The cryptocurrency market closed the day on a volatile note, with global and local cues influencing price action. Bitcoin briefly dipped below the ₹1 crore mark before recovering, and Ethereum continued to consolidate near the ₹3.6 lakh level. Altcoins delivered mixed performances—some rallied on strong community momentum while others retreated after earlier surges. Overall market sentiment remains cautiously optimistic, with investors weighing macro‑economic uncertainty against historical bullish patterns known as “Uptober,” where October tends to generate positive returns for Bitcoin and the wider crypto market.

Market movements and cues

The global crypto market cap is hovering in the ₹376 trillion range, indicating a slight decline from the previous day. Bitcoin’s recent slide below US$120,000 underscored the market’s sensitivity to macro‑economic events and regulatory developments. Analysts link the dip to U.S. government shutdown concerns and regulatory uncertainty in the U.S. and Europe. Despite this, seasonal tailwinds often favour crypto in October, contributing to cautious optimism.

Local factors added to the mix. India’s Financial Intelligence Unit (FIU‑IND) issued notices to 25 offshore crypto exchanges for failing to comply with anti‑money‑laundering rules, ordering platforms to remove apps and websites that serve Indian users. This crackdown reminds traders to use regulated platforms and could temporarily limit liquidity. On a more positive note, the Reserve Bank of India launched a retail sandbox for its digital rupee pilot, allowing fintech firms to build solutions for the e‑rupee. The pilot, which started in December 2022, now has roughly 7 million users. The rollout of India’s CBDC demonstrates the government’s commitment to blockchain technology even as private crypto remains heavily regulated.

Key coins to watch

Several coins drew attention in India today:

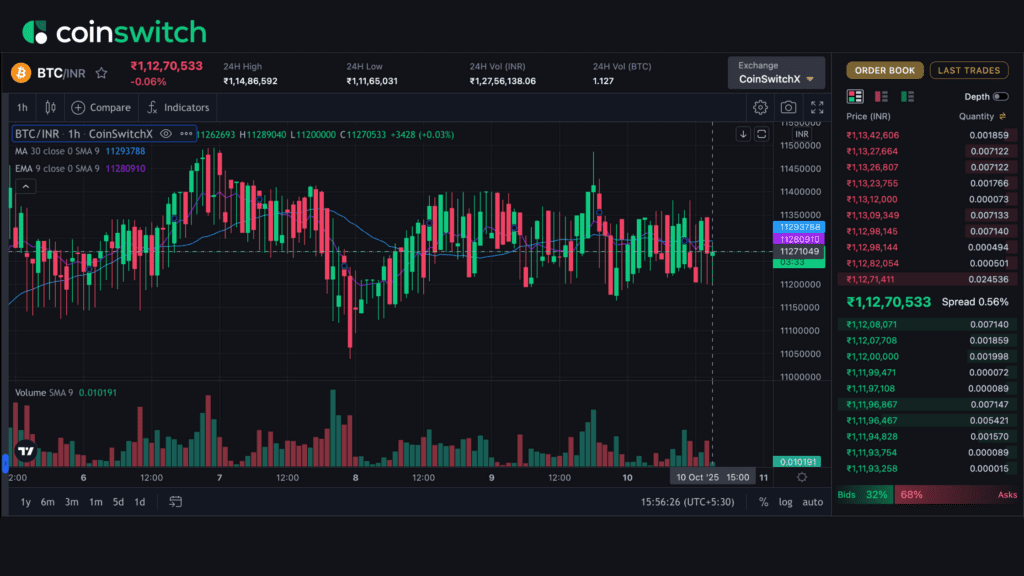

- Bitcoin (BTC) – After topping US$125 k earlier this month, Bitcoin fell below the US$120 k threshold but later recovered. Investors view this pullback as a typical mid‑cycle correction and continue to watch for a rebound.

- Ethereum (ETH) – Ethereum held steady near the ₹3.6 lakh (≈US$4,377) zone. Upgrades to the network and anticipation of future scaling improvements support long‑term sentiment.

- Zcash (ZEC) and Railgun (RAIL) – Privacy‑focused coins surged on speculation around new zero‑knowledge applications, with ZEC among the top global gainers.

- BNB (BNB) – Binance Coin rallied as investors rotated into low‑fee chains. BNB briefly traded near US$1,330 before consolidating.

