Centrifuge (WCFG) | ▲ 17.15 % | A leading token in the RWA (Real World Asset) sector, this surge highlights the strong ongoing capital rotation toward assets that bridge blockchain with traditional finance. |

| Zcash (ZEC) | ▲ 8.29 % | This strong move suggests traders are using privacy coins as a hedge against rising global regulatory scrutiny, a common post-correction phenomenon. |

| BNB (BNB) | ▲ 3.74 % | Maintaining strength, BNB’s performance reflects the platform’s utility and the ecosystem’s resilience, insulating it better than many other altcoins. |

| Sui (SUI) | ▲ 4.19 % | A significant bounce for this high-performance Layer-1, signaling renewed confidence and capital flowing back into fast, scalable blockchain solutions. |

| Cardano (ADA) | ▲ 3.49 % | Demonstrating robust demand, often seen in projects with large, loyal communities that engage in aggressive buy-the-dip strategies. |

Top Losers (Altcoins)

The few assets currently seeing losses are typically highly illiquid and susceptible to rapid declines when speculative enthusiasm wanes.

| Altcoin | 24‑h change (approx.) | Potential reason for decline |

| Subsquid (SQD) | ▼ 20.78 % | This severe drop is indicative of very thin liquidity or a project-specific concern, magnifying the impact of even small selling volume. |

| XPLA (XPL) | ▼ 11.36 % | The GameFi/metaverse sector remains fragile, struggling to maintain value while broader market focus shifts toward core utility projects. |

| Lombard BARD (BARD) | ▼ 6.09 % | A small-cap token facing relentless selling, which is often a result of forced liquidation of leveraged positions. |

Crypto Market Movements and Cues: Strategic Analysis

The Whale-Driven Reversal: A Structural Reset

The most impactful event this week is the confirmation of massive whale accumulation. This activity, totaling billions, provided the necessary liquidity to absorb the institutional profit-taking that triggered the slump, signaling that large capital views these prices as a clear buying opportunity. This structural reset is key to ending the volatility of “Red September.”

The INR Milestone and Indian Market Flow

For Indian investors, the successful fight back to the ₹1 Crore level for Bitcoin is a critical psychological victory. While the current price is slightly below this, the defense confirms strong latent domestic demand. The stable INR environment provides a solid foundation for continued crypto adoption in India.

Regulatory and Technical Edge

The rally in RWA tokens and the strength in Ethereum’s ecosystem highlight a shift toward verifiable utility. Globally, market participants are looking past the immediate US Core PCE Data and focusing on the long-term bullish factors: increasing institutional frameworks (ETFs) and the continuous technological upgrades across the major networks.

Key Coins to Watch & Outlook for Tomorrow

Key Coins to Watch (Top Trending Coins in India)

- Bitcoin (BTC): The key watch zone is between $111,000 and $112,500. Consolidating here is crucial. A sustained break above $113,000 signals the next upward leg.

- Ethereum (ETH): Its relative weakness during this consolidation makes the $4,000 support paramount. Look for strength in L2 projects as a lead indicator for ETH’s next major move.

- XRP: Continues to be a top trending coin in India due to speculative interest. Its price action will be heavily dictated by any new regulatory or legal headlines.

Outlook for Tomorrow

The short-term outlook for tomorrow is cautiously optimistic. The initial panic has passed, and momentum is stabilizing. We expect a period of tight consolidation as traders reposition for the end of the month. Altcoins with strong fundamentals are poised to continue their gradual recovery. Investors should monitor volume and defend the current price floor, as the major selling pressure appears to have subsided.