- Klink Finance (KLINK), Kendu (KENDU) and Crappy Bird (CRAPPY) – According to CoinGecko’s trending list, these smaller altcoins were among the most searched in India. Their popularity is driven by community hype and speculative interest.

- Dash (DASH) and Walrus (WAL) – On Indian exchanges, Dash and Walrus ranked among the top trending coins, with Dash rallying over 40% on the day.

Crypto Market cues & updates

- Global cues: The broader market saw investors rotate from large‑caps into altcoins after Bitcoin’s pullback. Privacy coins, DeFi tokens and Binance Smart Chain projects outperformed, while stablecoins maintained steady inflows.

- Local regulation: FIU‑IND’s enforcement actions against unregistered exchanges highlight the importance of compliance. Traders should stick to Indian‑regulated platforms and be aware of the 1% TDS and 30% gains tax in force.

- Digital rupee pilot: The RBI’s sandbox will expand the e‑rupee ecosystem. Industry watchers believe integration with online retail and inter‑bank settlement could boost adoption, although widespread use is still a few years away.

- Market sentiment: The fear‑and‑greed index for crypto stands at 70, indicating “greed”. While traders are optimistic, sharp corrections remain possible due to macro‑economic news or regulatory announcements.

Bitcoin & Ethereum price movement

| Metric | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Price (approx. INR) | ₹10,110,630 | ₹363,307 |

| Price (approx. USD) | $121,814.82 | $4,377.19 |

| 24‑h % change | +1.40 % | +4.27 % |

| 24‑h high | ₹10,277,233 (≈ $123,822) | ₹374,206 (≈ $4,508) |

| 24‑h low | ₹9,936,233 (≈ $119,714) | ₹352,408 (≈ $4,246) |

| Sentiment | Cautiously optimistic; investors expect a bounce after a brief correction. | Neutral to bullish as network upgrades and alt‑season optimism offset volatility. |

| Commentary | BTC dipped below ₹1 crore before rebounding; regulatory news and macro headwinds drive short‑term swings. | ETH consolidates near ₹3.6 lakh, benefiting from DeFi growth and anticipation of future network improvements. |

Top gainers (altcoins)

| Altcoin | Price (approx. INR) | Price (approx. USD) | 24‑h % change | Commentary |

|---|---|---|---|---|

| Cream Finance (CREAM) | ₹187.30 | ~$2.26 | +87.5 % | Lending‑platform token surged on news of expanded cross‑chain integrations, drawing DeFi enthusiasts. |

| Zora (ZORA) | ₹8.09 | ~$0.10 | +57.9 % | NFT‑marketplace coin jumped as traders rotated into art‑platform tokens. |

| Subsquid (SQD) | ₹24.85 | ~$0.30 | +57.25 % | Data‑indexing project rallied after announcing new partnerships with Web3 developers. |

Top losers (altcoins)

| Altcoin | Price (approx. INR) | Price (approx. USD) | 24‑h % change | Potential reasons for decline |

|---|---|---|---|---|

| Dovi (Ordin) | ₹0.368 | ~$0.0044 | −80.05 % | Thin liquidity and profit‑taking after a speculative pump caused a sharp pullback. |

| Gifto (GFT) | ₹0.154 | ~$0.0019 | −67.60 % | The metaverse‑focused token retraced gains as hype around virtual‑world projects cooled. |

| Beta Finance (BETA) | ₹0.032 | ~$0.0004 | −62.11 % | Borrow/lend token dropped amid concerns over declining TVL and competition from larger DeFi protocols. |

Outlook for tomorrow

Tomorrow’s crypto market in India is expected to remain volatile. Traders will watch how Bitcoin reacts to the US$120 k support area and whether Ethereum can hold above ₹3.5 lakh. Altcoins may continue to see outsized moves as investors chase momentum; however, risk management is crucial given the potential for rapid reversals. Local attention will remain on regulatory updates—any further action by FIU‑IND could influence sentiment. The digital rupee sandbox may generate positive headlines, but private crypto trading will likely stay dominated by speculative forces.

Overall, the crypto market analysis suggests maintaining a balanced portfolio, focusing on quality projects like Bitcoin, Ethereum, and fundamentally strong altcoins while exercising caution with highly speculative tokens.